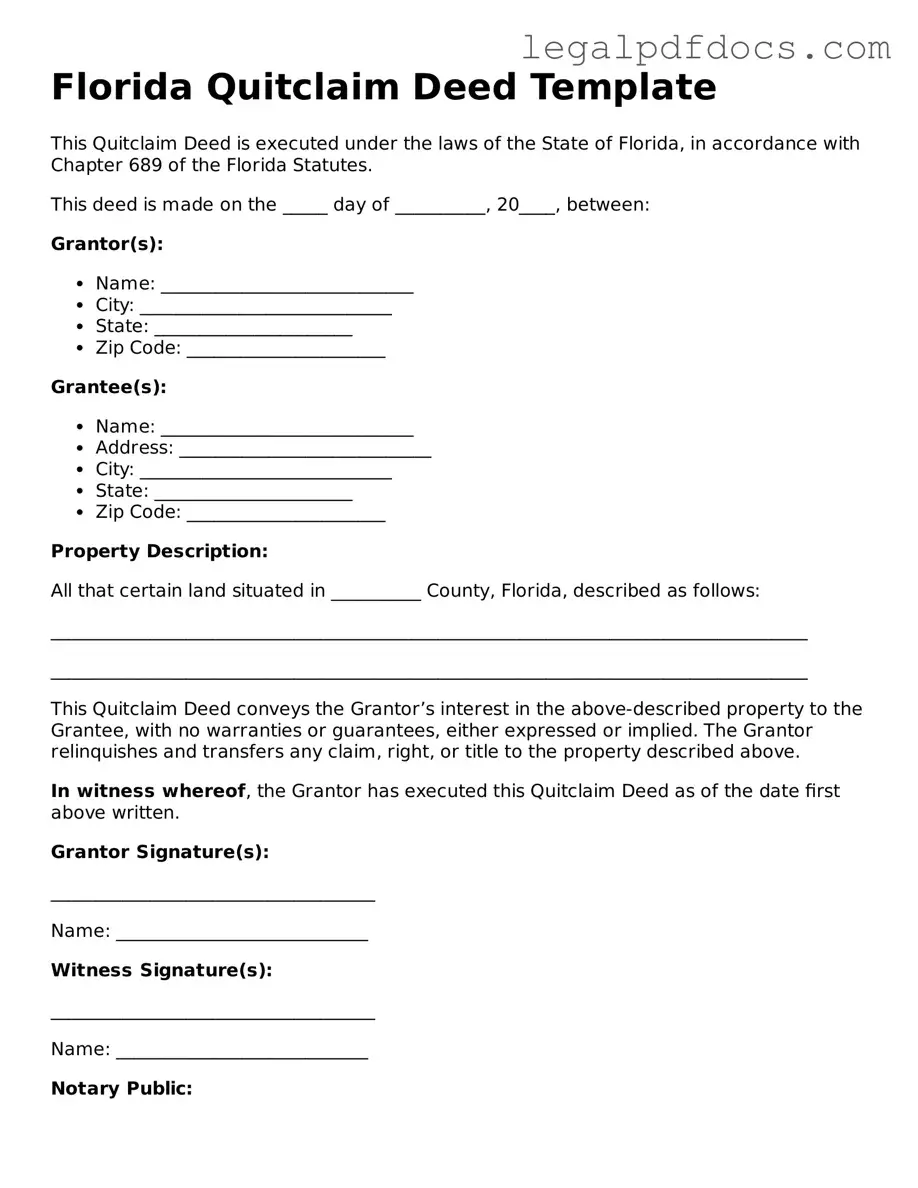

Official Quitclaim Deed Form for Florida

In the realm of real estate transactions, the Florida Quitclaim Deed form serves as a crucial tool for property owners looking to transfer their interests in a property without the complexities often associated with other types of deeds. This form is particularly useful in situations where the transferor, or the person giving up their rights, may not be able to provide a guarantee regarding the title’s validity. For instance, it is commonly used among family members or in situations involving divorce settlements, where the parties wish to simplify the process of transferring property ownership. The Quitclaim Deed does not ensure that the property is free from liens or other claims, which means the recipient takes on the property “as is.” Understanding the essential elements of this form, including the necessary information about the parties involved, the property description, and the signatures required, is vital for anyone considering its use. Additionally, knowing when to utilize a Quitclaim Deed versus other deed types can help prevent potential disputes and ensure a smoother transfer process.

Dos and Don'ts

When filling out the Florida Quitclaim Deed form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do during this process.

- Do: Ensure all parties' names are spelled correctly and match the official identification.

- Do: Include a legal description of the property being transferred.

- Do: Sign the form in the presence of a notary public.

- Do: Submit the completed form to the appropriate county clerk's office for recording.

- Don't: Leave any required fields blank, as this may invalidate the deed.

- Don't: Use abbreviations or informal names for the property or parties involved.

- Don't: Forget to check for any local recording fees that may apply.

- Don't: Attempt to modify the form without understanding the implications of those changes.

How to Use Florida Quitclaim Deed

After obtaining the Florida Quitclaim Deed form, it is essential to complete it accurately to ensure the transfer of property rights. Once filled out, the form must be signed and notarized before being filed with the appropriate county office. This process will help ensure that the deed is legally recognized.

- Begin by entering the date at the top of the form.

- Identify the grantor (the person transferring the property). Provide their full name and address.

- Next, identify the grantee (the person receiving the property). Include their full name and address.

- Clearly describe the property being transferred. Include the legal description, which can typically be found on the property’s current deed or tax assessment documents.

- Specify the consideration, or the amount paid for the property. If the transfer is a gift, indicate that as well.

- Include any additional clauses or stipulations if necessary. This may involve specifying conditions of the transfer.

- Both the grantor and grantee must sign the form. Ensure that signatures are dated.

- Have the signatures notarized. A notary public must witness the signing of the document.

- Make copies of the completed and notarized deed for personal records.

- Finally, file the original Quitclaim Deed with the county clerk's office in the county where the property is located.

Find Popular Quitclaim Deed Forms for US States

Quitclaim Deed Form Kansas - Unlike a warranty deed, a quitclaim deed does not provide any assurances about the property’s condition.

Illinois Quick Claim Deed - It is important to understand that the Quitclaim Deed provides no warranties.

Wuick Claim Deed - It is generally quick and does not involve lengthy processes.

Where Do I File a Quitclaim Deed - A Quitclaim Deed can be used to add or remove a co-owner from the title.

Documents used along the form

When transferring property ownership in Florida, a Quitclaim Deed is a common choice. However, several other forms and documents may accompany this deed to ensure a smooth transaction. Below are four important documents often used alongside the Florida Quitclaim Deed.

- Property Transfer Tax Form: This form is required to report the transfer of property to the local tax authority. It helps determine any applicable taxes based on the property's value.

- Affidavit of Title: This document certifies the seller's ownership of the property and confirms that there are no liens or encumbrances against it. It provides assurance to the buyer about the title's validity.

- Title Insurance Policy: Buyers often obtain title insurance to protect against any future claims or disputes regarding property ownership. This policy can cover legal fees and other costs associated with resolving title issues.

- Closing Statement: This document outlines the financial details of the property transaction, including the sale price, closing costs, and any adjustments. It provides transparency for both the buyer and seller.

Incorporating these documents alongside the Florida Quitclaim Deed can facilitate a more secure and efficient property transfer process. Understanding each form's purpose can help both parties navigate the complexities of real estate transactions.

Misconceptions

Understanding the Florida Quitclaim Deed can be challenging due to common misconceptions. Here are ten of those misconceptions explained:

- A Quitclaim Deed transfers ownership of property. This is partially true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property or has clear title.

- Quitclaim Deeds are only used between family members. While they are often used in family transactions, Quitclaim Deeds can be used in any situation where the parties agree to transfer property interest, including sales and gifts.

- Quitclaim Deeds are the same as warranty deeds. This is incorrect. A warranty deed provides a guarantee of clear title, while a Quitclaim Deed does not offer any such assurances.

- All states use Quitclaim Deeds in the same way. Each state has its own laws and regulations regarding Quitclaim Deeds. It is essential to understand the specific rules in Florida.

- A Quitclaim Deed is a quick way to clear title issues. This is misleading. While it can transfer interest quickly, it does not resolve underlying title issues or disputes.

- You do not need to record a Quitclaim Deed. While it is not legally required to record it, failing to do so can lead to problems in proving ownership in the future.

- Quitclaim Deeds are only for transferring property. They can also be used to transfer other interests, such as easements or rights of way, not just ownership of real estate.

- Once a Quitclaim Deed is signed, it cannot be revoked. This is not true. A Quitclaim Deed can be revoked if both parties agree or if certain conditions are met, depending on the situation.

- Quitclaim Deeds are only for residential properties. This misconception overlooks the fact that Quitclaim Deeds can be used for any type of property, including commercial real estate and vacant land.

- Using a Quitclaim Deed is always a bad idea. While there are risks involved, Quitclaim Deeds can be appropriate in certain situations, such as simplifying transfers between family members or in divorce settlements.

Understanding these misconceptions can help individuals make more informed decisions regarding property transfers in Florida.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate without guaranteeing that the title is clear. |

| Governing Law | This form is governed by Florida Statutes, Chapter 689, which outlines the requirements for property conveyances. |

| Use Cases | Commonly used among family members or in divorce settlements, as it allows for quick transfers without extensive title searches. |

| Limitations | It does not provide any warranties or guarantees about the property title, which may pose risks to the grantee. |

Key takeaways

When utilizing the Florida Quitclaim Deed form, several important aspects should be considered to ensure proper completion and usage. Below are key takeaways that can guide individuals through the process.

- The Quitclaim Deed is a legal document that transfers ownership of property without any warranties regarding the title.

- It is commonly used among family members or in situations where the parties know each other well.

- To complete the form, the names of the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly stated.

- The property description must be accurate and detailed, including the parcel number and legal description.

- Signatures of the grantor are required, and the deed must be notarized to be valid.

- Once completed, the Quitclaim Deed should be filed with the county clerk’s office where the property is located.

- Filing fees may apply, and these fees vary by county.

- After filing, the grantee should receive a copy of the recorded Quitclaim Deed for their records.

- It is advisable to consult with a legal professional if there are any uncertainties regarding the transfer or the deed itself.