Official Deed Form for Florida

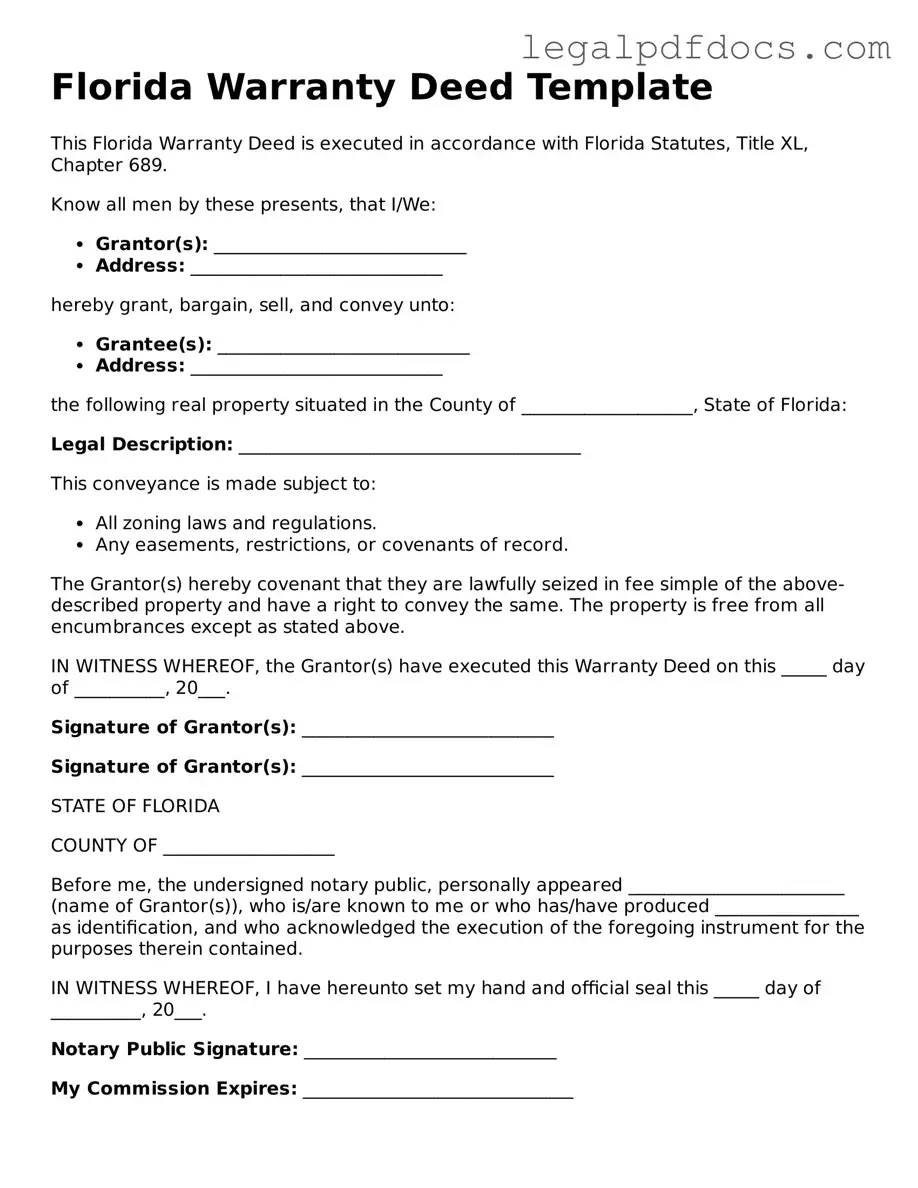

The Florida Deed form serves as a crucial legal document in the transfer of property ownership within the state. This form outlines the details of the transaction, including the names of the parties involved, a description of the property being transferred, and any relevant terms or conditions that may apply. It is essential for ensuring that the transfer is recorded accurately and legally, providing protection for both the buyer and the seller. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving distinct purposes and offering varying levels of protection. Additionally, the Florida Deed form must be properly executed and notarized to be valid, which underscores the importance of following the correct procedures. Understanding these aspects is vital for anyone looking to navigate the complexities of real estate transactions in Florida.

Dos and Don'ts

When filling out the Florida Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do double-check all names and addresses for accuracy.

- Do use clear and legible handwriting or type the information.

- Do include a legal description of the property.

- Do sign the deed in the presence of a notary public.

- Do ensure that the notary public also signs and stamps the document.

- Don't leave any required fields blank.

- Don't use abbreviations for names or property descriptions.

- Don't forget to check local recording requirements.

- Don't submit the deed without a proper cover letter if required.

By following these guidelines, you can help ensure that your Florida Deed form is completed correctly and processed without delays.

How to Use Florida Deed

Once you have the Florida Deed form in hand, it's essential to fill it out accurately to ensure a smooth transfer of property ownership. Follow these steps carefully to complete the form correctly.

- Begin with the title of the form at the top. Clearly write "Florida Deed" to identify the document.

- Enter the date of the deed in the designated space. Use the format month, day, year.

- Provide the name of the grantor (the person transferring the property). Include their full legal name and any relevant title.

- Next, enter the name of the grantee (the person receiving the property). Ensure the name is complete and accurate.

- Fill in the property description. This should include the address and legal description as it appears in public records.

- Indicate the consideration amount, which is the value of the property being transferred. Write this amount clearly.

- Sign the form in the presence of a notary public. Ensure that the notary provides their signature and seal as required.

- Finally, check the form for any errors or omissions. Double-check all names, dates, and descriptions.

After completing the form, it will need to be filed with the appropriate county clerk's office. Make sure to keep a copy for your records before submitting the original.

Find Popular Deed Forms for US States

Quit Claim Deed Georgia - A Deed establishes the legal interest in the property.

How Does House Title Look Like - Provides legal evidence in case of ownership disputes.

Documents used along the form

When transferring property in Florida, several forms and documents often accompany the Florida Deed form. Each serves a specific purpose in the transaction process, ensuring that all legal requirements are met and that the transfer is properly recorded.

- Title Search Report: This document verifies the ownership of the property and checks for any liens or encumbrances that may affect the transfer.

- Affidavit of Title: This sworn statement confirms that the seller has the legal right to sell the property and that there are no undisclosed claims against it.

- Closing Statement: Also known as a HUD-1, this document outlines the financial details of the transaction, including costs and fees associated with the sale.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes due at the time of sale.

- Bill of Sale: If personal property is included in the transaction, this document transfers ownership of those items from the seller to the buyer.

- Power of Attorney: If a party cannot be present at closing, this document allows someone else to act on their behalf, ensuring the transaction proceeds smoothly.

These documents play a crucial role in ensuring a clear and legally binding property transfer. It is essential to have all necessary forms completed accurately to avoid future disputes or complications.

Misconceptions

Understanding the Florida Deed form is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Below is a list of ten common misconceptions about the Florida Deed form, along with clarifications to help clarify these misunderstandings.

- All Deeds are the Same: Many people believe that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with its own implications and protections.

- A Deed Must Be Notarized: Some think that notarization is optional. In Florida, most deeds require notarization to be legally effective, ensuring the authenticity of the signatures.

- Only the Seller Signs the Deed: It is a common misconception that only the seller needs to sign the deed. However, all parties involved in the transaction may need to sign, depending on the type of deed.

- Filing a Deed is Optional: Some individuals believe that filing a deed with the county clerk is not necessary. In Florida, it is essential to record the deed to provide public notice of the property transfer.

- Verbal Agreements are Sufficient: Many assume that a verbal agreement is enough to transfer property. Florida law requires a written deed for the transfer of real estate to be valid.

- Deeds are Only for Sales: Some think that deeds are only used in sales transactions. In fact, deeds can also be used for gifts, inheritance, or transferring property between family members.

- All Deeds Transfer Ownership Immediately: It is a misconception that all deeds transfer ownership at the moment of signing. Certain deeds may include conditions that delay the transfer of ownership.

- Tax Implications are Irrelevant: Many people overlook the tax implications of transferring property. It's important to consider potential tax consequences when executing a deed.

- Deeds Cannot Be Changed: Some believe that once a deed is executed, it cannot be altered. While deeds can be amended or corrected, doing so requires following specific legal procedures.

- Only Real Estate Agents Can Prepare Deeds: There is a misconception that only licensed real estate agents can prepare deeds. In reality, anyone can draft a deed, but it is advisable to seek legal assistance to ensure accuracy.

Being aware of these misconceptions can help individuals navigate the complexities of property transactions in Florida more effectively. Always consult with a qualified professional when dealing with legal documents to ensure compliance and protection of your interests.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Deed is a legal document used to transfer property ownership in the state of Florida. |

| Types of Deeds | Common types include Warranty Deed, Quit Claim Deed, and Special Warranty Deed. |

| Governing Law | The Florida Statutes, specifically Chapter 689, govern the execution and recording of deeds. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property). |

| Witness Requirement | Two witnesses must sign the deed in the presence of the grantor. |

| Notarization | A notary public must acknowledge the grantor's signature on the deed. |

| Recording | To be effective against third parties, the deed must be recorded in the county where the property is located. |

| Property Description | The deed must include a clear and accurate description of the property being transferred. |

| Consideration | The deed should state the consideration, or value, exchanged for the property. |

| Tax Implications | Transfer taxes may apply, and it's important to check local regulations for specific requirements. |

Key takeaways

When filling out and using a Florida Deed form, it is essential to keep a few key points in mind to ensure the process goes smoothly. Here are some important takeaways:

- Understand the Types of Deeds: Florida recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special purpose deeds. Each serves a different purpose, so choose the one that fits your needs.

- Accurate Information is Crucial: Ensure that all names, addresses, and property descriptions are accurate. Any errors can lead to complications in the transfer of ownership.

- Signatures and Notarization: The deed must be signed by the grantor (the person transferring the property) and should be notarized. This step is vital for the deed to be legally valid.

- Recording the Deed: After completing the deed, it should be filed with the county clerk’s office where the property is located. This recording is necessary to make the transfer official and protect the new owner’s rights.