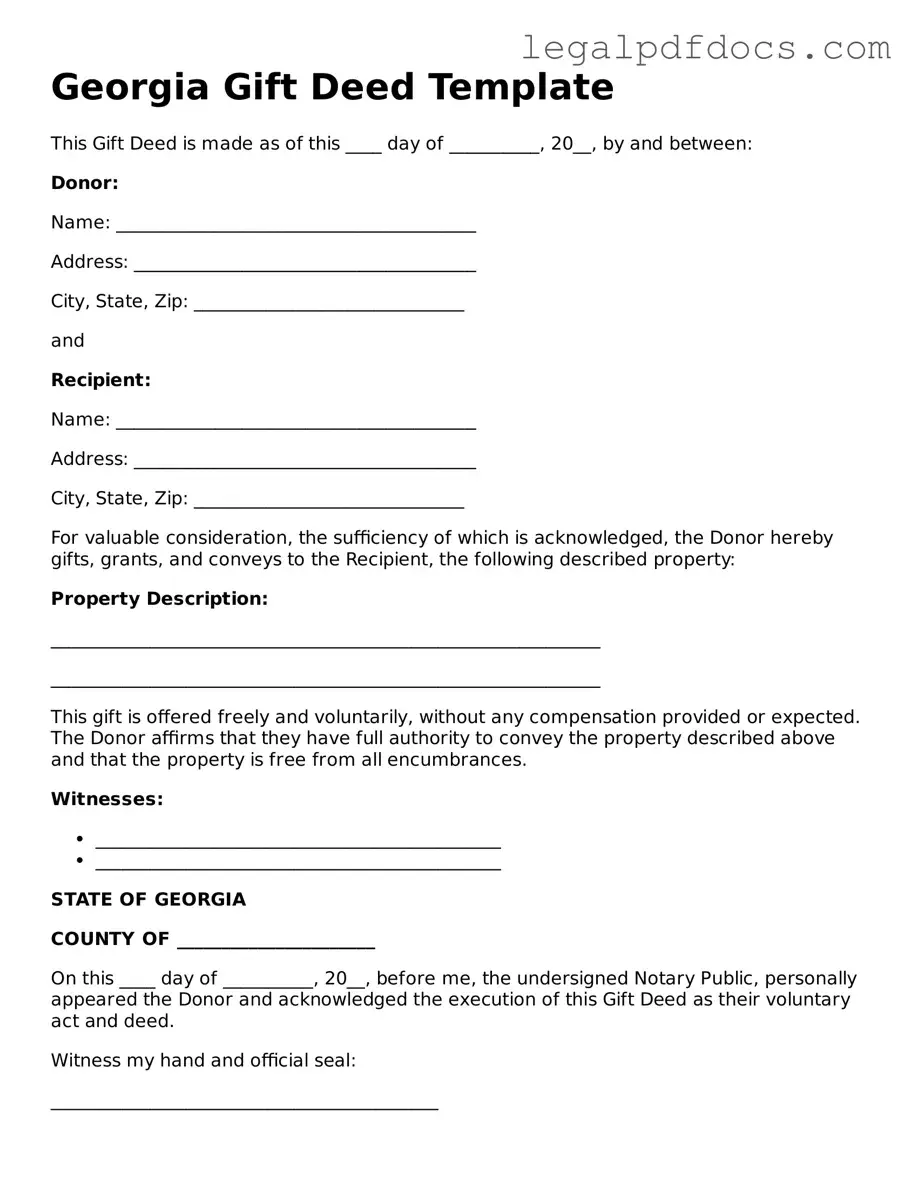

Official Gift Deed Form for Georgia

The Georgia Gift Deed form serves as a vital legal document for individuals wishing to transfer property ownership without the exchange of money. This form facilitates the gifting process, ensuring that the transfer is recognized by the state and protects the interests of both the donor and the recipient. It typically includes essential details such as the names of the parties involved, a description of the property being gifted, and any conditions tied to the gift. By completing this form, the donor formally relinquishes their rights to the property, while the recipient gains full ownership. It is important to understand that a gift deed must be executed with the appropriate signatures and notarization to be legally binding. Additionally, the form may have implications for tax purposes, so consulting with a tax advisor can be beneficial. Overall, the Georgia Gift Deed form is a straightforward yet crucial tool for anyone looking to make a charitable transfer of property in a legally sound manner.

Dos and Don'ts

When filling out the Georgia Gift Deed form, it is important to follow certain guidelines to ensure that the process goes smoothly. Here are some things you should and shouldn't do:

- Do: Carefully read the instructions provided with the form.

- Do: Provide accurate information about the donor and the recipient.

- Do: Sign the form in the presence of a notary public.

- Do: Include a legal description of the property being gifted.

- Don't: Forget to date the form when signing.

- Don't: Leave any sections blank; ensure all required fields are filled out.

- Don't: Use white-out or erasers on the form; corrections should be made by crossing out and initialing.

- Don't: Submit the form without checking for errors or inconsistencies.

By adhering to these guidelines, you can help ensure that the Gift Deed is completed correctly and effectively. If you have any questions, consider reaching out to a legal professional for assistance.

How to Use Georgia Gift Deed

After obtaining the Georgia Gift Deed form, you will need to fill it out accurately to ensure proper documentation of the gift transfer. Follow these steps to complete the form correctly.

- Obtain the Form: Download the Georgia Gift Deed form from a reliable source or visit your local county clerk's office to get a physical copy.

- Identify the Parties: Fill in the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Property: Clearly describe the property being gifted. Include details such as the address, legal description, and any identifying information.

- State the Gift Intent: Indicate that the property is being given as a gift. You may include a statement that the gift is made without consideration.

- Sign the Document: The donor must sign the form. If applicable, have the signature notarized to add an extra layer of authenticity.

- Record the Deed: Take the completed form to the county clerk’s office where the property is located to have it recorded. This step is crucial for legal recognition.

Find Popular Gift Deed Forms for US States

Transfer Deed to Family Member - It ensures that the recipient has clear ownership rights to the property.

Documents used along the form

When completing a gift deed in Georgia, several additional forms and documents may be required to ensure a smooth transaction. Each of these documents serves a specific purpose and helps clarify the terms of the gift, protect the interests of both the giver and the recipient, and comply with state laws.

- Quitclaim Deed: This document transfers any interest the grantor has in the property without making any guarantees about the title. It is often used in gift transactions to simplify the transfer process.

- Warranty Deed: Unlike a quitclaim deed, a warranty deed provides a guarantee that the grantor holds clear title to the property. This form is useful if the donor wants to assure the recipient of their ownership rights.

- Affidavit of Gift: This is a sworn statement confirming that the property is being given as a gift. It can help clarify the intent behind the transaction and may be required for tax purposes.

- Property Tax Exemption Form: In some cases, a gift may qualify for tax exemptions. This form ensures that the recipient is aware of any potential tax benefits associated with the gifted property.

- Transfer Tax Declaration: This document is used to report the transfer of property and may be required by local authorities. It helps ensure that all necessary taxes are accounted for during the transfer.

- Title Insurance Policy: While not always necessary, obtaining title insurance can protect the recipient from future claims against the property. It provides peace of mind regarding the ownership rights being transferred.

- Gift Tax Return (Form 709): If the value of the gift exceeds a certain threshold, the donor may need to file this federal form to report the gift for tax purposes. It is essential for compliance with IRS regulations.

- Notice of Gift: This document serves as a formal notification to relevant parties (such as financial institutions) that a gift has been made. It helps in updating records and ensuring proper acknowledgment of the transfer.

Understanding these documents can facilitate a smoother gift deed process in Georgia. Each form plays a vital role in ensuring that the transfer is legally sound and that both parties are protected throughout the transaction.

Misconceptions

Understanding the Georgia Gift Deed form can be challenging, especially with the various misconceptions that often arise. Here are four common misunderstandings:

-

Gift Deeds are only for family members.

This is not true. While many people use gift deeds to transfer property to family members, they can also be used for friends or charitable organizations. The key is that the transfer is made without expecting anything in return.

-

A Gift Deed does not require any formalities.

While it is true that gift deeds are generally simpler than other types of property transfers, they still need to be executed properly. This includes being signed by the giver and often requires notarization to be legally binding.

-

Once a Gift Deed is signed, the giver can change their mind.

Once the gift deed is executed and delivered, it is usually considered final. The giver cannot simply revoke the gift unless specific legal conditions are met. It’s important to understand the implications before signing.

-

Gift Deeds do not have tax implications.

This misconception can lead to surprises later. While there may not be immediate taxes owed on the transfer, gift deeds can have implications for gift taxes, and the recipient may face property tax assessments in the future.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property ownership without any exchange of money. |

| Governing Law | The Gift Deed in Georgia is governed by Title 44 of the Official Code of Georgia Annotated (O.C.G.A. § 44-5-30). |

| Requirements | The deed must be in writing, signed by the donor, and notarized to be valid. |

| Tax Implications | Gift tax may apply if the value of the property exceeds the annual exclusion limit set by the IRS. |

| Revocation | A Gift Deed is generally irrevocable once executed, unless specific conditions allow for revocation. |

Key takeaways

When filling out and using the Georgia Gift Deed form, keep these key takeaways in mind:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. This is a legal way to give property to someone else.

- Complete All Required Information: Ensure that all sections of the form are filled out accurately. This includes details about the donor, the recipient, and the property being transferred.

- Consider Tax Implications: Gifting property may have tax consequences. Consult a tax professional to understand any potential gift tax obligations.

- Signatures Matter: The deed must be signed by the donor in the presence of a notary public. This step is crucial for the document's validity.

- Record the Deed: After signing, the Gift Deed should be recorded with the local county clerk's office. This ensures the transfer is legally recognized and protects the recipient's ownership rights.