Fill Out a Valid Generic Direct Deposit Template

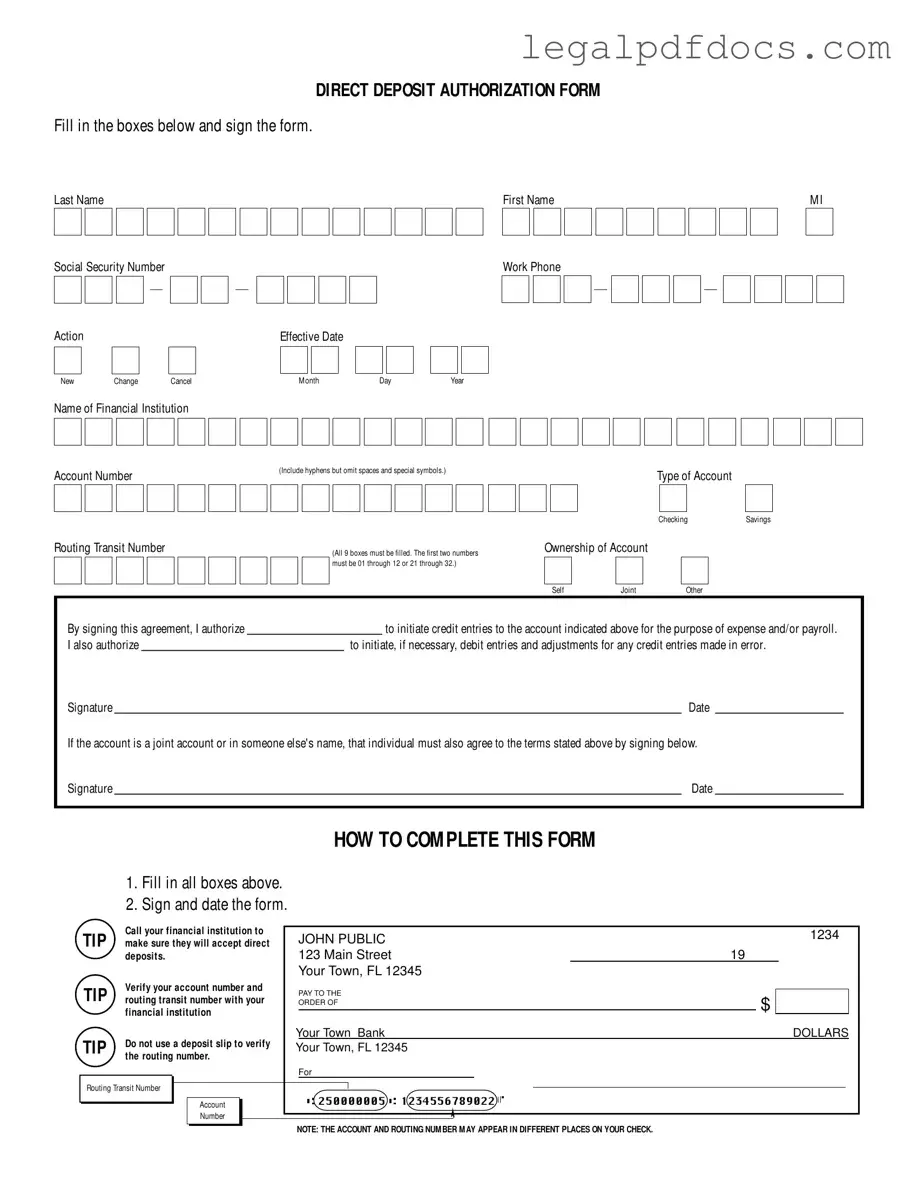

The Generic Direct Deposit form is a crucial document for anyone looking to streamline their payroll or expense payments. This form allows individuals to authorize their employer or other payers to deposit funds directly into their bank accounts, eliminating the need for paper checks. It requires essential information such as the individual's name, Social Security number, and contact details. Additionally, the form includes sections for the financial institution's name, account number, and routing transit number, which are vital for ensuring accurate and timely deposits. Users must specify whether the account is a checking or savings account and indicate the nature of the action—new, change, or cancellation. The form also necessitates signatures from both the account holder and, if applicable, any joint account holders, thereby ensuring that all parties agree to the terms. Completing the form accurately is imperative; it includes clear instructions to fill in all required fields and verify account details with the financial institution to avoid errors. With the right information, this form can facilitate a seamless transition to direct deposit, providing convenience and security for all parties involved.

Dos and Don'ts

When filling out the Generic Direct Deposit form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure a smooth process and avoid any potential issues.

- Do fill in all boxes completely. Missing information can delay the processing of your direct deposit.

- Do double-check your account number and routing transit number with your financial institution.

- Do sign and date the form to validate your authorization.

- Do confirm that your financial institution accepts direct deposits before submitting the form.

- Don't use a deposit slip to verify your routing number, as it may lead to inaccuracies.

- Don't forget that if the account is a joint account, the other account holder must also sign the form.

By adhering to these guidelines, you can help ensure that your direct deposit setup goes smoothly and that your funds are deposited correctly and on time.

How to Use Generic Direct Deposit

After completing the Generic Direct Deposit form, you will submit it to your employer or financial institution. They will process your request and set up your direct deposit. Make sure to double-check all information for accuracy to avoid any delays.

- Fill in your Last Name, First Name, and Middle Initial in the provided boxes.

- Enter your Social Security Number in the format XXX-XX-XXXX.

- Select the Action you want to take: New, Change, or Cancel.

- Write the Effective Date in the format Month/Day/Year.

- Provide your Work Phone number in the format XXX-XXX-XXXX.

- Fill in the Name of Financial Institution.

- Enter your Account Number (include hyphens, omit spaces and special symbols).

- Select your Type of Account: Savings or Checking.

- Fill in the Routing Transit Number (ensure all 9 boxes are filled correctly).

- Indicate your Ownership of Account: Self, Joint, or Other.

- Sign and date the form where indicated.

- If the account is joint or in someone else's name, that person must also sign and date the form.

Before you submit, consider calling your financial institution to confirm they accept direct deposits. Verify your account and routing numbers to ensure they are correct. Avoid using a deposit slip for verification, as the numbers may appear in different places on your check.

More PDF Templates

Notice of Intent to Lien Florida Pdf - The intent to lien alerts property owners about unpaid amounts for contracted services.

Fake Restraining Order Funny - This temporary order can restrict the restrained person’s movements.

Documents used along the form

When setting up direct deposit, several other forms and documents may be required to ensure a smooth process. Below is a list of commonly used documents that complement the Generic Direct Deposit form. Each plays a crucial role in establishing your banking details and confirming your identity.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax withholding from your paycheck.

- Employee Information Form: This document collects essential details about the employee, such as personal information, emergency contacts, and tax filing status, which may be needed for payroll processing.

- Bank Verification Letter: A letter from your bank confirming your account details, including the account holder's name and account number, may be necessary to validate your direct deposit setup.

- Payroll Deduction Authorization Form: If you wish to have certain deductions made from your paycheck (like retirement contributions or health insurance), this form authorizes your employer to withhold these amounts.

- Direct Deposit Change Request: This form is used to update your direct deposit information if you change banks or accounts, ensuring that your payments go to the correct place.

- Identification Documents: A copy of your government-issued ID, such as a driver's license or passport, may be required to verify your identity when setting up direct deposit.

- Employment Offer Letter: This letter outlines the terms of your employment, including salary and benefits. It may be requested to confirm your eligibility for direct deposit.

Having these documents ready can simplify the direct deposit setup process. It ensures that your employer has all the necessary information to process your payments accurately and efficiently.

Misconceptions

Many people have misunderstandings about the Generic Direct Deposit form. Here are six common misconceptions:

-

All fields are optional.

Some believe that they can skip certain fields on the form. In reality, every box must be filled out completely to ensure proper processing.

-

Only payroll deposits can be set up.

While payroll is a common use, the form can also be used for expense reimbursements and other types of credit entries.

-

Signature from only one account holder is needed.

If the account is joint or in someone else's name, all account holders must sign the form to authorize the direct deposit.

-

Routing numbers can be verified with a deposit slip.

This is a misconception. It is important to verify the routing number directly with your financial institution, as deposit slips may not always contain accurate information.

-

The form is the same for all banks.

Different banks may have specific requirements or additional forms. Always check with your financial institution to ensure compliance with their policies.

-

Once submitted, the direct deposit is permanent.

Many think that the direct deposit will continue indefinitely. However, changes or cancellations must be submitted using the same form to update your account information.

Understanding these misconceptions can help ensure a smoother experience when setting up direct deposit.

File Specs

| Fact Name | Details |

|---|---|

| Purpose | The Generic Direct Deposit form allows individuals to authorize a financial institution to deposit funds directly into their bank account. |

| Account Types | Individuals can choose between a checking or savings account for direct deposit. This selection must be indicated on the form. |

| Routing Number Requirement | The routing transit number must consist of 9 digits, with specific starting numbers indicating valid banks. It is essential to verify this number with the financial institution. |

| Signature Requirement | Both the account holder and any joint account holders must sign the form to authorize direct deposit and any potential adjustments. |

Key takeaways

- Fill in all required fields: Ensure that every box on the form is completed accurately.

- Provide your personal information: Include your last name, first name, middle initial, and Social Security number.

- Choose the correct action: Indicate whether you are setting up a new direct deposit, changing an existing one, or canceling.

- Specify your financial institution: Write the name of your bank or credit union clearly.

- Account details matter: Enter your account number and routing transit number without spaces or special symbols.

- Check account type: Select whether your account is a savings or checking account.

- Ownership verification: Indicate if the account is solely yours, joint, or under another person's name.

- Sign the form: Your signature is required to authorize the direct deposit.

- Joint account signatures: If applicable, the other account holder must also sign the form.

- Confirm with your bank: Call your financial institution to ensure they accept direct deposits and verify your account details.

- Do not use a deposit slip: Avoid using a deposit slip to check your routing number; it may lead to errors.