Deed Template

The Deed form plays a crucial role in real estate transactions, serving as a legal instrument that facilitates the transfer of property ownership from one party to another. This document outlines essential details, including the names of the grantor and grantee, a description of the property, and any conditions or covenants associated with the transfer. It is important to ensure that the Deed form is executed properly, as this affects the validity of the transaction. Various types of deeds exist, such as warranty deeds and quitclaim deeds, each offering different levels of protection and assurance regarding the title. Understanding these distinctions can help individuals make informed decisions during the property transfer process. Additionally, the Deed must be signed, notarized, and recorded in the appropriate jurisdiction to provide public notice of the change in ownership. This form not only signifies a legal agreement but also serves as a vital record that can protect the rights of both parties involved.

Dos and Don'ts

When filling out a Deed form, it's important to pay attention to detail. Here are some helpful tips on what to do and what to avoid:

- Do double-check all names and addresses for accuracy.

- Do use clear and legible handwriting or type the information if possible.

- Do sign the document in the presence of a notary public if required.

- Do keep a copy of the completed form for your records.

- Do read all instructions carefully before starting.

- Don't leave any required fields blank; this can cause delays.

- Don't use correction fluid or tape on the form.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to date the document where necessary.

- Don't submit the form without confirming that all information is complete.

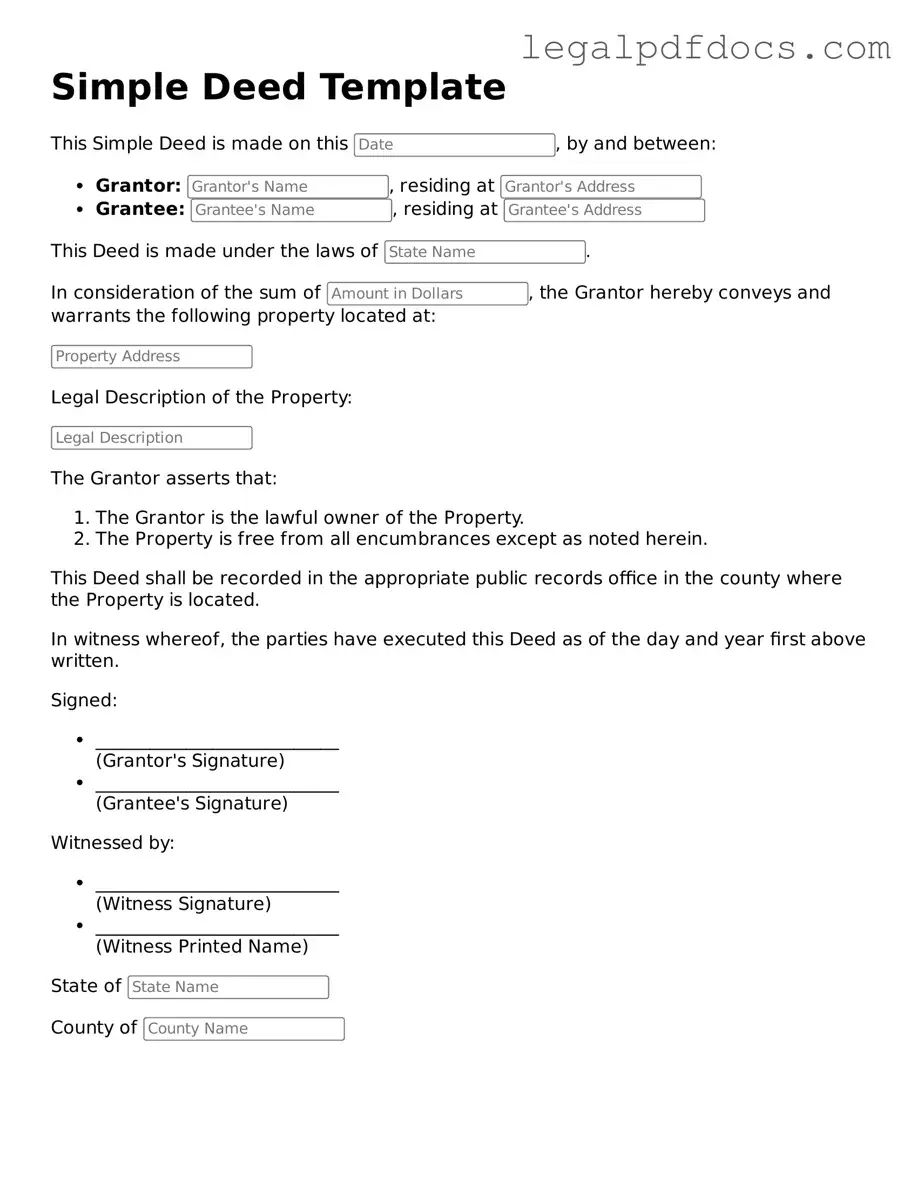

How to Use Deed

After obtaining the Deed form, you'll need to complete it carefully to ensure all necessary information is included. Once the form is filled out, it will be ready for the next steps, which typically involve signing and recording the document with the appropriate local authority.

- Begin by entering the date at the top of the form.

- Fill in the names of the parties involved in the transaction. This usually includes the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide the legal description of the property. This should include details like the address, parcel number, and any other identifying information.

- Specify the consideration amount. This is the value exchanged for the property, which can be monetary or non-monetary.

- Include any additional terms or conditions relevant to the transfer. This might involve stipulations about the property or any agreements between the parties.

- Sign the form. The grantor must sign, and in some cases, the grantee may also need to sign.

- Have the signature notarized. This step adds a layer of verification to the document.

- Make copies of the completed form for your records.

- Submit the original Deed form to the appropriate local office for recording.

More Forms:

USCIS Form I-864 - It ensures that an immigrant has adequate financial support and will not become a public charge.

What Is a Deed in Lieu of Foreclosure - Homeowners should ensure they fully understand the implications of the transfer.

Documents used along the form

When dealing with property transactions, several forms and documents accompany the Deed form to ensure a smooth process. Each document serves a specific purpose and helps protect the interests of all parties involved.

- Title Insurance Policy: This document protects the buyer from any future claims against the property that were not discovered during the title search.

- Purchase Agreement: A contract between the buyer and seller outlining the terms of the sale, including price, contingencies, and closing date.

- Property Disclosure Statement: A form completed by the seller detailing any known issues or defects with the property, ensuring transparency in the transaction.

- Closing Statement: Also known as a HUD-1, this document summarizes all financial transactions related to the sale, including fees and adjustments.

- Affidavit of Title: A sworn statement by the seller affirming their ownership of the property and the absence of any liens or encumbrances.

- Power of Attorney: A legal document allowing one person to act on behalf of another in property transactions, often used when the principal cannot attend the closing.

- IRS Form 1099-S: This form reports the sale of real estate to the IRS, ensuring compliance with tax regulations.

- Homeowners Association (HOA) Documents: These include rules, regulations, and financial statements of the HOA, which may affect the property's use and value.

- Certificate of Occupancy: A document issued by local authorities confirming that a property is safe for occupancy and complies with building codes.

Understanding these documents can help individuals navigate the complexities of property transactions more effectively. Each form plays a vital role in ensuring clarity and protection for everyone involved in the process.

Misconceptions

Understanding the Deed form is crucial for anyone involved in real estate transactions. However, several misconceptions often arise. Here are five common misunderstandings:

-

A Deed is the same as a Title.

This is not true. A deed is a legal document that transfers ownership of property, while a title is the legal right to own that property. You can think of the deed as the means of transfer, and the title as the proof of ownership.

-

All Deeds are the same.

There are different types of deeds, such as warranty deeds and quitclaim deeds. Each serves a different purpose and offers varying levels of protection to the buyer. Understanding the differences can help you choose the right one for your situation.

-

You don’t need a lawyer to prepare a Deed.

-

Once a Deed is signed, it cannot be changed.

This is misleading. While a deed is a binding document, it can be amended or revoked under certain conditions. However, this process can be complex and usually requires legal guidance.

-

Recording a Deed is optional.

Recording a deed is highly recommended, even though it may not be legally required in all states. Recording provides public notice of ownership and protects your rights as the owner. It can also help prevent fraud.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A deed is a legal document that conveys ownership of real property. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds. |

| Execution Requirements | Most states require the deed to be signed by the grantor and notarized. |

| Governing Law | Deeds are governed by state law, which can vary significantly. |

| Recording | To protect ownership rights, a deed should be recorded in the county where the property is located. |

| Consideration | While many deeds require consideration (payment), a gift deed may not. |

| Legal Description | A deed must include a legal description of the property being transferred. |

| Transfer of Title | The deed serves as proof of the transfer of title from the seller to the buyer. |

| Revocation | Once executed and delivered, a deed generally cannot be revoked unilaterally. |

| State-Specific Forms | Each state may have its own specific form and requirements for deeds. |

Key takeaways

When filling out and using a Deed form, keep these key takeaways in mind:

- Accuracy is Crucial: Ensure that all information entered is correct. Mistakes can lead to legal issues or delays.

- Signatures Matter: All necessary parties must sign the Deed. Without proper signatures, the document may not be valid.

- Notarization Requirements: Some Deeds may need to be notarized. Check local laws to confirm if this step is necessary.

- Record the Deed: After completing the form, file it with the appropriate government office. This step is essential for making the transfer official.