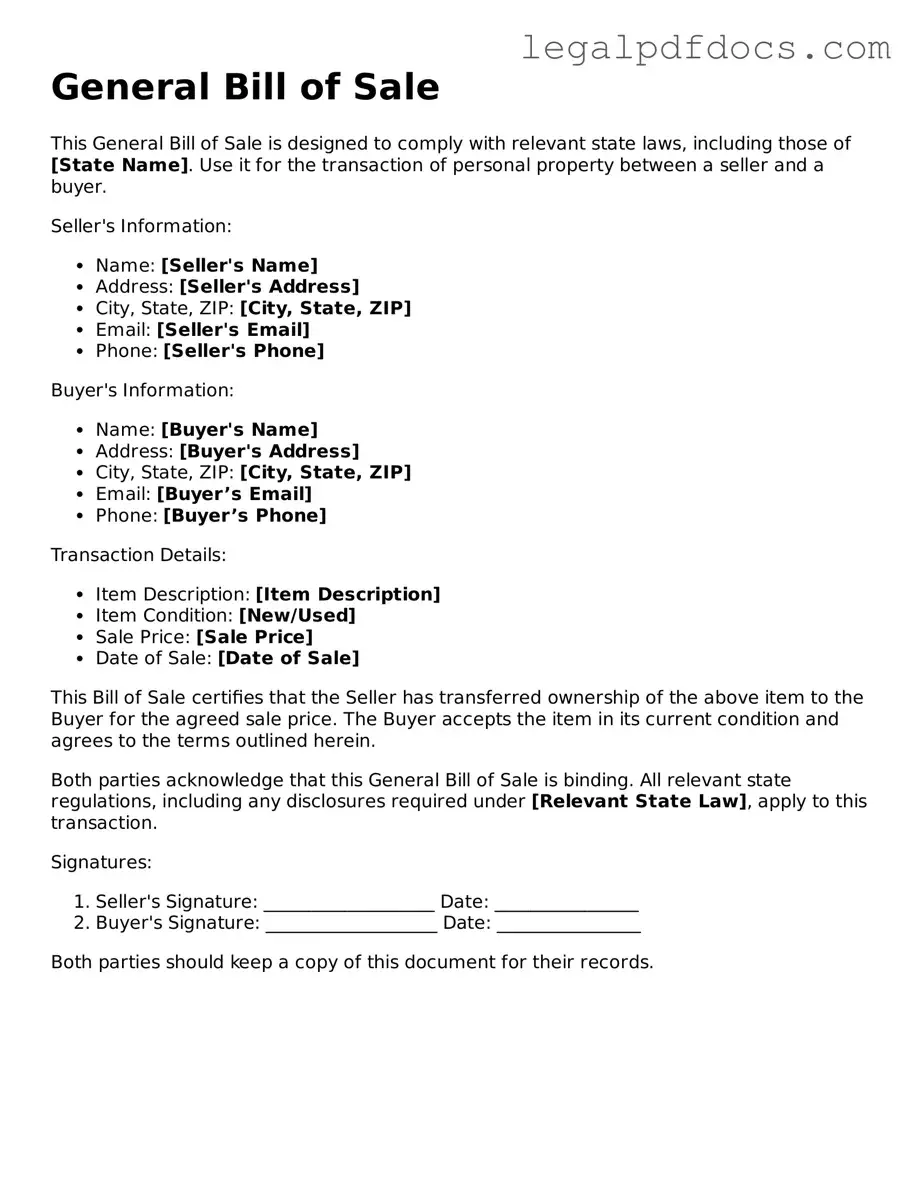

General Bill of Sale Template

When engaging in the sale or transfer of personal property, a General Bill of Sale form serves as a crucial document that outlines the details of the transaction. This form provides a written record of the exchange between the buyer and the seller, capturing essential information such as the names and addresses of both parties, a description of the item being sold, and the agreed-upon purchase price. Additionally, it may include terms related to warranties or the condition of the item, ensuring that both parties have a clear understanding of their rights and obligations. By documenting the transaction, the General Bill of Sale helps protect both the buyer and the seller, offering legal proof of ownership and the terms of the sale. Whether you're selling a vehicle, furniture, or other personal items, using this form can simplify the process and provide peace of mind for everyone involved.

Dos and Don'ts

When filling out the General Bill of Sale form, it's important to be careful and thorough. Here are some dos and don'ts to keep in mind:

- Do provide accurate information about the buyer and seller.

- Do include a detailed description of the item being sold.

- Do sign and date the form to make it legally binding.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; incomplete forms can lead to confusion.

- Don't use vague language when describing the item; clarity is key.

- Don't forget to verify the identities of both parties involved.

- Don't rush through the process; take your time to ensure accuracy.

How to Use General Bill of Sale

Filling out a General Bill of Sale form is a straightforward process that helps document the transfer of ownership of an item. After completing the form, you will typically need to provide it to the buyer and retain a copy for your records. Here are the steps to follow to fill out the form correctly:

- Obtain the form: Find a blank General Bill of Sale form, which can often be downloaded from legal websites or obtained from local government offices.

- Identify the seller: Enter the full name and address of the person or business selling the item.

- Identify the buyer: Fill in the full name and address of the person or business purchasing the item.

- Describe the item: Provide a detailed description of the item being sold, including its make, model, year, and any identifying numbers such as a VIN for vehicles.

- State the sale price: Clearly indicate the agreed-upon price for the item in the appropriate section.

- Include the date of sale: Write the date when the transaction is taking place.

- Sign the form: Both the seller and the buyer should sign the document to confirm the agreement.

- Make copies: After signing, make copies for both the seller and the buyer to keep for their records.

Check out Popular Types of General Bill of Sale Templates

Bill of Sale for Jet Ski and Trailer - If a jet ski has a lien, it's good practice to note it in the sale form.

Bill of Sale for 4 Wheeler - Can enhance buyer confidence in purchasing a used ATV.

Small Business Bill of Sale Pdf - Acts as a binding agreement once signed by both parties.

Documents used along the form

The General Bill of Sale form serves as a crucial document in the transfer of ownership for various types of personal property. However, it is often accompanied by other forms and documents that help clarify the transaction, protect the interests of both parties, and ensure compliance with local laws. Below are some commonly used documents that complement the General Bill of Sale.

- Title Transfer Document: This document is essential for transferring ownership of vehicles. It proves that the seller has the legal right to sell the vehicle and that the buyer is now the rightful owner.

- Odometer Disclosure Statement: Required in many states, this form verifies the mileage on a vehicle at the time of sale. It helps prevent fraud and ensures that the buyer is aware of the vehicle's condition.

- Purchase Agreement: This document outlines the terms of the sale, including the price, payment method, and any conditions of the sale. It serves as a formal agreement between the buyer and seller.

- Release of Liability: This form protects the seller from future claims related to the property after the sale is completed. It acknowledges that the buyer assumes all responsibility for the property once the transaction is finalized.

- Notarized Affidavit: In some cases, a notarized affidavit may be necessary to confirm the identities of the parties involved and the authenticity of the transaction. This adds an extra layer of security to the sale.

By understanding these additional documents, both buyers and sellers can navigate the process of transferring ownership more effectively. Ensuring that all necessary paperwork is completed can help prevent misunderstandings and legal issues down the road.

Misconceptions

Understanding the General Bill of Sale form is essential for anyone involved in buying or selling personal property. However, several misconceptions often arise. Here’s a breakdown of ten common misunderstandings:

- It’s only for vehicles. Many people think a bill of sale is only necessary for cars. In reality, it can be used for any personal property, including furniture, electronics, and more.

- It doesn’t need to be signed. Some believe that a verbal agreement is enough. However, a signed bill of sale provides legal proof of the transaction.

- It’s not legally binding. A properly completed and signed bill of sale is a legally binding document. It protects both the buyer and seller.

- All states require it. While many states recommend a bill of sale, not all require one for every transaction. Check local laws to be sure.

- It only protects the seller. This is false. A bill of sale protects both parties by documenting the transaction and terms agreed upon.

- It’s the same as a receipt. A receipt is proof of payment, while a bill of sale details the transfer of ownership. They serve different purposes.

- It doesn’t need to include details. Omitting important details like the item description, price, and date can lead to disputes. Always include relevant information.

- It’s only necessary for large transactions. Even small sales benefit from a bill of sale. It can help avoid misunderstandings later on.

- Once signed, it can’t be changed. While it’s best to create a new document for any changes, amendments can be made if both parties agree.

- It’s only for private sales. Businesses can also use a bill of sale for transactions. It’s a versatile document suitable for various sales contexts.

Clearing up these misconceptions can help ensure smoother transactions and protect everyone involved.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A General Bill of Sale is a document used to transfer ownership of personal property from one party to another. |

| Purpose | This form serves as a receipt and proof of sale, detailing the transaction between buyer and seller. |

| Property Types | It can be used for various types of personal property, including vehicles, equipment, and furniture. |

| State Variability | Each state may have its own specific requirements and variations for the Bill of Sale. |

| Governing Law | In most states, the sale of personal property is governed by the Uniform Commercial Code (UCC). |

| Notarization | Some states may require notarization of the Bill of Sale for it to be legally binding. |

| Information Required | The form typically requires details such as the buyer’s and seller’s names, addresses, and a description of the property. |

| Consideration | It must state the purchase price or consideration exchanged for the property. |

| As-Is Clause | Many Bills of Sale include an "as-is" clause, indicating that the buyer accepts the property in its current condition. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it can be important for future reference. |

Key takeaways

When using a General Bill of Sale form, keep these important points in mind:

- Accurate Information is Key: Ensure all details about the buyer and seller are correct. This includes names, addresses, and contact information. Any inaccuracies can lead to issues later.

- Describe the Item Thoroughly: Provide a clear and detailed description of the item being sold. This should include make, model, year, and any unique identifiers like a VIN for vehicles.

- Consider Payment Methods: Specify how the payment will be made. Whether it’s cash, check, or another method, clarity here can prevent misunderstandings.

- Keep a Copy for Your Records: After filling out the form, both parties should retain a signed copy. This serves as proof of the transaction and can be useful for future reference.