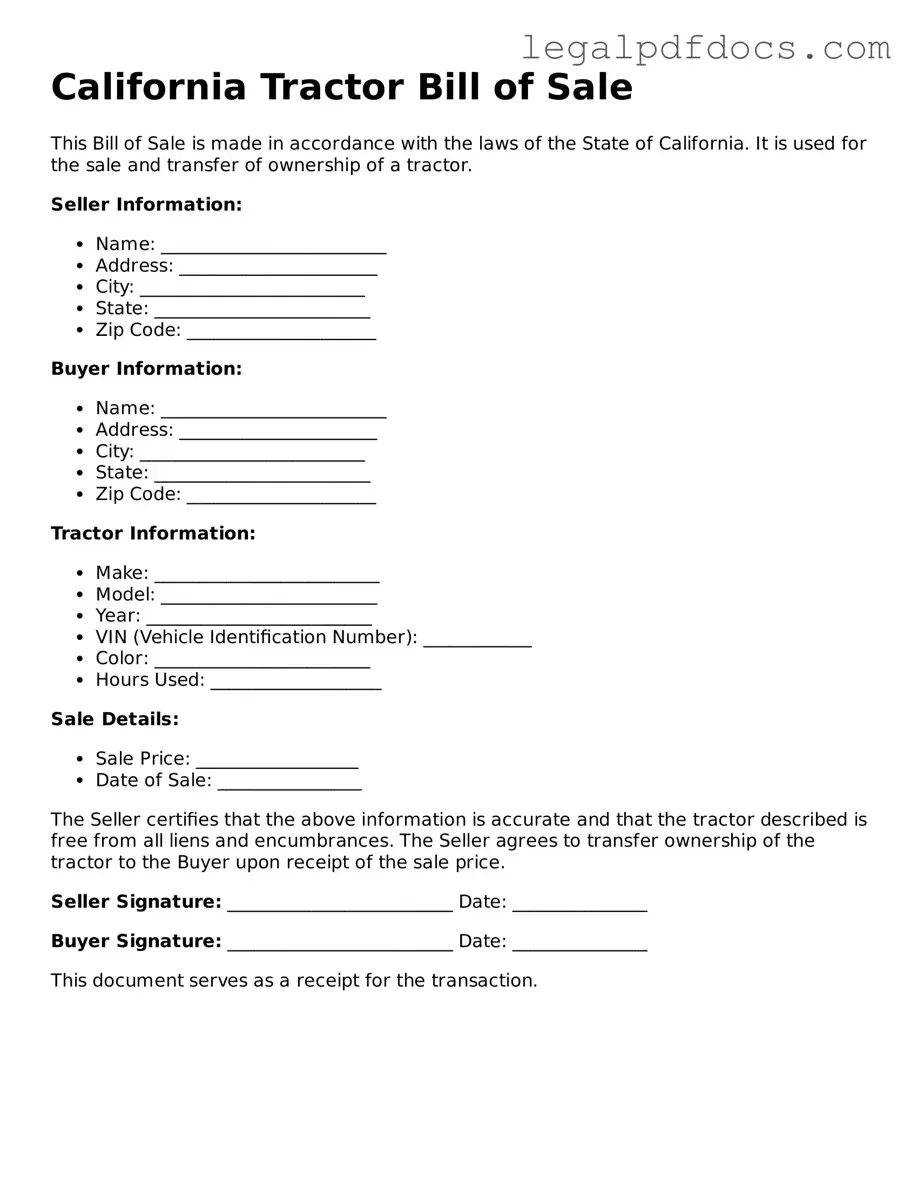

Official Tractor Bill of Sale Form for California

When it comes to buying or selling a tractor in California, having the right documentation is essential to ensure a smooth transaction. The California Tractor Bill of Sale form serves as a crucial legal document that records the details of the sale, including the names and addresses of both the buyer and seller, the tractor's identification number, and its make and model. This form not only confirms the transfer of ownership but also provides important information about the sale price and date of transaction. By utilizing this form, both parties protect their interests, as it serves as proof of the sale and can be referenced in future disputes or for registration purposes. Additionally, the form may include sections for any warranties or representations made by the seller, further clarifying the terms of the sale. Understanding the significance of this document is vital for anyone involved in the agricultural industry or simply looking to purchase or sell a tractor in the Golden State.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, attention to detail is essential. Here are ten important guidelines to follow:

- Do ensure that all information is accurate and complete.

- Do include the correct Vehicle Identification Number (VIN).

- Do provide the full names and addresses of both the buyer and the seller.

- Do specify the sale price clearly.

- Do sign and date the form in the appropriate sections.

- Don't leave any required fields blank.

- Don't use white-out or erasers on the form.

- Don't forget to keep a copy of the completed form for your records.

- Don't misrepresent the condition of the tractor.

- Don't rush through the process; take your time to review everything.

How to Use California Tractor Bill of Sale

Completing the California Tractor Bill of Sale form is an essential step in the transfer of ownership for your tractor. After filling out the form, you will need to ensure both parties have signed it and that you keep a copy for your records. Follow these steps carefully to avoid any issues.

- Obtain the California Tractor Bill of Sale form from a reliable source.

- Enter the date of the sale at the top of the form.

- Provide the full name and address of the seller.

- Fill in the full name and address of the buyer.

- Include the tractor's make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price of the tractor clearly.

- Indicate the method of payment (cash, check, etc.).

- Both the seller and buyer should sign the form at the designated areas.

- Make copies of the completed form for both parties' records.

Find Popular Tractor Bill of Sale Forms for US States

Farm Tractor Bill of Sale - It serves as a tangible asset for sellers to demonstrate the sale took place formally.

Tractor Bill of Sale Form - Verifies that the buyer has paid for the tractor in full.

Documents used along the form

When purchasing or selling a tractor in California, several forms and documents may accompany the Tractor Bill of Sale. Each of these documents serves a specific purpose and helps ensure that the transaction is legally sound and well-documented. Below is a list of commonly used forms and documents that may be required or beneficial in conjunction with the Tractor Bill of Sale.

- Title Certificate: This document proves ownership of the tractor. It is essential for transferring ownership from the seller to the buyer. The title should be signed over to the buyer at the time of sale.

- Vehicle/Vessel Transfer and Reassignment Form (REG 262): This form is used to transfer the title of the vehicle and includes sections for odometer disclosure and lienholder information, if applicable.

- Odometer Disclosure Statement: Required for vehicles under 10 years old, this statement provides the buyer with the current mileage of the tractor to prevent fraud regarding its condition and usage.

- Smog Certification: Depending on the age and type of tractor, a smog certification may be necessary to ensure the vehicle meets California's environmental standards.

- Bill of Sale for Equipment: This document serves a similar purpose to the Tractor Bill of Sale but can be used for additional equipment sold with the tractor, ensuring all items are properly accounted for.

- Proof of Insurance: Buyers may need to show proof of insurance coverage for the tractor before completing the sale. This protects both parties and ensures compliance with state laws.

- Sales Tax Payment Receipt: In California, sales tax applies to vehicle purchases. Keeping a receipt of this payment is important for both the buyer and seller for tax purposes.

- Power of Attorney (if applicable): If someone is handling the sale on behalf of the owner, a power of attorney document may be necessary to authorize that individual to act in the owner's stead.

- Warranty Document: If the tractor comes with a warranty, this document outlines the terms and conditions, providing the buyer with information on coverage and claims.

In summary, while the California Tractor Bill of Sale is a critical document for the sale of a tractor, other forms and documents play significant roles in ensuring a smooth and legally compliant transaction. It is advisable to gather all necessary paperwork to protect both the buyer's and seller's interests throughout the process.

Misconceptions

Misconceptions about the California Tractor Bill of Sale form can lead to confusion among buyers and sellers. Understanding these misconceptions is essential for a smooth transaction. Below are eight common misunderstandings.

- It is not legally required. Many people believe that a bill of sale is optional. In California, while it is not mandatory, having one provides legal protection for both parties.

- It is only for new tractors. Some assume that the form is only necessary for new purchases. However, it is equally important for used tractors to establish ownership and transaction details.

- All sales must be notarized. There is a misconception that a notary is required for a bill of sale to be valid. In California, notarization is not necessary, although it can add an extra layer of security.

- It covers all aspects of the sale. Some believe that the bill of sale includes warranties or guarantees. In reality, it primarily serves as a receipt and proof of ownership transfer.

- Only the seller needs to sign. A common misunderstanding is that only the seller's signature is needed. Both the buyer and seller should sign the document to validate the transaction.

- It is a standard form that requires no customization. Many think that the bill of sale is a one-size-fits-all document. In truth, it should be customized to reflect the specific details of the sale, including the tractor's condition and any agreements made.

- It is not necessary if there is a written contract. Some believe that if a formal contract exists, a bill of sale is redundant. However, the bill of sale serves a different purpose and can be beneficial even when a contract is in place.

- It is only relevant for private sales. Many think that only private sales require a bill of sale. In fact, businesses also benefit from using this document to ensure clear ownership transfer.

Clarifying these misconceptions can help individuals navigate the buying and selling process more effectively. A well-prepared bill of sale can serve as a crucial tool in any tractor transaction.

PDF Specifications

| Fact Name | Detail |

|---|---|

| Purpose | The California Tractor Bill of Sale form serves as a legal document to record the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by California Vehicle Code Section 5602, which outlines the requirements for vehicle sales. |

| Required Information | It must include details such as the names and addresses of both parties, the tractor's identification number, and the sale price. |

| Signatures | Both the buyer and the seller must sign the form to validate the transaction. |

Key takeaways

When filling out and using the California Tractor Bill of Sale form, keep these key takeaways in mind:

- Accurate Information: Ensure that all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are correct. This helps prevent future disputes.

- Signatures Required: Both the buyer and the seller must sign the form. This step is crucial as it indicates that both parties agree to the terms of the sale.

- Consider Notarization: While notarization is not mandatory, having the bill of sale notarized can provide an extra layer of protection and authenticity.

- Keep Copies: After completing the form, both parties should keep a copy for their records. This documentation is useful for future reference, especially for registration and tax purposes.