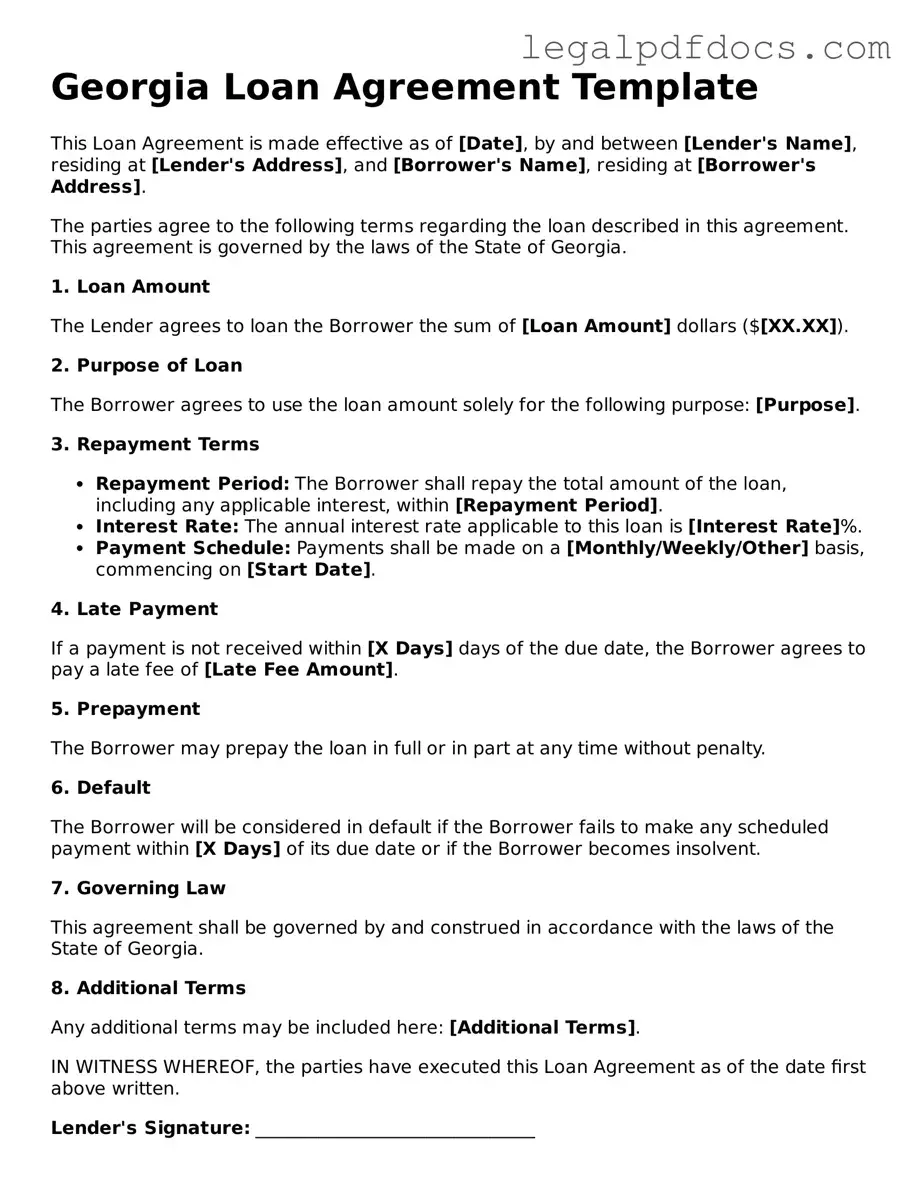

Official Loan Agreement Form for Georgia

The Georgia Loan Agreement form serves as a vital document in the realm of personal and commercial financing, outlining the terms and conditions under which a borrower receives funds from a lender. This form typically includes essential elements such as the loan amount, interest rate, repayment schedule, and any applicable fees. Both parties must agree on these terms, ensuring clarity and mutual understanding. Additionally, the document may specify collateral requirements, which provide security for the lender in case of default. Provisions regarding late payments and default consequences are often included, safeguarding the lender's interests while also informing the borrower of their obligations. Furthermore, the form may address the legal rights of both parties, including dispute resolution mechanisms, which can be crucial in maintaining a professional relationship throughout the loan's duration. Overall, the Georgia Loan Agreement form is designed to protect both the lender and the borrower, fostering transparency and accountability in financial transactions.

Dos and Don'ts

When filling out the Georgia Loan Agreement form, it is important to be thorough and accurate. Here are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate personal and financial information.

- Do ensure that all required fields are completed.

- Do double-check your calculations, especially if they involve loan amounts or interest rates.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't use abbreviations or shorthand that may confuse the lender.

- Don't rush through the form; take your time to avoid mistakes.

Following these guidelines will help ensure that your loan application process goes smoothly.

How to Use Georgia Loan Agreement

Once you have the Georgia Loan Agreement form in hand, it is important to complete it accurately. Each section of the form requires specific information that must be filled out carefully. Follow these steps to ensure that the form is completed correctly.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the borrower and the lender in the designated sections.

- Clearly state the loan amount in the appropriate field.

- Specify the interest rate being charged on the loan.

- Indicate the repayment terms, including the schedule and duration of payments.

- Provide details about any collateral, if applicable, in the specified section.

- Sign and date the form where indicated, ensuring that both parties do the same.

- Make copies of the completed form for your records.

After completing the form, review it for accuracy before submitting it to the relevant parties. It is essential that all information is clear and correct to avoid any potential issues in the future.

Find Popular Loan Agreement Forms for US States

Promissory Note Illinois - This form specifies the loan amount, interest rate, and repayment schedule.

Loan Agreement Template Texas - Entire sections of the agreement can be negotiated to suit both parties' needs.

Promissory Note California - When both parties agree on the terms, the Loan Agreement becomes legally binding.

Documents used along the form

When entering into a loan agreement in Georgia, several other forms and documents may be necessary to ensure clarity and legal compliance. Understanding these additional documents can help you navigate the lending process more smoothly and protect your interests.

- Promissory Note: This is a written promise to pay back the loan amount. It outlines the terms of repayment, including interest rates and due dates.

- Loan Disclosure Statement: This document provides detailed information about the loan terms, including fees and the annual percentage rate (APR). It ensures transparency between the borrower and lender.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security for the loan. It protects the lender's interests in case of default.

- Personal Guarantee: In some cases, especially for business loans, a personal guarantee may be required. This document holds the borrower personally responsible for the loan if the business cannot repay it.

- Credit Application: Lenders often require a credit application to assess the borrower's creditworthiness. This document collects personal and financial information to evaluate the risk of lending.

- Loan Closing Statement: At the closing of the loan, this statement outlines the final details of the transaction, including all costs and fees associated with the loan.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward principal and interest. It helps borrowers understand their payment obligations.

Being aware of these documents can empower you as a borrower or lender. Each plays a crucial role in the loan process, ensuring that both parties are informed and protected throughout the transaction. Always consider seeking professional advice if you have questions about any specific document.

Misconceptions

Understanding the Georgia Loan Agreement form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this form, along with clarifications to help you navigate the process more effectively.

- All loan agreements in Georgia are the same. Each loan agreement can vary significantly based on the lender's policies, the type of loan, and the specific terms negotiated between the parties involved.

- Only banks can issue loan agreements. While banks are common lenders, other financial institutions, credit unions, and private lenders also provide loan agreements in Georgia.

- The Georgia Loan Agreement form is legally binding only if notarized. While notarization can add a layer of authenticity, many loan agreements are legally binding even without a notary, as long as both parties agree to the terms.

- Borrowers can ignore the fine print. The fine print often contains important details about fees, interest rates, and penalties. Ignoring it can lead to unexpected obligations.

- Loan agreements are only for large sums of money. Loan agreements can be used for both small and large amounts. Even personal loans or small business loans require a formal agreement.

- Once signed, the terms of the loan cannot be changed. Modifications can be made if both parties agree to the changes. This is often done through an amendment to the original agreement.

- Georgia law does not require loan agreements to be in writing. While oral agreements can be enforceable, having a written agreement is highly recommended for clarity and legal protection.

- All loan agreements have the same interest rates. Interest rates can vary widely based on the lender, the borrower's creditworthiness, and market conditions. It's essential to shop around.

- Secured loans are always better than unsecured loans. While secured loans often have lower interest rates due to collateral, they also come with the risk of losing that collateral if payments are missed.

- Loan agreements are only necessary for personal loans. Business loans, mortgages, and even informal loans between friends can benefit from a structured loan agreement to avoid misunderstandings.

Being aware of these misconceptions can help individuals make informed decisions when entering into a loan agreement in Georgia. Understanding the nuances of these agreements is essential for both parties to protect their interests.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Loan Agreement is governed by the laws of the State of Georgia. |

| Parties Involved | The agreement typically involves a lender and a borrower. |

| Loan Amount | The specific amount of money being borrowed must be clearly stated in the agreement. |

| Interest Rate | The agreement must specify the interest rate, which can be fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates, should be outlined. |

| Default Conditions | The agreement should define what constitutes a default and the consequences of defaulting. |

| Signatures Required | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

When filling out and using the Georgia Loan Agreement form, it is crucial to understand its key components to ensure compliance and protect your interests. Here are four essential takeaways:

- Accurate Information is Essential: Ensure that all parties involved provide correct names, addresses, and contact information. This prevents future disputes and establishes clear communication.

- Clear Terms of the Loan: Specify the loan amount, interest rate, repayment schedule, and any fees. Clarity in these terms helps avoid misunderstandings and ensures both parties are on the same page.

- Legal Compliance: Familiarize yourself with Georgia state laws regarding loans. Compliance with these regulations is necessary to avoid potential legal issues down the line.

- Signature Requirements: All parties must sign the agreement for it to be legally binding. Ensure that signatures are dated and witnessed if required, as this adds an additional layer of validity.

Following these guidelines will help facilitate a smoother loan process and protect the rights of all parties involved.