Official Power of Attorney Form for Florida

In Florida, a Power of Attorney (POA) form serves as a crucial legal tool that allows individuals to appoint someone else to make decisions on their behalf. This form is particularly significant for those who want to ensure that their financial, medical, or legal affairs are managed according to their wishes when they are unable to do so themselves. A well-drafted POA can cover a range of powers, from handling banking transactions to making healthcare decisions. It can be tailored to be effective immediately or only in the event of incapacitation. Additionally, the form must meet specific state requirements, including being signed in the presence of a notary public or witnesses, to ensure its validity. Understanding the nuances of the Florida Power of Attorney form is essential for anyone looking to safeguard their interests and ensure their preferences are respected in times of need.

Dos and Don'ts

When filling out a Florida Power of Attorney form, it is essential to approach the task with care and attention to detail. Here are ten important dos and don'ts to keep in mind:

- Do ensure that you understand the powers you are granting. Familiarize yourself with the specific authority you are giving to your agent.

- Don't rush through the form. Take your time to read each section carefully to avoid mistakes.

- Do choose a trustworthy agent. Your agent will have significant control over your financial or health-related decisions.

- Don't use a generic template without considering your unique situation. Tailor the document to your specific needs.

- Do sign the form in the presence of a notary public. This step is crucial for the document's validity in Florida.

- Don't forget to date the form. An undated Power of Attorney may raise questions about its validity.

- Do discuss your decisions with your agent. Clear communication helps ensure that your wishes are understood.

- Don't overlook the need for witnesses. Florida law may require witnesses for certain types of Powers of Attorney.

- Do keep a copy of the completed form. Having a record can be helpful for both you and your agent in the future.

- Don't assume that the Power of Attorney will remain valid indefinitely. Review and update the document as necessary, especially if your circumstances change.

How to Use Florida Power of Attorney

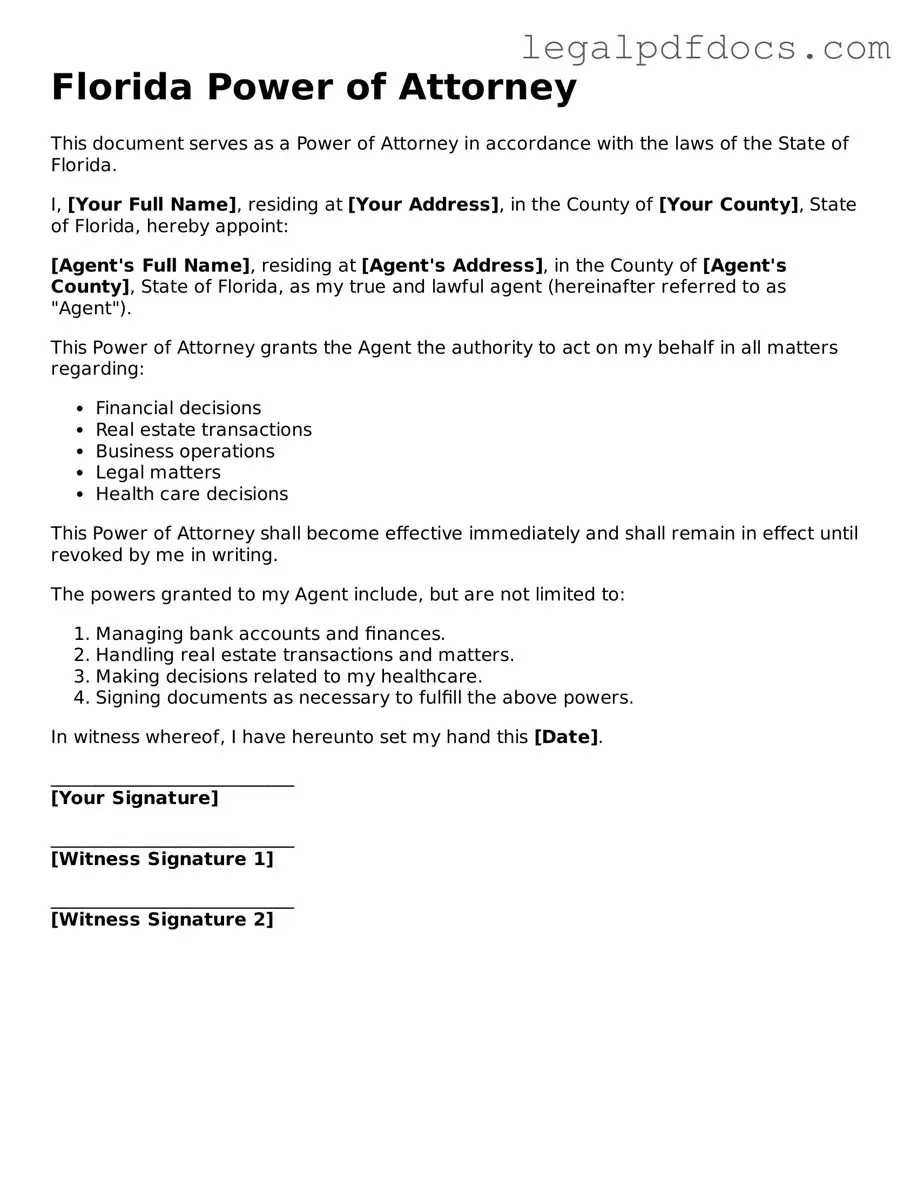

Filling out a Florida Power of Attorney form is a straightforward process that allows you to designate someone to act on your behalf in legal and financial matters. Once you have completed the form, you will need to sign it in the presence of a notary public and ensure that the appointed agent is aware of their responsibilities.

- Begin by downloading the Florida Power of Attorney form from a reliable source or obtain a physical copy from a legal office.

- Read through the entire form carefully to understand the sections that need to be filled out.

- In the first section, enter your name and address as the principal (the person granting the power). This identifies who is granting authority.

- Next, provide the name and address of the agent (the person you are appointing). This individual will have the authority to act on your behalf.

- Specify the powers you wish to grant to your agent. You can choose general powers or specific powers related to financial or healthcare decisions.

- If applicable, include any limitations or specific instructions regarding the powers granted to the agent.

- In the designated area, enter the date on which the Power of Attorney will become effective. You may choose to make it effective immediately or at a later date.

- Sign and date the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Provide a copy of the completed and notarized form to your agent and keep a copy for your records.

Find Popular Power of Attorney Forms for US States

Poa Financial Form - This document can also be effective in real estate transactions.

Do You Need a Lawyer for Power of Attorney - Facilitates a smoother transition during major life changes.

Ks Power of Attorney - This form can simplify estate management after a principal's passing.

General Power of Attorney Form California - Selecting a trusted individual as your agent is crucial to ensure your wishes are honored.

Documents used along the form

When establishing a Florida Power of Attorney, several other forms and documents often accompany it to ensure comprehensive legal coverage and clarity in decision-making. Each document serves a unique purpose and can help streamline the process of managing affairs. Below is a list of these important documents.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It allows the agent to continue making decisions on behalf of the principal during times of diminished capacity.

- Health Care Surrogate Designation: This form appoints someone to make medical decisions for an individual if they are unable to do so themselves. It is crucial for ensuring that healthcare preferences are respected.

- Living Will: A living will outlines an individual's wishes regarding medical treatment in situations where they cannot communicate their preferences, particularly at the end of life.

- HIPAA Release Form: This document allows designated individuals to access a person's medical records and health information. It ensures that the agent can make informed decisions regarding healthcare.

- Financial Power of Attorney: Similar to the general Power of Attorney, this document specifically grants authority over financial matters, such as managing bank accounts and paying bills.

- Will: A will specifies how a person's assets will be distributed after their death. It complements the Power of Attorney by addressing posthumous wishes.

- Trust Agreement: This document establishes a trust, allowing a trustee to manage assets on behalf of beneficiaries. It can help avoid probate and provide for asset management during incapacity.

- Declaration of Guardian: This form allows individuals to designate a guardian for themselves in case they become incapacitated. It can help ensure that the chosen guardian's authority is recognized by the court.

These documents work in tandem with the Florida Power of Attorney to create a robust framework for managing personal, financial, and medical decisions. By understanding and utilizing these forms, individuals can better prepare for the future and ensure their wishes are honored.

Misconceptions

- Misconception 1: A Power of Attorney is only necessary for the elderly.

- Misconception 2: A Power of Attorney can only be used for financial matters.

- Misconception 3: A Power of Attorney is permanent and cannot be revoked.

- Misconception 4: All Power of Attorney forms are the same.

- Misconception 5: A Power of Attorney can act on behalf of the principal without any limitations.

- Misconception 6: Once a Power of Attorney is executed, it cannot be modified.

- Misconception 7: A Power of Attorney automatically grants the agent the ability to make decisions after the principal's death.

This is not true. Individuals of any age may require a Power of Attorney, especially in situations involving health issues, travel, or business matters. It can be a useful tool for anyone who wants to ensure their affairs are managed according to their wishes when they are unable to do so themselves.

While many people associate Power of Attorney with financial decisions, it can also cover healthcare decisions. A specific type, known as a Healthcare Power of Attorney, allows someone to make medical decisions on behalf of another person if they are incapacitated.

This is incorrect. A Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. This flexibility allows individuals to change their designated agent or terminate the arrangement entirely if their circumstances change.

Different states have different laws and requirements regarding Power of Attorney forms. In Florida, specific language and formatting must be adhered to for the document to be valid. It is essential to use the appropriate form for the jurisdiction in which it will be executed.

This misconception overlooks the fact that the principal can specify the powers granted to the agent. The scope of authority can be broad or narrow, depending on the principal's preferences. Limitations can be included to ensure that the agent acts within defined boundaries.

This is false. A Power of Attorney can be modified or updated as needed. The principal may choose to revise the document to reflect changes in their wishes or circumstances, provided they are still competent to do so.

This is not accurate. A Power of Attorney ceases to be effective upon the death of the principal. After this point, the management of the deceased's estate typically falls under the jurisdiction of a will or probate process, not the Power of Attorney.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney form allows you to appoint someone to manage your financial or legal affairs on your behalf. |

| Governing Law | This form is governed by Florida Statutes, specifically Chapter 709, which outlines the rules and regulations for powers of attorney in the state. |

| Durability | The Florida Power of Attorney can be durable, meaning it remains effective even if you become incapacitated, unless specified otherwise in the document. |

| Revocation | You can revoke a Power of Attorney at any time, provided you do so in writing and notify your agent and any relevant third parties. |

Key takeaways

In Florida, a Power of Attorney (POA) allows you to designate someone to make decisions on your behalf. This can include financial, medical, or legal matters.

It is essential to choose a trusted individual as your agent. This person will have significant authority and responsibility over your affairs.

Florida law requires that the POA form be signed by you and witnessed by two individuals or notarized. This helps ensure the document's validity.

Consider specifying the powers you wish to grant. You can limit the authority to certain actions or grant broad powers.

Be aware that a POA can be revoked at any time, as long as you are mentally competent. You must provide written notice to your agent and any institutions where the POA was used.

It is advisable to keep copies of the completed POA form in a safe place and provide copies to your agent and relevant institutions.

Review your POA regularly, especially after major life changes such as marriage, divorce, or the birth of a child. This ensures it reflects your current wishes.