Fill Out a Valid Citibank Direct Deposit Template

For individuals seeking a convenient and reliable way to manage their finances, the Citibank Direct Deposit form serves as a crucial tool. This form allows customers to authorize the automatic deposit of their paychecks, government benefits, or other recurring payments directly into their Citibank accounts. By utilizing this service, account holders can enjoy timely access to their funds without the need for physical checks. The form typically requires essential information such as the account holder's name, account number, and the bank's routing number, ensuring that deposits are processed accurately and efficiently. Additionally, customers may need to provide details about their employer or the source of the funds to facilitate the setup. Understanding the importance of this form can help individuals streamline their financial transactions, reduce the risk of lost checks, and ultimately foster a more organized approach to personal finance management.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it is important to ensure accuracy and clarity. Below are some guidelines to help you complete the form correctly.

Things You Should Do:

- Double-check your account number to avoid errors.

- Provide your full name as it appears on your bank account.

- Include the correct routing number for your bank.

- Sign the form to authorize the direct deposit.

- Keep a copy of the completed form for your records.

- Submit the form to your employer or the designated department promptly.

Things You Shouldn't Do:

- Do not use a temporary account number.

- Avoid leaving any required fields blank.

- Do not forget to update your information if you change banks.

- Do not submit the form without checking for accuracy.

- Do not share your personal banking information with unauthorized individuals.

- Do not assume that your employer has the correct information from previous deposits.

How to Use Citibank Direct Deposit

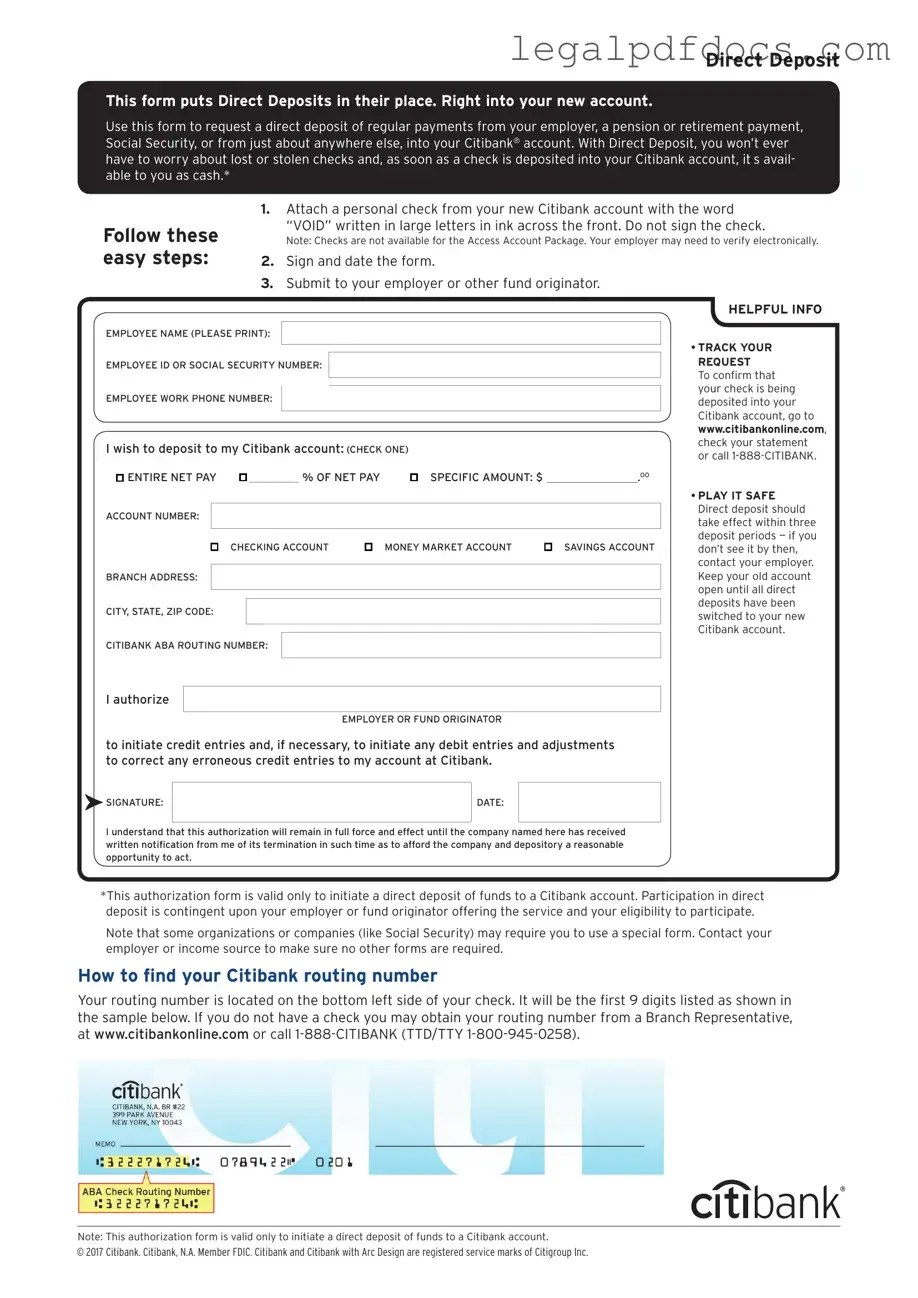

Filling out the Citibank Direct Deposit form is a straightforward process that allows you to set up automatic deposits into your Citibank account. Once completed, you'll need to submit the form to your employer or the relevant organization handling your payroll. This will help ensure that your funds are deposited directly into your account without any delays.

- Begin by downloading the Citibank Direct Deposit form from the Citibank website or obtaining a physical copy from your employer.

- Fill in your personal information at the top of the form. This typically includes your name, address, and contact information.

- Locate the section for your bank account details. Enter your Citibank account number and the routing number for Citibank. This information can usually be found on your checks or by logging into your online banking account.

- Indicate the type of account you are using for direct deposit. Choose either "Checking" or "Savings." Make sure to mark the correct box.

- Review the section regarding the deposit amount. If you want to deposit your entire paycheck, you can usually check a box that states "Full Amount." If you prefer to deposit a specific amount, write that amount in the designated area.

- Sign and date the form at the bottom. Your signature is necessary to authorize the direct deposit.

- Make a copy of the completed form for your records before submitting it.

- Submit the form to your employer or the payroll department. Ensure you follow any specific submission guidelines they may have.

More PDF Templates

Puppy Health Record - Capture details about your puppy's sire, dam, and breeding background.

Batting Lineup - Identify the first closer here.

Uscis I-589 - Under the I-589 process, asylum seekers can request lawful status in the U.S. based on humanitarian needs.

Documents used along the form

When setting up direct deposit with Citibank, several other forms and documents may be needed to ensure a smooth process. Below is a list of commonly used forms that complement the Citibank Direct Deposit form. Each document plays a unique role in facilitating your banking and payroll needs.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from your paycheck.

- Bank Account Verification Letter: A letter from your bank confirming your account details. This document may be required to verify your account number and routing number for direct deposit.

- Employment Verification Form: This form confirms your employment status and salary. Employers may request this to ensure that the direct deposit is being set up for a valid employee.

- Paystub: A recent paystub may be needed to confirm your earnings and deductions. It provides a snapshot of your financial situation and employment status.

- Employer Direct Deposit Authorization Form: This form allows your employer to deposit your paycheck directly into your bank account. It usually requires your signature and banking details.

Having these documents ready can simplify the process of setting up direct deposit. It’s always a good idea to check with your employer or bank for any specific requirements they might have.

Misconceptions

Here are some common misconceptions about the Citibank Direct Deposit form:

- It's only for employees. Many people think that only employees can use the direct deposit form. However, anyone receiving regular payments, like freelancers or pensioners, can benefit from it.

- It takes a long time to set up. Some believe that setting up direct deposit is a lengthy process. In reality, it often takes just one or two pay cycles to start seeing the benefits.

- You need a Citibank account. While the form is designed for Citibank customers, it can also be used by individuals with accounts at other banks. They just need to provide the correct routing and account numbers.

- Direct deposit is not secure. There’s a misconception that direct deposits are less secure than paper checks. In fact, direct deposits are often safer, as they reduce the risk of checks being lost or stolen.

- You can only deposit into one account. Some people think they can only use the form to deposit funds into a single account. Many employers allow splitting deposits between multiple accounts.

- Once set up, it cannot be changed. People often believe that once they submit the form, they cannot make changes. However, you can update your information whenever necessary by submitting a new form.

File Specs

| Fact Name | Details |

|---|---|

| Purpose | The Citibank Direct Deposit form allows customers to authorize direct deposit of funds into their Citibank accounts. |

| Eligibility | Any customer with a Citibank account can use this form to set up direct deposit. |

| Required Information | Customers must provide their account number, routing number, and personal identification details. |

| Governing Law | The form is governed by federal banking regulations and applicable state laws, which may vary. |

| Submission Method | The completed form can be submitted online, via mail, or in person at a Citibank branch. |

| Processing Time | Typically, it takes 1-2 business days for Citibank to process the direct deposit request. |

| Confirmation | Customers will receive a confirmation once their direct deposit has been successfully set up. |

| Changes | To change direct deposit information, customers must submit a new form with updated details. |

| Security | Citibank ensures that all personal information provided on the form is kept secure and confidential. |

Key takeaways

When filling out and using the Citibank Direct Deposit form, there are several important points to keep in mind to ensure a smooth process.

- Accurate Information: Ensure that all your personal details, including your name, address, and account number, are filled out correctly. Any discrepancies can lead to delays or issues with your deposit.

- Bank Routing Number: Double-check the routing number for your Citibank account. This number is crucial for directing your funds to the correct bank.

- Signature Requirement: Don't forget to sign the form. A missing signature can result in the form being rejected, preventing your direct deposit from being set up.

- Keep Copies: Always retain a copy of the completed form for your records. This can be helpful if any questions arise regarding your direct deposit in the future.

By following these key takeaways, you can help ensure that your direct deposit is processed efficiently and without complications.