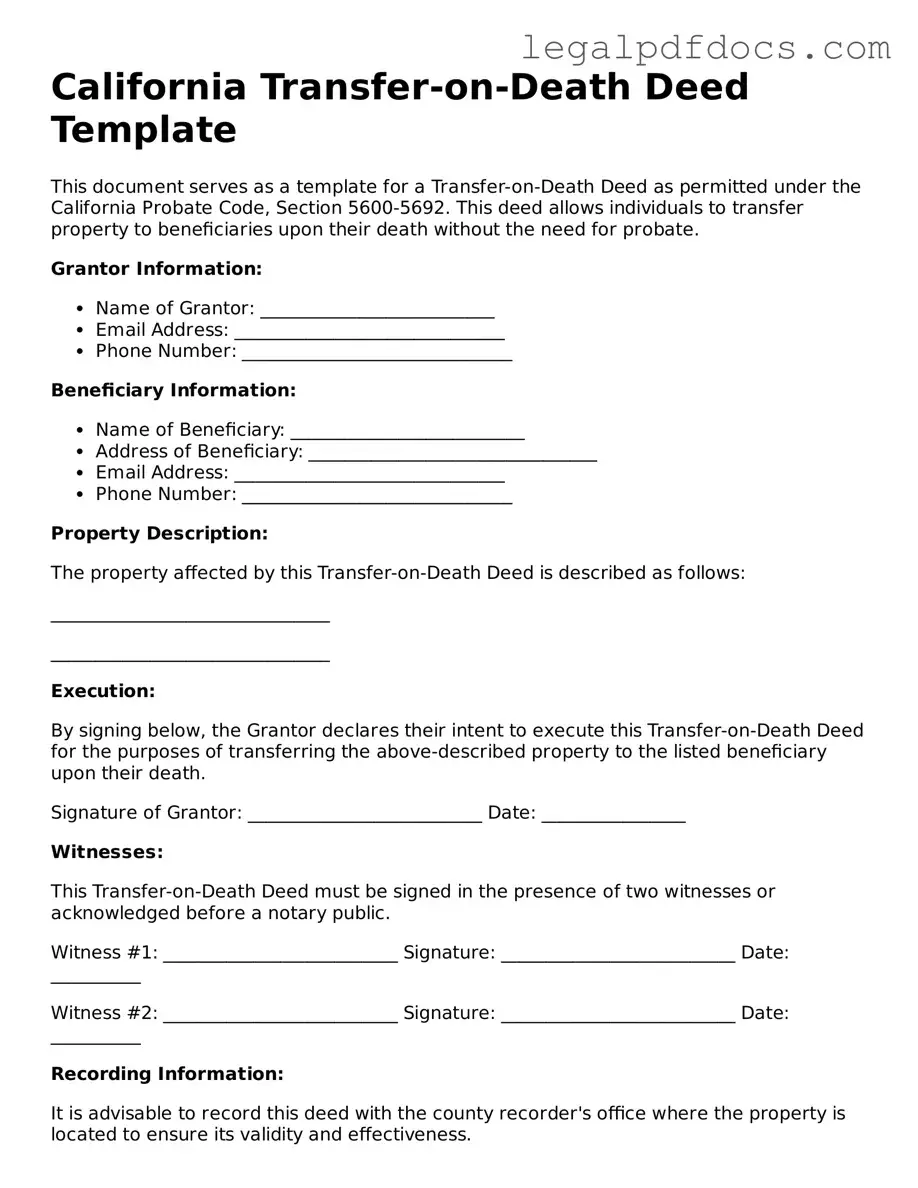

Official Transfer-on-Death Deed Form for California

In California, the Transfer-on-Death Deed (TOD) form offers a straightforward way for property owners to transfer their real estate to beneficiaries without the complications of probate. This legal tool allows individuals to designate who will receive their property upon their death, ensuring a smooth transition and minimizing the burden on loved ones. Importantly, the deed does not take effect until the owner's death, allowing the property owner to retain full control during their lifetime. The form is versatile, applicable to various types of real estate, including residential and commercial properties. To create a valid TOD, specific requirements must be met, such as signing the deed in front of a notary and recording it with the county recorder's office. Understanding these key aspects can empower property owners to make informed decisions about their estate planning and ensure their wishes are honored after they pass away.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it is essential to approach the task with care and attention. Here is a list of things you should and shouldn't do to ensure a smooth process.

- Do ensure that you understand the purpose of the Transfer-on-Death Deed.

- Do provide accurate information about the property being transferred.

- Do include the full names of all beneficiaries.

- Do sign the deed in the presence of a notary public.

- Don't forget to record the deed with the county recorder's office.

- Don't leave any sections of the form blank; complete all required fields.

- Don't use the form if you are not the legal owner of the property.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and serves its intended purpose.

How to Use California Transfer-on-Death Deed

After obtaining the California Transfer-on-Death Deed form, you will need to complete it accurately to ensure it serves its intended purpose. Follow the steps below carefully to fill out the form correctly.

- Obtain the form: Download the California Transfer-on-Death Deed form from the official state website or acquire a physical copy from a local government office.

- Identify the property: Clearly describe the property you wish to transfer. Include the address and legal description of the property, which can often be found on your property tax bill or deed.

- Provide your information: Fill in your full name and address as the transferor. Ensure your information is accurate and matches official records.

- Designate the beneficiary: Enter the name and address of the person or entity you wish to transfer the property to. This is your beneficiary.

- Include additional beneficiaries (if applicable): If you have more than one beneficiary, include their names and addresses. Clearly state how the property should be divided among them.

- Sign the form: As the transferor, you must sign the form in the presence of a notary public. Ensure that the notary acknowledges your signature.

- File the form: Submit the completed and notarized form to the county recorder's office in the county where the property is located. There may be a filing fee.

Once the form is filed, it will be recorded and become part of the public record. This step is crucial for ensuring that the transfer takes effect upon your passing. It is advisable to keep a copy of the filed deed for your records and inform your beneficiary about the transfer.

Find Popular Transfer-on-Death Deed Forms for US States

Deed on Death - Beneficiaries named in the deed have no rights to the property until the owner's death.

Beneficiary Deed Georgia - Written documentation of the deed's execution is advisable for future legal clarity.

Does a Transfer on Death Deed Supersede a Will - Privacy is maintained since the deed does not become public until the owner's death, unlike a will.

Documents used along the form

The California Transfer-on-Death Deed is a useful tool for individuals looking to transfer property upon their passing without going through probate. However, several other forms and documents often accompany this deed to ensure a smooth transfer process and to address various aspects of estate planning. Here’s a brief overview of those documents.

- Grant Deed: This document is used to transfer ownership of real property. It provides a clear title and is often required when executing a Transfer-on-Death Deed, ensuring that the property is legally conveyed to the designated beneficiaries.

- Revocable Living Trust: This trust allows individuals to manage their assets during their lifetime and specify how those assets will be distributed after death. It can complement a Transfer-on-Death Deed by providing a more comprehensive estate plan, especially for complex situations.

- Will: A will outlines how a person wishes to distribute their assets after death. While the Transfer-on-Death Deed directly transfers property, a will can address any remaining assets and clarify intentions, ensuring nothing is overlooked.

- Affidavit of Death: This document serves as proof of the death of the property owner. It may be required by financial institutions or title companies when processing the transfer of the property to the beneficiaries named in the Transfer-on-Death Deed.

Understanding these accompanying documents can help streamline the transfer process and provide peace of mind. Each serves a unique purpose and collectively contributes to a well-rounded estate plan, making it easier for loved ones during a difficult time.

Misconceptions

The California Transfer-on-Death Deed (TOD) form is a valuable estate planning tool, yet several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions about their estate planning. Below is a list of six common misconceptions about the California TOD deed.

- 1. The TOD Deed Avoids Probate for All Assets. Many believe that using a TOD deed eliminates probate for all assets. However, the TOD deed only applies to the specific property it covers. Other assets not included may still require probate.

- 2. The Grantor Retains No Control Over the Property. Some think that once a TOD deed is executed, the grantor loses all control over the property. In reality, the grantor retains full ownership and can sell, rent, or change the deed at any time before death.

- 3. The TOD Deed Automatically Transfers Upon Death. There is a misconception that the transfer is automatic without any further action. While the deed does facilitate transfer upon death, it must be recorded with the county to ensure the new owner’s rights are established.

- 4. A TOD Deed is Only for Married Couples. Some believe that only married couples can utilize a TOD deed. This is not true. Any individual can create a TOD deed to designate beneficiaries, regardless of marital status.

- 5. The TOD Deed is Irrevocable Once Created. It is often thought that a TOD deed cannot be revoked or changed once it is executed. In fact, the grantor can revoke or amend the deed at any time prior to death, as long as the proper legal procedures are followed.

- 6. The TOD Deed Eliminates Tax Liabilities. Many people assume that transferring property via a TOD deed avoids all tax implications. However, while it may avoid probate taxes, other tax liabilities, such as capital gains taxes, may still apply upon the transfer of the property.

Understanding these misconceptions is crucial for effective estate planning. A clear grasp of how the California Transfer-on-Death Deed operates can lead to better decisions regarding property transfer and inheritance.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5690. |

| Eligibility | Any individual who holds title to real property in California can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the property owner through a written document or by creating a new deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, and they can also specify alternate beneficiaries. |

| Recording Requirement | The deed must be recorded with the county recorder’s office where the property is located to be effective. |

| Tax Implications | Transferring property via a Transfer-on-Death Deed generally does not trigger gift taxes during the property owner's lifetime. |

| Limitations | This deed cannot be used for transferring property held in a trust or for certain types of property, such as those with liens or mortgages. |

Key takeaways

Here are some important points to consider when filling out and using the California Transfer-on-Death Deed form:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- To create a valid deed, the property owner must be at least 18 years old and legally competent.

- Ensure the deed is signed by the property owner in the presence of a notary public.

- The deed must clearly identify the property being transferred, including the legal description.

- Beneficiaries must be clearly named, and their relationship to the property owner should be specified.

- Once completed, the deed must be recorded with the county recorder's office where the property is located.

- It is advisable to keep a copy of the recorded deed in a safe place for future reference.

- The deed can be revoked or changed at any time before the property owner's death.

- Understand that the Transfer-on-Death Deed does not affect the property owner's rights during their lifetime.

- Consulting with a legal expert can help ensure that the deed meets all requirements and serves your intentions.