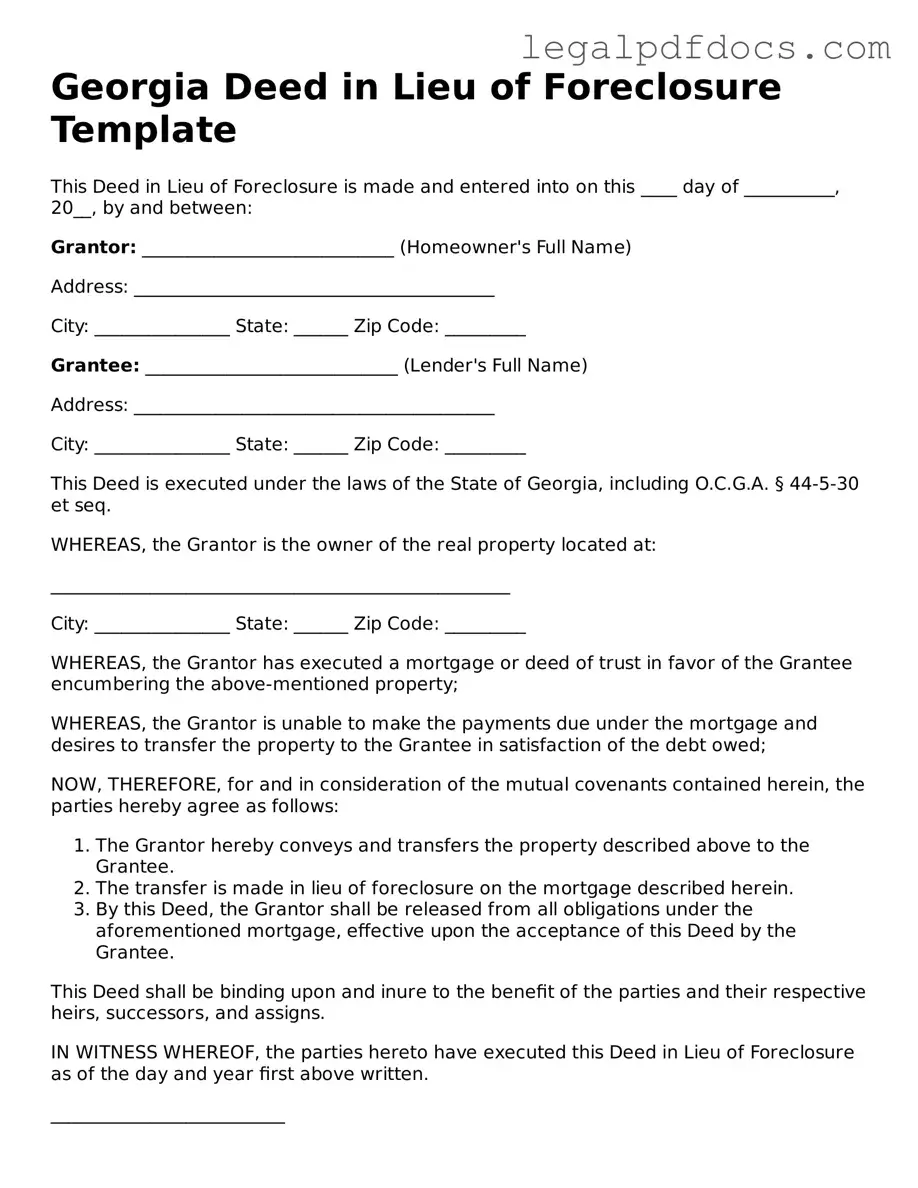

Official Deed in Lieu of Foreclosure Form for Georgia

In the state of Georgia, homeowners facing financial difficulties may find themselves exploring alternatives to foreclosure, and one such option is the Deed in Lieu of Foreclosure form. This legal document serves as a means for property owners to voluntarily transfer ownership of their property back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By executing this form, homeowners can mitigate the negative impact on their credit scores and potentially negotiate more favorable terms with their lender. The Deed in Lieu of Foreclosure also includes essential elements such as the identification of the parties involved, a description of the property, and any pertinent conditions or agreements that both the borrower and lender must adhere to. Understanding the implications of this form is crucial, as it can provide a pathway to financial recovery while allowing lenders to reclaim their assets without resorting to court proceedings. Overall, the Deed in Lieu of Foreclosure form represents a significant tool for those seeking to navigate the challenges of homeownership in times of economic hardship.

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, there are several important things to keep in mind. Here’s a helpful list of dos and don’ts:

- Do ensure all names on the deed match the names on the mortgage.

- Do clearly describe the property being conveyed.

- Do include the correct legal description of the property.

- Do check for any outstanding liens or claims against the property.

- Don't leave any sections blank; complete all required fields.

- Don't forget to have the document notarized before submission.

Following these guidelines can help ensure a smoother process when dealing with a deed in lieu of foreclosure. Always double-check your work and seek assistance if needed.

How to Use Georgia Deed in Lieu of Foreclosure

Once you have gathered the necessary information and documents, you can proceed to fill out the Georgia Deed in Lieu of Foreclosure form. This process is important for transferring property ownership and ensuring that all parties involved are clear on their rights and responsibilities moving forward.

- Begin by clearly writing the full names of all parties involved. This includes the current property owner (the grantor) and the entity receiving the property (the grantee).

- Next, provide the complete address of the property being transferred. This should include the street address, city, state, and zip code.

- Include the legal description of the property. This can often be found on the property deed or tax records and should detail the boundaries and location of the property.

- Indicate the date on which the deed is being executed. This is important for record-keeping and establishing the timeline of the transaction.

- Sign the document in the presence of a notary public. Both the grantor and the grantee should sign the form to validate the transfer.

- Have the notary public complete their section. This includes their signature, seal, and the date of notarization.

- Make copies of the completed deed for your records. It’s essential to keep a copy for future reference.

- Finally, file the original deed with the appropriate county office. This step is crucial to ensure the transfer is officially recorded.

Find Popular Deed in Lieu of Foreclosure Forms for US States

Sale in Lieu of Foreclosure - This document helps the homeowner remove the burden of a mortgage that they can no longer afford.

California Voluntary Foreclosure Deed - Homeowners should review their financial situation to confirm if a Deed in Lieu of Foreclosure is the best option for their circumstances.

Deed in Lieu of Forclosure - The form may require notarization to be legally binding and enforceable.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. This process involves several other forms and documents that help facilitate the transaction. Below is a list of common documents that are often used alongside the Georgia Deed in Lieu of Foreclosure form.

- Loan Modification Agreement: This document outlines the new terms of the mortgage loan, including changes to interest rates or payment schedules, which may be offered to the borrower before considering a deed in lieu.

- Property Appraisal: An appraisal provides an independent assessment of the property's market value, which helps both parties understand the financial implications of the deed in lieu.

- Title Search Report: A title search is conducted to ensure that the property is free of liens or other claims that could complicate the transfer of ownership.

- Release of Liability: This document releases the borrower from any further obligation on the mortgage after the deed is executed, protecting them from future claims related to the loan.

- Settlement Statement: This statement outlines all financial transactions related to the deed in lieu, including any costs or fees incurred during the process.

- Authorization to Release Information: This form allows the lender to share the borrower’s information with third parties, ensuring transparency throughout the process.

- Affidavit of Title: This affidavit confirms that the borrower holds clear title to the property and has the right to transfer ownership to the lender.

- Notice of Default: This document notifies the borrower of their default status on the mortgage and outlines the steps they can take to avoid foreclosure.

- Deed of Trust or Mortgage Release: If applicable, this document formally releases the lender's claim on the property, ensuring that the borrower is no longer liable for the mortgage.

- Borrower’s Financial Statement: This statement provides a snapshot of the borrower’s financial situation, helping the lender assess the viability of the deed in lieu option.

Each of these documents plays a critical role in the deed in lieu process, ensuring that both the borrower and lender are protected and informed throughout the transaction. Proper preparation and understanding of these forms can lead to a smoother resolution for all parties involved.

Misconceptions

Understanding the Georgia Deed in Lieu of Foreclosure form can be challenging. Here are some common misconceptions that may lead to confusion:

- It eliminates all debt obligations. Many believe that signing a deed in lieu of foreclosure cancels all debts. However, this is not always the case. You may still be responsible for any remaining balance after the property is sold.

- It is a quick and easy process. While a deed in lieu can be faster than foreclosure, it still requires negotiation and approval from the lender. The process can take time and may involve complex documentation.

- It does not affect your credit score. Some think that a deed in lieu will not impact their credit. In reality, it can negatively affect your credit score, though it may be less damaging than a foreclosure.

- It is the same as a short sale. A deed in lieu of foreclosure is different from a short sale. In a short sale, the lender agrees to accept less than the amount owed, while a deed in lieu involves transferring ownership back to the lender without a sale.

- All lenders accept deeds in lieu of foreclosure. Not all lenders offer this option. It is essential to check with your lender to determine if they will accept a deed in lieu as a solution.

- You can keep your home during the process. Once you initiate a deed in lieu, you may need to vacate the property, depending on the lender's requirements. This is not a way to retain possession of your home.

- It is a guaranteed solution to avoid foreclosure. A deed in lieu is not a guaranteed way to avoid foreclosure. Lenders will assess your situation and may reject the deed in lieu if they believe other options are more suitable.

- Legal assistance is unnecessary. Some individuals think they can navigate the process alone. However, seeking legal advice can help you understand your rights and obligations, ensuring a smoother process.

- It is free of tax implications. Many assume that there are no tax consequences. However, you may face tax liabilities on any forgiven debt, so it is wise to consult a tax professional.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Georgia law, specifically O.C.G.A. § 44-14-162. |

| Eligibility | Homeowners must be in default on their mortgage payments to qualify for a deed in lieu of foreclosure. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and potentially reduce damage to their credit score. |

| Process | Borrowers must negotiate the deed in lieu with the lender, which often requires a formal agreement. |

| Property Condition | The property must typically be in good condition; lenders may refuse if significant repairs are needed. |

| Tax Implications | Borrowers may face tax consequences, as forgiven debt can be considered taxable income. |

| Impact on Credit | A deed in lieu of foreclosure can still impact credit scores, though generally less severely than a foreclosure. |

| Alternatives | Other options include loan modification, short sale, or bankruptcy, which may be more suitable for some borrowers. |

Key takeaways

When dealing with the Georgia Deed in Lieu of Foreclosure form, understanding the process and implications is crucial. Here are some key takeaways to keep in mind:

- Ensure that you are eligible to use the Deed in Lieu of Foreclosure. This option is typically available to homeowners who are facing financial difficulties but wish to avoid the lengthy foreclosure process.

- Consult with a legal advisor or real estate professional before proceeding. They can provide guidance specific to your situation and help you understand the potential consequences.

- Gather all necessary documentation. You will need to provide proof of ownership, mortgage details, and any relevant financial information.

- Understand that signing a Deed in Lieu of Foreclosure transfers ownership of the property back to the lender. This means you will no longer have any claim to the property.

- Be aware of the potential impact on your credit score. A Deed in Lieu of Foreclosure may affect your credit differently than a foreclosure, but it can still have negative implications.

- Check if your lender will forgive any remaining debt after the property transfer. Some lenders may pursue a deficiency judgment for the difference between the loan balance and the property's value.

- Consider tax implications. The IRS may treat the forgiven debt as taxable income, so it's wise to consult a tax professional.

- Document the entire process. Keep copies of all correspondence and agreements with your lender to protect yourself in the future.

Taking these steps can help ensure that you navigate the Deed in Lieu of Foreclosure process more effectively and with greater peace of mind.