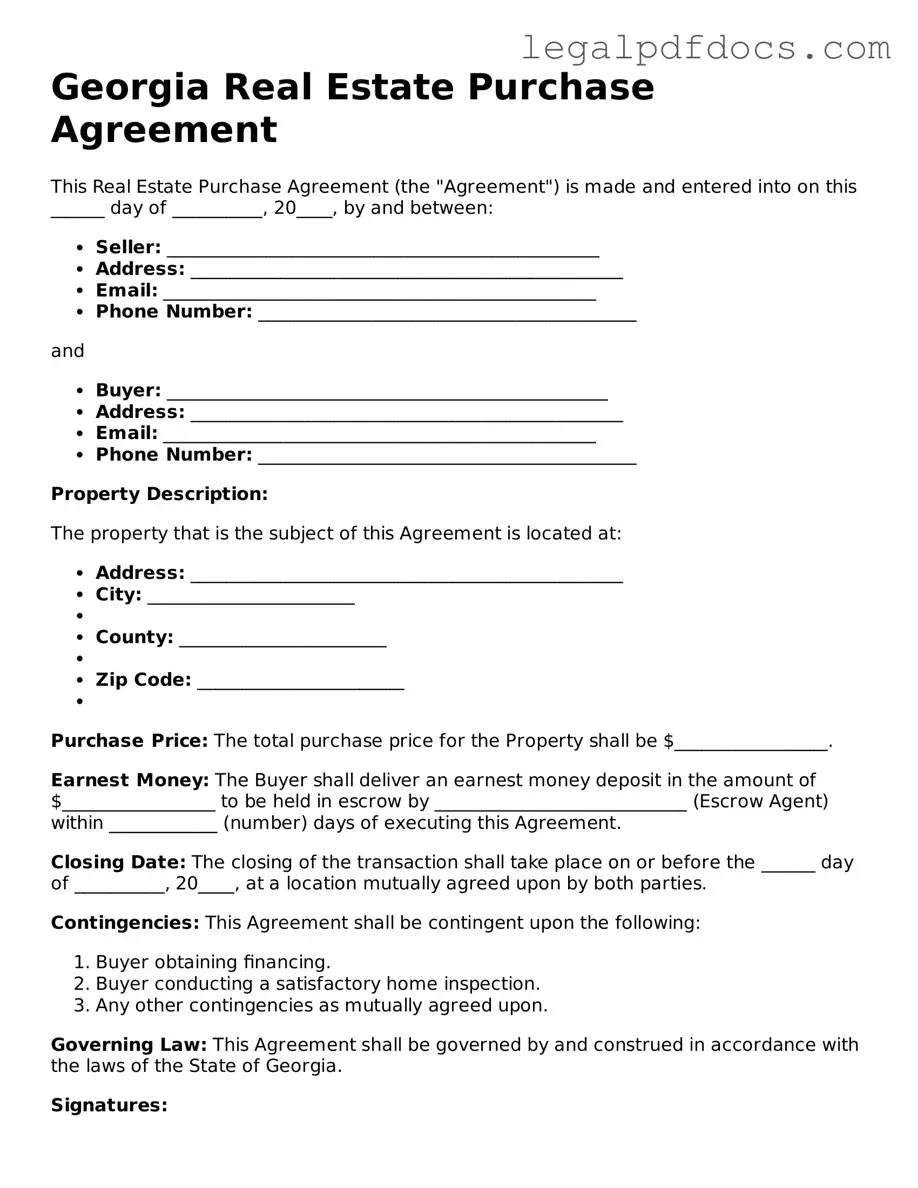

Official Real Estate Purchase Agreement Form for Georgia

The Georgia Real Estate Purchase Agreement form serves as a crucial document in the home buying and selling process within the state. This form outlines the terms and conditions agreed upon by both the buyer and the seller, ensuring that each party understands their rights and responsibilities. Key components of the agreement include the purchase price, the property description, and the closing date, which is vital for establishing a timeline for the transaction. Additionally, the form addresses contingencies, such as financing or inspection requirements, that must be met before the sale can proceed. Other important aspects include earnest money deposits, which demonstrate the buyer's commitment, and provisions for handling disputes that may arise during the process. By clearly delineating these elements, the Georgia Real Estate Purchase Agreement fosters transparency and helps facilitate a smoother transaction for all parties involved.

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information for all parties involved.

- Do specify all terms clearly, including the purchase price and any contingencies.

- Do consult with a real estate professional if you have questions.

- Do keep a copy of the completed agreement for your records.

- Don't leave any sections blank unless instructed otherwise.

- Don't make assumptions about terms; clarify any uncertainties.

- Don't rush through the form; take your time to ensure accuracy.

- Don't sign the agreement without fully understanding its contents.

- Don't forget to date the agreement and initial any changes made.

How to Use Georgia Real Estate Purchase Agreement

After obtaining the Georgia Real Estate Purchase Agreement form, it is essential to fill it out accurately to facilitate a smooth transaction. This form will require specific information about the property, the buyer, and the seller. Follow the steps outlined below to complete the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the names and contact information of the buyer(s). Ensure that all details are accurate and up-to-date.

- Next, provide the seller(s) information, including their names and contact details.

- Identify the property being purchased by including the complete address and legal description.

- Specify the purchase price in the designated section. Ensure this amount reflects any negotiations that took place.

- Indicate the amount of earnest money deposit. This is typically a percentage of the purchase price.

- Outline the terms of financing, including whether the buyer will be using a loan or paying in cash.

- Include any contingencies that may apply, such as inspections or financing approvals.

- Review the closing date and fill in the proposed date for the transaction to be finalized.

- Both parties should sign and date the agreement at the bottom of the form. Make sure that all signatures are legible.

Find Popular Real Estate Purchase Agreement Forms for US States

Kansas Real Estate Purchase Contract - Terms regarding title transfer and ownership rights are key components of this document.

Florida Purchase Agreement - It usually emphasizes the importance of title insurance in protecting the buyer's investment.

Purchasing Agreements - Establishes what happens to the earnest money upon cancellation of the agreement.

Documents used along the form

In Georgia, several documents often accompany the Real Estate Purchase Agreement to facilitate the transaction process. Each of these documents serves a specific purpose and helps ensure that all parties are informed and protected throughout the real estate transaction.

- Seller's Disclosure Statement: This document requires the seller to disclose known issues with the property, such as structural problems or pest infestations. It helps buyers make informed decisions.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential risks of lead-based paint and requires the seller to disclose any known lead hazards.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document outlines all costs associated with the transaction, including fees, taxes, and the final sale price.

- Title Search Report: This report confirms the legal ownership of the property and identifies any liens or encumbrances. It ensures that the buyer receives clear title upon closing.

- Loan Estimate: For buyers financing their purchase, this document provides a breakdown of the expected costs associated with the mortgage, including interest rates and monthly payments.

- Property Appraisal: An independent assessment of the property’s value, this document is often required by lenders to ensure that the property is worth the loan amount.

- Home Inspection Report: After an inspection, this report details the condition of the property, highlighting any necessary repairs or maintenance issues that may affect the buyer’s decision.

- Earnest Money Agreement: This document outlines the terms of the earnest money deposit, which shows the buyer's commitment to the purchase and is typically applied to the purchase price at closing.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and that there are no undisclosed liens or claims against it.

These documents collectively help streamline the real estate transaction process in Georgia. Understanding each one can assist both buyers and sellers in navigating their responsibilities and rights effectively.

Misconceptions

Understanding the Georgia Real Estate Purchase Agreement is crucial for anyone involved in buying or selling property in the state. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about this important document:

- It’s a one-size-fits-all document. Many believe that the Georgia Real Estate Purchase Agreement can be used for any property transaction without modifications. In reality, each transaction is unique, and specific terms may need to be tailored to fit the situation.

- It’s only necessary for residential properties. Some think this agreement is only for homes. However, it applies to all types of real estate transactions, including commercial properties and land sales.

- Once signed, it cannot be changed. A common belief is that the agreement is set in stone once both parties sign it. In fact, amendments can be made if both parties agree to the changes, and it’s documented properly.

- It guarantees the sale will go through. Many assume that signing the agreement means the sale is guaranteed. Unfortunately, various contingencies can allow either party to back out under certain conditions.

- All terms are negotiable. While many terms can be negotiated, some aspects of the agreement are standard and may not be open for negotiation, especially those dictated by law.

- It’s just a formality. Some view the agreement as merely a formality. However, it serves as a legally binding contract that outlines the rights and responsibilities of both parties.

- Real estate agents handle everything. A misconception is that real estate agents take care of all aspects of the agreement. While they can provide guidance, buyers and sellers should also understand the terms and implications themselves.

- It doesn’t need to be reviewed by a lawyer. Many people think they can sign the agreement without legal advice. Consulting with a lawyer can help clarify terms and protect your interests.

- It only protects the seller. Some believe that the agreement is designed solely to protect the seller’s interests. In truth, it is structured to protect both parties and ensure a fair transaction.

- It’s the same as a lease agreement. Lastly, there’s confusion between a purchase agreement and a lease. A purchase agreement is for buying property, while a lease agreement is for renting it. They serve very different purposes.

By dispelling these misconceptions, individuals can approach the Georgia Real Estate Purchase Agreement with a clearer understanding, ensuring a smoother transaction process.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Real Estate Purchase Agreement is governed by the laws of the State of Georgia. |

| Purpose | This form is used to outline the terms and conditions for the sale of real property in Georgia. |

| Parties Involved | The agreement typically includes a buyer and a seller, both of whom must be identified in the document. |

| Property Description | A detailed description of the property being sold is required, including the address and legal description. |

| Purchase Price | The form must specify the purchase price agreed upon by both parties. |

| Earnest Money | The agreement usually includes a provision for earnest money, which demonstrates the buyer's commitment. |

| Contingencies | Common contingencies may include financing, inspections, and appraisals, protecting the buyer's interests. |

| Closing Date | A closing date is typically specified, indicating when the transaction will be finalized. |

| Disclosures | The seller is required to provide certain disclosures about the property's condition and history. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Key takeaways

Understanding the Georgia Real Estate Purchase Agreement form is crucial for anyone involved in real estate transactions within the state. Here are some key takeaways to consider:

- The agreement serves as a legally binding contract between the buyer and seller.

- It outlines the terms of the sale, including the purchase price and any contingencies.

- Both parties must provide accurate information to avoid disputes later on.

- Buyers typically need to include an earnest money deposit to demonstrate their commitment.

- Contingencies, such as financing or inspection, can protect buyers in case certain conditions are not met.

- The form requires signatures from both parties, indicating their agreement to the terms.

- It is advisable to review the agreement carefully, possibly with legal assistance, before signing.

- Amendments to the agreement can be made, but they should be documented in writing.

- Once signed, the agreement initiates the closing process, leading to the transfer of property ownership.

By keeping these points in mind, individuals can navigate the complexities of the Georgia Real Estate Purchase Agreement more effectively.