Fill Out a Valid Erc Broker Market Analysis Template

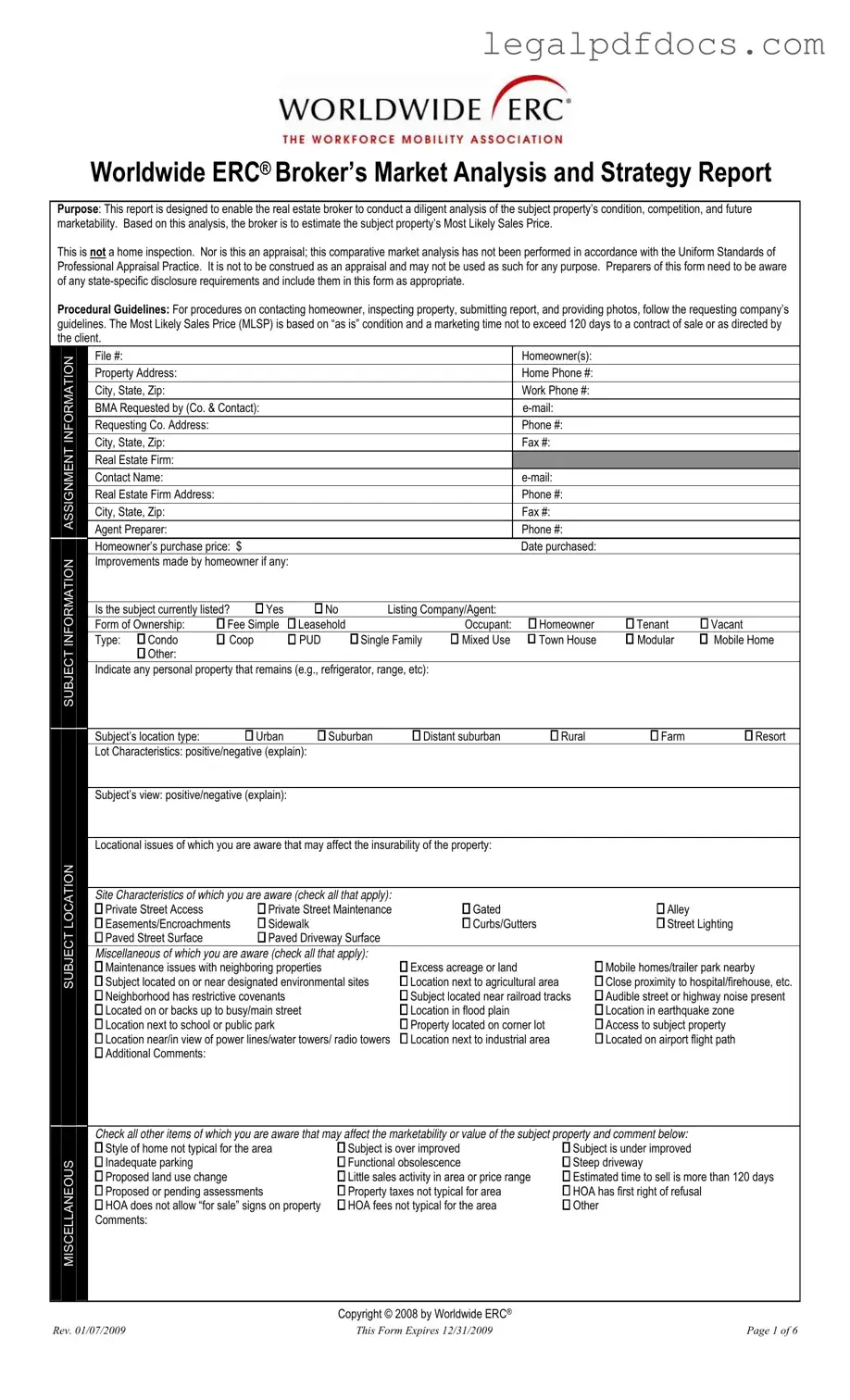

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a vital tool for real estate brokers in assessing a property’s condition, competitive landscape, and future marketability. This comprehensive form facilitates a diligent analysis, allowing brokers to estimate the Most Likely Sales Price (MLSP) of the subject property based on its “as is” condition and anticipated marketing time, typically not exceeding 120 days. It is important to note that this analysis is distinct from a home inspection or appraisal and should not be used as such. The report requires preparers to be mindful of state-specific disclosure requirements, ensuring that all necessary information is included. Key components of the form encompass property details, neighborhood characteristics, financing options, and any potential issues that could affect marketability or insurability. Additionally, the form prompts brokers to document required repairs and improvements, assess comparable listings and sales, and evaluate the broader market area. By following the procedural guidelines laid out in the report, brokers can provide a thorough and accurate market analysis that supports informed decision-making for their clients.

Dos and Don'ts

When filling out the ERC Broker Market Analysis form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a helpful list of things you should and shouldn’t do:

- Do follow the procedural guidelines provided by the requesting company.

- Do accurately describe the condition of the property and any improvements made.

- Do disclose any issues that may affect the insurability or marketability of the property.

- Do provide complete contact information for all parties involved.

- Don't treat this report as a home inspection or appraisal.

- Don't omit any state-specific disclosure requirements that may apply.

- Don't make assumptions about the property’s value without proper analysis.

- Don't forget to include any necessary photos or documentation as required.

How to Use Erc Broker Market Analysis

Completing the ERC Broker Market Analysis form requires careful attention to detail and accurate information about the property and its surroundings. After filling out the form, the next steps will involve analyzing the data collected to estimate the property’s Most Likely Sales Price and preparing a report based on that analysis.

- Begin with the INFORMATION section. Fill in the File #, Homeowner(s) name, Property Address, Home Phone #, Work Phone #, and other relevant contact details.

- In the ASSIGNMENT section, provide details about the Real Estate Firm, including the Contact Name, email, and address.

- Document the Homeowner’s purchase price and date purchased in the appropriate fields.

- Note any improvements made by the homeowner, and indicate if the property is currently listed.

- Specify the form of ownership and the occupant type (Homeowner, Tenant, or Vacant).

- Describe the subject property’s location type and any personal property that remains with the sale.

- Evaluate the Lot Characteristics and Subject’s view, noting any positive or negative aspects.

- List any locational issues that could affect the property’s insurability.

- Check all relevant Site Characteristics and Miscellaneous

- Assess the PROPERTY CONDITION by checking the appropriate boxes for any observed issues.

- Provide estimated costs for recommended repairs and improvements in both the Interior and Exterior sections.

- List any required, customary, and additionally recommended inspections.

- Identify the most probable means of financing and describe any necessary financing concessions.

- Evaluate any anticipated issues affecting the ability to secure financing.

- Define the Subject Neighborhood and gather statistics reflecting the market area.

- Calculate the months supply of inventory and describe marketing conditions.

- Document comparable sales and their details, ensuring to include all relevant metrics.

- Finally, summarize any comments or observations that may influence the analysis.

More PDF Templates

Profit and Loss Form - Utilized by management for strategic decision-making.

Immunization Records Florida - Documentation of vaccination histories using this form is crucial for protecting the well-being of the broader community.

Roof Condition Report - Structure identification is necessary for tracking and reference.

Documents used along the form

The ERC Broker Market Analysis form is a vital tool for real estate brokers, helping them assess property conditions and marketability. However, several other documents complement this analysis, providing a comprehensive view of the real estate landscape. Understanding these additional forms can enhance the effectiveness of the market analysis process.

- Comparative Market Analysis (CMA): A CMA evaluates similar properties that have recently sold in the area. It helps brokers determine a competitive price for the subject property based on real-time market data.

- Property Inspection Report: This document outlines the physical condition of the property, highlighting any repairs or issues that may need addressing. It serves as a detailed account of the property’s structural integrity and safety.

- Disclosure Statements: These are legal documents that inform potential buyers of any known issues with the property, such as past water damage or environmental hazards. They ensure transparency and protect both the seller and buyer.

- Listing Agreement: This contract between the seller and the broker outlines the terms of the listing, including the commission rate and duration of the agreement. It formalizes the broker’s role in marketing the property.

- Sales Contract: Once a buyer is found, this legally binding document details the terms of the sale, including the purchase price, contingencies, and closing date. It is essential for finalizing the transaction.

- Appraisal Report: Conducted by a licensed appraiser, this report provides an objective assessment of the property's value based on various factors, including location, condition, and market trends.

- Financing Pre-Approval Letter: This letter from a lender indicates that a buyer has been pre-approved for a mortgage, which can strengthen their offer and expedite the buying process.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community. They are crucial for buyers to understand ongoing obligations.

- Title Report: This report verifies the property’s ownership and identifies any liens or claims against it. A clear title is essential for a smooth transaction.

Each of these documents plays a critical role in the real estate transaction process. By understanding and utilizing them alongside the ERC Broker Market Analysis form, brokers can provide a more thorough and informed service to their clients, ultimately leading to better outcomes in property sales.

Misconceptions

- Misconception 1: The ERC Broker Market Analysis form is an appraisal.

- Misconception 2: The analysis includes a detailed home inspection.

- Misconception 3: The Most Likely Sales Price is a guaranteed selling price.

- Misconception 4: The form is universally applicable without state-specific considerations.

- Misconception 5: The analysis covers only the immediate property.

Many people mistakenly believe that this form serves as a formal appraisal of the property. In reality, it is a comparative market analysis designed to estimate the Most Likely Sales Price based on various factors. It does not adhere to the strict guidelines of an appraisal and should not be used as such.

Some assume that the form involves a thorough inspection of the property. However, it is important to note that the analysis does not replace a home inspection. It focuses on the property's condition and marketability rather than providing a comprehensive assessment of its physical state.

Another common misunderstanding is that the Most Likely Sales Price (MLSP) is a guaranteed figure. The MLSP is merely an estimate based on current market conditions and comparable properties. It reflects what the broker believes the property could sell for, but actual sale prices may vary.

Some users think the ERC Broker Market Analysis form can be used in every state without modifications. In truth, brokers must be aware of and incorporate any state-specific disclosure requirements into the form to ensure compliance with local laws.

Lastly, many believe that the analysis only pertains to the subject property itself. In fact, it includes insights about the broader market area, competition, and economic conditions that may impact the property's marketability and value.

File Specs

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used by real estate brokers to analyze the condition, competition, and marketability of a property to estimate its Most Likely Sales Price. |

| Not an Appraisal | The report is not an appraisal and should not be used as such. It does not comply with the Uniform Standards of Professional Appraisal Practice. |

| State-Specific Requirements | Preparers must be aware of and include any state-specific disclosure requirements in the form. |

| Most Likely Sales Price (MLSP) | The MLSP is based on the property's "as is" condition and assumes a marketing time of up to 120 days unless otherwise directed by the client. |

| Property Inspection Guidelines | Guidelines for contacting homeowners, inspecting properties, and submitting reports must follow the requesting company's procedures. |

| Disclosure of Property Issues | Inspectors must check for issues that could affect the property's insurability and marketability, such as maintenance problems or environmental concerns. |

| Financing Options | The form identifies various financing options, including FHA, VA, cash, and conventional mortgages, and notes any necessary concessions. |

| Expiration Date | This form is valid until December 31, 2009, as indicated by the copyright notice. |

Key takeaways

Filling out and utilizing the ERC Broker Market Analysis form effectively can streamline the process of evaluating a property. Here are some key takeaways to consider:

- Purpose Clarity: Understand that this form is meant for conducting a market analysis rather than a home inspection or appraisal. It helps estimate the Most Likely Sales Price based on the property’s condition and market factors.

- Accurate Information: Ensure that all fields are filled out accurately, including homeowner details, property specifics, and contact information for all involved parties. This information is crucial for effective communication and follow-up.

- Disclosure Requirements: Be aware of state-specific disclosure requirements. Including these disclosures in the form is essential to comply with local laws and regulations.

- Market Conditions: Assess both the subject neighborhood and the broader market area. Understanding local trends, such as property values and average days on the market, will inform your analysis and pricing strategy.

- Condition Observations: Document any observed issues regarding the property’s condition, such as maintenance needs or structural concerns. This information can significantly impact the estimated sales price and marketability.

- Financing Considerations: Identify potential financing issues that may arise, including the type of financing likely to be used and any necessary concessions. This foresight can aid in preparing the homeowner for potential challenges during the sale process.