Fill Out a Valid Cg 20 10 07 04 Liability Endorsement Template

The CG 20 10 07 04 Liability Endorsement form is an essential component of the Commercial General Liability (CGL) insurance policy, specifically designed to extend coverage to additional insured parties such as owners, lessees, or contractors. This endorsement modifies the existing policy, allowing for the inclusion of specified individuals or organizations as additional insureds, but only for liabilities arising from bodily injury, property damage, or personal and advertising injury linked to the actions or omissions of the named insured or their representatives. It is important to note that the coverage provided is limited to the scope outlined in the endorsement and is contingent upon the requirements of any applicable contracts. The endorsement also introduces specific exclusions, particularly concerning injuries or damages that occur after the completion of work related to the project. Furthermore, it establishes limits on the insurance available to additional insureds, ensuring that the coverage does not exceed what is mandated by contract or the existing policy limits. This careful delineation of coverage parameters is crucial for both insured parties and additional insureds, as it clarifies the extent of liability protection available under the policy.

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don’ts:

- Do: Carefully read all instructions provided with the form to understand the requirements.

- Do: Clearly print the name of the additional insured person(s) or organization(s) in the designated area.

- Do: Double-check the location(s) of covered operations to ensure they match the project details.

- Do: Confirm that the coverage aligns with any contracts or agreements you have in place.

- Don't: Leave any sections blank; incomplete forms may lead to processing delays.

- Don't: Provide inaccurate information, as this can affect the validity of the coverage.

- Don't: Assume that the endorsement automatically increases your insurance limits; verify the terms.

- Don't: Forget to sign and date the form before submission to ensure it is considered valid.

How to Use Cg 20 10 07 04 Liability Endorsement

Completing the CG 20 10 07 04 Liability Endorsement form requires careful attention to detail. This form is essential for ensuring that the necessary parties are included as additional insureds under your commercial general liability coverage. Below are the steps to guide you through the process of filling out the form accurately.

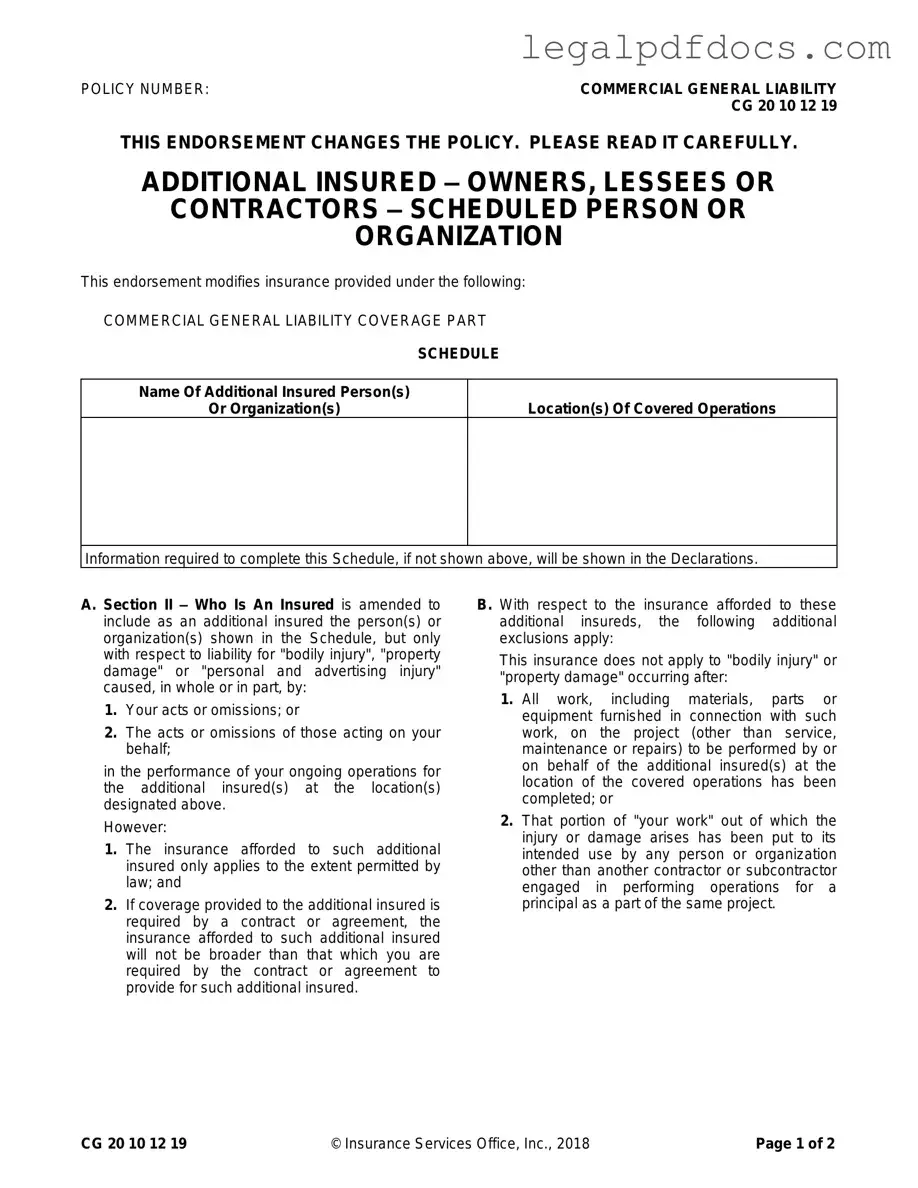

- Locate the Policy Number: At the top of the form, find the section labeled "POLICY NUMBER." Enter your commercial general liability policy number in the designated space.

- Identify Additional Insureds: In the section titled "Name Of Additional Insured Person(s) Or Organization(s)," list the names of the individuals or organizations that need to be added as additional insureds. Ensure that you spell each name correctly.

- Specify Locations: Next, move to the "Location(s) Of Covered Operations" section. Here, provide the specific addresses or descriptions of the locations where the additional insureds will be covered. Be as precise as possible.

- Review Declarations: If there is any information that is not shown on the form but is necessary for completion, refer to the Declarations page of your policy. This page may contain important details that need to be included.

- Understand Coverage Limitations: Familiarize yourself with the coverage limitations and exclusions mentioned in the form. This understanding will help you communicate effectively with the additional insureds regarding their coverage.

- Sign and Date: Finally, ensure that you sign and date the form at the bottom. This step is crucial as it signifies your agreement to the terms outlined in the endorsement.

Once you have completed the form, it is advisable to keep a copy for your records. Additionally, provide the completed form to the relevant parties to ensure they are aware of their coverage status. This proactive approach can help prevent misunderstandings in the future.

More PDF Templates

Employer's Quarterly Federal Tax Return - Form 941 can be amended using Form 941-X, which allows for corrections.

How to Create Payroll Checks - Important for documenting contract worker payments.

Documents used along the form

When dealing with the CG 20 10 07 04 Liability Endorsement form, there are several other documents that are often used in conjunction. Each of these documents serves a specific purpose and can help clarify the terms of the insurance policy. Below is a list of these forms and a brief description of each.

- Commercial General Liability Policy (CGL): This is the main insurance policy that provides coverage for bodily injury, property damage, and personal injury claims. It outlines the general terms and conditions of the insurance coverage.

- Certificate of Insurance: This document serves as proof of insurance. It summarizes the coverage provided and is often requested by clients or partners before work begins.

- Additional Insured Endorsement: Similar to the CG 20 10 07 04 form, this endorsement adds other parties as insured under the primary policy, ensuring they are covered for claims arising from the policyholder’s operations.

- Contract Agreement: A legal document outlining the terms of a business relationship. It often specifies the insurance requirements, including the need for additional insured coverage.

- Waiver of Subrogation: This document prevents the insurance company from seeking recovery from a third party after a claim is paid. It is often included in contracts to protect all parties involved.

- Indemnity Agreement: This agreement outlines one party's obligation to compensate another for certain damages or losses. It often relates to liability coverage and can affect insurance requirements.

- Claims Reporting Form: This form is used to report any incidents or claims to the insurance company. Timely reporting is essential for maintaining coverage.

- Policy Declarations Page: This page summarizes the key details of the insurance policy, including coverage limits, deductibles, and the insured parties.

- Exclusion Endorsements: These documents outline specific exclusions or limitations in coverage. Understanding these exclusions is crucial for managing risk.

- Loss Run Report: This report provides a history of claims made under the insurance policy. It is often requested by underwriters when evaluating coverage needs.

Each of these documents plays a vital role in the overall management of liability insurance. Understanding their purpose can help ensure that all parties involved are adequately protected and informed. It is essential to review these forms carefully to maintain compliance and safeguard against potential risks.

Misconceptions

Understanding the Cg 20 10 07 04 Liability Endorsement form can be challenging, and several misconceptions often arise. Here are five common misunderstandings:

- All parties are automatically covered. Many believe that once an additional insured is listed, they receive full coverage. In reality, coverage is limited to specific circumstances, such as liability arising from the acts of the named insured.

- Coverage applies indefinitely. Some assume that the coverage lasts indefinitely. However, the endorsement only applies until the work related to the project is completed or the property is put to its intended use.

- Additional insured status equals primary coverage. There is a misconception that being named as an additional insured means receiving primary coverage. In fact, the coverage is often excess to any other available insurance that the additional insured may have.

- Limits of insurance are automatically increased. A common belief is that adding an additional insured increases the overall limits of the policy. This is not true; the limits remain the same as stated in the original policy.

- All types of liability are covered. Some people think that all forms of liability are included. However, the endorsement includes specific exclusions, such as bodily injury or property damage occurring after the project is completed.

By clarifying these misconceptions, individuals can better understand the scope and limitations of the Cg 20 10 07 04 Liability Endorsement form.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | This endorsement adds specific individuals or organizations as additional insureds under a commercial general liability policy, primarily for liability related to bodily injury, property damage, or personal and advertising injury. |

| Coverage Limitations | The coverage for additional insureds is limited to what is required by contract or agreement and does not exceed the policy's existing limits of insurance. |

| Exclusions | Insurance does not cover bodily injury or property damage that occurs after the completion of all work related to the project, or after the work has been put to its intended use by someone other than a contractor or subcontractor involved in the same project. |

| Governing Law | The specific laws governing the use of this endorsement may vary by state, and it is essential to consult local regulations to ensure compliance. |

Key takeaways

Here are key takeaways regarding the CG 20 10 07 04 Liability Endorsement form:

- This endorsement is specifically for Commercial General Liability coverage.

- It adds additional insured parties, such as owners, lessees, or contractors, as specified in the schedule.

- Coverage applies only to liability for bodily injury, property damage, or personal and advertising injury.

- Liability must be caused, in whole or in part, by your actions or those acting on your behalf.

- The endorsement is limited to ongoing operations at the designated locations.

- Insurance for additional insureds is subject to legal limits.

- If required by a contract, the coverage cannot exceed what the contract stipulates.

- Exclusions apply if the work has been completed or if the work has been put to its intended use.

- The maximum payout for additional insureds is the lesser of the contract requirement or the available policy limits.

- This endorsement does not increase the overall limits of the insurance policy.