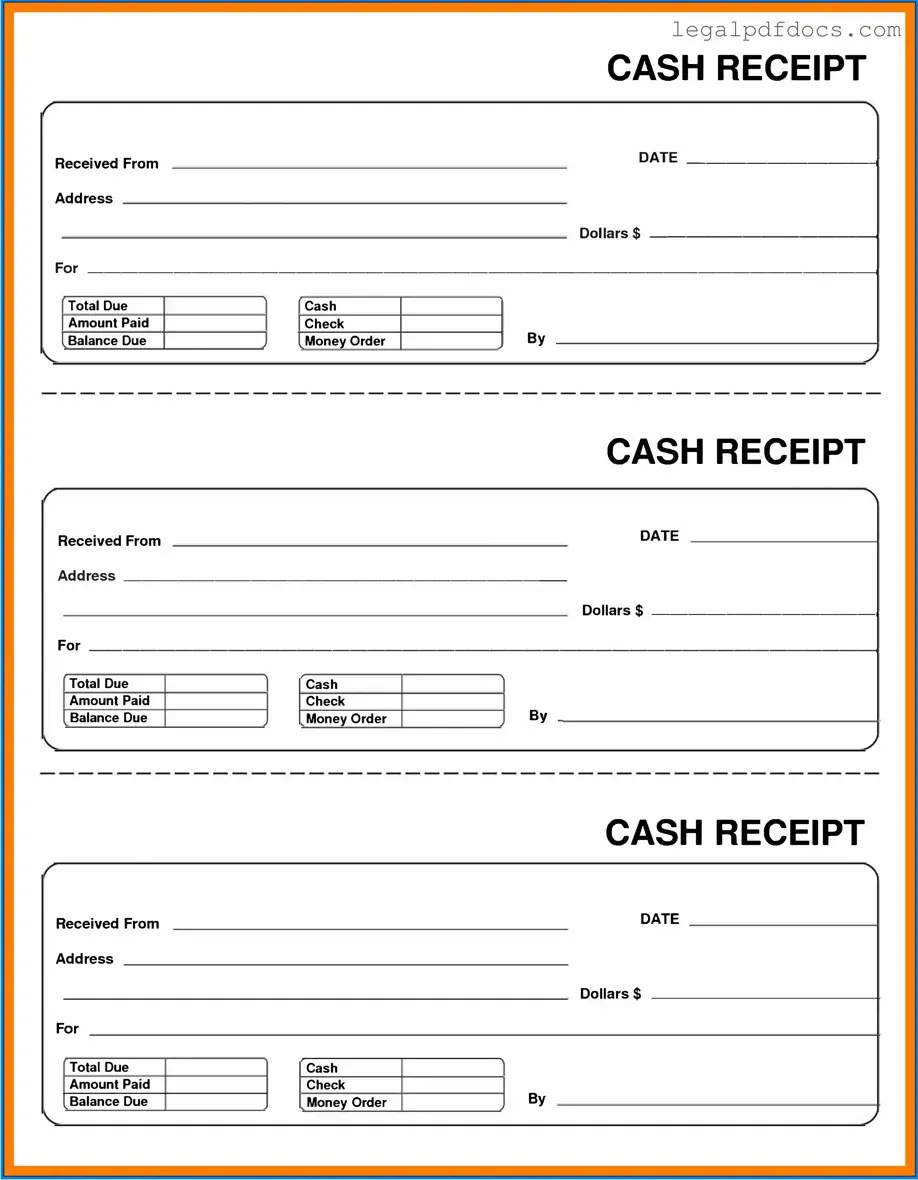

Fill Out a Valid Cash Receipt Template

Managing finances effectively is crucial for any business, and one essential tool that helps in this process is the Cash Receipt form. This form serves as a record of transactions where cash is received, providing both the business and the customer with important documentation. It typically includes details such as the date of the transaction, the amount received, the method of payment, and a description of the goods or services provided. By keeping a clear and accurate record, businesses can track their income, reconcile accounts, and maintain transparency with their clients. Additionally, a well-structured Cash Receipt form can help prevent disputes and provide a reliable reference for future financial audits. Understanding how to properly utilize this form can significantly enhance financial management and contribute to the overall success of a business.

Dos and Don'ts

When filling out the Cash Receipt form, it’s essential to ensure accuracy and clarity. Here’s a list of dos and don’ts to guide you through the process.

- Do double-check the amount received before submitting the form.

- Do ensure that all required fields are filled out completely.

- Do use clear and legible handwriting if filling out the form by hand.

- Do keep a copy of the completed form for your records.

- Don’t leave any fields blank; if a field is not applicable, mark it as such.

- Don’t use correction fluid or tape on the form; it can create confusion.

- Don’t forget to sign and date the form where required.

Following these guidelines will help ensure that your Cash Receipt form is processed smoothly and efficiently.

How to Use Cash Receipt

After obtaining the Cash Receipt form, it’s important to ensure that all necessary information is accurately filled out. This will facilitate proper record-keeping and financial tracking. Follow these steps to complete the form correctly.

- Begin by entering the date of the transaction at the top of the form.

- In the next section, write the name of the individual or business making the payment.

- Provide a brief description of the purpose of the payment.

- Clearly indicate the amount received in the designated field.

- If applicable, include any reference number associated with the payment.

- Sign the form to confirm the receipt of the payment.

- Finally, make a copy of the completed form for your records.

More PDF Templates

Da 638 Pdf - This form is a vital link between soldiers and the recognition of their service.

How Many Cells in 96 Well Plate - Can be stored in freezer conditions for long-term sample preservation.

Five Wishes Document Pdf - By completing this document, you take control of important healthcare decisions affecting your life.

Documents used along the form

The Cash Receipt form is a crucial document used to acknowledge the receipt of cash payments. It serves as proof of transaction and is often accompanied by other forms and documents to ensure proper record-keeping and compliance. Below is a list of related documents that are commonly used alongside the Cash Receipt form.

- Invoice: This document details the goods or services provided, along with the amount due. It serves as a request for payment and is often issued before the Cash Receipt form is completed.

- Deposit Slip: A deposit slip is used when cash is deposited into a bank account. It provides details about the transaction, including the amount and date, and may be required for bank reconciliation.

- Payment Voucher: This form is used to authorize a payment. It includes information about the payee, the amount, and the purpose of the payment, ensuring that funds are allocated correctly.

- Transaction Log: A transaction log is a record of all cash transactions. It helps track incoming and outgoing cash flow and is useful for audits and financial reviews.

- Receipt Book: A receipt book contains pre-printed receipts that can be filled out for various transactions. It provides a physical record of payments received and is often used for smaller transactions.

- Credit Memo: A credit memo is issued when a refund is necessary or when a customer returns goods. It serves to adjust the accounts receivable and provides documentation for the transaction reversal.

Each of these documents plays a vital role in the financial process, ensuring transparency and accountability in cash transactions. Proper management of these forms can help businesses maintain accurate financial records and comply with regulatory requirements.

Misconceptions

The Cash Receipt form is a vital document in many financial transactions, yet several misconceptions surround its use and purpose. Understanding these misconceptions can help clarify its role and importance. Here are eight common misunderstandings about the Cash Receipt form:

- It is only for cash transactions. Many believe that the Cash Receipt form is exclusively for cash payments. In reality, it can also be used for other payment methods, such as checks or credit card transactions.

- It is not necessary for small transactions. Some individuals think that for minor purchases, a Cash Receipt form is unnecessary. However, maintaining a record for all transactions, regardless of size, is crucial for accurate bookkeeping.

- Only businesses need Cash Receipt forms. While businesses frequently use these forms, individuals receiving payments—like freelancers or service providers—also benefit from issuing Cash Receipts for their records.

- Cash Receipt forms are the same as invoices. Although both documents serve financial purposes, they are not interchangeable. An invoice requests payment, while a Cash Receipt acknowledges that payment has been received.

- They are only used for sales. Cash Receipts can be used for various types of transactions, including refunds, deposits, and other financial exchanges, not just sales.

- Once issued, a Cash Receipt cannot be modified. This is a common myth. While it’s best to avoid alterations, if a mistake is made, corrections can be documented on a new form or noted on the original.

- Cash Receipts are not legally binding. Some people think these forms lack legal weight. In fact, they can serve as important evidence of a transaction in disputes or audits.

- They do not require detailed information. A common misconception is that minimal information suffices. However, including details like date, amount, payer’s name, and purpose enhances the form's effectiveness and clarity.

By dispelling these myths, individuals and businesses can better utilize the Cash Receipt form to maintain accurate financial records and ensure smooth transactions.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments for goods or services provided. |

| Record Keeping | This form serves as an official record for accounting purposes, ensuring accurate financial tracking. |

| State-Specific Regulations | In some states, specific laws govern the use of cash receipt forms, such as the Uniform Commercial Code (UCC) for transactions. |

| Information Required | Typically, the form includes details like the date, amount received, payer's information, and the purpose of the payment. |

Key takeaways

Understanding the Cash Receipt form is essential for accurate financial record-keeping. Here are some key takeaways to keep in mind:

- Ensure all information is complete before submission. Missing details can lead to confusion and delays in processing.

- Always double-check the amounts entered. Errors in figures can result in discrepancies in your financial records.

- Use the form consistently. Regular use helps establish a routine and minimizes the risk of mistakes.

- Keep a copy of each completed Cash Receipt form for your records. This practice aids in tracking transactions and resolving any future issues.

- Familiarize yourself with the approval process. Knowing who needs to review or sign off on the form can expedite processing.

By following these guidelines, you can enhance the accuracy and efficiency of your financial transactions.