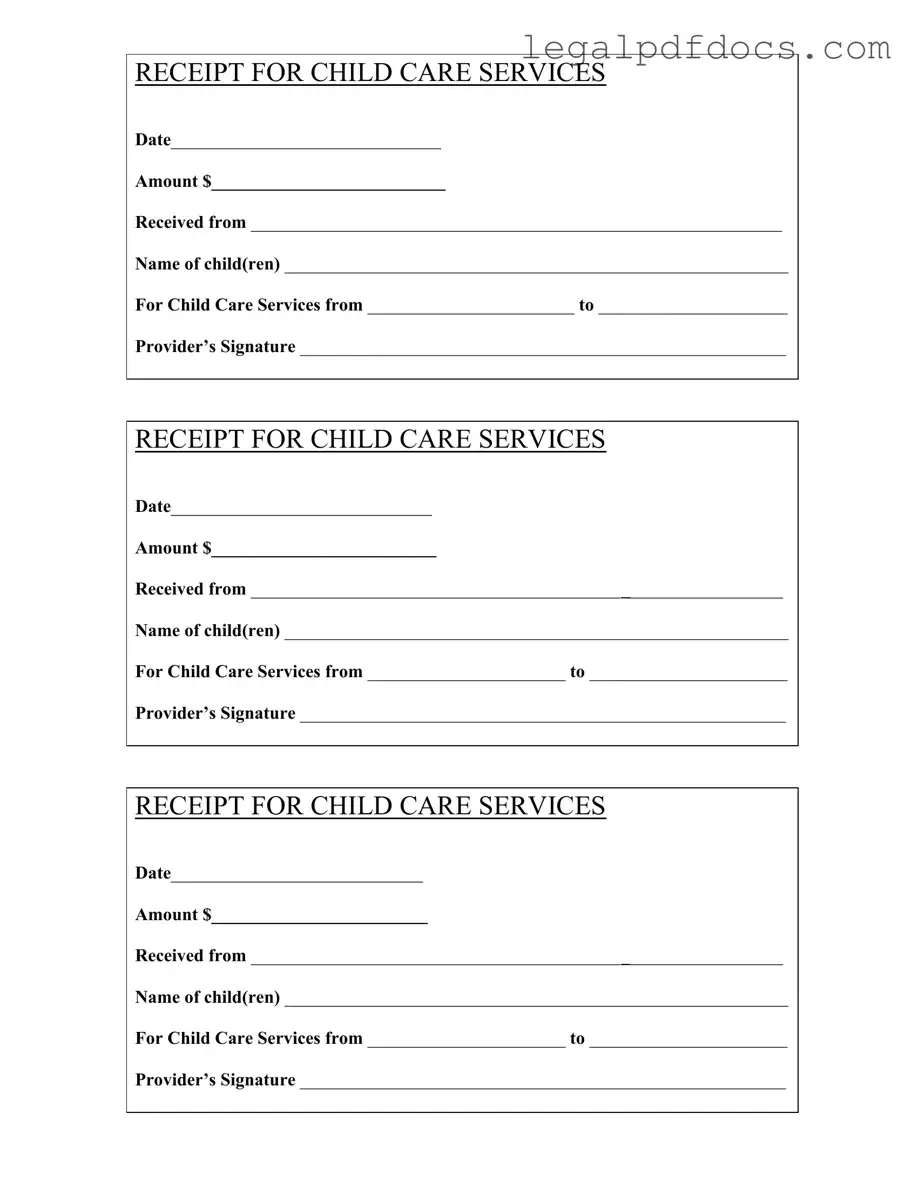

Fill Out a Valid Childcare Receipt Template

The Childcare Receipt form serves as a vital document for parents and guardians who utilize childcare services. It provides a clear record of payments made for childcare, ensuring transparency between the provider and the family. Each receipt includes essential information such as the date of service, the total amount paid, and the name of the child or children receiving care. Additionally, it specifies the period during which the childcare services were rendered, offering a detailed account of the services provided. The form also requires the signature of the childcare provider, which validates the transaction and confirms receipt of payment. By documenting these key aspects, the Childcare Receipt form helps families keep accurate financial records and can be useful for tax purposes or reimbursement requests.

Dos and Don'ts

When filling out the Childcare Receipt form, it’s important to ensure accuracy and clarity. Here are some guidelines to follow:

- Do write clearly and legibly to avoid any misunderstandings.

- Do include the correct date for the services provided.

- Do specify the total amount received for the childcare services.

- Do list the names of all children receiving care.

- Do ensure the provider’s signature is included at the end of the form.

- Don’t leave any fields blank; fill in all required information.

- Don’t use abbreviations or shorthand that may confuse the reader.

- Don’t forget to double-check for any spelling errors.

- Don’t submit the form without a signature from the provider.

How to Use Childcare Receipt

Completing the Childcare Receipt form is an important step in documenting childcare services. This form will help ensure that all necessary information is accurately recorded. Follow the steps below to fill out the form correctly.

- Locate the date section at the top of the form. Write the current date.

- In the amount section, enter the total amount paid for childcare services.

- Find the "Received from" line. Write the name of the person making the payment.

- On the line for the name of child(ren), list the names of all children receiving care.

- Identify the dates for the childcare services provided. Fill in the start date and end date in the designated spaces.

- Finally, the childcare provider must sign the form in the provided signature line.

Once you have completed the form, ensure that all information is clear and legible. This will help maintain accurate records for both you and the childcare provider.

More PDF Templates

Navpers 1336 3 - Rated personnel must specify their rank when filling out the form.

Doctor's Note to Return to Work - Submitting this form helps establish a structured plan for returning to society through employment.

U.S. Corporation Income Tax Return - Corporations in different industries may have unique reporting considerations that affect how Form 1120 is completed.

Documents used along the form

When managing childcare services, several important documents complement the Childcare Receipt form. Each of these documents serves a specific purpose and helps ensure that both parents and childcare providers have clear records of transactions and agreements. Below is a list of commonly used forms.

- Childcare Agreement: This document outlines the terms of service between the parent and the childcare provider. It typically includes details about hours of care, payment terms, and any specific rules or policies.

- Enrollment Form: Parents fill out this form to provide essential information about their child. It usually includes details like emergency contacts, medical information, and special needs, ensuring the provider is well-informed.

- Payment Schedule: This document lays out the expected payment dates and amounts. It helps both parties keep track of when payments are due and can prevent misunderstandings.

- Tax Documents: Parents may need to keep records for tax purposes. This could include forms like the W-10, which is used to claim childcare expenses on tax returns.

- Incident Report: If any accidents or unusual incidents occur during childcare, this form is completed to document the event. It helps maintain transparency and can be important for liability reasons.

- Attendance Log: This log records the days and hours a child attends care. It can be useful for both billing purposes and verifying attendance for tax deductions.

- Provider's License: A copy of the childcare provider’s license may be required to ensure they are operating legally. This document provides assurance that the provider meets state regulations.

Having these documents organized and accessible can streamline communication and ensure that everyone involved understands their rights and responsibilities. Clear records help build trust between parents and childcare providers, making for a smoother childcare experience.

Misconceptions

Understanding the Childcare Receipt form is crucial for parents and guardians seeking to document childcare expenses. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- It is only necessary for tax purposes. Many believe that the Childcare Receipt form is solely for tax deductions. While it can be helpful for tax purposes, it also serves as proof of payment and can be important for personal record-keeping.

- Any format is acceptable. Some assume that any handwritten note can substitute for the official form. In reality, using the standard Childcare Receipt form ensures all necessary information is documented, making it easier to reference when needed.

- Providers do not need to sign the receipt. There is a misconception that a signature from the childcare provider is optional. However, a signature is essential as it verifies the legitimacy of the transaction and confirms that the service was provided.

- The amount on the receipt must match the invoice. Many think the amount on the receipt must be identical to an invoice amount. While it should reflect the total paid, adjustments can occur for various reasons, such as discounts or partial payments, and these should be clearly noted.

Addressing these misconceptions can help ensure that parents and guardians utilize the Childcare Receipt form correctly and effectively.

File Specs

| Fact Name | Description |

|---|---|

| Date | The receipt must include the date when the child care services were provided. This helps in tracking services and payments. |

| Amount | The total amount paid for child care services should be clearly stated. This figure is essential for both the provider and the parent for record-keeping. |

| Name of Child(ren) | The names of the children receiving care must be included. This ensures that the receipt is specific to the services rendered. |

| Provider's Signature | The provider must sign the receipt. This signature serves as verification that the services were rendered and payment was received. |

Key takeaways

When filling out and using the Childcare Receipt form, it’s important to keep several key points in mind to ensure clarity and accuracy.

- Complete All Sections: Make sure to fill in every section of the form, including the date, amount, and names of both the provider and the child(ren). Incomplete forms can lead to confusion and potential issues later.

- Keep Copies: Always retain a copy of the completed receipt for your records. This will help you keep track of payments made and can be useful for tax purposes or disputes.

- Signatures Matter: The provider's signature is crucial. It serves as confirmation that the childcare services were provided and payment was received. Without it, the receipt may not hold up as proof of payment.

- Use Clear Dates: Clearly indicate the period during which the childcare services were rendered. This helps in verifying the timeframe of services and ensures that all parties are on the same page.