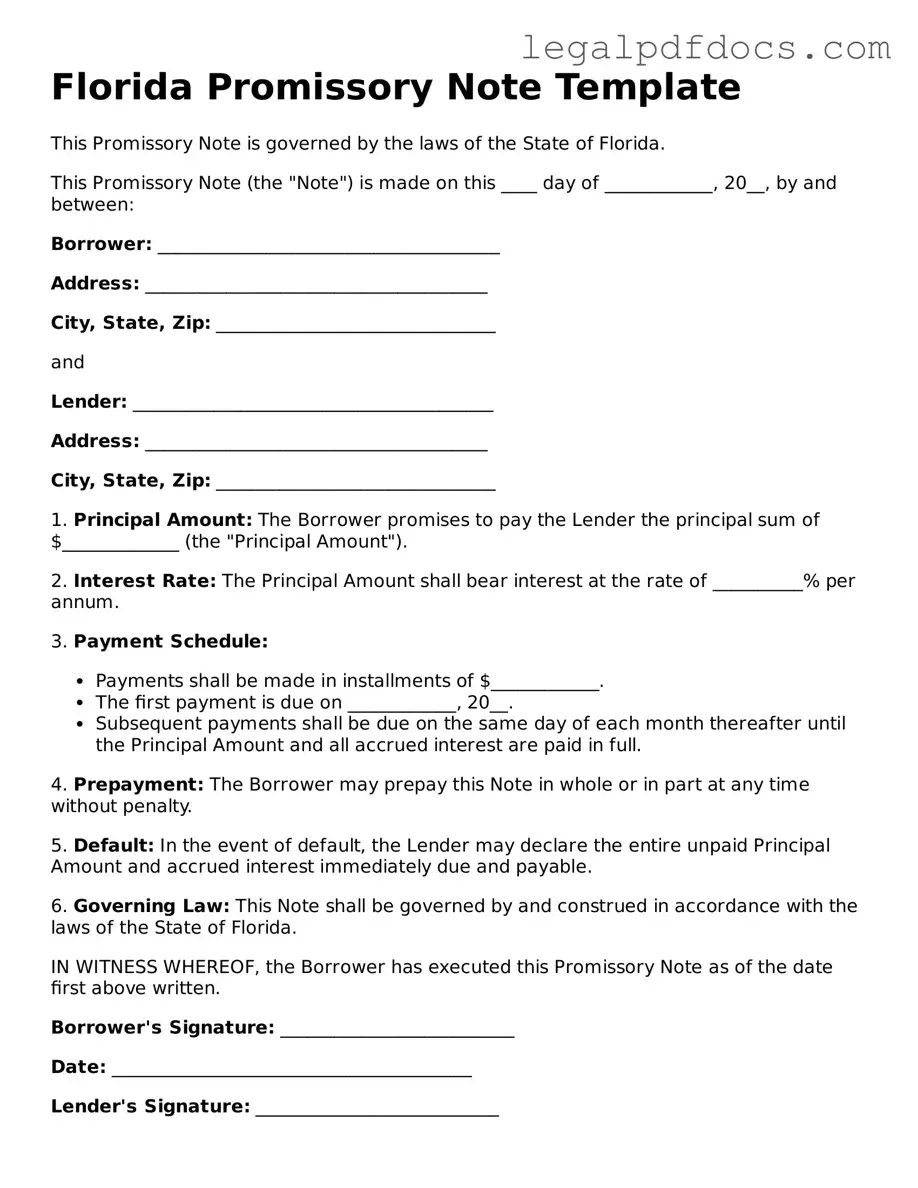

Official Promissory Note Form for Florida

In the state of Florida, a Promissory Note serves as a crucial financial instrument, outlining the terms under which one party agrees to pay a specified sum of money to another. This document typically includes key elements such as the principal amount, interest rate, payment schedule, and any applicable fees. It often specifies whether the loan is secured or unsecured, indicating if collateral is involved. Additionally, the Promissory Note may detail the consequences of default, providing clarity on what happens if the borrower fails to meet their obligations. Understanding this form is essential for both lenders and borrowers, as it establishes the legal framework for the loan agreement and protects the rights of both parties involved. By familiarizing oneself with the nuances of the Florida Promissory Note, individuals can navigate the lending process more effectively and ensure that their financial agreements are sound and enforceable.

Dos and Don'ts

When filling out the Florida Promissory Note form, it is important to adhere to certain guidelines to ensure accuracy and compliance. Below are essential dos and don'ts to consider:

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information regarding the borrower and lender.

- Do include the correct date and amount of the loan.

- Do specify the interest rate clearly, if applicable.

- Don't leave any required fields blank.

- Don't use white-out or erasers on the form; corrections should be made by crossing out and initialing.

- Don't forget to sign and date the document at the end.

- Don't submit the form without making a copy for your records.

How to Use Florida Promissory Note

After obtaining the Florida Promissory Note form, you are ready to begin filling it out. This document will require specific information about the borrower, the lender, and the terms of the loan. Take your time to ensure accuracy, as this will help avoid any misunderstandings later on.

- Identify the parties involved: Write the full name and address of the lender at the top of the form. Next, provide the full name and address of the borrower.

- Specify the loan amount: Clearly state the total amount of money being borrowed. This should be written both in numbers and in words to avoid any confusion.

- Determine the interest rate: Indicate the annual interest rate for the loan. Make sure this is clear and easy to understand.

- Set the repayment terms: Outline how the borrower will repay the loan. Include details such as the payment schedule (monthly, bi-weekly, etc.) and the due date for each payment.

- Include any late fees: If applicable, specify any penalties for late payments. This helps both parties understand the consequences of missed payments.

- Sign and date the document: Both the lender and borrower must sign the document. Make sure to include the date of signing next to each signature.

- Consider notarization: Although not always required, having the document notarized can add an extra layer of security and validity.

Once the form is completed, ensure that both parties keep a copy for their records. This will provide clarity and serve as a reference point for the terms agreed upon.

Find Popular Promissory Note Forms for US States

Kansas Promissory Note - Signing a promissory note may create a paper trail that assists with future financial decisions.

Idaho Promissory Note Descargar - The note can be secured or unsecured, depending on the agreement.

Promissory Note Template Illinois - The lender can enforce the agreement in court if necessary.

Documents used along the form

When entering into a loan agreement in Florida, a Promissory Note is often accompanied by several other important documents. Each of these forms serves a specific purpose in ensuring clarity and protection for both the lender and the borrower. Below is a list of documents frequently used alongside a Florida Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any fees. It provides a comprehensive overview of the expectations for both parties.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets being used as security. It specifies what happens if the borrower defaults on the loan.

- Personal Guarantee: This form may be required if the borrower is a business entity. It holds an individual personally responsible for repaying the loan if the business fails to do so.

- Disclosure Statement: This document provides important information about the loan terms, including any fees, penalties, and the total cost of the loan over its lifetime. It ensures transparency in the lending process.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward interest and how much goes toward the principal. It helps borrowers understand their repayment obligations.

- Deed of Trust: In some cases, a deed of trust may be used instead of a mortgage. This document gives the lender a security interest in the property until the loan is repaid.

- Loan Modification Agreement: If the borrower needs to change the terms of the loan, this agreement outlines the new terms and conditions. It’s essential for formalizing any adjustments to the original agreement.

- Payment Receipt: After each payment is made, a receipt serves as proof of payment. It helps both parties keep track of transactions and confirms that the borrower is fulfilling their obligations.

Each of these documents plays a vital role in the lending process, ensuring that both parties are protected and informed. It’s important to review and understand each form before signing to avoid any misunderstandings down the line.

Misconceptions

Understanding the Florida Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- All promissory notes are the same. Many believe that all promissory notes have identical terms and conditions. In reality, each note can be tailored to fit specific agreements between the parties involved.

- Promissory notes do not need to be in writing. Some think that verbal agreements suffice. However, to be enforceable, a promissory note must be documented in writing.

- Only banks can issue promissory notes. This is false. Individuals and businesses can create and issue promissory notes, not just financial institutions.

- Promissory notes are not legally binding. Many assume that these documents lack legal weight. In fact, a properly executed promissory note is a legally binding contract.

- Interest rates must be included in all promissory notes. While it is common to include interest rates, it is not a requirement. A note can be interest-free if the parties agree.

- Only one party needs to sign the note. This is incorrect. Both the borrower and lender must sign the promissory note for it to be valid.

- Promissory notes cannot be transferred. Some believe that once a note is created, it cannot change hands. In fact, promissory notes can be assigned or sold to other parties.

- Defaulting on a promissory note has no consequences. This is a misconception. Defaulting can lead to serious legal repercussions, including lawsuits and damage to credit ratings.

- Florida law does not govern promissory notes. Many think that promissory notes are governed by federal law only. However, Florida law provides specific regulations that apply to these documents.

- All promissory notes require notarization. While notarization can add an extra layer of authenticity, it is not a legal requirement for all promissory notes in Florida.

Being aware of these misconceptions can help individuals navigate the complexities of promissory notes more effectively.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, Chapter 673, which pertains to negotiable instruments. |

| Parties Involved | The note involves at least two parties: the borrower (maker) and the lender (payee). |

| Payment Terms | It outlines the payment terms, including the principal amount, interest rate, and payment schedule. |

| Default Consequences | The note specifies what happens in the event of default, including potential legal actions. |

| Signatures Required | Both parties must sign the note for it to be legally binding, indicating their agreement to the terms. |

Key takeaways

When filling out and using the Florida Promissory Note form, it is essential to understand the following key points:

- Clear Identification: Clearly identify the borrower and lender, including full names and addresses. This ensures that both parties are easily identifiable.

- Loan Amount: Specify the exact amount being borrowed. This figure must be precise to avoid future disputes.

- Interest Rate: Indicate the interest rate applicable to the loan. Ensure it complies with Florida's usury laws.

- Payment Schedule: Outline the payment terms, including the frequency and due dates of payments. This clarity helps in managing expectations.

- Maturity Date: State the date when the loan will be fully repaid. This is crucial for both parties to understand the timeline.

- Default Terms: Include the terms that define what constitutes a default. This section protects the lender's interests.

- Governing Law: Note that the agreement will be governed by Florida law. This ensures that any legal issues will be resolved under local regulations.

- Signatures: Both parties must sign the document. This step is vital for the enforceability of the note.

- Witnesses or Notarization: Depending on the situation, consider having the document witnessed or notarized. This adds an extra layer of validation.

- Record Keeping: Keep a copy of the signed Promissory Note for your records. This is important for future reference and legal protection.

By following these guidelines, both borrowers and lenders can ensure that their interests are protected and that the agreement is clear and enforceable.