Fill Out a Valid Employee Advance Template

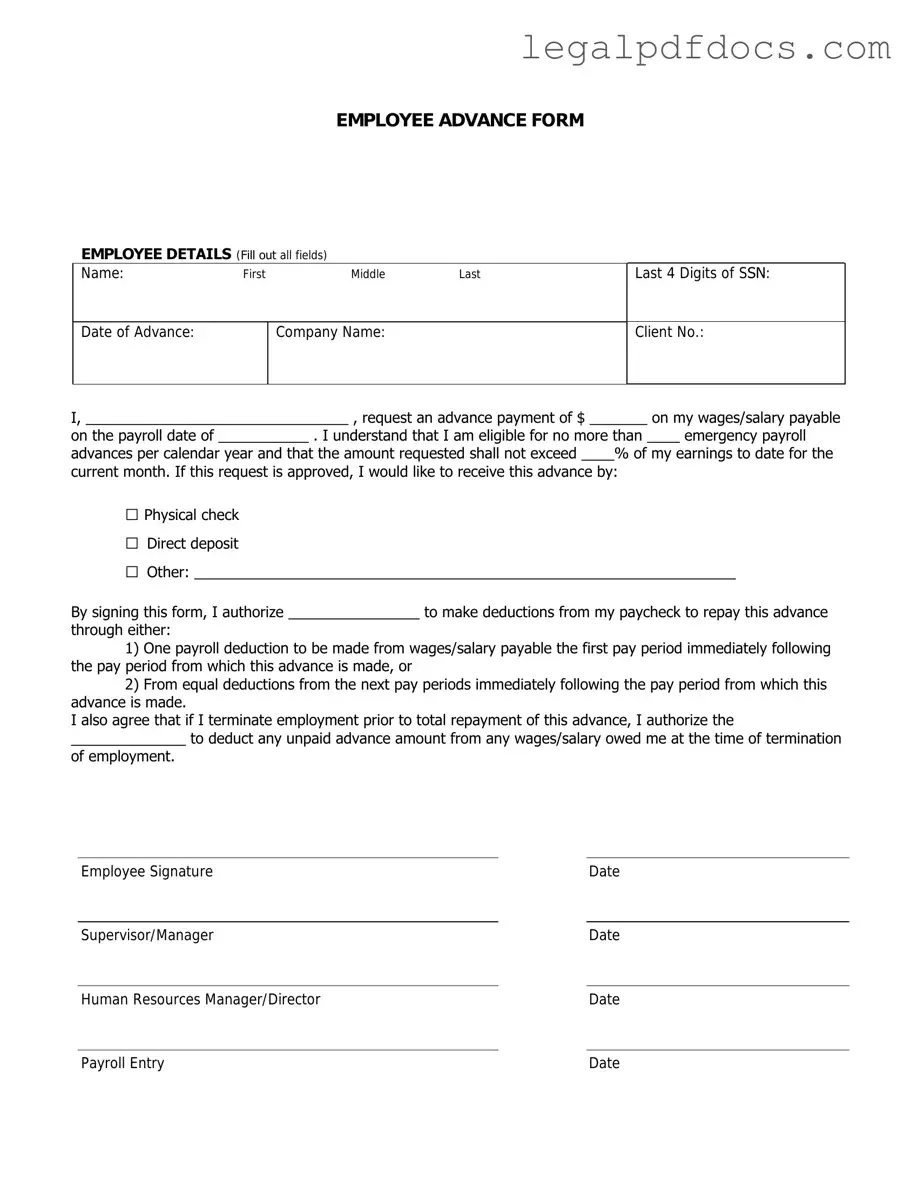

The Employee Advance form plays a crucial role in facilitating financial assistance for employees who may need immediate funds for various work-related expenses. This form serves as a formal request for an advance on salary or reimbursement for costs incurred while performing job duties. Employees can use it to cover expenses such as travel, training, or other necessary purchases that support their work. The form typically requires details such as the employee's name, department, the amount requested, and a brief description of the intended use of the funds. Additionally, it often includes a section for managerial approval, ensuring that the request is reviewed and sanctioned by a supervisor. Properly filling out this form not only streamlines the process of obtaining an advance but also helps maintain transparency and accountability within the organization. Understanding the key components and procedures related to the Employee Advance form can empower employees to navigate financial requests effectively, ensuring they have the resources they need to perform their jobs efficiently.

Dos and Don'ts

When filling out the Employee Advance form, attention to detail is crucial. Follow these guidelines to ensure a smooth process.

Things You Should Do:

- Read the instructions carefully before starting. Understanding the requirements will help you complete the form correctly.

- Provide accurate information. Double-check names, dates, and amounts to avoid delays in processing.

- Use clear and legible handwriting or type the information. This helps prevent misunderstandings.

- Include all necessary documentation. Attach any required receipts or proof of expenses to support your request.

- Submit the form on time. Adhering to deadlines ensures that your request is processed promptly.

Things You Shouldn't Do:

- Do not leave any sections blank. Incomplete forms may be rejected or delayed.

- Avoid using jargon or abbreviations that may not be understood by the reviewer.

- Do not submit the form without reviewing it. Errors can lead to complications or denial of your request.

- Do not forget to sign the form. An unsigned form is often considered invalid.

- Refrain from submitting multiple forms for the same request. This can create confusion and slow down the approval process.

How to Use Employee Advance

Once you have the Employee Advance form in hand, it's time to fill it out accurately. This form is essential for requesting an advance on your salary. After completing it, you will submit it to your supervisor for approval.

- Start by entering your full name at the top of the form.

- Provide your employee ID number in the designated section.

- Fill in the department you work in.

- Next, indicate the amount requested for the advance.

- In the reason for advance section, briefly explain why you need the funds.

- Sign and date the form at the bottom to confirm your request.

- Finally, submit the completed form to your supervisor for their review.

More PDF Templates

Wage and Tax Statement - W-2 forms are often generated through payroll software used by the employer.

Simple Shared Well Agreement Form - The well must supply safe drinking water, verified by local health authorities.

Asurion Phone Replacement - Quickly report device troubles with this form.

Documents used along the form

When submitting an Employee Advance form, several other documents may also be required to ensure a smooth process. These documents help provide additional context and support for the request. Below are four commonly used forms that may accompany the Employee Advance form.

- Expense Report: This document details the expenses the employee intends to cover with the advance. It includes dates, amounts, and descriptions of each expense.

- Approval Request: This form is often needed to obtain necessary approvals from supervisors or managers before processing the advance. It outlines the reasons for the advance and the expected benefits.

- Repayment Agreement: This agreement outlines the terms under which the employee will repay the advance. It specifies the repayment schedule and any conditions related to the repayment process.

- Tax Form: Depending on the amount and purpose of the advance, a tax form may be required. This ensures compliance with tax regulations and proper reporting of the advance as needed.

Including these documents with the Employee Advance form can help streamline the approval process and ensure that all necessary information is available for review. This thorough approach minimizes delays and supports proper financial management within the organization.

Misconceptions

Understanding the Employee Advance form can be challenging due to various misconceptions. Below is a list of common misunderstandings, along with clarifications to help clear up any confusion.

-

Only salaried employees can request an advance.

This is not true. Both hourly and salaried employees are eligible to request an advance, provided they meet the necessary criteria set by the organization.

-

Employee advances are loans that must be repaid with interest.

Employee advances typically do not incur interest. They are often considered an advance on future earnings and are repaid through payroll deductions.

-

All requests for advances are automatically approved.

Each request is reviewed based on company policy and individual circumstances. Approval is not guaranteed.

-

The Employee Advance form is only for emergency situations.

While many use it for emergencies, advances can be requested for various reasons, including planned expenses.

-

Submitting the form guarantees immediate payment.

There may be processing times involved. Employees should be aware that immediate payment is not always possible.

-

Advances can be requested at any time without limits.

Most companies have policies that limit the number of advances an employee can request within a specific timeframe.

-

Once an advance is approved, the amount cannot be changed.

In some cases, employees may be able to adjust the amount before the payment is processed, depending on company policy.

-

Employees must provide a detailed explanation for the advance.

While a reason may be requested, it does not need to be overly detailed. A simple explanation is often sufficient.

-

Repayment terms are the same for everyone.

Repayment terms can vary based on individual agreements and company policies, allowing for flexibility.

-

Using the Employee Advance form affects credit scores.

Employee advances are internal transactions and do not impact personal credit scores.

By addressing these misconceptions, employees can navigate the process of requesting an advance more effectively and with greater confidence.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used by employees to request an advance on their salary or wages for various reasons, such as unexpected expenses. |

| Eligibility | Typically, only full-time employees are eligible to request an advance, although this may vary by company policy. |

| Repayment Terms | Employees must agree to specific repayment terms, which may include deductions from future paychecks. |

| Documentation Required | Employees may need to provide documentation supporting their request, such as receipts or bills. |

| State-Specific Regulations | Some states have laws governing employee advances, which may dictate how advances are processed and repaid. For example, California has specific labor laws that address wage deductions. |

| Tax Implications | Advances may be considered taxable income, and employees should consult a tax professional for guidance. |

| Approval Process | The approval process often involves a supervisor or HR review to ensure the request is valid and complies with company policy. |

| Confidentiality | Requests for advances are generally treated confidentially, but employees should be aware that their supervisors may be informed of the request. |

Key takeaways

When filling out and using the Employee Advance form, consider the following key takeaways:

- Ensure all personal information is accurate and up-to-date.

- Clearly state the purpose of the advance request.

- Include the exact amount requested, rounding to the nearest dollar.

- Submit the form to your direct supervisor for approval.

- Keep a copy of the submitted form for your records.

- Understand the repayment terms associated with the advance.

- Follow up if you do not receive a response within a reasonable timeframe.