Closing Date Extension Addendum Form Template

The Closing Date Extension Addendum Form serves as a crucial tool in real estate transactions, particularly when unforeseen circumstances arise that necessitate a delay in the closing date. This form allows both buyers and sellers to formally agree on a new closing date, ensuring that all parties are on the same page and minimizing potential disputes. It typically outlines the original closing date, the proposed new date, and any conditions that must be met prior to the closing. By utilizing this addendum, parties can maintain the integrity of their agreement while accommodating changes that may affect the transaction timeline. It is important for both parties to review the terms carefully, as this document can impact the overall process of buying or selling a property. The addendum not only reflects the mutual consent of the involved parties but also helps to keep the transaction moving forward smoothly, even in the face of unexpected delays.

Dos and Don'ts

When filling out the Closing Date Extension Addendum Form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are seven things to keep in mind:

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the new closing date.

- Do ensure all parties involved sign the addendum.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections blank unless instructed to do so.

- Don’t use white-out or erase any mistakes on the form.

- Don’t forget to check for any additional requirements specific to your state.

How to Use Closing Date Extension Addendum Form

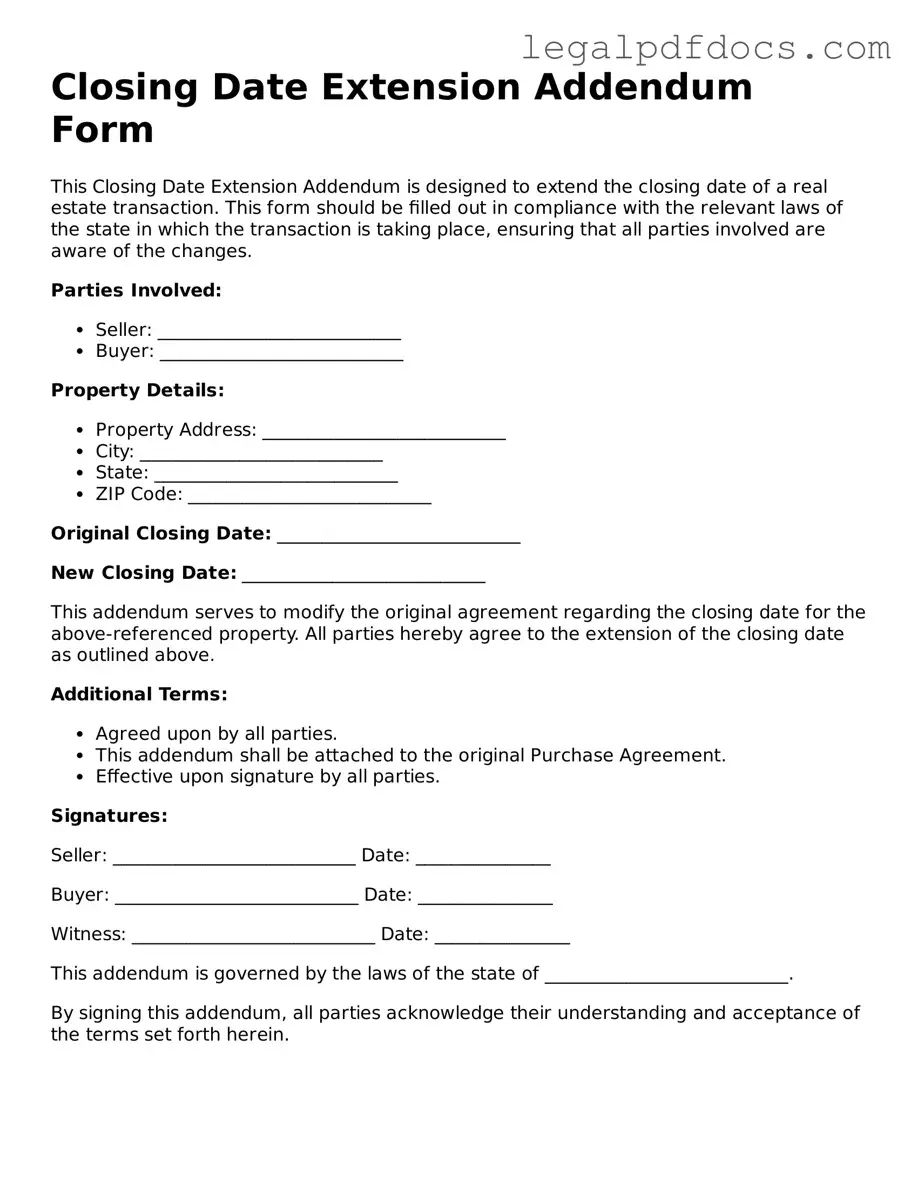

Once you have the Closing Date Extension Addendum Form in front of you, it’s time to get started. This form is essential for extending the closing date of a real estate transaction. Completing it accurately ensures that all parties are on the same page and helps avoid any potential misunderstandings. Follow these steps to fill out the form correctly.

- Begin by entering the date you are filling out the form at the top.

- Next, identify the parties involved in the transaction. This typically includes the buyer and seller. Write their full names and addresses in the designated spaces.

- In the section labeled original closing date, indicate the date originally set for closing. This is crucial for clarity.

- Now, specify the new closing date you are proposing. Make sure this date is realistic and agreeable to all parties.

- Include any additional terms or conditions if necessary. This can help clarify expectations and responsibilities.

- Each party should then sign and date the form. Ensure that everyone involved has signed to make the extension official.

- Finally, make copies of the completed form for all parties involved. Distributing these copies ensures everyone has a record of the new agreement.

After completing the form, it’s a good idea to review it with all parties involved to confirm that everyone understands the new terms. Open communication can prevent any future issues and keep the transaction moving smoothly.

More Forms:

Security Guard Example Incident Report Writing - Promote a culture of transparency with systematic documentation.

Roof Condition Report - Sagging points to possible overload or structural failure in the roof deck.

Documents used along the form

The Closing Date Extension Addendum Form is a vital document used in real estate transactions to extend the closing date of a property sale. However, it is not the only form that may be necessary in the process. Below is a list of other important documents often used alongside this addendum. Each serves a specific purpose in ensuring that all parties are clear on their rights and obligations.

- Purchase Agreement: This is the primary contract between the buyer and seller that outlines the terms of the sale, including the purchase price and closing date.

- Inspection Report: A document detailing the findings from a property inspection, which can influence negotiations and closing timelines.

- Financing Commitment Letter: A letter from a lender confirming that the buyer has been approved for a mortgage, often required before closing.

- Title Report: This report provides information about the property's title status, including any liens or claims against it, ensuring the buyer receives clear title at closing.

- Disclosure Statements: These documents inform buyers about any known issues with the property, such as lead paint or mold, and are crucial for transparency.

- Closing Disclosure: A detailed account of the final loan terms and closing costs, which must be provided to the buyer at least three days before closing.

- Power of Attorney: A legal document that allows one person to act on behalf of another, often used when one party cannot attend the closing in person.

- Deed: This document transfers ownership of the property from the seller to the buyer and is recorded in public records after closing.

Understanding these documents can help facilitate a smoother transaction. Each plays a role in protecting the interests of the parties involved and ensuring compliance with legal requirements. Familiarity with these forms can empower individuals in their real estate dealings.

Misconceptions

Misconceptions about the Closing Date Extension Addendum Form can lead to confusion and potential legal issues. Here are ten common misconceptions clarified:

- It is only used in residential transactions. The Closing Date Extension Addendum can be utilized in both residential and commercial real estate transactions.

- It automatically extends the closing date. The addendum must be signed by all parties involved to be effective; it does not grant an extension unilaterally.

- It can be used without a valid reason. While it is not required to provide a reason, parties typically use it to address specific circumstances impacting the closing process.

- All parties must agree to the same extension period. Parties can negotiate different extension periods, but all must agree on the final terms documented in the addendum.

- It negates the original contract terms. The addendum modifies the original agreement but does not invalidate the terms of the contract unless explicitly stated.

- It is only necessary if the closing date is missed. The addendum can be proactively used before the original closing date if delays are anticipated.

- Verbal agreements are sufficient. Any changes to the closing date must be documented in writing to be legally enforceable.

- It does not affect the earnest money deposit. Depending on the terms agreed upon, an extension could impact the handling of earnest money.

- There is no deadline for submitting the addendum. Timely submission is crucial; delays can complicate the closing process and create legal uncertainties.

- It is a standard form that requires no customization. While there is a standard format, specific details must be tailored to fit the unique circumstances of each transaction.

Understanding these misconceptions can help parties navigate the closing process more effectively and avoid potential pitfalls.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Closing Date Extension Addendum is used to extend the closing date of a real estate transaction. |

| Parties Involved | This form is typically signed by both the buyer and the seller. |

| Governing Law | In the United States, the governing law varies by state. For example, California law applies to transactions in California. |

| Conditions for Extension | The addendum outlines specific conditions that must be met for the extension to be valid. |

| Signature Requirement | Both parties must sign the addendum for it to be legally binding. |

| Deadline for Submission | The addendum should be submitted before the original closing date to avoid complications. |

| Effect on Other Terms | Extending the closing date does not change other terms of the original purchase agreement unless explicitly stated. |

| Potential Fees | There may be additional fees associated with extending the closing date, depending on the agreement between the parties. |

Key takeaways

When dealing with the Closing Date Extension Addendum Form, understanding its purpose and proper usage is crucial. Here are some key takeaways to keep in mind:

- Purpose of the Form: This form is used to extend the closing date of a real estate transaction, allowing both parties more time to fulfill their obligations.

- Mutual Agreement: Both the buyer and seller must agree to the extension. Communication is key to ensure that both parties are on the same page.

- Specific Dates: Clearly specify the new closing date on the form. Ambiguity can lead to confusion and potential disputes.

- Initials Required: Both parties should initial next to the new closing date to acknowledge the change formally.

- Signatures: The form must be signed by all parties involved in the transaction. This finalizes the agreement for the extension.

- Consideration of Other Terms: Review other terms of the original contract that may be affected by the extension, such as contingencies and financing timelines.

- Legal Advice: While not mandatory, seeking legal advice can help clarify any uncertainties regarding the implications of the extension.

- Submission: Once completed, the form should be submitted to all relevant parties, including the title company and any involved agents.

- Documentation: Keep a copy of the signed addendum with your transaction records for future reference.

- Timeliness: Submit the addendum promptly to avoid any last-minute complications that could arise as the original closing date approaches.

By following these guidelines, you can ensure a smoother process when extending the closing date of a real estate transaction. Clear communication and thorough documentation are essential components of a successful agreement.