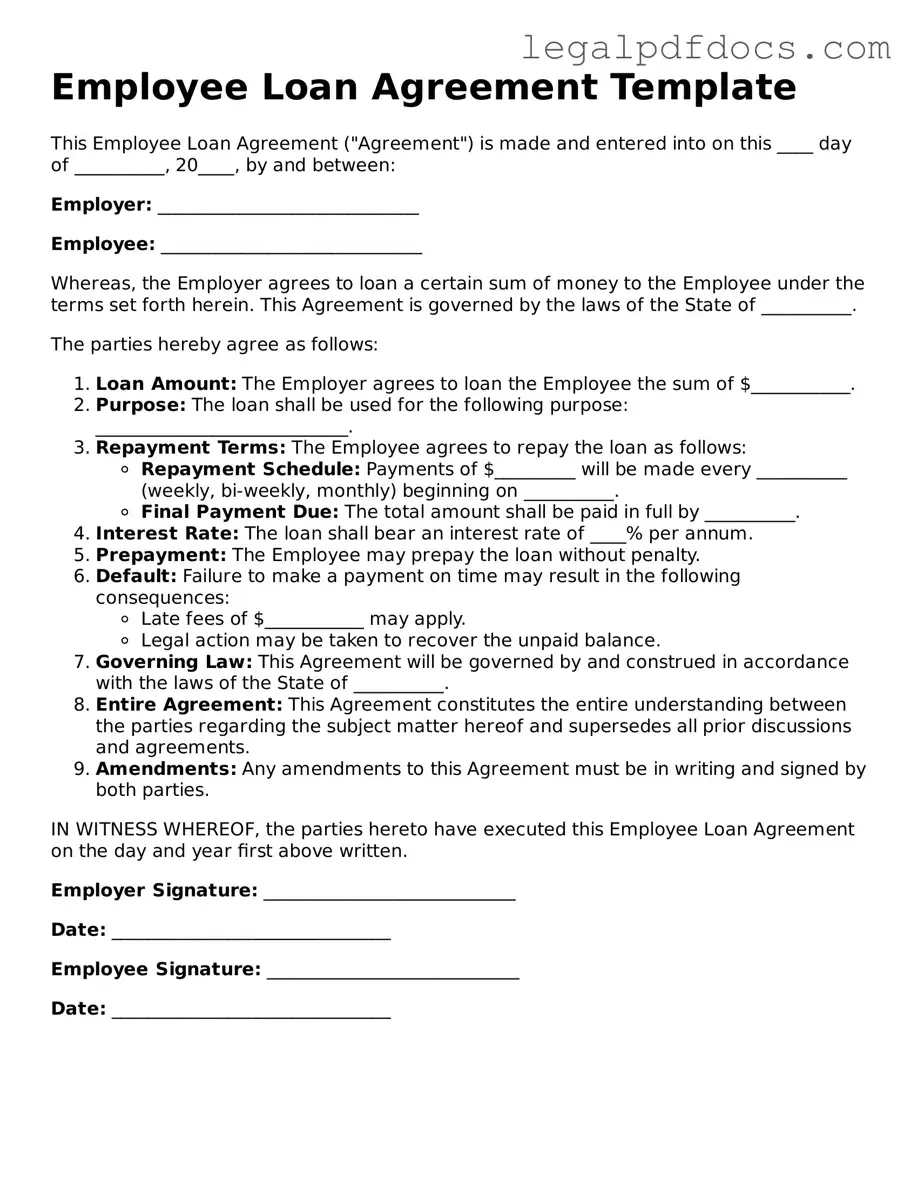

Employee Loan Agreement Template

When employees find themselves in need of financial assistance, an Employee Loan Agreement can serve as a vital tool to facilitate a supportive and structured lending process. This form outlines the terms and conditions under which an employer provides a loan to an employee, ensuring that both parties are clear on their rights and responsibilities. Key elements typically included in the agreement are the loan amount, repayment schedule, interest rates (if applicable), and any potential consequences for defaulting on the loan. Additionally, the form may specify the purpose of the loan, whether it’s for personal emergencies, education, or other significant expenses. By formalizing the arrangement, the Employee Loan Agreement not only protects the employer’s interests but also provides the employee with a clear understanding of the obligations they are undertaking. Such transparency fosters trust and accountability, making it easier for both parties to navigate the lending process smoothly.

Dos and Don'ts

When filling out an Employee Loan Agreement form, it is crucial to approach the task with care. A well-completed form can facilitate a smooth lending process, while errors or omissions may lead to complications. Here are nine important dos and don’ts to consider:

- Do read the entire form thoroughly before starting.

- Do provide accurate and complete personal information.

- Do clearly state the purpose of the loan.

- Do review the repayment terms carefully.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank unless instructed otherwise.

- Don't fabricate or exaggerate your financial situation.

- Don't forget to sign and date the form before submission.

By adhering to these guidelines, individuals can navigate the process of completing an Employee Loan Agreement with greater ease and confidence.

How to Use Employee Loan Agreement

Filling out the Employee Loan Agreement form is an important step in formalizing the loan arrangement between an employer and an employee. This agreement outlines the terms and conditions of the loan, ensuring both parties understand their rights and responsibilities. Follow the steps below to complete the form accurately.

- Begin with the date: Write the date when the agreement is being signed at the top of the form.

- Enter employee information: Fill in the employee's full name, address, and contact information in the designated sections.

- Provide employer details: Include the name of the employer or company, along with the address and contact information.

- Specify the loan amount: Clearly state the total amount of the loan being provided to the employee.

- Outline repayment terms: Detail the repayment schedule, including the frequency of payments (weekly, bi-weekly, monthly) and the due date for each payment.

- Include interest rate: If applicable, specify the interest rate for the loan. If there is no interest, indicate that as well.

- State the purpose of the loan: Briefly describe the reason for the loan, if necessary.

- Signatures: Ensure both the employee and an authorized representative from the employer sign and date the agreement at the bottom.

After completing the form, both parties should keep a copy for their records. This agreement serves as a reference point throughout the loan period, helping to prevent misunderstandings.

Documents used along the form

When entering into an Employee Loan Agreement, it is important to consider several other forms and documents that may be necessary to ensure clarity and legal compliance. Each of these documents serves a specific purpose and can help both the employer and employee navigate the loan process effectively.

- Loan Application Form: This document is filled out by the employee to request a loan. It typically includes personal information, the amount requested, and the purpose of the loan.

- Promissory Note: A promissory note is a written promise from the employee to repay the loan under specified terms. It outlines the repayment schedule, interest rate, and consequences for default.

- Employment Verification Letter: This letter confirms the employee's current employment status, position, and salary. It may be required by the lender to assess the employee's ability to repay the loan.

- Repayment Schedule: This document details the timeline for loan repayments. It specifies the due dates, amounts, and any interest that will accrue over time.

- Loan Disclosure Statement: This statement provides essential information about the loan, including terms, fees, and interest rates. It ensures transparency and helps the employee understand the financial implications of the loan.

- Authorization for Payroll Deduction: This form allows the employer to deduct loan repayments directly from the employee's paycheck. It streamlines the repayment process and ensures timely payments.

- Loan Agreement Amendment: If any changes need to be made to the original loan agreement, this document outlines the amendments. It ensures that both parties agree to the new terms.

- Termination of Loan Agreement: This document is used to formally end the loan agreement, either upon full repayment or if the loan is deemed uncollectible. It protects both parties by providing a clear record of the loan's conclusion.

Incorporating these documents alongside the Employee Loan Agreement can help create a comprehensive framework for managing the loan process. Each form plays a vital role in ensuring that both the employer and employee are protected and informed throughout the duration of the loan.

Misconceptions

Many individuals have misunderstandings about the Employee Loan Agreement form. Clarifying these misconceptions can help ensure that both employers and employees are on the same page. Here are four common misconceptions:

- The Employee Loan Agreement is just a formality. Many believe that this agreement is merely a formality. In reality, it is a binding document that outlines the terms of the loan, including repayment schedules and interest rates. It is crucial for protecting both parties.

- Employees are not required to repay the loan. Some employees may think that loans provided by employers do not need to be repaid. This is incorrect. The agreement clearly states the repayment obligations, and failure to repay can have serious consequences.

- The loan terms are negotiable after signing. Another misconception is that the terms of the loan can be changed after the agreement is signed. While discussions can occur, any changes typically require a formal amendment to the original agreement.

- The Employee Loan Agreement is the same as a paycheck advance. Many confuse this agreement with a paycheck advance. While both involve borrowing money, the terms, repayment methods, and implications differ significantly. The Employee Loan Agreement usually has a structured repayment plan over a set period.

Understanding these points can help foster a more transparent relationship between employers and employees regarding financial matters.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a formal document outlining the terms under which an employer lends money to an employee. |

| Purpose | This agreement helps clarify the responsibilities of both parties, including repayment terms and interest rates. |

| Repayment Terms | Typically, the agreement specifies how and when the employee must repay the loan, including any applicable interest. |

| Governing Law | The agreement is subject to state laws, which can vary. For example, in California, the governing law is the California Civil Code. |

| Documentation | Both parties should keep a signed copy of the agreement for their records, ensuring clarity and accountability. |

| Loan Amount | The agreement should clearly state the total amount being loaned to the employee. |

| Interest Rate | If applicable, the interest rate must be disclosed, which can affect the total repayment amount. |

| Default Clause | Many agreements include a default clause, detailing what happens if the employee fails to repay the loan on time. |

| Confidentiality | Confidentiality provisions may be included to protect the privacy of both the employee and employer. |

| Modification | Any changes to the agreement must be documented and signed by both parties to be enforceable. |

Key takeaways

When dealing with an Employee Loan Agreement, it's important to understand the key elements that will ensure clarity and compliance. Here are some essential takeaways to keep in mind:

- Clearly Define Loan Terms: Specify the amount being borrowed, the interest rate, and the repayment schedule. This clarity helps prevent misunderstandings later on.

- Document the Purpose: Indicate why the loan is being taken out. This can help both parties understand the context and necessity of the loan.

- Include Repayment Details: Outline how and when payments will be made. Consider including options for early repayment or consequences for late payments.

- Address Default Conditions: Clearly state what happens if the employee fails to repay the loan. This could include deductions from future paychecks or other measures.

- Ensure Compliance with Company Policies: Make sure the agreement aligns with your organization’s policies and any applicable laws. This protects both the employer and employee.

- Get Signatures: Both parties should sign the agreement. This step is crucial as it shows mutual consent and understanding of the terms.

- Keep a Copy: Each party should retain a copy of the signed agreement. This ensures that both sides have access to the terms and can refer back to them if needed.

By following these guidelines, you can create a solid foundation for your Employee Loan Agreement, fostering trust and clarity in the process.