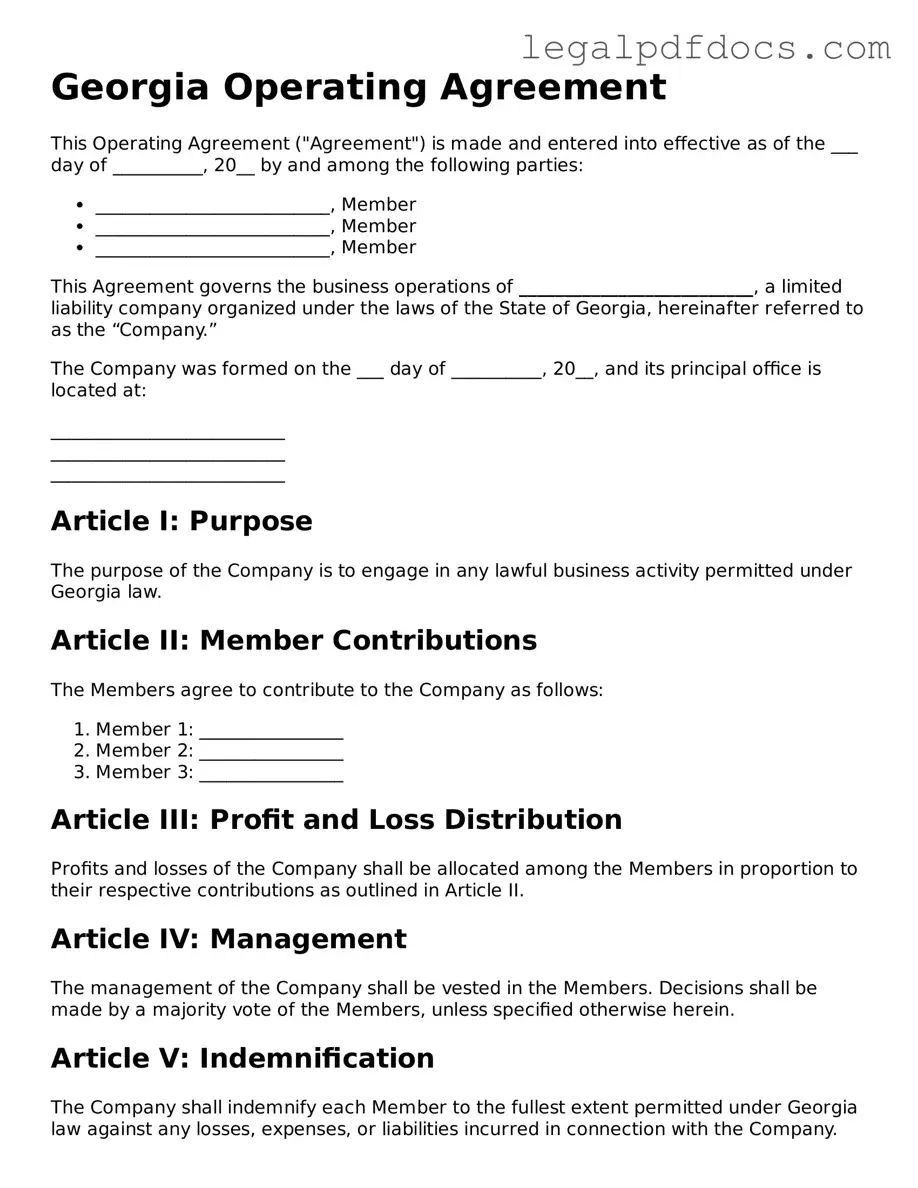

Official Operating Agreement Form for Georgia

The Georgia Operating Agreement form serves as a vital document for individuals forming a limited liability company (LLC) in the state of Georgia. This agreement outlines the management structure, operational procedures, and financial arrangements of the LLC, ensuring that all members are on the same page regarding their rights and responsibilities. Key elements typically included in the form encompass the designation of members, the allocation of profits and losses, and the procedures for adding or removing members. Additionally, the agreement addresses decision-making processes, meeting protocols, and dispute resolution methods, providing a clear framework for governance. By establishing these guidelines, the Operating Agreement not only helps prevent misunderstandings among members but also protects the LLC's limited liability status. Therefore, having a comprehensive and well-drafted Operating Agreement is essential for the smooth operation of an LLC in Georgia.

Dos and Don'ts

When filling out the Georgia Operating Agreement form, it's important to be thorough and accurate. Here are some things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the members and the business.

- Do ensure that all members sign the agreement.

- Do keep a copy of the completed agreement for your records.

- Don't leave any required fields blank.

- Don't use unclear or ambiguous language when describing the business purpose.

By following these guidelines, you can help ensure that your Operating Agreement is completed correctly and effectively. This can save you time and potential issues down the road.

How to Use Georgia Operating Agreement

Completing the Georgia Operating Agreement form is an essential step for members of a limited liability company (LLC) to outline the management structure and operational guidelines. Once the form is filled out accurately, it should be kept with your business records and shared with all members to ensure everyone is on the same page regarding the company’s operations.

- Begin by clearly stating the name of your LLC at the top of the form.

- Next, provide the date on which the agreement is being executed.

- List the names and addresses of all members involved in the LLC. Ensure that each member's information is accurate.

- Define the purpose of the LLC. This should be a brief description of what the business will do.

- Outline the management structure. Specify whether the LLC will be member-managed or manager-managed.

- Detail the contributions of each member. This includes initial capital contributions and any other resources each member will provide.

- Include provisions for profit and loss distribution. Clearly state how profits and losses will be shared among members.

- Address the procedures for adding new members or removing existing ones. This section should outline the process to ensure clarity in future changes.

- Specify the duration of the LLC. Indicate whether it will be a perpetual entity or if there is a specific end date.

- Finally, have all members sign and date the agreement. Each member should receive a copy for their records.

Find Popular Operating Agreement Forms for US States

Idaho Llc Operating Agreement - The Operating Agreement can outline the scope of business activities.

Operating Agreement Llc Arizona Template - Finally, the Operating Agreement can help streamline operations and improve overall efficiency.

Documents used along the form

When forming a limited liability company (LLC) in Georgia, the Operating Agreement is a crucial document that outlines the management structure and operating procedures. However, there are several other forms and documents that often accompany the Operating Agreement to ensure compliance and proper functioning of the LLC. Below is a list of these important documents.

- Articles of Organization: This is the foundational document filed with the state to officially create your LLC. It includes basic information such as the LLC's name, address, and registered agent.

- Member Consent Forms: These forms are used to document the agreement of all members regarding important decisions, such as the admission of new members or changes in management.

- Operating Procedures Manual: This document outlines the day-to-day operations of the LLC. It provides guidance on roles, responsibilities, and standard operating procedures.

- Bylaws: While not required for LLCs, bylaws can provide additional structure. They detail the rules governing the internal management of the company, including voting procedures and member rights.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They can be useful for establishing ownership stakes and transferring interests.

- Tax Election Forms: Depending on how the LLC chooses to be taxed, specific forms (like IRS Form 8832) may need to be filed to elect a tax classification, such as partnership or corporation.

- Annual Reports: Many states, including Georgia, require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the business and its members.

Each of these documents plays a vital role in the establishment and operation of an LLC in Georgia. By ensuring that all necessary paperwork is completed and filed correctly, you can help your business run smoothly and stay compliant with state regulations.

Misconceptions

Understanding the Georgia Operating Agreement form is crucial for anyone looking to establish a limited liability company (LLC) in the state. However, there are several misconceptions that can lead to confusion and potential pitfalls. Here are ten common misconceptions explained:

- It’s not necessary to have an Operating Agreement. Many believe that an Operating Agreement is optional. In Georgia, while it is not legally required, having one is highly recommended to outline the management structure and protect member interests.

- Only large businesses need an Operating Agreement. This is false. Regardless of size, every LLC can benefit from having an Operating Agreement. It helps clarify roles and responsibilities, ensuring smooth operations.

- The Operating Agreement is a public document. This is a misconception. The Operating Agreement is a private document and does not need to be filed with the state. It is kept among the members of the LLC.

- All members must sign the Operating Agreement. While it’s best practice for all members to sign, it is not a strict requirement. However, having all members sign can prevent future disputes.

- The Operating Agreement cannot be changed. This is incorrect. An Operating Agreement can be amended as needed, provided that all members agree to the changes. Flexibility is key.

- It’s only about profit distribution. While profit distribution is a part of the Operating Agreement, it also covers management roles, decision-making processes, and procedures for member changes.

- Verbal agreements are sufficient. Relying on verbal agreements can lead to misunderstandings. A written Operating Agreement provides clarity and serves as a reference in case of disputes.

- All Operating Agreements are the same. This is a misconception. Each Operating Agreement should be tailored to the specific needs of the LLC and its members. Generic templates may not address unique situations.

- Once created, the Operating Agreement is set in stone. This is not true. As businesses evolve, so can their Operating Agreements. Regular reviews and updates are important to keep the document relevant.

- Legal advice is unnecessary for drafting an Operating Agreement. While it’s possible to draft one without legal assistance, consulting with a legal professional can help ensure that the document meets all legal requirements and adequately protects your interests.

Addressing these misconceptions is vital for ensuring that your LLC operates smoothly and that all members are on the same page. Take the time to understand the importance of an Operating Agreement and how it can benefit your business.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | The agreement is governed by the Georgia Limited Liability Company Act, found in Title 14, Chapter 11 of the Official Code of Georgia Annotated. |

| Members | All members of the LLC should be included in the agreement, detailing their rights and responsibilities. |

| Management Structure | The agreement can specify whether the LLC is member-managed or manager-managed, impacting decision-making processes. |

| Amendments | Provisions for amending the agreement can be included, allowing flexibility for future changes in management or structure. |

| Dispute Resolution | It is common to include methods for resolving disputes among members, such as mediation or arbitration. |

| Compliance | Having a well-drafted operating agreement helps ensure compliance with state laws and protects members’ interests. |

Key takeaways

Understanding the purpose of an Operating Agreement is crucial. It serves as a foundational document for your LLC, outlining the structure and management of the business.

Each member's roles and responsibilities should be clearly defined. This clarity helps prevent misunderstandings and ensures smooth operations.

Specify how profits and losses will be distributed among members. This section is essential for financial transparency and fairness.

Consider including provisions for adding new members. This flexibility can be beneficial as your business grows.

Outline the process for member withdrawal or termination. Knowing how to handle these situations in advance can save time and conflict.

Decide on the management structure of your LLC. Whether it’s member-managed or manager-managed, this decision impacts daily operations.

Ensure compliance with state laws. The Operating Agreement must align with Georgia's regulations to be valid and enforceable.

Review and update the agreement regularly. As your business evolves, so should your Operating Agreement to reflect current practices and agreements.

Consult with a legal professional if needed. While the form can be filled out independently, expert advice can provide additional assurance of accuracy and completeness.