Fill Out a Valid Free And Invoice Pdf Template

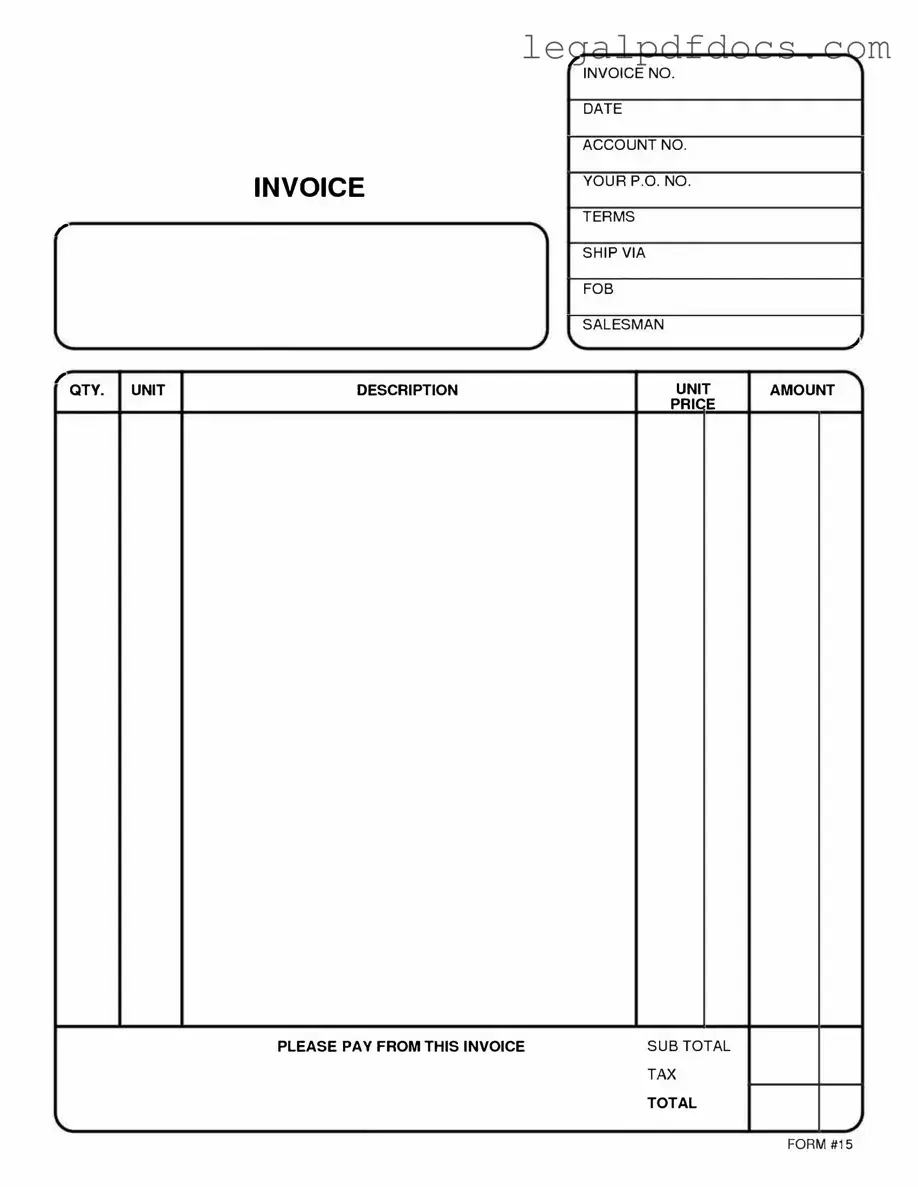

The Free And Invoice PDF form serves as a vital tool for individuals and businesses alike, streamlining the invoicing process and enhancing financial management. This form allows users to create professional invoices quickly and efficiently, ensuring that all necessary details are included. From itemizing services or products to specifying payment terms, the form covers essential aspects such as the date, invoice number, and contact information for both the sender and recipient. Users can easily customize the template to reflect their brand identity, adding logos and adjusting colors as needed. Additionally, the PDF format guarantees that the invoice will maintain its formatting across different devices and platforms, making it easy to share via email or print. Overall, the Free And Invoice PDF form is designed to simplify the invoicing experience, enabling users to focus more on their core activities while ensuring timely payments.

Dos and Don'ts

When filling out the Free And Invoice PDF form, it is important to follow certain guidelines to ensure accuracy and efficiency. Here are seven things to keep in mind:

- Do: Read the instructions carefully before starting.

- Do: Use clear and legible handwriting if filling out a paper form.

- Do: Double-check all entries for accuracy.

- Do: Provide complete information, including all required fields.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or shorthand that may be unclear.

- Don't: Submit the form without reviewing it first.

Following these guidelines will help ensure that your form is processed smoothly and without delays.

How to Use Free And Invoice Pdf

Filling out the Free And Invoice PDF form requires attention to detail and accuracy. This guide provides straightforward steps to ensure you complete the form correctly. Follow these instructions carefully to avoid any mistakes.

- Start by downloading the Free And Invoice PDF form from the designated source.

- Open the PDF using a compatible reader that allows for form filling.

- Locate the section for your personal information. Enter your name, address, and contact details as required.

- Proceed to the itemized list section. Here, input the details of the products or services provided. Include descriptions, quantities, and prices.

- Calculate the total amount due. Ensure all calculations are accurate and reflect the correct totals.

- If applicable, add any taxes or additional fees in the designated fields.

- Review all entries for accuracy. Check for any spelling errors or incorrect figures.

- Once satisfied, save the completed form to your device.

- Print the form if a hard copy is needed, or prepare to send it electronically if required.

More PDF Templates

T47 Paralympics - Title companies may request the T-47 to facilitate title examination processes.

Acord Application - The Acord 50 WM is valuable for any business looking to protect its workforce.

S Corp Abbreviation - Shareholders must consent to the S corporation election by signing the IRS 2553 form.

Documents used along the form

When managing finances, especially in a business context, several forms and documents often accompany the Free And Invoice PDF form. Each of these documents plays a crucial role in ensuring clear communication and proper record-keeping. Below is a list of commonly used documents that can enhance your invoicing process.

- Purchase Order (PO): This document is issued by a buyer to a seller, indicating the types and quantities of products or services needed. It serves as a formal agreement before the transaction takes place.

- Sales Receipt: A sales receipt is provided to the buyer as proof of payment for goods or services. It typically includes details such as the date of purchase, items bought, and total amount paid.

- Credit Note: This document is issued by a seller to a buyer, indicating a reduction in the amount owed. It may be used in cases of returned goods or overpayments.

- Payment Receipt: A payment receipt confirms that a payment has been made. It includes information about the payer, the amount, and the date of the transaction, ensuring transparency.

- Statement of Account: This document summarizes all transactions between a buyer and seller over a specific period. It helps both parties keep track of outstanding balances and payment history.

- Contract Agreement: A contract outlines the terms and conditions of a business relationship. It provides clarity on services rendered, payment terms, and obligations of both parties.

- Delivery Note: A delivery note accompanies goods being delivered, confirming that the items listed have been sent. It is important for both the sender and recipient to verify the delivery.

- Expense Report: This document details expenses incurred by employees or contractors on behalf of the business. It is essential for reimbursement and accounting purposes.

- Tax Form: Various tax forms, such as W-9 or 1099, may be necessary for reporting income or withholding taxes. These forms ensure compliance with tax regulations.

- Refund Request Form: If a customer is unsatisfied with a product or service, this form allows them to formally request a refund. It streamlines the process for both the customer and the business.

Utilizing these documents alongside the Free And Invoice PDF form can significantly improve your financial management and communication processes. Each form serves a specific purpose, ensuring that all parties involved have a clear understanding of their rights and obligations.

Misconceptions

There are several misconceptions surrounding the Free And Invoice PDF form. Understanding these can help individuals and businesses use the form more effectively. Here are seven common misconceptions:

- It’s only for businesses. Many believe that the Free And Invoice PDF form is exclusively for businesses. In reality, anyone can use this form, including freelancers and individuals who need to track payments.

- It must be printed and mailed. Some think that the form has to be printed out and sent by mail. However, it can be filled out digitally and emailed, making the process faster and more convenient.

- It’s complicated to fill out. Many people assume that the form is difficult to complete. In truth, it is designed to be user-friendly, with clear sections for all necessary information.

- It’s only available in English. There is a belief that the form is only offered in English. However, various versions may be available in other languages to accommodate diverse users.

- It’s not legally binding. Some individuals think that using this form does not create any legal obligations. In fact, when properly filled out and signed, it can serve as a binding agreement between parties.

- It can’t be customized. A common misconception is that the form is static and cannot be changed. Users can often customize the form to fit their specific needs, including adding logos or changing terms.

- It’s free, but with hidden costs. Some people worry that the “free” aspect comes with hidden fees. Typically, the form is genuinely free to use, with no additional costs involved unless optional features are chosen.

Clarifying these misconceptions can help users make the most of the Free And Invoice PDF form, ensuring they understand its benefits and how to use it effectively.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Free And Invoice PDF form is designed to facilitate the creation and management of invoices for businesses and freelancers. |

| Format | This form is available in PDF format, ensuring easy printing and sharing. |

| Customization | Users can customize the form with their business name, logo, and specific billing details. |

| State-Specific Laws | In California, the form must comply with the California Civil Code Section 17200 regarding fair business practices. |

| Usage | Businesses across various industries use this form to request payment for goods and services rendered. |

Key takeaways

The Free And Invoice Pdf form is a useful tool for managing billing and invoicing. Here are some key takeaways to consider when filling out and using this form:

- The form is designed to be user-friendly and accessible, allowing for easy entry of necessary information.

- Ensure all fields are completed accurately to prevent delays in payment processing.

- Include your business name and contact information prominently at the top of the form.

- Clearly itemize services or products provided, including quantities and prices, for transparency.

- Double-check the total amount due to avoid discrepancies that could lead to confusion.

- Incorporate payment terms, such as due dates and accepted payment methods, to set clear expectations.

- Consider adding a unique invoice number for tracking purposes.

- Save a copy of the completed form for your records after sending it to the client.

- Utilize the PDF format to maintain the integrity of the document when sharing it electronically.