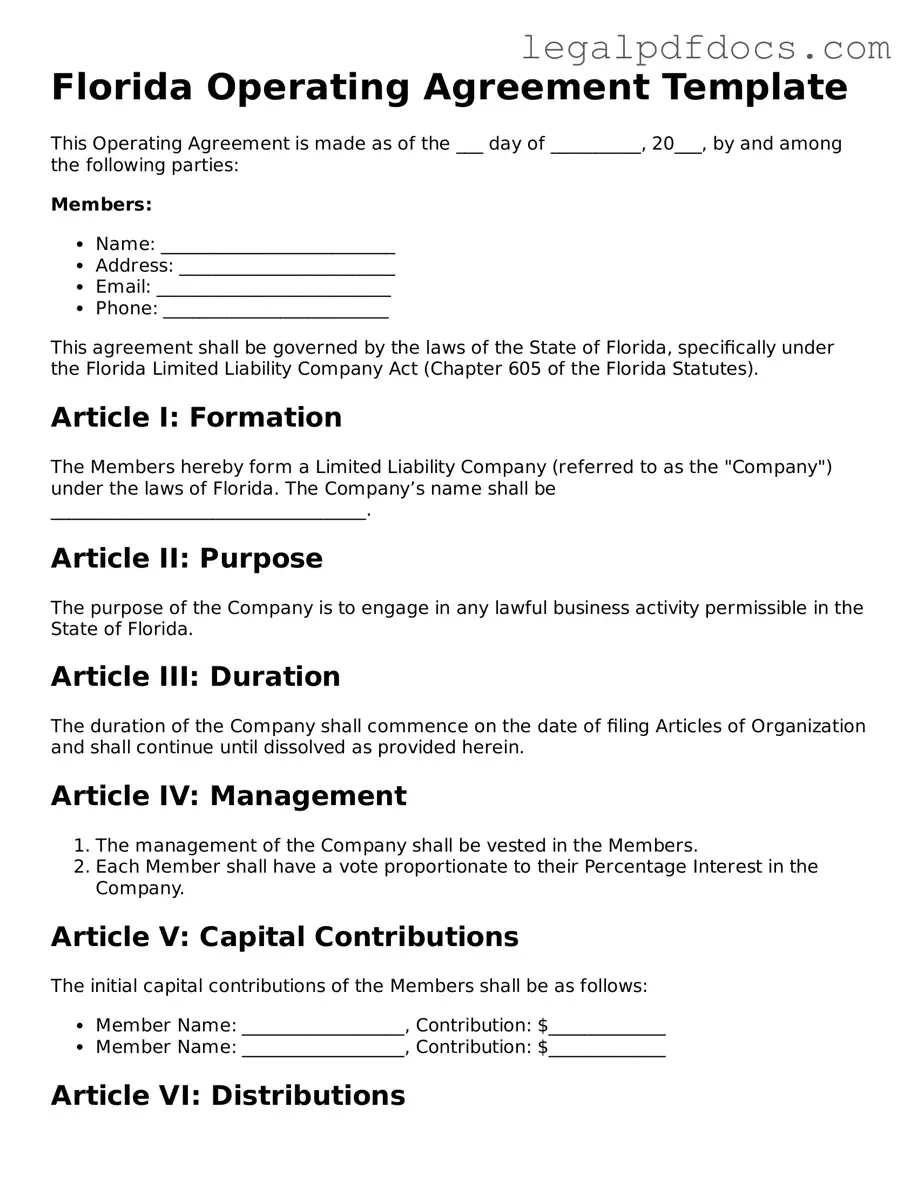

Official Operating Agreement Form for Florida

In the vibrant and diverse business landscape of Florida, the Operating Agreement form plays a crucial role for limited liability companies (LLCs) seeking to establish clear guidelines and expectations among their members. This essential document outlines the management structure, operational procedures, and financial arrangements of the LLC, ensuring that all members are on the same page. It addresses key elements such as member roles, voting rights, profit distribution, and procedures for adding or removing members. By laying out these foundational aspects, the Operating Agreement not only helps prevent disputes but also provides a roadmap for the company’s future. Without this agreement, an LLC may face uncertainty and complications, particularly in times of conflict or transition. As such, understanding the significance of this form is vital for anyone looking to form or manage an LLC in Florida.

Dos and Don'ts

When filling out the Florida Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are seven things to consider doing and avoiding during this process.

- Do read the instructions carefully before starting.

- Do provide complete and accurate information about all members.

- Do specify the management structure clearly.

- Do include provisions for profit distribution.

- Don't leave any sections blank unless instructed.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to have all members sign the agreement.

By adhering to these guidelines, individuals can help ensure that the Operating Agreement is filled out correctly and serves its intended purpose.

How to Use Florida Operating Agreement

Filling out the Florida Operating Agreement form is a crucial step for those looking to establish a limited liability company (LLC). This document outlines the management structure and operating procedures of your LLC. Completing it accurately ensures clarity among members and can help prevent future disputes. The following steps will guide you through the process.

- Begin by entering the name of your LLC at the top of the form. Ensure it matches the name registered with the state.

- Next, provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members. Include each member's full name and their corresponding address.

- Specify the percentage of ownership for each member. This is important for determining profit distribution and voting rights.

- Outline the management structure of the LLC. Indicate whether it will be member-managed or manager-managed.

- Detail the voting rights of members. Clarify how decisions will be made and what percentage of votes is needed for approval.

- Include provisions for adding new members or handling the departure of existing members. This ensures a smooth transition in ownership.

- Address the distribution of profits and losses. Clearly state how these will be allocated among members.

- Review the form for accuracy and completeness. Make sure all information is correct and all necessary sections are filled out.

- Finally, have all members sign and date the agreement. This signifies their agreement to the terms outlined in the document.

Find Popular Operating Agreement Forms for US States

How to Create an Operating Agreement - Wraps important operational policies into one cohesive document.

Is an Operating Agreement Required for an Llc in California - By outlining clear guidelines, the Operating Agreement helps to reduce legal risks.

How to Set Up an Operating Agreement for Llc - The agreement can set forth guidelines for updating the business plan.

Operating Agreement Llc Arizona Template - By creating an Operating Agreement, members can ensure their rights and obligations are clear.

Documents used along the form

When forming a limited liability company (LLC) in Florida, the Operating Agreement is a crucial document. However, several other forms and documents complement this agreement, ensuring that the LLC operates smoothly and in compliance with state regulations. Below is a list of five essential documents often used alongside the Florida Operating Agreement.

- Articles of Organization: This document is filed with the Florida Division of Corporations to officially create the LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Member Resolution: A Member Resolution is a formal document that records decisions made by the members of the LLC. It serves to document important agreements or actions taken by the members, providing clarity and a record of governance.

- Bylaws: While not required for LLCs, bylaws outline the internal rules and procedures for the company. They can cover various topics, including the roles of members, voting procedures, and meeting protocols, contributing to better management and organization.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company and may include details such as the member's name and the percentage of ownership.

- Operating Procedures: This document details the day-to-day operations of the LLC. It can include guidelines for financial management, decision-making processes, and conflict resolution, ensuring that members have a clear understanding of how the business will function.

Each of these documents plays a vital role in establishing and maintaining the integrity of an LLC. By understanding their purposes and ensuring they are properly executed, members can foster a well-organized and compliant business environment.

Misconceptions

When it comes to the Florida Operating Agreement form, several misconceptions can lead to confusion for business owners. Understanding these misconceptions can help ensure that your business operates smoothly and in compliance with state laws.

- Misconception 1: An Operating Agreement is optional in Florida.

- Misconception 2: All Operating Agreements must be filed with the state.

- Misconception 3: A verbal agreement is sufficient.

- Misconception 4: The Operating Agreement is only for multi-member LLCs.

- Misconception 5: Once created, the Operating Agreement cannot be changed.

While it is true that Florida law does not require LLCs to have an Operating Agreement, it is highly recommended. This document outlines the management structure and operating procedures of your business, helping to prevent disputes among members.

Many people believe that they need to submit their Operating Agreement to the state of Florida. In reality, this document is kept internally and does not need to be filed. It serves as an internal guide for the members of the LLC.

Some individuals think that a verbal agreement among members is enough to govern the LLC. However, without a written Operating Agreement, it becomes challenging to resolve disputes and clarify responsibilities. A written document provides clear terms that can be referred to in case of disagreements.

Many assume that only LLCs with multiple members need an Operating Agreement. However, even single-member LLCs benefit from having one. It helps establish the business as a separate entity and can protect personal assets.

Some people think that an Operating Agreement is set in stone once it is drafted. In fact, it can be amended as needed. As your business evolves, updating the Operating Agreement can help reflect changes in membership, management structure, or business goals.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Florida Operating Agreement outlines the management structure and operating procedures for an LLC. |

| Governing Law | This form is governed by the Florida Limited Liability Company Act, Chapter 605 of the Florida Statutes. |

| Member Roles | It defines the roles and responsibilities of members and managers within the LLC. |

| Profit Distribution | The agreement specifies how profits and losses will be distributed among members. |

| Decision-Making | It outlines the decision-making process, including voting rights and procedures. |

| Amendments | Members can amend the agreement as needed, following the procedures set forth within the document. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members. |

| Confidentiality | It can contain clauses that address confidentiality and the handling of sensitive information. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a set term. |

| Compliance | Having an Operating Agreement helps ensure compliance with state regulations and protects members' interests. |

Key takeaways

When filling out and using the Florida Operating Agreement form, there are several important aspects to consider. Below are key takeaways that can help ensure a smooth process.

- Understand the purpose of the Operating Agreement. It outlines the management structure and operational procedures of your business.

- Identify all members involved. Clearly list the names and roles of each member in the agreement.

- Specify ownership percentages. Clearly define how ownership is divided among members to avoid future disputes.

- Detail management responsibilities. Outline who will handle day-to-day operations and decision-making processes.

- Include provisions for profit distribution. Explain how profits and losses will be shared among members.

- Address member changes. Establish a procedure for adding or removing members from the agreement.

- Incorporate dispute resolution methods. Specify how conflicts will be resolved to maintain harmony among members.

- Consider state requirements. Ensure that the agreement complies with Florida laws and regulations.

- Review and update regularly. Regularly revisit the agreement to make necessary adjustments as the business evolves.

By keeping these points in mind, you can create a comprehensive Operating Agreement that protects the interests of all members and provides a clear framework for your business operations.