Fill Out a Valid Florida Commercial Contract Template

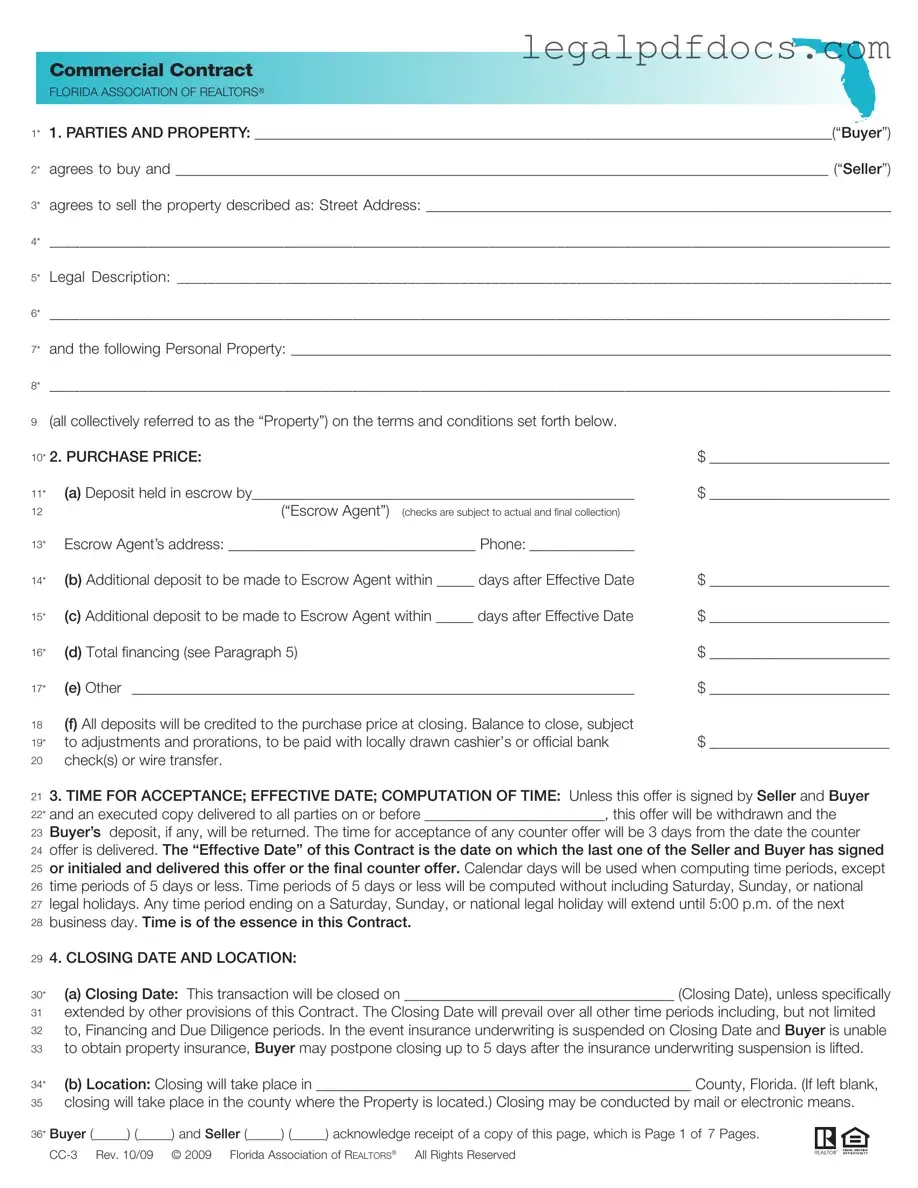

The Florida Commercial Contract form is a crucial document for anyone involved in buying or selling commercial real estate in the state. It outlines the responsibilities and rights of both the buyer and the seller, ensuring that all parties are on the same page. Key elements include the identification of the parties involved, a detailed description of the property, and the purchase price. The contract also specifies the terms for deposits, financing, and the timeline for acceptance. Closing details, including the date and location, are clearly laid out, along with provisions for title transfer and property condition. Additionally, it addresses the buyer's obligation to secure financing and the seller's duty to provide a marketable title. The form includes sections on inspections, property operation during the contract period, and the closing process, making it comprehensive for all parties. Understanding this form can help avoid misunderstandings and ensure a smoother transaction.

Dos and Don'ts

When filling out the Florida Commercial Contract form, it is essential to approach the process with care. Here are four key actions to take and avoid:

- Do ensure all parties' names are clearly and accurately written to avoid any confusion.

- Do specify the legal description of the property in detail, as this is crucial for identifying the property involved in the transaction.

- Don't leave any sections blank, especially those related to purchase price and deposits, as this may lead to disputes later.

- Don't rush through the terms and conditions; carefully read and understand each clause to ensure compliance and avoid future issues.

How to Use Florida Commercial Contract

Completing the Florida Commercial Contract form requires attention to detail and accurate information. This step-by-step guide will help ensure that all necessary sections are filled out correctly, facilitating a smoother transaction process.

- Identify the Parties: Fill in the names of the Buyer and Seller in the designated spaces.

- Property Description: Provide the street address and legal description of the property being sold.

- Personal Property: List any personal property included in the sale.

- Purchase Price: Enter the total purchase price and details of any deposits held in escrow.

- Escrow Agent: Specify the name and address of the escrow agent and the amounts for any deposits.

- Time for Acceptance: Indicate the deadline for the Seller to sign and return the contract.

- Closing Date and Location: Fill in the anticipated closing date and location of the closing.

- Financing Details: Enter the terms of any third-party financing, including interest rates and loan amounts.

- Title Information: Specify how the title will be conveyed and any existing liens or encumbrances.

- Property Condition: Indicate whether the property is being sold "as is" or if there will be a due diligence period.

- Closing Procedure: Detail the responsibilities of both parties regarding possession, costs, and required documents.

- Escrow Agent Authorization: Confirm the authorization of the escrow agent to manage the funds according to the contract terms.

- Signatures: Ensure both Buyer and Seller sign and date the contract at the end of the document.

Once the form is completed, review it for accuracy. Both parties should retain copies for their records. This ensures clarity and helps prevent any disputes during the transaction process.

More PDF Templates

How to Create Payroll Checks - Contributes to building trust through clear payment processes.

Baseball Player Evaluation Form - Overall, the assessment aims to identify talented players for future opportunities.

Asurion Phone Replacement - Essential for reporting device loss or theft.

Documents used along the form

The Florida Commercial Contract form is a crucial document in real estate transactions, particularly for commercial properties. Along with this contract, several other forms and documents are commonly utilized to ensure a smooth transaction. Below is a list of these additional documents, each serving a specific purpose in the process.

- Title Insurance Commitment: This document outlines the terms under which a title insurance policy will be issued. It provides details about the title, including any liens or encumbrances that may affect ownership.

- Escrow Agreement: This agreement details the roles and responsibilities of the escrow agent, who holds funds and documents until all conditions of the contract are met. It protects both the buyer and seller during the transaction.

- Property Survey: A property survey is a detailed map of the property, showing boundaries, easements, and any structures. It is essential for identifying any encroachments or zoning issues that may affect the property.

- Due Diligence Checklist: This checklist helps the buyer assess the property’s condition and suitability for their intended use. It may include inspections, environmental assessments, and reviews of zoning regulations.

- Lease Agreements: If the property is leased to tenants, these agreements outline the terms of the leases, including rent, duration, and tenant responsibilities. They are crucial for understanding the property’s income potential.

- Disclosure Statements: These statements inform buyers of any known issues with the property, such as environmental hazards or structural problems. They are essential for transparency and legal compliance.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, closing costs, and any adjustments. It is provided at closing for review by both parties.

- Estoppel Certificates: These certificates are used to confirm the terms of existing leases and the status of tenants. They provide assurance to the buyer regarding rental income and tenant obligations.

- Bill of Sale: This document transfers ownership of personal property included in the sale, such as equipment or inventory. It ensures that all agreed-upon items are officially transferred to the buyer.

Each of these documents plays an integral role in the commercial real estate transaction process. Understanding their purpose and importance can help both buyers and sellers navigate the complexities of closing a commercial property deal in Florida.

Misconceptions

- Misconception 1: The Florida Commercial Contract form is only for large businesses.

- Misconception 2: The contract guarantees financing for the buyer.

- Misconception 3: Once signed, the contract cannot be changed.

- Misconception 4: The seller is responsible for all repairs after the sale.

- Misconception 5: The contract is only enforceable in Florida.

This is not true. The form can be used by any party engaged in a commercial transaction, regardless of the size of the business. Small businesses and individual investors can also benefit from using this contract to formalize their agreements.

While the contract includes provisions for financing, it does not guarantee that financing will be obtained. Buyers must still apply for and secure their financing, and the contract outlines the steps to take if financing is not approved.

In fact, the contract can be modified. Any changes must be made in writing and signed by both parties. This flexibility allows buyers and sellers to adjust terms as needed before closing.

This is misleading. The contract typically states that the property is sold "as is," meaning the buyer accepts the property in its current condition. Buyers should conduct inspections and due diligence before finalizing the purchase.

While the contract is governed by Florida law, its enforceability can extend beyond state lines, depending on the circumstances and the parties involved. It's important for all parties to understand their rights and obligations under the law.

File Specs

| Fact Name | Details |

|---|---|

| Parties Involved | The contract identifies the Buyer and Seller, including their roles in the transaction. |

| Property Description | It requires a detailed description of the property, including the street address and legal description. |

| Purchase Price | The contract specifies the purchase price and outlines how deposits will be handled. |

| Time for Acceptance | Offers must be accepted within a specified timeframe, typically three days for counteroffers. |

| Closing Date | The contract sets a closing date, which may be extended under certain conditions. |

| Third Party Financing | Buyers are obligated to apply for financing within a specified number of days after the effective date. |

| Title Conveyance | The Seller must convey marketable title free of liens, with exceptions noted in the contract. |

| Property Condition | The property is sold "as is," and the Buyer waives claims for defects unless otherwise specified. |

| Escrow Agent | The contract designates an escrow agent responsible for holding and disbursing funds according to the contract terms. |

| Governing Law | This contract is governed by Florida law, ensuring compliance with state-specific regulations. |

Key takeaways

Key Takeaways for Filling Out the Florida Commercial Contract Form

- Accurate Information: Ensure that all parties' names, addresses, and property details are filled out correctly. This includes the street address and legal description of the property. Any inaccuracies can lead to complications later.

- Understand Financial Obligations: Be clear about the purchase price, deposits, and financing terms. Know how much is required upfront and what additional deposits may be needed after the effective date.

- Timeframes Matter: Pay attention to deadlines for acceptance, financing, and inspections. Missing these deadlines can result in the contract being voided or deposits being forfeited.

- Property Condition and Inspections: Decide whether to accept the property "as is" or to conduct inspections during the due diligence period. This decision impacts your ability to negotiate repairs or cancel the contract based on findings.