Deed in Lieu of Foreclosure Template

When facing financial difficulties and the looming threat of foreclosure, homeowners often seek alternatives that can ease their burden and facilitate a smoother transition. One such option is the Deed in Lieu of Foreclosure, a legal document that allows a homeowner to voluntarily transfer ownership of their property back to the lender in exchange for the cancellation of the mortgage debt. This process can be a viable solution for those who wish to avoid the lengthy and often stressful foreclosure process. By signing this deed, homeowners can mitigate the impact on their credit score, as it may be viewed more favorably than a foreclosure. Additionally, lenders may prefer this route as it can save them time and resources associated with foreclosure proceedings. Understanding the nuances of the Deed in Lieu of Foreclosure form is crucial for homeowners, as it outlines the rights and responsibilities of both parties involved, ensuring a clearer path forward during a challenging time. As you navigate this option, being informed can empower you to make decisions that align with your financial goals and personal circumstances.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are some key actions to consider:

- Do ensure that all personal information is accurate and complete.

- Do consult with a legal advisor or a real estate professional for guidance.

- Don't rush through the form; take your time to understand each section.

- Don't ignore any outstanding debts or liens related to the property.

How to Use Deed in Lieu of Foreclosure

After you complete the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. They will review the document and guide you through the next steps, which may include finalizing the transfer of property ownership and addressing any outstanding obligations.

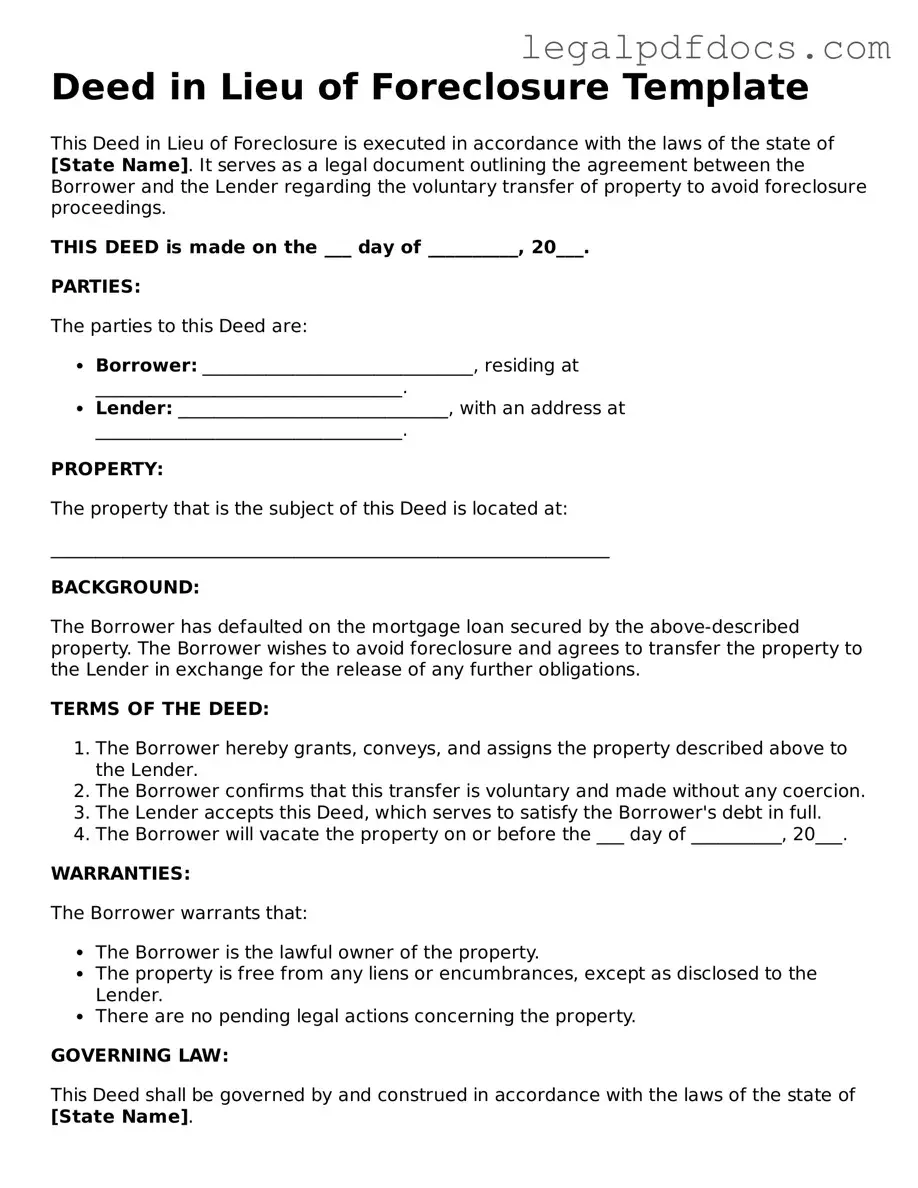

- Start by obtaining the Deed in Lieu of Foreclosure form from your lender or a reliable legal resource.

- Fill in your name and contact information in the designated fields at the top of the form.

- Provide the property address, including the city, state, and zip code.

- Enter the name of the lender or financial institution that holds your mortgage.

- Include the loan number associated with the mortgage.

- Describe the property by including details such as the type of property (e.g., single-family home, condo) and any relevant legal descriptions.

- Indicate the date of the deed's execution.

- Sign the form where indicated, ensuring that your signature matches the name on the mortgage documents.

- Have the form notarized, as many lenders require notarization for it to be valid.

- Make copies of the completed form for your records before submitting it to your lender.

Check out Popular Types of Deed in Lieu of Foreclosure Templates

Problems With Transfer on Death Deeds California - Property owners can designate multiple beneficiaries in the deed, allowing for shared ownership upon their death.

Documents used along the form

A Deed in Lieu of Foreclosure is a useful document for homeowners facing foreclosure, allowing them to transfer ownership of their property back to the lender. However, several other forms and documents often accompany this process to ensure everything is legally sound and clear. Below is a list of these essential documents.

- Loan Modification Agreement: This document outlines changes to the original loan terms, which may include adjusted interest rates or repayment schedules. It can help homeowners retain their property by making payments more manageable.

- Notice of Default: This formal notification informs the homeowner that they are in default on their mortgage. It is typically the first step in the foreclosure process and serves as a warning to the borrower.

- Foreclosure Sale Notice: This document provides details about the upcoming foreclosure auction, including the date, time, and location. It ensures that the homeowner is aware of the impending sale of their property.

- Release of Liability: This form releases the homeowner from any further obligations related to the mortgage after the deed transfer. It protects the homeowner from being pursued for any remaining debt on the loan.

- Property Condition Disclosure: This document requires the homeowner to disclose any known issues with the property. It helps the lender assess the property's value and condition before accepting the deed.

- Affidavit of Title: This sworn statement confirms the homeowner's ownership of the property and that there are no undisclosed liens or claims against it. It provides assurance to the lender during the transfer process.

- Settlement Statement: This document outlines all financial transactions involved in the deed transfer, including any fees or costs associated with the process. It provides transparency for both parties.

- Release of Mortgage: Once the deed is transferred, this document officially cancels the mortgage lien on the property. It is an important step in clearing the homeowner's financial obligations.

- Power of Attorney: This document may be necessary if the homeowner is unable to be present for the signing of the deed. It allows another individual to act on their behalf in the transaction.

- Loan Payoff Statement: This statement provides the total amount needed to pay off the mortgage. It is crucial for determining the financial obligations that must be settled before the deed transfer.

Each of these documents plays a vital role in the Deed in Lieu of Foreclosure process. Understanding their purpose can help homeowners navigate this challenging situation with greater clarity and confidence.

Misconceptions

When facing financial difficulties, homeowners often encounter various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure. However, several misconceptions surround this process. Understanding the truth can help homeowners make informed decisions.

- Myth 1: A Deed in Lieu of Foreclosure eliminates all debt.

- Myth 2: The process is quick and easy.

- Myth 3: A Deed in Lieu of Foreclosure has no impact on credit scores.

- Myth 4: Homeowners cannot negotiate terms with the lender.

This is not entirely accurate. While a Deed in Lieu transfers ownership of the property to the lender, it does not automatically erase any remaining debt. If the mortgage balance exceeds the property's value, the lender may still pursue the borrower for the difference, known as a deficiency judgment.

Many believe that a Deed in Lieu is a straightforward solution. In reality, the process can be complex and may take time. Lenders often require a thorough review of the homeowner's financial situation, and additional documentation may be necessary, which can delay the resolution.

This misconception can be misleading. While a Deed in Lieu is generally less damaging to credit scores than a foreclosure, it still negatively affects credit ratings. Homeowners should expect a decline in their scores, which can impact future borrowing opportunities.

Some homeowners think they have no power in this situation. However, negotiation is possible. Homeowners can discuss terms with their lender, potentially leading to more favorable conditions, such as the possibility of remaining in the home for a short period post-transfer.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Purpose | This form is primarily used to help homeowners who are struggling to make mortgage payments and want to avoid the lengthy foreclosure process. |

| Benefits | Homeowners may benefit from a Deed in Lieu of Foreclosure by potentially minimizing damage to their credit score and avoiding legal fees associated with foreclosure. |

| Governing Laws | The laws governing Deeds in Lieu of Foreclosure can vary by state. For instance, in California, it is governed by California Civil Code Section 2929.5. |

| Eligibility | To qualify, homeowners typically need to demonstrate financial hardship and show that they cannot continue making mortgage payments. |

| Process | The process usually involves contacting the lender, submitting a request, and completing the necessary paperwork to finalize the transfer of property. |

| Considerations | Homeowners should carefully consider the implications, including potential tax consequences and the impact on future homeownership opportunities. |

Key takeaways

Filling out and utilizing a Deed in Lieu of Foreclosure form can be a significant step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- Understand the Process: A Deed in Lieu of Foreclosure is an agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process can help mitigate the negative impact on credit scores.

- Complete the Form Accurately: It is crucial to fill out the form with precise information. This includes details about the property, the homeowner, and the lender. Errors or omissions can lead to delays or complications.

- Consult with Professionals: Before proceeding, it is advisable to seek guidance from a real estate attorney or a housing counselor. They can provide insights and ensure that all legal aspects are addressed properly.

- Communicate with Your Lender: Open dialogue with the lender is essential. They can offer specific instructions and may have additional requirements that need to be met before the deed can be accepted.

- Consider the Consequences: While a Deed in Lieu can prevent foreclosure, it may still impact your credit. Understanding the long-term effects is vital before making this decision.

Taking the time to understand each aspect of the Deed in Lieu of Foreclosure can lead to a smoother transition during a challenging time. Being informed and proactive is key to navigating this process effectively.