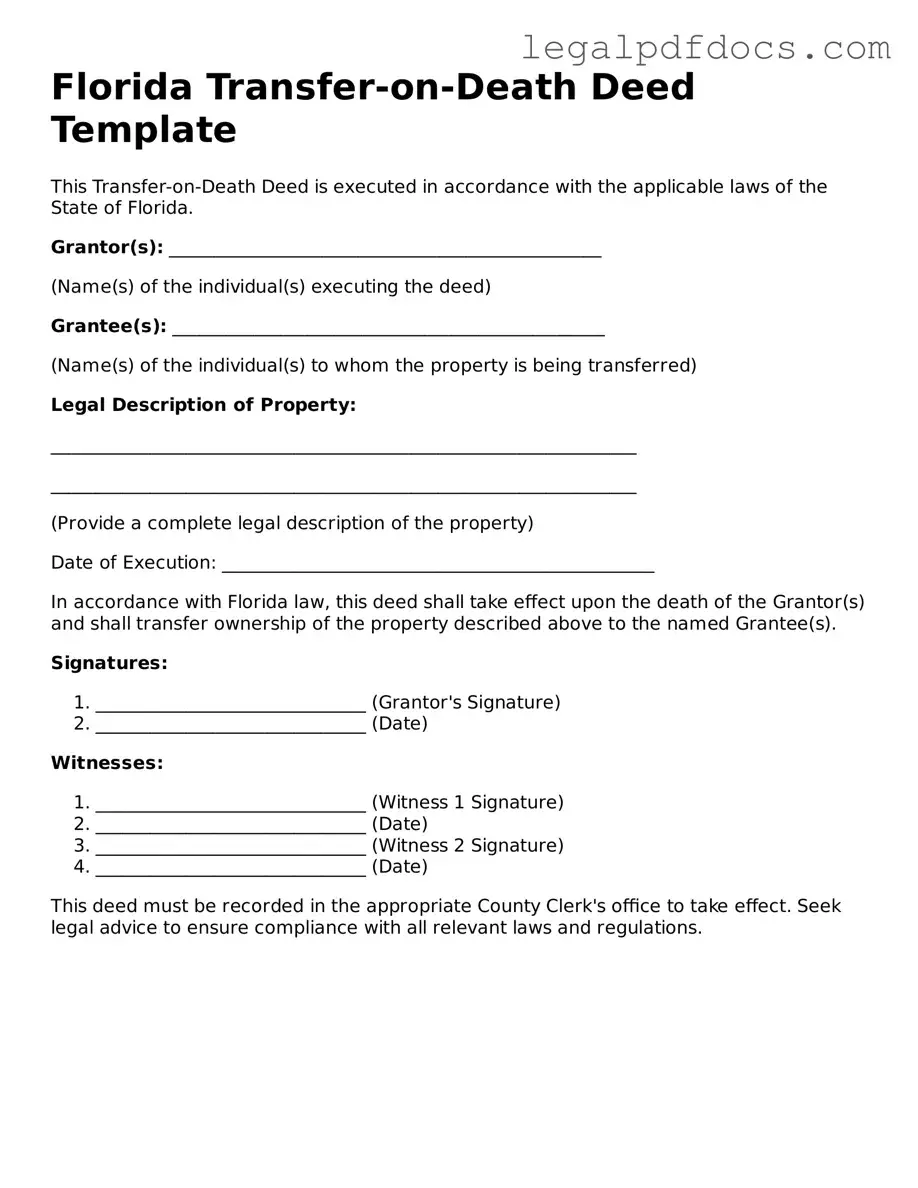

Official Transfer-on-Death Deed Form for Florida

In Florida, property owners have a valuable tool at their disposal known as the Transfer-on-Death Deed (TODD). This legal document allows individuals to transfer real estate directly to designated beneficiaries upon their death, bypassing the often lengthy and costly probate process. One of the key advantages of the TODD is its simplicity; it can be executed without the need for a will or complex estate planning. Property owners can retain full control over their assets during their lifetime, as the deed does not take effect until death. Additionally, the TODD can be revoked or modified at any time, providing flexibility to adapt to changing circumstances or wishes. Understanding the nuances of this form is essential for anyone looking to streamline the transfer of property and ensure that their loved ones receive their inheritance smoothly and efficiently.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, there are important steps to follow to ensure everything is done correctly. Here’s a list of things you should and shouldn't do:

- Do: Clearly identify the property you wish to transfer. Include the legal description and address.

- Do: Ensure that all owners of the property sign the deed if there are multiple owners.

- Do: Provide accurate information about the beneficiaries, including their full names and addresses.

- Do: Have the deed notarized. This adds an extra layer of validity to your document.

- Don't: Leave any sections blank. Incomplete forms can lead to confusion and potential legal issues.

- Don't: Forget to record the deed with the county clerk’s office. This step is crucial for the transfer to be effective.

- Don't: Use vague language when describing the property. Be as specific as possible to avoid disputes later.

- Don't: Wait until the last minute to fill out the form. Take your time to review everything carefully.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is filled out correctly and serves its intended purpose.

How to Use Florida Transfer-on-Death Deed

Filling out the Florida Transfer-on-Death Deed form is a straightforward process. After completing the form, it must be signed and notarized before being recorded with the county clerk's office. Ensure that all information is accurate to avoid any potential issues in the future.

- Obtain the Florida Transfer-on-Death Deed form from a reliable source, such as the Florida Department of Revenue or a legal document provider.

- Fill in your name as the "Grantor" in the designated section. Include your full legal name as it appears on official documents.

- Provide your address, ensuring it is complete and accurate.

- Identify the "Grantee," the person or people who will receive the property upon your passing. List their full names.

- Include the address of the Grantee(s) to provide clarity on their identity.

- Describe the property being transferred. This includes the property’s legal description, which can often be found on your property deed or tax assessment documents.

- Specify any conditions or limitations regarding the transfer, if applicable. This is optional but can clarify your intentions.

- Sign the form in the presence of a notary public. Your signature must be witnessed for the deed to be valid.

- Have the notary public complete their section, confirming that they witnessed your signature.

- Make copies of the completed and notarized form for your records.

- File the original deed with the county clerk's office where the property is located. Be aware that there may be a recording fee.

Find Popular Transfer-on-Death Deed Forms for US States

Kansas Transfer on Death Form - The form should include the current owner's information, the property description, and the named beneficiary's details.

Transfer on Death Deed Idaho - Owners should review their deeds regularly to ensure that the listed beneficiaries reflect current wishes.

Beneficiary Deed Georgia - Property is transferred automatically without the need for a will, making it a convenient option for estate planning.

Deed on Death - It is an effective estate planning tool for individuals wanting to streamline property transfer.

Documents used along the form

The Florida Transfer-on-Death Deed is a useful tool for individuals looking to transfer real estate to their beneficiaries without the need for probate. However, it is often accompanied by several other forms and documents that can facilitate the process and ensure that the transfer is executed smoothly. Below is a list of commonly used documents alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines an individual's wishes regarding the distribution of their assets after death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Beneficiary Designation Form: Often used for financial accounts and insurance policies, this form allows individuals to name beneficiaries directly, ensuring that these assets bypass probate.

- Power of Attorney: This legal document grants someone the authority to act on behalf of another person in financial or legal matters. It can be crucial if the property owner becomes incapacitated before the transfer occurs.

- Affidavit of Heirship: This document helps establish the identity of heirs when someone passes away without a will. It can clarify ownership issues related to the property covered by the Transfer-on-Death Deed.

- Notice of Death: This form may be filed with the county to officially notify the public of an individual's passing. It can help in clearing any potential claims against the estate.

- Deed of Distribution: This document is used to formally transfer property from an estate to the heirs after the probate process. It may be necessary if the Transfer-on-Death Deed is not the sole means of property transfer.

- Real Estate Purchase Agreement: If the property is being sold rather than transferred, this agreement outlines the terms and conditions of the sale, ensuring that all parties understand their rights and obligations.

Each of these documents plays a vital role in estate planning and property transfer. Understanding their purposes can help individuals navigate the complexities of transferring assets and ensure that their wishes are honored. Proper preparation can alleviate stress for both the property owner and their beneficiaries during a challenging time.

Misconceptions

Understanding the Florida Transfer-on-Death Deed (TODD) is crucial for effective estate planning. Unfortunately, several misconceptions surround this legal tool. Here are six common misunderstandings:

- It automatically transfers property upon death. Many believe that the TODD instantly transfers property to the beneficiary upon the owner's death. In reality, the deed must be properly recorded and executed to be effective.

- It eliminates the need for a will. Some think that using a TODD means they do not need a will. However, a TODD only applies to specific properties and does not cover all assets, so having a will is still important.

- Beneficiaries have immediate access to the property. There is a misconception that beneficiaries can access the property right away. In truth, they must go through the probate process if there are debts or other claims against the estate.

- It can be used for any type of property. Many assume that any property can be transferred using a TODD. However, Florida law restricts this deed to certain types of real estate, such as residential properties.

- It is irrevocable once signed. Some people think that once a TODD is executed, it cannot be changed. In fact, the owner can revoke or change the deed at any time before their death.

- It avoids estate taxes. There is a belief that using a TODD helps avoid estate taxes. However, the value of the property will still be included in the estate for tax purposes, so this is not an effective strategy for tax avoidance.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning options in Florida.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, specifically Section 732.4015. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries, and they can also specify alternate beneficiaries. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, provided they follow the correct procedures. |

| Recording Requirement | The deed must be recorded with the county clerk in the county where the property is located to be effective. |

| No Immediate Transfer | The transfer of property does not occur until the owner's death; the owner retains full control during their lifetime. |

| Tax Implications | There are generally no immediate tax implications for the property owner when executing a Transfer-on-Death Deed. |

| Limitations | Transfer-on-Death Deeds cannot be used for all types of property, such as those subject to liens or mortgages. |

| Legal Assistance | While it's possible to create a Transfer-on-Death Deed without an attorney, consulting with one can help ensure compliance with all legal requirements. |

Key takeaways

When considering the Florida Transfer-on-Death Deed, it is essential to understand its implications and requirements. Here are key takeaways to keep in mind:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- To be valid, the deed must be signed by the property owner and notarized.

- Beneficiaries must be clearly identified in the deed to avoid confusion later.

- It is important to ensure that the deed complies with Florida law to prevent potential legal challenges.

- Property owners can revoke or change the deed at any time before their death, providing flexibility.

- Filing the deed with the county clerk's office is necessary for it to take effect.

- Consulting with a legal professional can help clarify any uncertainties and ensure proper execution.

- After the owner's death, the beneficiaries must file a death certificate to claim the property.