Official Deed in Lieu of Foreclosure Form for Florida

The Florida Deed in Lieu of Foreclosure form serves as an important legal instrument for homeowners facing financial difficulties and potential foreclosure. This document allows a homeowner to voluntarily transfer ownership of their property back to the lender in exchange for the cancellation of the mortgage debt. By choosing this route, homeowners can avoid the lengthy and often costly foreclosure process. The form outlines the terms and conditions of the transfer, including any potential liabilities that may still exist after the deed is executed. It is crucial for homeowners to understand that executing this deed does not absolve them of all financial responsibilities, as certain obligations may remain. Additionally, the form requires the lender's acceptance, meaning that both parties must agree to the terms laid out in the document. By utilizing this option, homeowners may find a way to mitigate the negative impacts of foreclosure on their credit and regain financial stability more quickly.

Dos and Don'ts

When navigating the process of filling out the Florida Deed in Lieu of Foreclosure form, it is essential to approach the task with care and attention. This document can have significant implications for your financial future, so understanding what to do and what to avoid is crucial. Below is a list of actions to consider.

- Do: Ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do: Consult with a legal professional or real estate expert before submitting the form. Their guidance can help clarify any uncertainties.

- Do: Keep copies of all documents for your records. This can be important for future reference.

- Do: Understand the implications of signing the deed. Be aware of how it may affect your credit and future housing options.

- Don't: Rush through the form. Taking your time can prevent costly mistakes.

- Don't: Ignore any additional requirements or instructions provided with the form. Each detail can be critical to the process.

By following these guidelines, individuals can better navigate the complexities of the Deed in Lieu of Foreclosure process in Florida. Each step taken with care can lead to a more favorable outcome.

How to Use Florida Deed in Lieu of Foreclosure

After completing the Florida Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties. This may include the lender and possibly local government offices, depending on your situation. Ensure that all parties receive copies for their records.

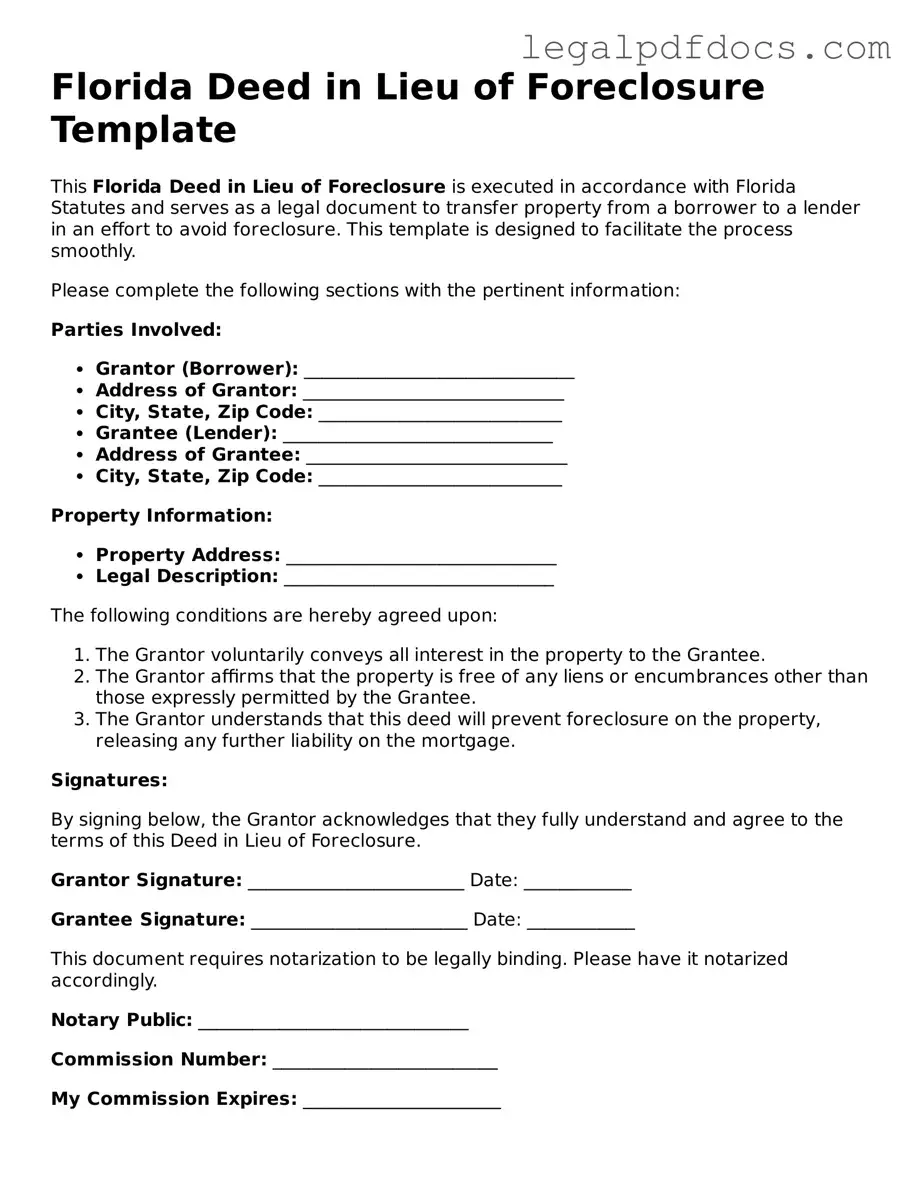

- Obtain the Florida Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the names of the property owner(s) in the designated area.

- Provide the complete address of the property being transferred.

- Include the legal description of the property. This can often be found on the property deed.

- State the name of the lender receiving the deed.

- Sign the form in the presence of a notary public.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the lender and keep a record of the submission.

Find Popular Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu Vs Foreclosure - A Deed in Lieu allows homeowners to eliminate the hassle of a lengthy foreclosure process.

Foreclosure in Georgia - A Deed in Lieu does not guarantee loan forgiveness; homeowners must clarify this with lenders.

Will I Owe Money After a Deed in Lieu of Foreclosure - This form helps provide a clear title to the lender while relieving the homeowner from the burden of debt.

Documents used along the form

When navigating the process of a deed in lieu of foreclosure in Florida, several other forms and documents often come into play. These documents help ensure that both parties—the borrower and the lender—understand their rights and responsibilities, and they facilitate a smoother transition during the process. Below is a list of commonly used forms that accompany the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines changes to the original loan terms, which may include adjustments to interest rates, payment schedules, or the principal balance. It’s often used when a borrower is attempting to avoid foreclosure by negotiating new terms with the lender.

- Notice of Default: This formal notice is sent by the lender to the borrower when they have fallen behind on their mortgage payments. It informs the borrower of their default status and outlines the next steps, including the potential for foreclosure.

- Release of Liability: This document releases the borrower from any further obligations on the mortgage after the deed in lieu is executed. It is crucial for ensuring that the borrower is not held responsible for any remaining debt associated with the property.

- Property Condition Disclosure: This form provides information about the property's condition. It is typically filled out by the borrower and helps the lender assess any potential issues with the property before accepting the deed in lieu.

- Affidavit of Title: This sworn statement confirms the borrower's ownership of the property and that there are no undisclosed liens or claims against it. This affidavit helps protect the lender's interest in the property.

- Closing Statement: This document summarizes the financial aspects of the transaction, including any costs, fees, and the final terms of the deed in lieu. It serves as a record of the transaction and is often reviewed by both parties.

- Release of Mortgage: Once the deed in lieu is completed, this document is filed to officially remove the mortgage lien from the property. It signifies that the borrower has transferred ownership and that the lender has accepted the property in lieu of foreclosure.

Understanding these accompanying documents is essential for anyone considering a deed in lieu of foreclosure. Each plays a vital role in ensuring that the process is clear, fair, and legally sound for both parties involved. Being informed can make a significant difference in navigating this challenging situation.

Misconceptions

Understanding the Florida Deed in Lieu of Foreclosure can be challenging, especially with various misconceptions surrounding it. Here are nine common misunderstandings:

-

It completely eliminates all debt.

Many people believe that signing a deed in lieu of foreclosure wipes out all mortgage debt. However, this is not always the case. If there are other debts associated with the property, such as second mortgages or liens, those may still remain.

-

It is a quick process.

While a deed in lieu can be faster than a traditional foreclosure, it is not instantaneous. The process involves negotiations with the lender and may take time to finalize.

-

It has no impact on credit scores.

Some believe that a deed in lieu of foreclosure has no effect on their credit. In reality, it can negatively impact credit scores, similar to a foreclosure, although the exact impact may vary.

-

Only homeowners facing foreclosure can use it.

This is a common misconception. Homeowners who are struggling to make payments but have not yet received a foreclosure notice can also consider a deed in lieu as an option.

-

It is the same as a short sale.

While both options involve transferring property to the lender, a short sale requires selling the home for less than the mortgage amount, whereas a deed in lieu involves handing over the property without a sale.

-

It absolves you of all liability.

Signing a deed in lieu does not necessarily release you from all liabilities. If there are any remaining debts, such as personal guarantees, you may still be held accountable.

-

It is available to all types of properties.

Not all properties qualify for a deed in lieu of foreclosure. Properties with multiple liens or those that are not owner-occupied may face additional hurdles.

-

It guarantees acceptance by the lender.

Just because a homeowner requests a deed in lieu does not mean the lender will accept it. Lenders typically evaluate the situation and may have specific requirements that must be met.

-

It is a simple form to fill out.

While the form itself may seem straightforward, the implications and details surrounding it can be complex. It is advisable to seek guidance to ensure all aspects are properly addressed.

By understanding these misconceptions, homeowners can make more informed decisions about their options when facing financial difficulties.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | In Florida, the deed in lieu of foreclosure is governed by Florida Statutes, particularly Chapter 697. |

| Eligibility | Homeowners must be in default on their mortgage payments to consider this option. The lender must also agree to accept the deed. |

| Benefits | This process can help borrowers avoid the lengthy foreclosure process and its negative impact on credit scores. |

| Process | The borrower must provide the lender with a written request and any necessary financial documentation to initiate the deed in lieu process. |

| Potential Risks | Borrowers may still face tax implications and potential deficiency judgments, depending on the lender's policies and state laws. |

Key takeaways

When dealing with the Florida Deed in Lieu of Foreclosure, it is essential to understand several key points. This form can be a viable option for homeowners facing foreclosure. Here are five important takeaways:

- Voluntary Process: A deed in lieu of foreclosure is a voluntary agreement between the homeowner and the lender. The homeowner willingly transfers the property to the lender to avoid foreclosure proceedings.

- Impact on Credit: While a deed in lieu may be less damaging to your credit score than a foreclosure, it still has negative implications. It is crucial to consider how this decision will affect your credit in the long term.

- Clear Title: The lender typically requires that the property has a clear title. Any liens or encumbrances on the property may complicate the process. Ensure that all debts related to the property are resolved before proceeding.

- Negotiation Opportunities: Homeowners can negotiate the terms of the deed in lieu, including potential relocation assistance or forgiveness of remaining mortgage debt. Engaging in open communication with the lender can lead to more favorable outcomes.

- Legal Advice Recommended: Consulting with a legal expert is advisable. They can provide guidance specific to your situation and help navigate the complexities of the process.

Understanding these key points can help you make informed decisions regarding the deed in lieu of foreclosure process in Florida.