Official Lady Bird Deed Form for Florida

In the realm of estate planning, the Florida Lady Bird Deed stands out as a valuable tool for property owners seeking to navigate the complexities of transferring real estate while retaining certain rights. This unique form allows individuals to convey their property to designated beneficiaries while maintaining the ability to live in and manage the property during their lifetime. Unlike traditional deeds, the Lady Bird Deed offers a seamless way to avoid probate, which can often be a lengthy and costly process. One of its most notable features is the ability to retain control over the property, allowing the grantor to sell, mortgage, or even revoke the deed without the consent of the beneficiaries. Additionally, upon the grantor's passing, the property automatically transfers to the beneficiaries without the need for court intervention, simplifying the transition and providing peace of mind. Understanding the nuances of this deed is essential for anyone considering its use, as it can significantly impact both estate planning and tax implications for heirs. As property owners in Florida explore their options, the Lady Bird Deed emerges as a compelling choice for those looking to maintain control while ensuring a smooth transfer of assets to loved ones.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are four things you should and shouldn't do:

- Do: Clearly identify the property you are transferring. Include the legal description to avoid confusion.

- Do: Specify the names of the beneficiaries accurately. Double-check spelling and relationship to you.

- Don't: Leave any sections blank. Incomplete forms can lead to delays or rejections.

- Don't: Forget to sign and date the form. An unsigned deed is not valid.

How to Use Florida Lady Bird Deed

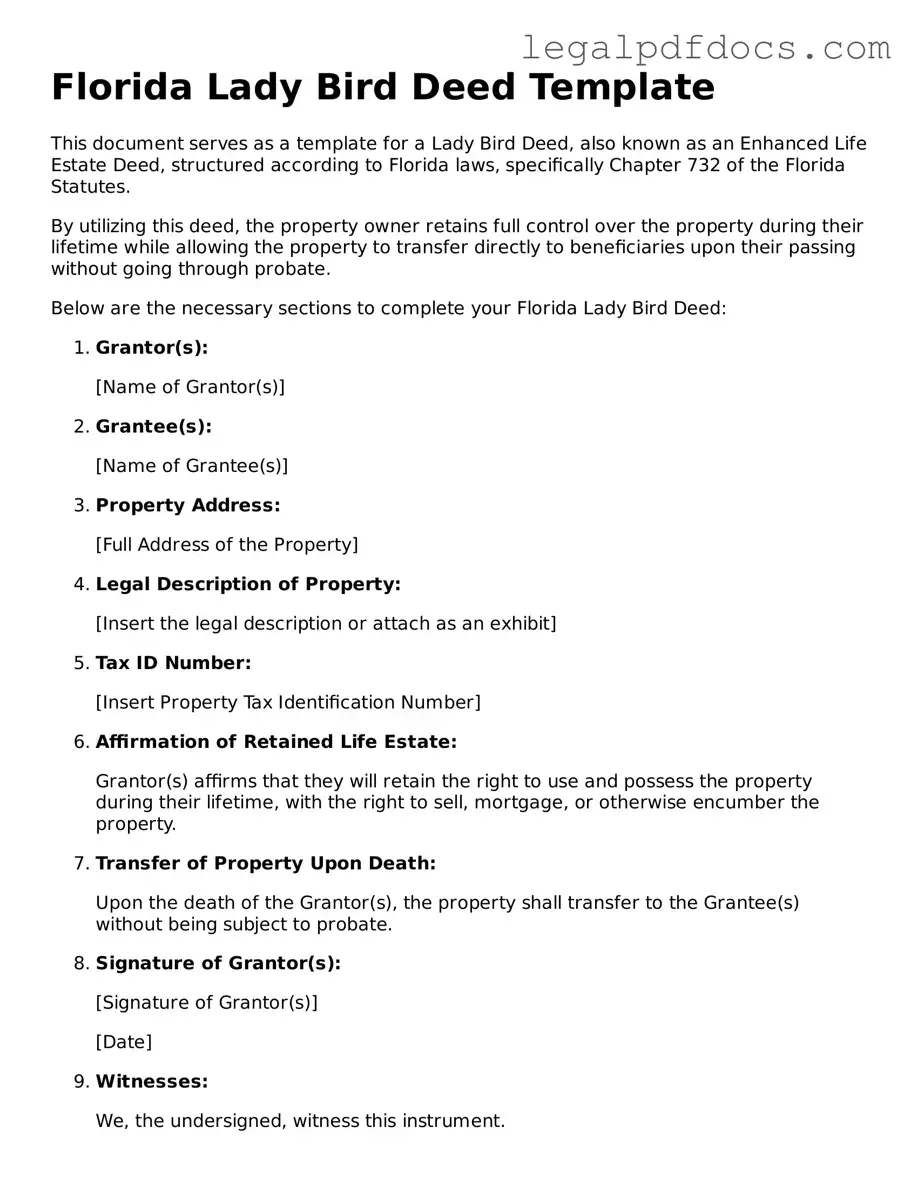

Filling out the Florida Lady Bird Deed form requires careful attention to detail. This document allows property owners to transfer their property while retaining certain rights. Following these steps will help ensure that the form is completed correctly.

- Obtain the Form: Access the Florida Lady Bird Deed form from a reliable source, such as a legal forms website or local courthouse.

- Property Description: Fill in the legal description of the property. This includes the address and any relevant parcel numbers.

- Grantor Information: Enter the full name of the current property owner(s) in the designated section.

- Grantee Information: List the full names of the beneficiaries who will receive the property upon the grantor's passing.

- Retention of Rights: Clearly indicate that the grantor retains the right to live in and control the property during their lifetime.

- Signature: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name listed as the grantor.

- Notarization: Have the document notarized to confirm the authenticity of the signatures.

- Recording the Deed: Submit the completed form to the appropriate county clerk’s office for recording. There may be a fee for this service.

After completing the form and ensuring it is properly notarized, you can submit it for recording. This step is essential to make the deed legally effective. Ensure that you keep a copy for your records.

Find Popular Lady Bird Deed Forms for US States

Lady Bird Deed Form Michigan - It can act as a financial planning tool that helps organize asset distribution efficiently.

Texas Life Estate Deed Form - The transfer of property is accomplished without the need for court intervention after the grantor passes away.

Documents used along the form

The Florida Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. When utilizing this deed, several other forms and documents may be relevant to ensure comprehensive estate planning. Below is a list of commonly used documents that may accompany the Lady Bird Deed.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can include provisions for property not transferred via the Lady Bird Deed.

- Durable Power of Attorney: This form allows an individual to designate someone else to make financial decisions on their behalf, especially in the event of incapacity.

- Healthcare Surrogate Designation: This document appoints someone to make medical decisions for an individual if they are unable to do so themselves.

- Living Will: A living will expresses an individual's wishes regarding medical treatment and end-of-life care, providing guidance to healthcare providers and family members.

- Revocable Trust: A revocable trust can hold assets during a person’s lifetime and can be altered or revoked. It often helps avoid probate and can work in conjunction with a Lady Bird Deed.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for certain accounts, such as life insurance policies or retirement accounts, which can bypass probate.

- Property Deeds: Other property deeds may be necessary if there are multiple properties involved or if a transfer of property is needed for estate planning.

- Affidavit of Heirship: This document can help establish the heirs of a deceased person, particularly when there is no will or formal estate proceedings.

Each of these documents plays a vital role in effective estate planning. Together with the Florida Lady Bird Deed, they can help ensure that a person's wishes are honored and that their assets are managed according to their preferences.

Misconceptions

Understanding the Florida Lady Bird Deed can be a bit confusing, especially with the many misconceptions surrounding it. Below are some common myths and the truths that dispel them.

- It avoids probate entirely. While a Lady Bird Deed can simplify the transfer of property upon death, it does not completely avoid probate. Certain circumstances may still require probate proceedings.

- It is only for married couples. Many believe that this deed is exclusively for married couples. In reality, anyone can utilize a Lady Bird Deed, including single individuals and partners.

- It transfers ownership immediately. Some think that the property is transferred as soon as the deed is signed. However, the original owner retains control of the property during their lifetime, and the transfer only occurs upon their death.

- It cannot be changed once executed. There is a misconception that once a Lady Bird Deed is signed, it cannot be altered. In fact, the grantor can revoke or modify the deed at any time while they are alive.

- It’s only for primary residences. Many people assume that this deed is limited to primary residences. The truth is that it can be used for any real property, including vacation homes and rental properties.

- It eliminates property taxes for heirs. Some believe that heirs will not have to pay property taxes on the inherited property. However, property taxes are still applicable, and the heirs will be responsible for them after the transfer.

- It requires a lawyer to create. While having legal assistance can be beneficial, it is not a requirement. Individuals can create a Lady Bird Deed on their own, provided they understand the necessary steps and requirements.

By addressing these misconceptions, individuals can make informed decisions about their estate planning options. The Lady Bird Deed can be a powerful tool, but understanding its nuances is essential for effective use.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Florida Statutes, specifically Section 732.4015. |

| Benefits | It helps avoid probate, allowing for a smoother transition of property upon the owner's death. |

| Revocability | The deed can be revoked or modified at any time by the property owner, maintaining flexibility. |

| Tax Implications | Property transferred via a Lady Bird Deed may receive a step-up in basis, which can benefit heirs for tax purposes. |

Key takeaways

When considering the Florida Lady Bird Deed, it is essential to grasp its unique features and implications. Here are some key takeaways to keep in mind:

- Retain Control: The Lady Bird Deed allows property owners to maintain full control over their property during their lifetime. This means you can sell, mortgage, or alter the property without restrictions.

- Automatic Transfer: Upon the owner’s death, the property automatically transfers to the designated beneficiaries, bypassing the lengthy probate process. This can save time and reduce costs for heirs.

- Tax Benefits: This type of deed can help preserve the property’s tax basis, potentially providing significant tax advantages for heirs when they inherit the property.

- Medicaid Planning: Utilizing a Lady Bird Deed can be a strategic part of Medicaid planning. It may help protect the property from being counted as an asset for Medicaid eligibility, depending on individual circumstances.

- Legal Requirements: Proper execution of the Lady Bird Deed is crucial. It must be signed, notarized, and recorded in the county where the property is located to be effective.

Understanding these points can facilitate informed decisions regarding property management and estate planning in Florida.