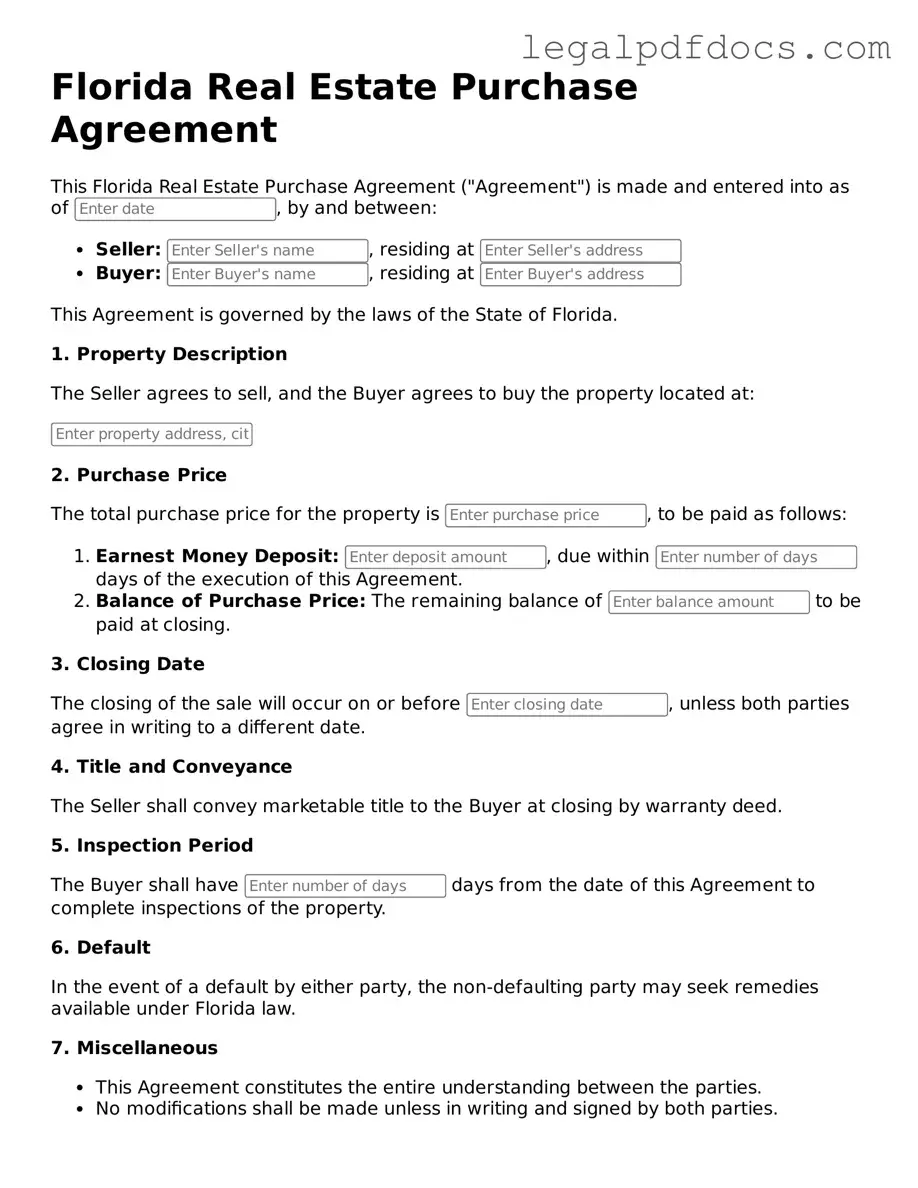

Official Real Estate Purchase Agreement Form for Florida

The Florida Real Estate Purchase Agreement form serves as a crucial document in the home buying process, outlining the terms and conditions agreed upon by both the buyer and seller. This form typically includes essential details such as the purchase price, the property description, and the closing date. Additionally, it addresses contingencies that may affect the sale, such as financing, inspections, and appraisals. Buyers and sellers can find provisions related to earnest money deposits, which demonstrate the buyer's commitment to the transaction. The agreement also clarifies the responsibilities of each party, including disclosures and repairs, ensuring that all expectations are set clearly from the outset. By understanding the components of this form, individuals can navigate the complexities of real estate transactions with greater confidence and clarity.

Dos and Don'ts

When filling out the Florida Real Estate Purchase Agreement form, it’s essential to approach the process with care. Here are four important do's and don'ts to consider:

- Do: Read the entire agreement carefully before signing. Understanding every clause ensures that you know your rights and obligations.

- Do: Provide accurate information. Double-check names, addresses, and property details to avoid any potential issues later on.

- Do: Consult a real estate professional if you have questions. Their expertise can help clarify complex terms and conditions.

- Do: Keep a copy of the signed agreement for your records. This can be invaluable for future reference.

- Don't: Rush through the form. Taking your time can prevent mistakes that might lead to complications.

- Don't: Leave any sections blank. Ensure all required fields are filled out to avoid delays in the process.

- Don't: Ignore deadlines. Be mindful of any time-sensitive clauses, as missing them could jeopardize the agreement.

- Don't: Sign without understanding the implications. Every signature carries weight, so be certain of what you are agreeing to.

How to Use Florida Real Estate Purchase Agreement

Completing the Florida Real Estate Purchase Agreement form is a critical step in the home-buying process. This document will outline the terms of the sale and protect the interests of both the buyer and seller. After filling out the form, both parties will need to review the agreement carefully before signing it.

- Begin by entering the date of the agreement at the top of the form.

- Fill in the names and contact information of both the buyer and seller.

- Provide the property address, including the city, county, and zip code.

- Specify the purchase price being agreed upon for the property.

- Indicate the amount of the earnest money deposit, if applicable.

- Detail the financing terms, including whether the buyer will use a mortgage or pay in cash.

- Outline any contingencies, such as inspections or financing approvals.

- State the closing date or the timeframe for closing the sale.

- Include any special provisions or additional terms that either party wishes to add.

- Sign and date the form at the bottom. Ensure both parties do this.

Once the form is completed and signed, both parties should keep a copy for their records. This agreement will serve as the foundation for the transaction moving forward.

Find Popular Real Estate Purchase Agreement Forms for US States

Purchase and Sale Agreement Georgia - Facilitates communication through established points of contact.

Purchasing Agreements - Allows for negotiation of seller concessions to assist with buyer costs.

Arizona Real Estate Purchase Contract Pdf - May require third-party approvals, such as from a homeowners' association.

Real Estate Purchase and Sale Agreement - Specific language can influence how the property will be used in the future.

Documents used along the form

When engaging in a real estate transaction in Florida, several important forms and documents accompany the Real Estate Purchase Agreement. Each document plays a crucial role in ensuring that the transaction proceeds smoothly and that both parties are protected throughout the process. Below is a list of commonly used forms in conjunction with the Florida Real Estate Purchase Agreement.

- Seller's Disclosure Statement: This document provides information about the property's condition, including any known defects or issues. It helps buyers make informed decisions by disclosing material facts about the home.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers of potential lead hazards. Sellers must disclose any known lead-based paint and provide buyers with information on lead safety.

- Financing Addendum: This document outlines the terms of financing that the buyer will use to purchase the property. It details the type of loan, interest rates, and any contingencies related to financing.

- Contingency Addendum: This form specifies conditions that must be met for the sale to proceed, such as the buyer securing financing or the home passing inspections. It protects the buyer's interests by allowing them to back out if conditions aren't met.

- Property Inspection Report: Conducted by a licensed inspector, this report provides an assessment of the property's condition. It highlights any repairs needed and can influence the buyer's decision or negotiations.

- Title Commitment: This document outlines the title insurance coverage that will be provided to the buyer. It details any existing liens or encumbrances on the property and ensures that the title is clear at closing.

- Closing Disclosure: This form provides a detailed breakdown of the final closing costs, including loan terms, monthly payments, and any fees associated with the transaction. It must be provided to the buyer at least three days before closing.

- Bill of Sale: This document is used to transfer ownership of personal property that may be included in the sale, such as appliances or furniture. It ensures that both parties agree on what is included in the transaction.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be legally effective.

Understanding these documents can help both buyers and sellers navigate the complexities of real estate transactions in Florida. Each form serves a specific purpose, ensuring that all parties are informed and protected throughout the process. It is advisable to review each document carefully and consult with a qualified professional if any questions arise.

Misconceptions

-

Misconception 1: The Florida Real Estate Purchase Agreement is a standard form that cannot be customized.

This is incorrect. While there is a standard template, parties can modify terms to fit their specific needs. Adjustments can include price, closing dates, and contingencies.

-

Misconception 2: The agreement is only for residential properties.

This is misleading. The Florida Real Estate Purchase Agreement can be used for both residential and commercial properties. It is adaptable to various types of real estate transactions.

-

Misconception 3: Once signed, the agreement cannot be changed.

This is not true. Parties can amend the agreement after it has been signed, provided both agree to the changes. Written amendments are advisable for clarity.

-

Misconception 4: The agreement guarantees the sale will go through.

This is false. The agreement outlines the terms of the sale but does not guarantee completion. It includes contingencies that can allow either party to back out under certain conditions.

-

Misconception 5: Only real estate agents can fill out the agreement.

This is incorrect. Buyers and sellers can complete the agreement themselves. However, consulting a real estate professional or attorney is recommended to ensure all legal aspects are covered.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by the laws of the State of Florida. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement includes information about the buyer and the seller, clearly identifying both parties. |

| Property Description | A detailed description of the property being sold is included, which may encompass the address and legal description. |

| Purchase Price | The total purchase price of the property is specified in the agreement, along with any deposit amounts. |

| Closing Date | The agreement typically includes a proposed closing date, which is the date when the sale will be finalized. |

| Contingencies | Common contingencies, such as financing or inspection, may be included to protect the buyer's interests. |

| Disclosure Requirements | Florida law requires sellers to disclose certain information about the property, which must be acknowledged in the agreement. |

| Signatures | The agreement must be signed by both the buyer and the seller to be legally binding. |

| Use of Standard Forms | The Florida Real Estate Purchase Agreement often utilizes standard forms provided by real estate associations to ensure compliance. |

Key takeaways

When filling out and using the Florida Real Estate Purchase Agreement form, several key points should be considered to ensure a smooth transaction.

- Understand the Basics: Familiarize yourself with the essential components of the agreement, including the purchase price, property description, and closing date.

- Disclosures are Important: Sellers must provide necessary disclosures about the property. These can include information about any known defects or issues.

- Contingencies Matter: Include contingencies that protect your interests, such as financing, inspection, and appraisal contingencies.

- Review the Terms: Carefully review all terms and conditions before signing. Ensure that all parties agree on the details outlined in the document.

- Seek Professional Guidance: Consider consulting with a real estate professional or attorney if you have questions or need assistance with the agreement.