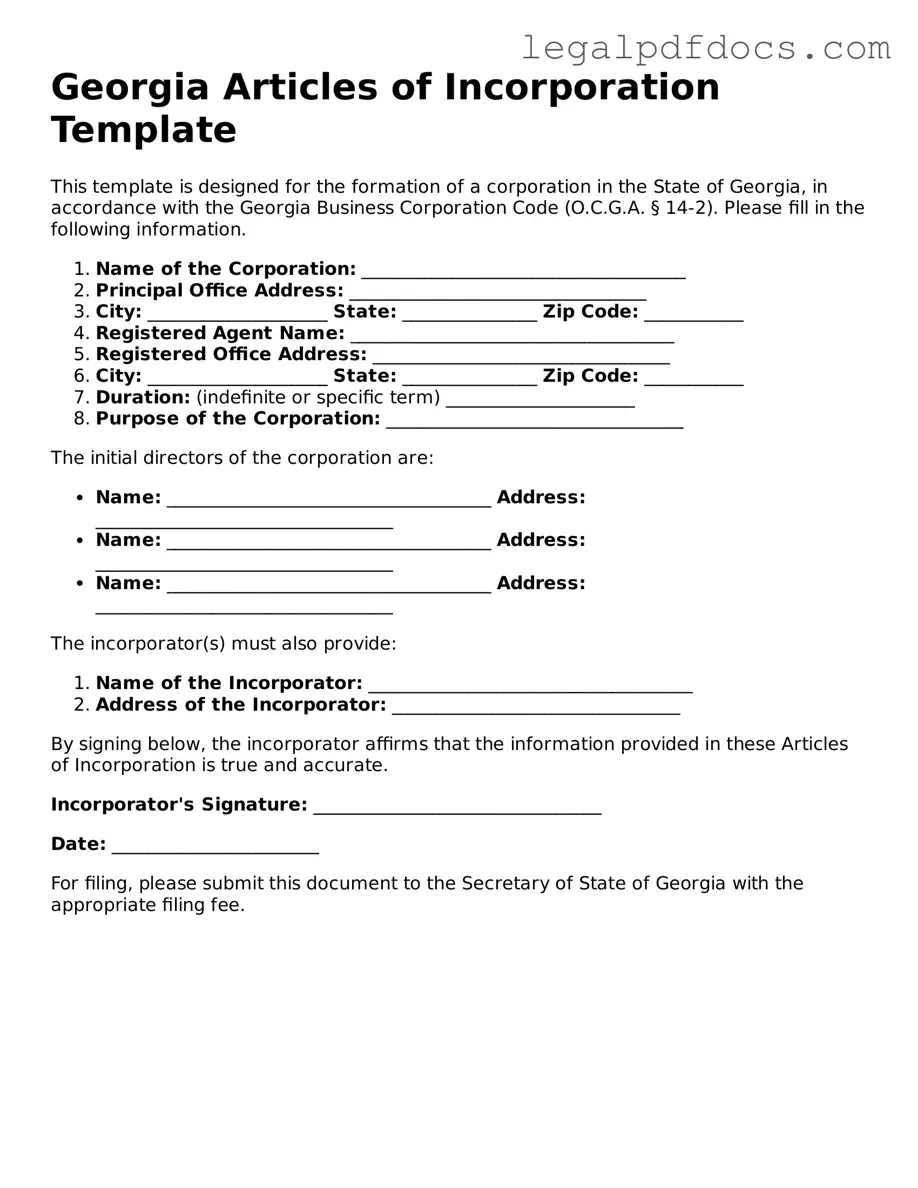

Official Articles of Incorporation Form for Georgia

The Georgia Articles of Incorporation form is a crucial document for individuals or groups seeking to establish a corporation in the state of Georgia. This form serves as the foundational legal instrument that outlines essential information about the corporation, including its name, purpose, and registered agent. A clear and accurate description of the corporation's activities is necessary to comply with state regulations. Additionally, the form requires the identification of the initial directors and the number of shares the corporation is authorized to issue. Completing this form correctly is vital, as it not only initiates the incorporation process but also ensures that the corporation is recognized as a separate legal entity. Filing the Articles of Incorporation with the Georgia Secretary of State is a necessary step for gaining limited liability protection and other benefits associated with corporate status. Understanding each section of the form can help streamline the incorporation process and facilitate compliance with Georgia's legal requirements.

Dos and Don'ts

When filling out the Georgia Articles of Incorporation form, it is essential to approach the process with care. Here are seven important dos and don'ts to keep in mind:

- Do ensure that you have a clear understanding of your business structure before starting the form.

- Do provide accurate and complete information for all required fields.

- Do include the name of your corporation, ensuring it complies with Georgia naming requirements.

- Do designate a registered agent who has a physical address in Georgia.

- Don't leave any required fields blank, as this can lead to delays or rejection of your application.

- Don't use abbreviations or informal names that do not meet the legal requirements for corporate names.

- Don't forget to review the form for errors before submitting it to the Secretary of State.

How to Use Georgia Articles of Incorporation

Once you have the Georgia Articles of Incorporation form in hand, it’s time to start filling it out. This document is essential for officially establishing your corporation in the state of Georgia. Follow these steps carefully to ensure that all necessary information is provided accurately.

- Gather Necessary Information: Before you begin, collect all relevant details about your corporation, including the name, address, and purpose.

- Choose a Name: Ensure your corporation name is unique and complies with Georgia naming requirements. Check the availability through the Georgia Secretary of State's website.

- Provide Principal Office Address: Enter the physical address of your corporation’s main office. This cannot be a P.O. Box.

- List Registered Agent: Designate a registered agent who will receive legal documents on behalf of the corporation. Include their name and address.

- State the Purpose: Clearly describe the purpose of your corporation. This can be a general statement or a specific business activity.

- Incorporators Information: List the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Number of Shares: Indicate the total number of shares your corporation is authorized to issue. Specify the par value, if applicable.

- Sign and Date: Ensure that all incorporators sign and date the form. This signifies their agreement and commitment to forming the corporation.

- Submit the Form: File the completed form with the Georgia Secretary of State, either online or by mail, along with the required filing fee.

After submitting the Articles of Incorporation, you will receive confirmation from the state. This will include a certificate of incorporation, which officially marks the establishment of your corporation. Keep this document safe, as it is crucial for your business operations moving forward.

Find Popular Articles of Incorporation Forms for US States

How Do I Get a Certificate of Good Standing - Once submitted and accepted, an incorporation certificate is usually issued by the state.

Kansas Llc Requirements - Future business expansion plans may be addressed within these articles.

Idaho Llc Registration - This document can impact the corporate tax status.

How Much Does a Llc Cost in Texas - Incorporators consent to the contents of the Articles as a record of establishment.

Documents used along the form

When forming a corporation in Georgia, several other documents may be necessary in addition to the Articles of Incorporation. These documents help establish the corporation's structure, governance, and compliance with state laws. Below is a list of common forms and documents that are often used alongside the Georgia Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for the corporation. It covers topics such as the responsibilities of directors and officers, how meetings are conducted, and voting procedures.

- Organizational Meeting Minutes: After incorporation, the initial meeting of the board of directors is documented in these minutes. They record important decisions, such as the appointment of officers and the adoption of bylaws.

- Initial Report: In some cases, corporations may need to file an initial report with the state, detailing key information about the business, including its address and officers.

- Employer Identification Number (EIN) Application: This form is necessary for tax purposes. An EIN is required for opening a business bank account and filing taxes.

- Business License Application: Depending on the type of business and location, a license may be required to operate legally. This application is typically submitted to the local government.

- State Tax Registration: Corporations may need to register with the Georgia Department of Revenue for state tax purposes, including sales tax and corporate income tax.

- Shareholder Agreements: If there are multiple shareholders, this document outlines the rights and responsibilities of each shareholder, including how shares can be sold or transferred.

Each of these documents plays a crucial role in establishing and maintaining a corporation in Georgia. Ensuring that all necessary forms are completed accurately can help facilitate smooth operations and compliance with state regulations.

Misconceptions

When it comes to the Georgia Articles of Incorporation form, several misconceptions can lead to confusion for those looking to establish a business. Understanding these common misunderstandings can help streamline the incorporation process and ensure compliance with state laws.

- Misconception 1: The Articles of Incorporation are the only document needed to start a business.

- Misconception 2: All corporations must have a board of directors listed in the Articles.

- Misconception 3: Incorporation guarantees personal liability protection.

- Misconception 4: The Articles of Incorporation cannot be amended once filed.

Many believe that filing the Articles of Incorporation is the sole requirement for forming a corporation in Georgia. However, additional steps such as obtaining an Employer Identification Number (EIN) from the IRS and securing any necessary business licenses are also essential for full compliance.

While having a board of directors is a requirement for most corporations, the Articles of Incorporation do not need to include the names of the directors. Instead, the information about the board can be documented in the corporation's bylaws.

Incorporating a business does provide a level of personal liability protection for its owners, but it is not absolute. If a business owner engages in fraudulent activities or fails to adhere to corporate formalities, they may still be held personally liable for the corporation’s debts and obligations.

Some individuals think that once the Articles of Incorporation are submitted, they are set in stone. In reality, amendments can be made to the Articles, allowing corporations to adapt to changes in ownership, business structure, or other important factors over time.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Articles of Incorporation are governed by the Georgia Business Corporation Code, specifically O.C.G.A. § 14-2-201. |

| Purpose | The form is used to officially create a corporation in the state of Georgia. |

| Filing Requirement | To form a corporation, the Articles of Incorporation must be filed with the Georgia Secretary of State. |

| Information Needed | Key information includes the corporation's name, registered agent, and the number of shares authorized. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Incorporator | At least one incorporator is required to sign the Articles of Incorporation; this person can be an individual or entity. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which can vary based on the type of corporation. |

| Processing Time | The processing time for the Articles of Incorporation can vary, but expedited services are available for an additional fee. |

| Amendments | If changes are needed after filing, amendments to the Articles of Incorporation can be submitted to the Secretary of State. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record and can be accessed by anyone. |

Key takeaways

When filling out and using the Georgia Articles of Incorporation form, there are several important points to keep in mind. This document is essential for establishing your business as a corporation in the state of Georgia. Below are key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation, outlining its structure and purpose.

- Choose a Unique Name: Ensure that the name you select for your corporation is unique and complies with Georgia naming requirements. It must include "Corporation," "Incorporated," or an abbreviation like "Inc." or "Corp."

- Designate a Registered Agent: You must appoint a registered agent who will receive legal documents on behalf of the corporation. This agent must have a physical address in Georgia.

- Specify the Business Purpose: Clearly state the purpose of your corporation. This can be broad, but it should reflect the primary activities your business will engage in.

- File with the Secretary of State: Submit the completed Articles of Incorporation to the Georgia Secretary of State along with the required filing fee. Ensure that you keep a copy for your records.

- Understand Ongoing Requirements: After incorporation, be aware of ongoing compliance obligations, such as annual reports and maintaining a registered agent.

By following these key points, you can navigate the process of incorporating your business in Georgia more effectively.