Official Tractor Bill of Sale Form for Georgia

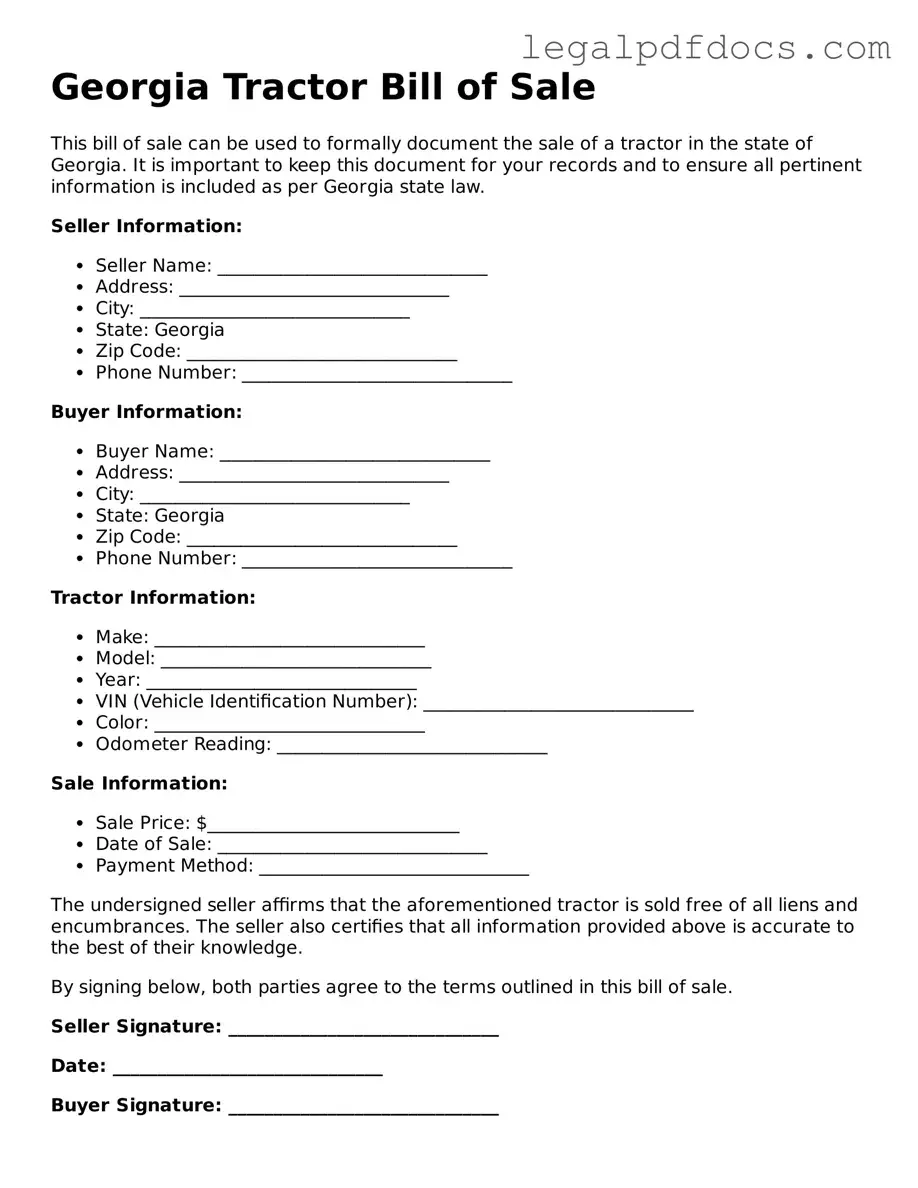

When engaging in the purchase or sale of a tractor in Georgia, understanding the importance of a Tractor Bill of Sale form is essential. This document serves as a legal record of the transaction, providing crucial details about the buyer, seller, and the equipment being exchanged. It typically includes information such as the names and addresses of both parties, a description of the tractor—including its make, model, year, and Vehicle Identification Number (VIN)—as well as the sale price and date of the transaction. Additionally, the form may outline any warranties or guarantees provided by the seller, ensuring clarity and protection for both parties involved. By accurately completing this form, individuals can help safeguard their rights and responsibilities in the transaction, making it a vital step in the process of buying or selling a tractor in the state of Georgia.

Dos and Don'ts

When filling out the Georgia Tractor Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do provide complete and accurate information about the tractor, including make, model, year, and VIN.

- Do include the sale price clearly to avoid any misunderstandings.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed bill of sale for your records.

- Don't leave any required fields blank; this could lead to issues later.

- Don't use vague descriptions; be specific about the tractor's condition and features.

- Don't forget to include the buyer's and seller's contact information.

- Don't rush through the process; take your time to ensure all information is correct.

How to Use Georgia Tractor Bill of Sale

Once you have the Georgia Tractor Bill of Sale form ready, it's time to fill it out accurately. This document is essential for both the buyer and seller, as it provides a record of the transaction and helps ensure a smooth transfer of ownership. Follow these steps to complete the form correctly.

- Gather necessary information: Collect all relevant details about the tractor, including the make, model, year, Vehicle Identification Number (VIN), and odometer reading.

- Identify the seller: Write the full name, address, and contact information of the seller. This should be the person or entity selling the tractor.

- Identify the buyer: Fill in the buyer's full name, address, and contact information. Ensure that this information is accurate to avoid any issues later on.

- Specify the sale price: Clearly state the total amount for which the tractor is being sold. This should be a numeric value.

- Include the date of sale: Write the date on which the transaction is taking place. This is important for record-keeping purposes.

- Signatures: Both the seller and buyer must sign the form. This indicates that both parties agree to the terms outlined in the document.

- Notarization (if required): Depending on local regulations, you may need to have the document notarized. Check if this step is necessary in your area.

After completing the form, ensure that both parties retain a copy for their records. This will help avoid any misunderstandings in the future and provide proof of the transaction if needed.

Find Popular Tractor Bill of Sale Forms for US States

Tractor Bill of Sale - Meets the requirements for tractor sales in most states.

Do Tractors Need to Be Registered - The document includes the signature lines for both the buyer and seller.

Farm Tractor Bill of Sale - For sellers, this form can provide peace of mind regarding the completed sale.

Tractor Bill of Sale Form - Using this form can simplify the process of selling or buying a tractor.

Documents used along the form

When completing a transaction for a tractor in Georgia, several documents may accompany the Georgia Tractor Bill of Sale form to ensure a smooth process. Each of these documents serves a specific purpose and helps protect both the buyer and seller during the sale. Below is a list of commonly used forms and documents.

- Title Transfer Document: This document officially transfers ownership of the tractor from the seller to the buyer. It must be completed and submitted to the Georgia Department of Revenue to update the vehicle's title records.

- Odometer Disclosure Statement: Required for vehicles under 10 years old, this statement verifies the tractor's mileage at the time of sale. It helps prevent fraud and ensures that the buyer is aware of the tractor's usage history.

- Affidavit of Purchase: This sworn statement is used to confirm the legitimacy of the sale. It may include details about the transaction, such as the sale price and date, and can be helpful in case of disputes.

- Sales Tax Form: In Georgia, sales tax may apply to the purchase of a tractor. This form helps calculate and document the appropriate tax amount that must be paid during the transaction.

- Insurance Verification: Buyers often need to provide proof of insurance before completing the sale. This document ensures that the tractor will be covered under an insurance policy once ownership is transferred.

Having these documents ready can streamline the buying and selling process, making it easier for both parties to complete the transaction. Ensure that all forms are filled out accurately to avoid any complications down the line.

Misconceptions

The Georgia Tractor Bill of Sale form is an important document for anyone involved in the buying or selling of tractors in Georgia. However, several misconceptions surround its use and requirements. Here are nine common misunderstandings:

- It is not necessary to have a bill of sale for a tractor. Some people believe that a bill of sale is optional. In Georgia, a bill of sale serves as proof of the transaction and is often required for registration purposes.

- Only licensed dealers can provide a bill of sale. This is incorrect. Private individuals can also create and use a bill of sale for their transactions.

- The bill of sale must be notarized. While notarization adds an extra layer of authenticity, it is not a requirement for the bill of sale in Georgia.

- All information must be typed on the bill of sale. Handwritten information is acceptable, as long as it is legible and complete.

- The buyer and seller must both be present when completing the bill of sale. This is a misconception. It is not necessary for both parties to be present; however, both should sign the document for it to be valid.

- The bill of sale is only needed for new tractors. This is false. A bill of sale is required for both new and used tractors.

- There is a specific form that must be used. While there is no official state form, the bill of sale should include certain key elements to be valid.

- Once the bill of sale is completed, it is no longer needed. In fact, both the buyer and seller should keep a copy for their records.

- The bill of sale guarantees a clear title. A bill of sale does not guarantee that the seller has clear title to the tractor. Buyers should perform due diligence to verify ownership.

Understanding these misconceptions can help ensure that transactions involving tractors are conducted smoothly and legally in Georgia.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in the state of Georgia. |

| Governing Law | This form is governed by the laws of the state of Georgia, specifically under O.C.G.A. § 10-1-680, which relates to the sale of goods. |

| Required Information | The form typically requires details such as the buyer's and seller's names, addresses, the tractor's make, model, year, and Vehicle Identification Number (VIN). |

| Notarization | While notarization is not mandatory, having the Bill of Sale notarized can provide additional protection and verification of the transaction. |

Key takeaways

Filling out and using the Georgia Tractor Bill of Sale form is an important process for both buyers and sellers. Here are some key takeaways to consider:

- Accurate Information: Ensure that all details regarding the tractor, including make, model, year, and Vehicle Identification Number (VIN), are filled out accurately.

- Seller's Information: The seller must provide their full name, address, and contact information. This is essential for any future communication.

- Buyer's Information: The buyer's full name and address should also be included to establish a clear record of the transaction.

- Purchase Price: Clearly state the agreed-upon purchase price. This figure is crucial for both parties and may be needed for tax purposes.

- As-Is Condition: The bill of sale typically includes a statement that the tractor is sold "as-is," meaning the buyer accepts the tractor in its current condition.

- Signatures: Both the buyer and seller must sign the document. This step is vital for legal validation of the sale.

- Date of Sale: Include the date of the transaction. This helps establish the timeline of ownership.

- Notarization: Although not always required, having the bill of sale notarized can add an extra layer of authenticity and protection.

- Record Keeping: Keep a copy of the signed bill of sale for personal records. This document serves as proof of ownership transfer.

- Local Regulations: Be aware of any local regulations or requirements regarding tractor sales in Georgia, as these may vary by county.

By following these key points, both buyers and sellers can ensure a smoother transaction process and protect their interests in the sale of a tractor.