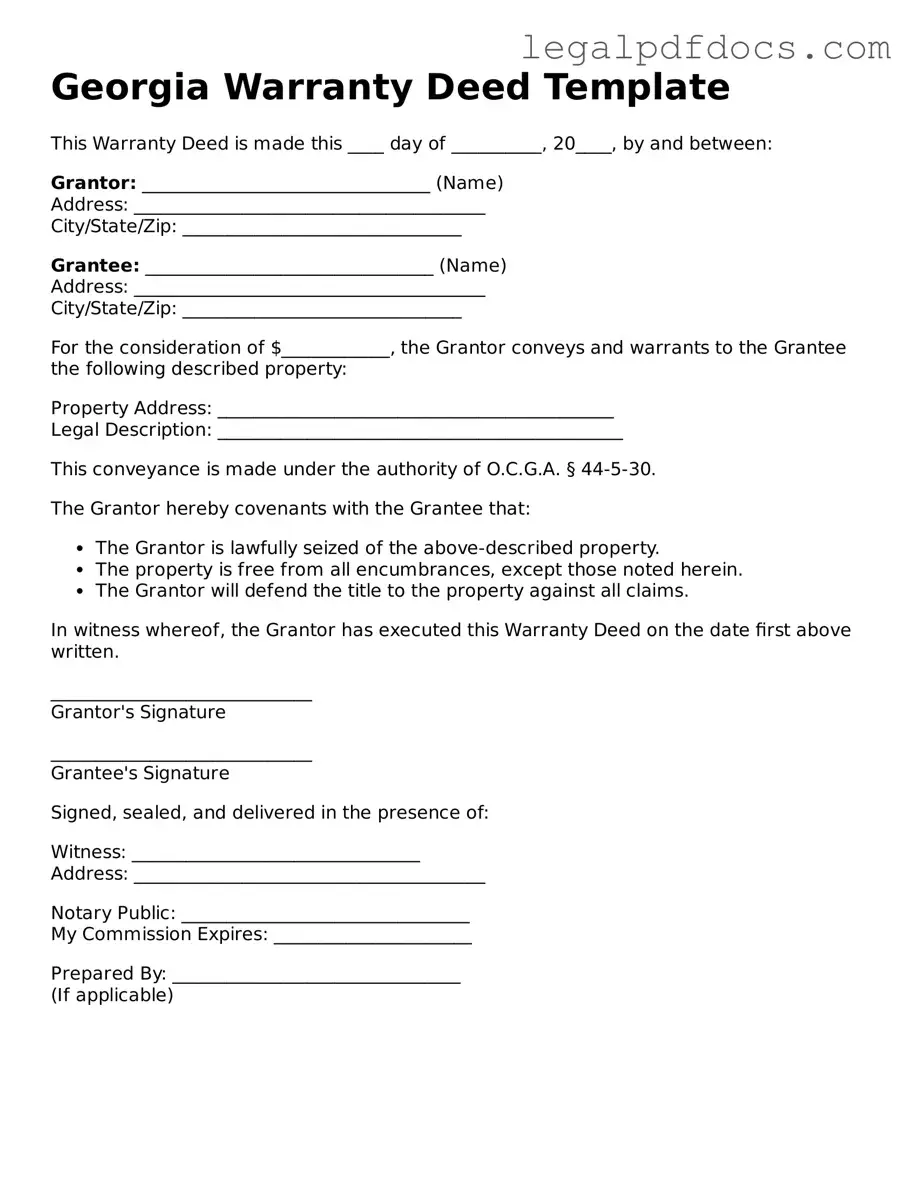

Official Deed Form for Georgia

The Georgia Deed form serves as a crucial legal document in the realm of real estate transactions, facilitating the transfer of property ownership from one party to another. This form encompasses various essential components, including the names of the grantor and grantee, a clear description of the property, and the terms of the transfer. In Georgia, the deed must be executed with the appropriate signatures and notarization to ensure its validity. Different types of deeds, such as warranty deeds and quitclaim deeds, may be utilized depending on the nature of the transaction and the level of protection desired by the parties involved. Additionally, the form requires adherence to state-specific regulations, including the payment of transfer taxes and recording fees, which can vary by county. Understanding these key aspects is vital for anyone involved in real estate transactions in Georgia, as it helps to ensure that the transfer process is both legally sound and efficient.

Dos and Don'ts

Filling out a Georgia Deed form can seem daunting, but with the right approach, you can navigate it successfully. Here are some important dos and don'ts to keep in mind:

- Do ensure that all names are spelled correctly. Accuracy is crucial.

- Do include the complete legal description of the property. This can often be found in previous deeds or property records.

- Do sign the deed in front of a notary public. This step is essential for the document to be legally binding.

- Do check for any specific requirements that may vary by county. Local regulations can differ.

- Don't leave any blank spaces on the form. Every section should be filled out completely.

- Don't use abbreviations in the legal description. Clarity is key.

- Don't forget to record the deed with the county clerk's office after signing. This step is vital for public record.

- Don't rush through the process. Taking your time can help prevent costly mistakes.

By following these guidelines, you can help ensure that your Georgia Deed form is completed correctly and efficiently. Remember, attention to detail is your best ally in this process.

How to Use Georgia Deed

After obtaining the Georgia Deed form, you will need to provide specific information to ensure it is completed correctly. Follow the steps below to fill out the form accurately.

- Begin by entering the date at the top of the form.

- Fill in the names of the grantor(s) (the person(s) transferring the property) in the designated space.

- Provide the names of the grantee(s) (the person(s) receiving the property) in the next section.

- Include the complete legal description of the property being transferred. This may be found in previous deeds or property tax records.

- Specify the consideration, or the amount being exchanged for the property, in the appropriate area.

- Sign the form where indicated. The grantor(s) must sign the document in front of a notary public.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed deed for your records before filing.

- File the original deed with the appropriate county office, usually the Clerk of Superior Court, to record the transfer.

Find Popular Deed Forms for US States

Property Deed Form - A warranty deed provides guarantees about the property's title to the grantee.

Deed for Property - In some states, specific forms must be used for deeds to comply with local laws.

Documents used along the form

When dealing with property transactions in Georgia, several important forms and documents accompany the Georgia Deed form. Each of these documents plays a crucial role in ensuring the legality and clarity of the transaction. Below is a list of commonly used documents that you may encounter.

- Title Search Report: This document provides a detailed history of the property’s ownership, including any liens or encumbrances. It helps verify that the seller has the legal right to sell the property.

- Property Survey: A survey outlines the exact boundaries of the property. It can reveal any potential disputes with neighboring properties and is essential for confirming the property's dimensions.

- Closing Statement: Also known as a HUD-1, this document itemizes all final credits and debits for both the buyer and seller. It is typically reviewed at the closing meeting to ensure all financial aspects are clear.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and discloses any issues that may affect the title. It assures the buyer that there are no undisclosed claims against the property.

- Bill of Sale: This document transfers ownership of personal property associated with the real estate transaction, such as appliances or fixtures. It is important for clarifying what is included in the sale.

- Loan Documents: If financing is involved, various loan documents will be necessary. These include the mortgage agreement and promissory note, which outline the terms of the loan and the borrower’s obligations.

Understanding these documents is essential for a smooth property transaction process in Georgia. Each plays a distinct role in protecting the interests of both buyers and sellers, ensuring that all legal requirements are met.

Misconceptions

Understanding the Georgia Deed form is crucial for anyone involved in real estate transactions in the state. However, there are several misconceptions that can lead to confusion. Here’s a list of nine common misunderstandings:

- All deeds are the same. Many believe that all deeds serve the same purpose. In reality, different types of deeds—like warranty deeds and quitclaim deeds—offer varying levels of protection and rights.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, it is not always necessary for the deed to be legally binding between parties.

- Only lawyers can prepare a deed. This is not true. While having legal assistance is beneficial, property owners can prepare their own deeds if they understand the requirements.

- Once a deed is signed, it cannot be changed. People often think that a deed is final once signed. However, deeds can be amended or revoked under certain circumstances.

- All property transfers require a new deed. Some transfers, such as those between spouses or family members, may not require a new deed if the ownership structure remains the same.

- Deeds are only important at the time of sale. Many overlook the importance of deeds after a sale. They are essential for establishing ownership and can be referenced in future legal matters.

- Property taxes are not affected by the deed. It’s a common belief that the deed has no bearing on property taxes. In fact, changes in ownership can trigger reassessment and affect tax obligations.

- Once recorded, a deed is permanent and cannot be disputed. While recording a deed provides public notice, it does not guarantee that the deed cannot be challenged in court.

- All deeds must be filed with the county clerk. Although most deeds should be recorded to protect ownership rights, some deeds may not require recording depending on the situation.

By dispelling these misconceptions, individuals can better navigate the complexities of real estate transactions in Georgia. Understanding the nuances of the Georgia Deed form will lead to more informed decisions and smoother transactions.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Deed form is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30 et seq. |

| Types of Deeds | Common types of deeds in Georgia include Warranty Deeds, Quitclaim Deeds, and Security Deeds. |

| Execution Requirements | Deeds in Georgia must be signed by the grantor and witnessed by at least two individuals or a notary public. |

| Recording | To be enforceable against third parties, a deed must be recorded in the county where the property is located. |

| Legal Capacity | Only individuals who are legally competent can execute a deed, which generally means they must be at least 18 years old. |

| Transfer of Title | The Georgia Deed form serves as a legal document to transfer ownership of real property from one party to another. |

Key takeaways

Understanding the Georgia Deed form is essential for anyone looking to transfer property ownership. This legal document serves as the official record of the transfer.

Accurate information is crucial. Ensure that all names, addresses, and property descriptions are correct to avoid complications in the future.

In Georgia, the Grantor (the person transferring the property) and the Grantee (the person receiving the property) must be clearly identified. This clarity helps prevent disputes.

It is important to include a legal description of the property. This description should be precise and may differ from the address commonly used.

Consider the type of deed being used. Different types, such as a warranty deed or quitclaim deed, offer varying levels of protection and rights.

Once completed, the deed must be signed by the Grantor in the presence of a notary public. This step is crucial for the deed's validity.

After signing, the deed should be filed with the county's Clerk of Superior Court. This filing is necessary to make the transfer official and public.

Keep a copy of the recorded deed for your records. This document serves as proof of ownership and may be needed for future transactions or legal matters.