Official Articles of Incorporation Form for Florida

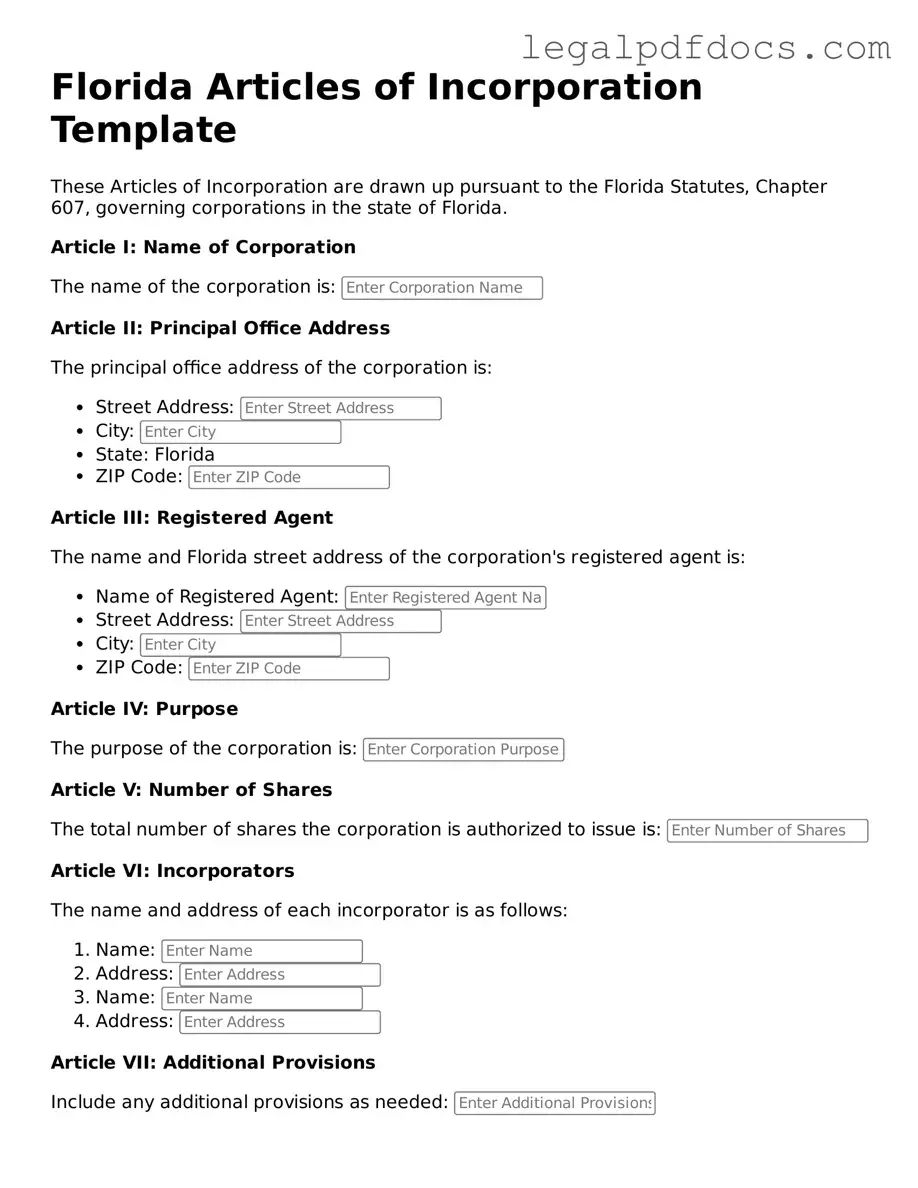

In Florida, the Articles of Incorporation serve as a crucial document for anyone looking to establish a corporation. This form outlines essential information that defines the corporation's identity and structure. Key aspects include the corporation's name, which must be unique and comply with state regulations, ensuring it doesn't conflict with existing entities. Additionally, the form requires details about the corporation's purpose, which can be broad or specific, depending on the business goals. Incorporators must also provide the principal office address and the registered agent's information, who will receive legal documents on behalf of the corporation. Furthermore, the Articles of Incorporation may include provisions related to stock, such as the number of shares the corporation is authorized to issue. Understanding these components is vital for a successful incorporation process in Florida, as they lay the foundation for the corporation's legal existence and operations.

Dos and Don'ts

When completing the Florida Articles of Incorporation form, it is essential to adhere to certain guidelines to ensure a smooth process. Below are key do's and don'ts to consider.

- Do provide accurate and complete information about the corporation.

- Do include the name of the corporation, ensuring it complies with state naming requirements.

- Do designate a registered agent with a physical address in Florida.

- Do specify the purpose of the corporation clearly and concisely.

- Don't use a name that is too similar to an existing corporation.

- Don't forget to sign and date the form before submission.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't underestimate the importance of reviewing the form for errors before filing.

How to Use Florida Articles of Incorporation

Once you have gathered the necessary information, you are ready to complete the Florida Articles of Incorporation form. This form is essential for establishing your business as a legal entity in the state of Florida. After filling it out, you will submit it to the Florida Department of State for processing.

- Begin by downloading the Florida Articles of Incorporation form from the Florida Department of State’s website.

- Enter the name of your corporation. Ensure it complies with Florida naming requirements and is distinguishable from other registered entities.

- Provide the principal office address. This should be a physical address where your business will be located, not a P.O. Box.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Indicate the purpose of your corporation. A brief description of what your business will do is required.

- Specify the number of shares your corporation is authorized to issue. You can also note the par value of the shares if applicable.

- Fill in the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. All incorporators must sign to validate the document.

- Prepare the payment for the filing fee. Check the Florida Department of State’s website for the current fee amount.

- Submit the completed form along with the payment to the Florida Department of State, either by mail or online, depending on your preference.

Find Popular Articles of Incorporation Forms for US States

Georgia Secretary of State Forms - It often requires the names and addresses of the initial directors.

Illinois Articles of Incorporation - Each state has its own requirements for Articles of Incorporation.

Kansas Llc Requirements - The Articles of Incorporation can affect tax liabilities and responsibilities.

Documents used along the form

When incorporating a business in Florida, the Articles of Incorporation serve as a foundational document. However, several other forms and documents are often necessary to ensure compliance with state regulations and to facilitate smooth business operations. Here are four key documents that are frequently used alongside the Articles of Incorporation.

- Bylaws: Bylaws outline the internal rules and procedures for the corporation. They cover topics such as the roles of directors and officers, how meetings will be conducted, and how decisions are made. Having clear bylaws helps prevent disputes and ensures that the corporation operates smoothly.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document typically includes basic information about the corporation, such as its address, officers, and registered agent. It helps the state keep accurate records of newly formed businesses.

- Employer Identification Number (EIN): An EIN is a unique identifier assigned by the IRS for tax purposes. Most businesses need an EIN to hire employees, open a business bank account, and file taxes. Obtaining an EIN is a crucial step for newly incorporated businesses.

- Business License: Depending on the type of business and its location, a business license may be required. This license ensures that the business complies with local regulations and can operate legally. Checking with local authorities is essential to determine the specific licenses needed.

Incorporating a business involves more than just filing the Articles of Incorporation. Understanding and preparing these additional documents can help ensure compliance and lay a solid foundation for future operations. Properly addressing these requirements will contribute to the long-term success of the business.

Misconceptions

Understanding the Florida Articles of Incorporation form is essential for anyone looking to start a business in the state. However, several misconceptions can lead to confusion. Here are seven common misconceptions about this important document:

- Filing Articles of Incorporation is optional. Many people believe that incorporating is not necessary for their business. However, filing Articles of Incorporation is a legal requirement for establishing a corporation in Florida.

- All businesses must file Articles of Incorporation. While corporations must file this document, not all business entities require it. Sole proprietorships and partnerships do not need to file Articles of Incorporation.

- Articles of Incorporation and business licenses are the same. These two documents serve different purposes. Articles of Incorporation create the corporation, while business licenses allow the business to operate legally in its specific industry.

- Once filed, Articles of Incorporation cannot be changed. This is incorrect. Amendments can be made to the Articles of Incorporation after filing, allowing for changes in the business structure or other important details.

- Anyone can file Articles of Incorporation. While individuals can file the form, it is important to ensure that the person filing is authorized to do so on behalf of the corporation. This usually includes directors or officers of the corporation.

- The Articles of Incorporation are the only documents needed to start a business. In addition to this form, businesses may need to obtain permits, licenses, and other registrations to operate legally.

- Filing Articles of Incorporation guarantees business success. While incorporating provides legal protection and credibility, it does not ensure that the business will be profitable or successful. Business planning and management are crucial for success.

Being aware of these misconceptions can help aspiring business owners navigate the incorporation process more effectively. Proper understanding ensures compliance with state laws and contributes to a solid foundation for future business operations.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Florida Articles of Incorporation form is used to legally establish a corporation in the state of Florida. |

| Governing Law | This form is governed by the Florida Business Corporation Act, specifically Chapter 607 of the Florida Statutes. |

| Filing Requirement | To incorporate, the form must be filed with the Florida Department of State, Division of Corporations. |

| Information Needed | Key information includes the corporation's name, principal office address, and the names and addresses of the initial directors. |

| Filing Fee | A filing fee is required, which varies based on the type of corporation being formed. |

| Approval Time | Typically, the processing time for the Articles of Incorporation is around 2 to 3 business days, but this may vary. |

| Amendments | If changes occur, amendments to the Articles of Incorporation can be filed to update the corporation's information. |

Key takeaways

When filling out and using the Florida Articles of Incorporation form, there are several important points to keep in mind. Understanding these key takeaways can help ensure a smooth incorporation process.

- Accurate Information is Crucial: Ensure that all details provided, such as the name of the corporation, its purpose, and the registered agent, are accurate and complete. Mistakes can lead to delays or complications.

- Filing Fees Apply: Be prepared to pay the required filing fees when submitting the Articles of Incorporation. These fees can vary, so check the latest information from the Florida Department of State.

- Consider Your Business Structure: Decide on the type of corporation you want to form, whether it be a profit or nonprofit corporation. This decision will affect your tax obligations and legal responsibilities.

- Follow Up After Filing: After submitting the form, monitor the status of your application. You should receive confirmation once your incorporation is approved. Keep this documentation for your records.