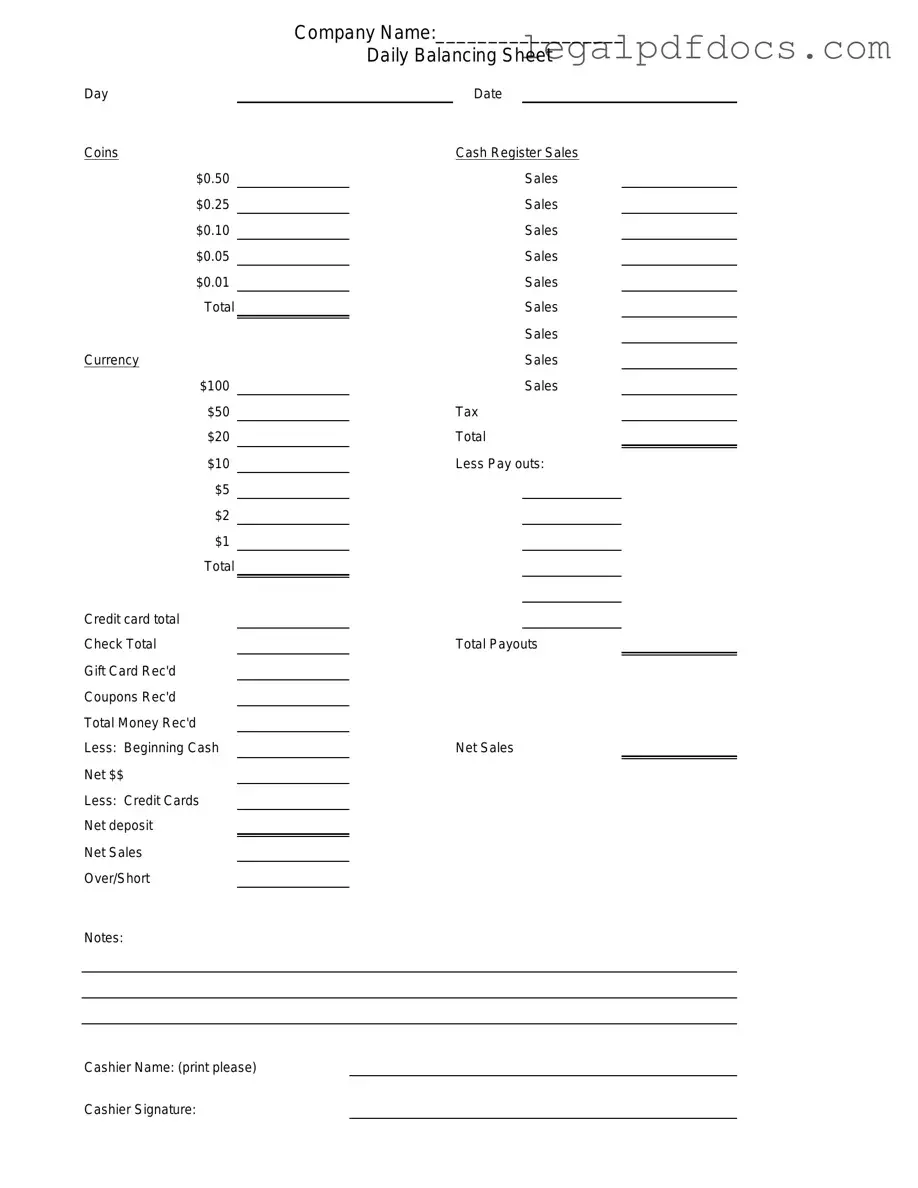

Fill Out a Valid Cash Drawer Count Sheet Template

The Cash Drawer Count Sheet is an essential tool for businesses that handle cash transactions. It serves as a systematic method for tracking the cash flow within a register or drawer, ensuring accountability and accuracy in financial reporting. This form typically includes sections for recording the starting cash balance, daily sales, and any cash received or disbursed throughout the day. By providing a clear overview of cash movements, it helps in identifying discrepancies and aids in reconciling cash at the end of a shift or business day. Additionally, the form often features spaces for signatures, which can enhance security and verify that the counts have been conducted by authorized personnel. Ultimately, the Cash Drawer Count Sheet is designed to promote transparency and efficiency in cash management, making it a vital resource for both small businesses and larger retail operations.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what you should and shouldn’t do:

- Do double-check your cash totals before submitting the form.

- Do use clear and legible handwriting to avoid misunderstandings.

- Do ensure all required fields are filled out completely.

- Do keep the form in a secure location until it is submitted.

- Do report any discrepancies immediately to your supervisor.

- Don't leave any sections of the form blank.

- Don't use correction fluid or tape on the form.

- Don't sign the form if you are unsure about the accuracy of the information.

- Don't fill out the form in a rushed manner; take your time.

- Don't forget to date the form before submitting it.

How to Use Cash Drawer Count Sheet

After gathering the necessary cash drawer information, you are ready to fill out the Cash Drawer Count Sheet. This form will help ensure that all cash is accounted for and provide a clear record of the cash balance at the end of your shift. Follow these steps carefully to complete the form accurately.

- Begin by entering the date at the top of the form. This helps in tracking the cash count over time.

- Write down your name or the name of the person responsible for the cash drawer. This identifies who conducted the count.

- In the designated area, list the denominations of cash present in the drawer. This typically includes $1, $5, $10, $20, $50, and $100 bills.

- Count the number of bills for each denomination and record this number next to the corresponding denomination.

- Calculate the total amount for each denomination by multiplying the number of bills by the value of each bill. Write this total in the appropriate column.

- Add up all the totals from each denomination to find the grand total cash amount. Enter this figure in the designated spot on the form.

- If applicable, note any discrepancies or issues in the comments section. This could include missing cash or errors in counting.

- Finally, sign and date the form to confirm that the count has been completed and is accurate.

More PDF Templates

D2 Application Form - Before starting, it's important to read the accompanying booklet INF1D for guidance.

Basketball Player Evaluation Form Pdf - Two-handed passes indicate a well-rounded passing ability.

Documents used along the form

The Cash Drawer Count Sheet is an essential document used to track the cash flow in a business. It helps ensure that the cash on hand matches the recorded transactions. Along with this form, several other documents are commonly utilized to maintain accurate financial records. Below is a list of these documents, each serving a unique purpose in the financial management process.

- Daily Sales Report: This report summarizes the total sales made during a specific day. It includes cash, credit, and any other forms of payment, providing a clear overview of daily revenue.

- Deposit Slip: A deposit slip is used to record the details of cash being deposited into a bank account. It includes the amount being deposited and the account number, ensuring that funds are tracked accurately.

- Transaction Log: This log tracks individual transactions made throughout the day. It provides detailed information about each sale, including the time, amount, and payment method, which aids in reconciling the cash drawer.

- Expense Report: An expense report records all expenditures made by the business. It helps in tracking spending and ensuring that all expenses are accounted for, which is crucial for financial planning.

- Reconciliation Statement: This document compares the cash on hand with the recorded transactions. It helps identify any discrepancies and ensures that financial records are accurate and up-to-date.

These documents work together to create a comprehensive financial picture for a business. Utilizing them effectively can lead to improved accuracy in financial reporting and better overall management of cash flow.

Misconceptions

The Cash Drawer Count Sheet is an essential tool for managing cash in retail and service environments. However, several misconceptions surround its use and purpose. Here are seven common misunderstandings:

- It is only used for cash registers. Many believe that the Cash Drawer Count Sheet is exclusively for cash registers. In reality, it can be utilized in various settings, including mobile payment systems and point-of-sale terminals.

- It is only necessary at the end of the day. Some think that the Cash Drawer Count Sheet is only required at closing time. However, regular counts throughout the day can help identify discrepancies and prevent theft.

- It is a complicated form that requires extensive training. While accuracy is crucial, the Cash Drawer Count Sheet is designed to be straightforward. Most employees can complete it with minimal training, ensuring efficiency in cash management.

- It only tracks cash transactions. A common misconception is that the form only records cash. In fact, it can also track credit card transactions, refunds, and other payment methods, providing a comprehensive overview of daily sales.

- It is only relevant for large businesses. Many assume that only large retailers need a Cash Drawer Count Sheet. In truth, small businesses and independent vendors can benefit significantly from maintaining accurate cash records.

- It is not necessary if you use digital payment systems. Some believe that reliance on digital payments eliminates the need for a Cash Drawer Count Sheet. However, even businesses that primarily accept digital payments should track cash for accountability and transparency.

- It is a one-time document. A misconception exists that the Cash Drawer Count Sheet is a one-time form. In reality, it should be filled out regularly, ideally after every shift or significant transaction, to maintain accurate financial records.

Understanding these misconceptions can lead to better cash management practices and improved financial accountability in various business settings.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to track cash transactions and ensure accurate cash management in retail environments. |

| Importance | Maintaining a Cash Drawer Count Sheet helps prevent discrepancies and provides a clear record for audits and reconciliations. |

| Frequency of Use | This form should be completed at the beginning and end of each shift to ensure accountability and transparency in cash handling. |

| State-Specific Laws | In some states, businesses must adhere to specific cash handling regulations. Check local laws for compliance requirements. |

Key takeaways

When using the Cash Drawer Count Sheet form, keep the following key points in mind:

- Ensure accuracy by counting cash and coins before filling out the form.

- Record the total amount of cash and checks separately for clarity.

- Double-check your entries to avoid discrepancies during audits.

- Use the form consistently for each cash drawer count to maintain reliable records.

- Sign and date the form after completion to validate the count.

- Store completed forms securely for future reference and compliance purposes.