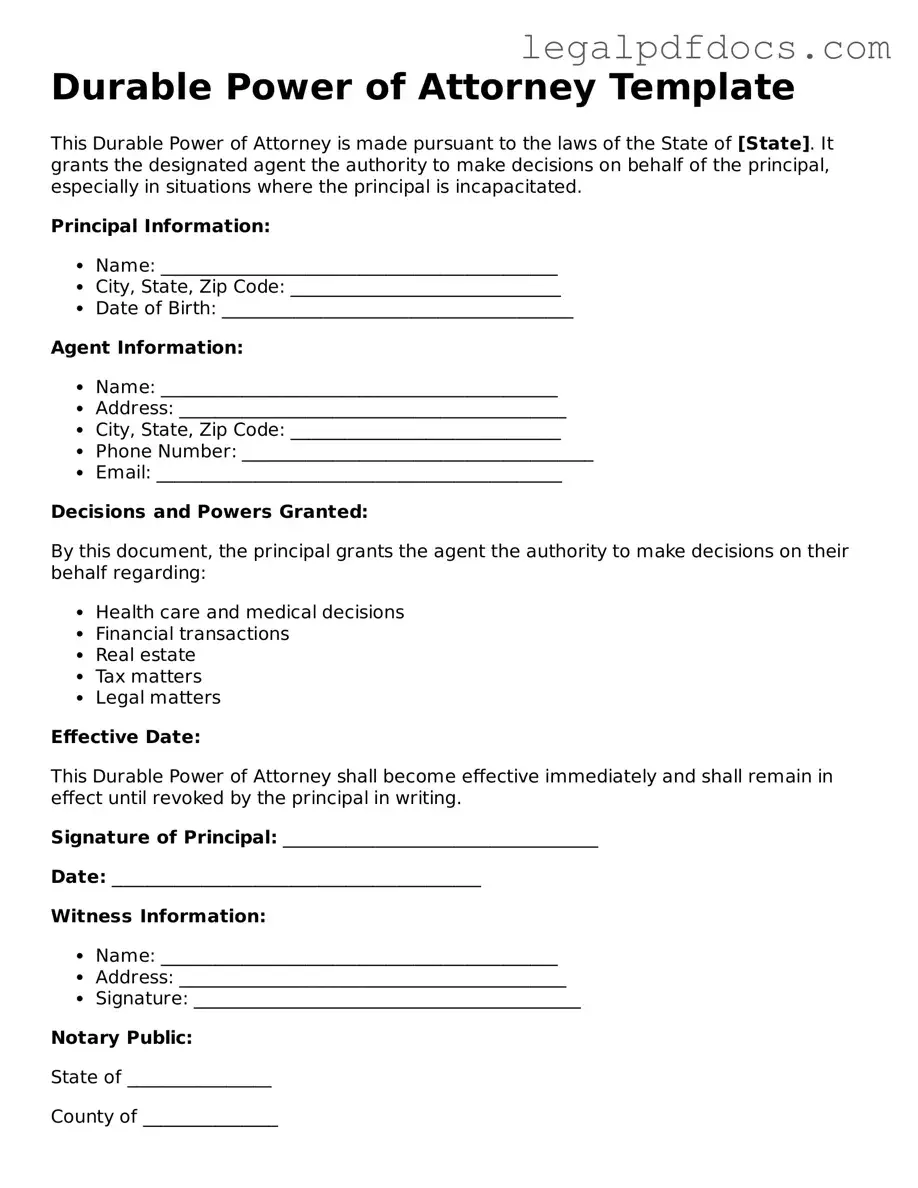

Durable Power of Attorney Template

The Durable Power of Attorney (DPOA) form serves as a crucial legal document that allows individuals to appoint someone they trust to make decisions on their behalf in the event they become incapacitated. This form is designed to remain effective even if the principal, the person granting authority, loses the ability to make decisions due to illness or disability. Typically, the DPOA can cover a wide range of decisions, including financial matters, healthcare choices, and property management. It is important for the appointed agent, also known as the attorney-in-fact, to understand their responsibilities and the scope of their authority. The DPOA can be tailored to fit specific needs, allowing the principal to outline particular powers granted to the agent. Additionally, the form must comply with state laws to ensure its validity, and it often requires signatures from witnesses or a notary public. Understanding the key elements and implications of a Durable Power of Attorney is essential for anyone considering this important legal tool.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it's crucial to follow certain guidelines to ensure the document is valid and effective. Here are some important dos and don’ts to keep in mind:

- Do clearly identify the principal and the agent in the document.

- Do specify the powers granted to the agent in detail.

- Do sign the form in the presence of a notary public or witnesses, as required by your state.

- Do keep a copy of the completed form in a safe place and provide copies to your agent and relevant parties.

- Don't use vague language that could lead to confusion about the agent's authority.

- Don't forget to review and update the document if your circumstances change.

- Don't assume that a general power of attorney is the same as a durable power of attorney.

- Don't sign the form without fully understanding the implications of granting authority to your agent.

How to Use Durable Power of Attorney

Filling out a Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. After completing the form, you will need to sign it in front of a notary public to make it legally binding. It’s essential to keep a copy for your records and provide copies to the appointed agent and any relevant institutions.

- Begin by downloading the Durable Power of Attorney form from a trusted source.

- Read through the entire form carefully to understand the sections you need to fill out.

- In the first section, enter your full name and address as the principal.

- Next, provide the name and address of the person you are appointing as your agent.

- Specify the powers you are granting to your agent. You can choose specific powers or give them broad authority.

- Indicate the effective date of the power of attorney. You may choose to have it effective immediately or only if you become incapacitated.

- Sign and date the form in the designated area.

- Have the form notarized. This step is crucial for the document to be valid.

- Make copies of the signed and notarized form for your records and for your agent.

Check out Popular Types of Durable Power of Attorney Templates

Revoking Power of Attorney Form - Revoking power of attorney does not require a specific reason, but clarity is beneficial.

How to Write a Notarized Letter for a Vehicle - The form enables another to represent you in all matters pertaining to your vehicle.

Documents used along the form

A Durable Power of Attorney (DPOA) is an important legal document that allows an individual to appoint someone else to make decisions on their behalf. However, it often works best in conjunction with other documents that further clarify intentions and provide additional authority. Below are four commonly used forms and documents that complement a Durable Power of Attorney.

- Advance Healthcare Directive: This document outlines a person's preferences regarding medical treatment and end-of-life care. It ensures that healthcare decisions align with the individual's wishes when they are unable to communicate them.

- Living Will: A living will specifically addresses the types of medical interventions a person does or does not want in critical situations. It serves as a clear guideline for healthcare providers and family members during emergencies.

- HIPAA Authorization: This authorization allows designated individuals to access a person's medical records and health information. It ensures that the appointed agent can make informed decisions regarding healthcare.

- Financial Power of Attorney: This document grants authority to an agent to manage financial matters, such as paying bills, managing investments, and handling real estate transactions. It can be tailored to be effective immediately or only upon the principal's incapacitation.

By utilizing these documents alongside a Durable Power of Attorney, individuals can create a comprehensive plan that addresses both health and financial decisions. This proactive approach helps ensure that their preferences are respected and that their affairs are managed according to their wishes.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) can be crucial for making informed decisions about your future. However, several misconceptions often arise regarding this important legal document. Here are ten common misunderstandings, along with clarifications to help you navigate this topic more effectively.

- Misconception 1: A DPOA only takes effect when a person becomes incapacitated.

- Misconception 2: A DPOA gives the agent unlimited power.

- Misconception 3: A DPOA is only for older adults.

- Misconception 4: A DPOA becomes invalid upon the principal's death.

- Misconception 5: You cannot change or revoke a DPOA once it is created.

- Misconception 6: All DPOAs are the same across states.

- Misconception 7: A DPOA can only be used for financial matters.

- Misconception 8: The agent must be a family member.

- Misconception 9: You need a lawyer to create a DPOA.

- Misconception 10: A DPOA is only necessary if you have significant assets.

In reality, a DPOA can be effective immediately upon signing, depending on how it is drafted. Some individuals choose to have it activated only when they are unable to make decisions for themselves.

This is not true. The authority granted to the agent can be limited to specific tasks, such as managing finances or making healthcare decisions. The principal can define the scope of the agent's powers.

Anyone, regardless of age, can benefit from having a DPOA. Unexpected events, such as accidents or sudden illness, can happen to anyone, making this document relevant for all adults.

This is true. However, it is important to understand that the DPOA ceases to be effective once the person who created it passes away. At that point, a will or trust would take over in managing the estate.

On the contrary, a DPOA can be revoked at any time, as long as the principal is mentally competent. It is advisable to notify the agent and any relevant institutions of the revocation.

Different states have varying laws and requirements regarding DPOAs. It is crucial to ensure that the document complies with the laws of the state where it will be used.

A DPOA can cover various areas, including healthcare decisions. A separate healthcare power of attorney may also be created for more specific medical directives.

While many people choose family members as their agents, it is not a requirement. Friends, professionals, or even organizations can serve in this role, as long as they are trustworthy.

While consulting a lawyer can provide valuable guidance, it is not mandatory. Many states offer templates that individuals can use to create their own DPOA, provided they follow the legal requirements.

This is a common belief, but a DPOA is beneficial for anyone who wants to ensure their wishes are followed in case of incapacity, regardless of their financial situation.

By dispelling these misconceptions, individuals can make informed choices about their legal and healthcare decisions, ensuring their preferences are respected in the future.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows someone to make decisions on behalf of another person, even if that person becomes incapacitated. |

| Durability | This type of power of attorney remains effective even if the principal can no longer make decisions due to illness or disability. |

| Principal and Agent | The person who creates the document is called the principal, while the person designated to act is known as the agent or attorney-in-fact. |

| State-Specific Forms | Each state has its own Durable Power of Attorney form, and it's important to use the correct one for your state. |

| Governing Laws | In the U.S., the laws governing Durable Power of Attorney vary by state. For example, California's law is found in the California Probate Code. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Limitations | While the agent has broad powers, certain actions may require specific language or additional documentation. |

| Signatures | Most states require the Durable Power of Attorney to be signed by the principal and may also need a witness or notary public. |

| Healthcare Decisions | A Durable Power of Attorney can include authority for healthcare decisions, but this may require a separate document in some states. |

Key takeaways

When considering a Durable Power of Attorney (DPOA), it's essential to understand its importance and how to use it effectively. Here are some key takeaways:

- A Durable Power of Attorney allows someone to make decisions on your behalf if you become unable to do so.

- Choose a trusted individual as your agent. This person will have significant authority over your financial and legal matters.

- The DPOA remains effective even if you become incapacitated, unlike a regular power of attorney.

- Clearly outline the powers granted to your agent. This can include managing finances, paying bills, or making healthcare decisions.

- Consider including specific limitations to your agent's authority to ensure your wishes are respected.

- It is advisable to have the document notarized to enhance its validity and acceptance by financial institutions.

- Keep copies of the DPOA in accessible locations, and share them with your agent and relevant institutions.

- Review and update the DPOA regularly, especially after significant life changes, such as marriage or divorce.

- Understand that you can revoke the DPOA at any time, as long as you are mentally competent to do so.

Being informed about the Durable Power of Attorney can help ensure your wishes are honored and your affairs are managed according to your preferences.