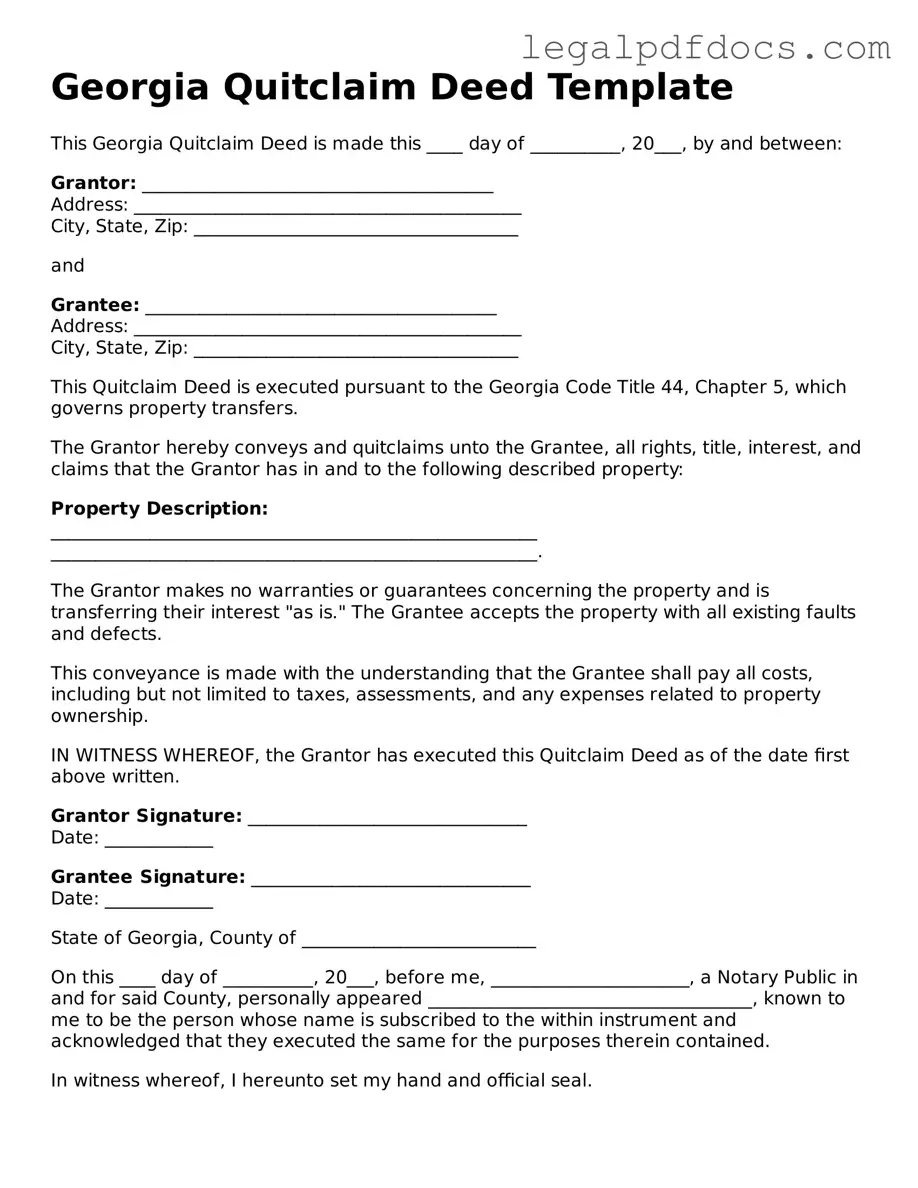

Official Quitclaim Deed Form for Georgia

The Georgia Quitclaim Deed form is a crucial document for anyone looking to transfer property rights in the state of Georgia. This form allows a property owner, known as the grantor, to convey their interest in a property to another party, called the grantee, without making any guarantees about the title's validity. It's often used in situations where the parties know each other well, such as family members or friends, and trust that the transfer is legitimate. Unlike other types of deeds, the quitclaim deed does not provide any warranties, meaning that if there are issues with the title, the grantee has limited recourse. It's a straightforward and efficient way to transfer property, but it’s essential to understand its implications fully. Completing the form requires specific information, including the names of both parties, a legal description of the property, and the date of the transfer. Once executed, the quitclaim deed must be filed with the county clerk's office to ensure it is legally recognized. Understanding the nuances of this form can help individuals navigate property transfers smoothly and avoid potential pitfalls down the road.

Dos and Don'ts

When filling out the Georgia Quitclaim Deed form, it's essential to follow certain guidelines to ensure the process goes smoothly. Here are ten things to consider:

- Do provide accurate property details, including the legal description.

- Don't leave any fields blank; incomplete forms can lead to delays.

- Do include the names of all parties involved in the transaction.

- Don't use abbreviations or shorthand when writing names or addresses.

- Do sign the deed in the presence of a notary public.

- Don't forget to check for any local requirements that may apply.

- Do keep a copy of the completed deed for your records.

- Don't assume that verbal agreements are sufficient; everything should be in writing.

- Do verify that the grantor has the authority to transfer the property.

- Don't rush through the process; take your time to ensure accuracy.

How to Use Georgia Quitclaim Deed

After obtaining the Georgia Quitclaim Deed form, it's important to fill it out carefully to ensure the transfer of property is executed properly. Once completed, the form must be signed and notarized before being recorded with the county clerk's office. Follow these steps to fill out the form accurately.

- Identify the Grantor: Write the full name of the person transferring the property. Include their address and any other identifying information required.

- Identify the Grantee: Enter the full name of the person receiving the property. Make sure to include their address as well.

- Describe the Property: Provide a clear legal description of the property being transferred. This may include the parcel number or a brief description of the location.

- State the Consideration: Indicate the amount of money or other consideration being exchanged for the property. If it’s a gift, you may write “for love and affection.”

- Include Additional Provisions: If there are any special conditions or provisions related to the transfer, list them clearly.

- Sign the Document: The grantor must sign the Quitclaim Deed in front of a notary public. The notary will then sign and stamp the document.

- File the Deed: Take the completed and notarized Quitclaim Deed to the county clerk’s office where the property is located to have it recorded.

Find Popular Quitclaim Deed Forms for US States

Free Quit Claim Deed Form Arizona - A quitclaim deed can serve as a simple solution for clarifying property rights among co-owners.

Idaho Quitclaim Deed Form - This document does not require an appraisal or property inspection.

Quitclaim Deed Form Kansas - In real estate, a quitclaim deed can speed up the process of transferring land ownership.

Wuick Claim Deed - Quitclaim Deeds are not suitable for transactions requiring warranties.

Documents used along the form

When transferring property in Georgia, the Quitclaim Deed is a common document used. However, several other forms and documents may accompany it to ensure a smooth transaction. Below is a list of documents often utilized in conjunction with the Quitclaim Deed.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. It offers more protection to the buyer compared to a quitclaim deed.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes. It must be submitted to the local tax office.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and discloses any liens or claims against it. It helps establish the seller's legal standing.

- Title Insurance Policy: This insurance protects the buyer from potential disputes regarding property ownership. It can cover legal fees and other costs associated with title issues.

- Closing Statement: This document outlines the financial details of the property transaction, including the purchase price, closing costs, and any adjustments. It is essential for both parties to review.

- Power of Attorney: If a party cannot be present for the transaction, this document allows someone else to act on their behalf. It must be properly executed to be valid.

- Lease Agreement: If the property is being rented out, this document outlines the terms of the lease, including rent amount, duration, and responsibilities of both landlord and tenant.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community. Buyers should review these before finalizing the purchase.

Utilizing these documents alongside the Quitclaim Deed can help facilitate a smoother property transfer process. It is advisable to consult with a legal professional to ensure all necessary paperwork is completed accurately and in compliance with Georgia law.

Misconceptions

Understanding the Georgia Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are nine common misconceptions about this form:

- A Quitclaim Deed Transfers Ownership Automatically. Many believe that simply signing a quitclaim deed transfers ownership. While it does convey whatever interest the grantor has, it does not guarantee that the grantor has any ownership to transfer.

- A Quitclaim Deed Provides Title Insurance. Some assume that using a quitclaim deed means they will receive title insurance. In reality, title insurance is separate and must be obtained through a different process.

- Quitclaim Deeds Are Only for Family Transfers. It is a common misconception that quitclaim deeds can only be used for transferring property between family members. They can be used in various situations, including sales and transfers between unrelated parties.

- Quitclaim Deeds Eliminate Liens and Encumbrances. Many think that a quitclaim deed clears all liens and encumbrances on a property. This is incorrect; any existing liens remain attached to the property even after the transfer.

- All Quitclaim Deeds Are the Same. Some believe that all quitclaim deeds are identical. In fact, the language and stipulations can vary based on the specific transaction and the parties involved.

- A Quitclaim Deed Requires a Notary Public. While it is often recommended to have a quitclaim deed notarized for added legitimacy, it is not a strict legal requirement in Georgia.

- Quitclaim Deeds Are Irrevocable. There is a misconception that once a quitclaim deed is executed, it cannot be undone. In reality, it can be revoked or challenged in court under certain circumstances.

- Quitclaim Deeds Are Only Used for Real Estate. Some people think quitclaim deeds are limited to real estate transactions. However, they can also be used to transfer interests in other types of property, such as vehicles or personal property.

- A Quitclaim Deed Is Always the Best Option. Many assume that a quitclaim deed is the best choice for all property transfers. In some cases, a warranty deed may provide better protection and assurances regarding ownership.

Being aware of these misconceptions can help individuals make informed decisions when dealing with property transfers in Georgia.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties. |

| Governing Law | The quitclaim deed in Georgia is governed by O.C.G.A. § 44-5-30. |

| Parties Involved | The grantor (seller) and grantee (buyer) are the two main parties involved in the quitclaim deed. |

| No Guarantees | This type of deed does not guarantee that the title is clear or free from claims. |

| Usage | Quitclaim deeds are often used to transfer property between family members or to clear up title issues. |

| Filing Requirement | The deed must be filed with the county clerk’s office in the county where the property is located. |

| Consideration | Consideration is not always required, but it is common to include a nominal amount. |

| Signature Requirement | The grantor must sign the quitclaim deed in the presence of a notary public. |

| Effect on Title | Once recorded, the quitclaim deed transfers whatever interest the grantor has in the property to the grantee. |

Key takeaways

When filling out and using the Georgia Quitclaim Deed form, it is essential to understand several key aspects to ensure the process is smooth and legally sound.

- Purpose of the Quitclaim Deed: This form transfers ownership of property from one party to another without guaranteeing the title's validity.

- Parties Involved: The form requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: A complete legal description of the property must be included. This often includes the lot number, block number, and subdivision name.

- Consideration: The form should state the consideration, or payment, involved in the transaction, even if it is a nominal amount.

- Signature Requirement: The grantor must sign the deed in front of a notary public. This step is crucial for the deed's validity.

- Recording the Deed: After completion, the Quitclaim Deed should be recorded at the county's Clerk of Superior Court to provide public notice of the ownership transfer.

- Tax Implications: Consider potential tax implications associated with the transfer, such as property transfer taxes.

- Legal Advice: It is advisable to consult with a legal professional if there are any uncertainties regarding the deed or the property being transferred.