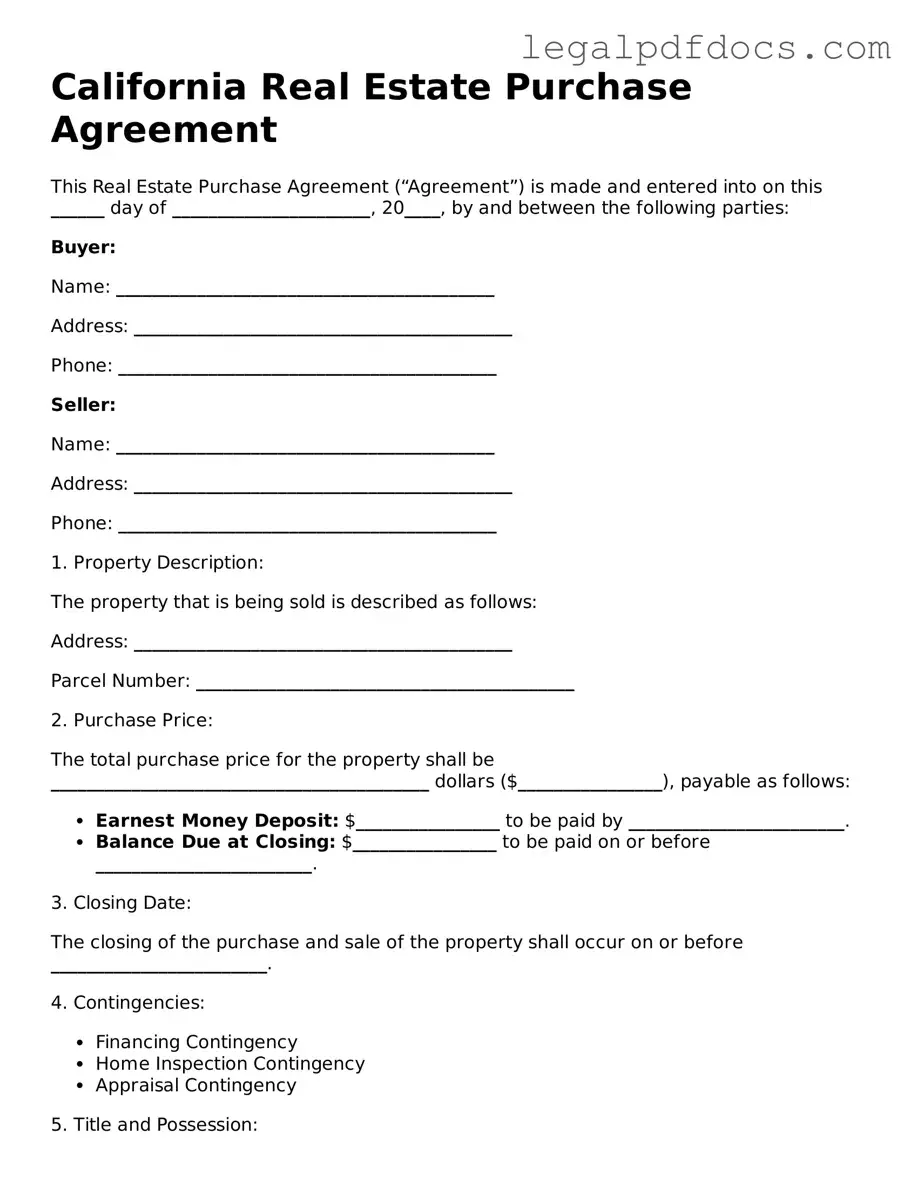

Official Real Estate Purchase Agreement Form for California

The California Real Estate Purchase Agreement form is a critical document in the home buying process, serving as the foundation for real estate transactions in the state. This form outlines the essential terms and conditions agreed upon by both the buyer and the seller, ensuring clarity and legal protection for both parties. Key elements include the purchase price, financing details, and contingencies, which may cover inspections, appraisals, and the buyer's ability to secure a loan. Additionally, the agreement specifies the closing date, which marks the official transfer of property ownership. It also addresses disclosures required by law, such as any known issues with the property. By detailing these aspects, the form helps to minimize misunderstandings and disputes, fostering a smoother transaction process. Understanding this agreement is vital for anyone involved in buying or selling real estate in California, as it lays out the rights and responsibilities of each party involved.

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it is essential to approach the task with care. Here are some key do's and don'ts to consider:

- Do read the entire agreement carefully before filling it out. Understanding all terms and conditions is crucial.

- Do provide accurate information. Ensure that all details about the property and parties involved are correct.

- Do consult with a real estate professional if you have questions. Their expertise can help clarify complex sections.

- Do keep a copy of the completed agreement for your records. This will be important for future reference.

- Don't rush through the form. Taking your time can prevent mistakes that may lead to complications later.

- Don't leave any sections blank unless instructed. Missing information can delay the process.

- Don't ignore deadlines. Timely submission is often critical in real estate transactions.

- Don't sign the agreement without fully understanding it. Ensure that you are comfortable with all terms before proceeding.

How to Use California Real Estate Purchase Agreement

After you have gathered all necessary information, you can begin filling out the California Real Estate Purchase Agreement form. This document is essential for formalizing the sale of a property. Follow these steps carefully to ensure that all required details are accurately provided.

- Identify the Parties: Write the names of the buyer(s) and seller(s) at the top of the form. Make sure to include their legal names as they appear on official documents.

- Property Description: Fill in the property address, including the city, state, and ZIP code. Include any relevant details that specify the property type.

- Purchase Price: Clearly state the total purchase price of the property. This should be a specific dollar amount.

- Earnest Money Deposit: Indicate the amount of earnest money the buyer will provide. This shows the buyer's commitment to the purchase.

- Financing Terms: Specify whether the purchase will be made with cash, a loan, or other means. If financing is involved, include details about the lender and loan type.

- Contingencies: Outline any conditions that must be met for the sale to proceed. Common contingencies include inspections, appraisals, and financing approvals.

- Closing Date: Write down the anticipated closing date when the sale will be finalized. This date should be mutually agreed upon by both parties.

- Signatures: Both the buyer and seller must sign and date the agreement. Ensure that each party has a copy of the signed document for their records.

Once the form is completed, review it thoroughly for accuracy. It is advisable to consult with a real estate professional or legal expert to ensure that all aspects are covered properly before proceeding with the transaction.

Find Popular Real Estate Purchase Agreement Forms for US States

Florida Purchase Agreement - The agreement also specifies how disputes will be resolved if they arise.

Simple Real Estate Purchase Agreement - The contract may establish a timeframe for the sale to be completed.

Illinois Real Estate Contract for Sale by Owner - The form typically includes a section for earnest money to show the buyer’s serious intent.

Purchase and Sale Agreement Georgia - Includes clauses specific to the market conditions or property type.

Documents used along the form

When engaging in a real estate transaction in California, several documents accompany the Real Estate Purchase Agreement. Each document serves a specific purpose and is crucial for ensuring a smooth process. Below is a list of commonly used forms that you may encounter.

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers must provide this information to potential buyers to promote transparency.

- Preliminary Title Report: Issued by a title company, this report reveals the current ownership of the property and any liens or encumbrances that may affect the sale.

- Home Inspection Report: Conducted by a licensed inspector, this report assesses the condition of the property, identifying necessary repairs or maintenance issues that may impact the buyer's decision.

- Loan Pre-Approval Letter: A document from a lender stating that a buyer is qualified for a mortgage up to a certain amount. This letter strengthens a buyer's position when making an offer.

- Contingency Addendum: This form outlines specific conditions that must be met for the sale to proceed, such as financing or inspection contingencies.

- Escrow Instructions: These are detailed instructions provided to the escrow company, outlining how to handle the transaction and disburse funds once all conditions are met.

- Purchase Agreement Addendum: An addition to the original purchase agreement that modifies terms or adds new conditions agreed upon by both parties.

- Closing Statement: Also known as the HUD-1, this document itemizes all closing costs and outlines how funds will be distributed at the closing of the sale.

- Property Tax Disclosure: This document informs buyers about the current property tax obligations and any potential changes that may arise after the sale.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential risks of lead-based paint and must be signed before finalizing the sale.

Understanding these documents will help streamline your real estate transaction and ensure all parties are well-informed. Always consider consulting a professional if you have questions about any specific form or requirement.

Misconceptions

Many people have misunderstandings about the California Real Estate Purchase Agreement form. Here are nine common misconceptions, clarified for better understanding.

-

It's just a simple contract.

While it may seem straightforward, the agreement contains numerous legal obligations and terms that protect both buyers and sellers.

-

All real estate transactions require the same agreement.

Different types of transactions may require different forms or addendums. It's essential to use the correct document for your specific situation.

-

Once signed, the agreement cannot be changed.

Parties can negotiate changes before finalizing the sale. Amendments can be made as long as both parties agree.

-

Only real estate agents can complete the form.

While agents often assist, individuals can fill out the form themselves, provided they understand the terms and conditions.

-

The agreement guarantees the sale will go through.

Signing the agreement does not guarantee the transaction will close. Various factors can lead to the deal falling through.

-

It's a one-size-fits-all document.

Each agreement can be tailored to fit the unique circumstances of the transaction, including contingencies and special provisions.

-

Buyers are always at a disadvantage.

The agreement is designed to protect the interests of both parties. Buyers have rights and protections outlined within the document.

-

It's unnecessary to read the entire agreement.

Every section of the agreement is important. Understanding all terms helps prevent misunderstandings and disputes later on.

-

Legal advice isn't needed.

While not mandatory, consulting with a real estate attorney can provide valuable insights and help avoid potential pitfalls.

PDF Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California Civil Code Sections 1624 and 2985. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Offer and Acceptance | The agreement serves as an offer from the buyer, which the seller can accept, reject, or counter. |

| Earnest Money Deposit | Typically, the buyer provides an earnest money deposit to demonstrate their serious intent to purchase. |

| Contingencies | The form allows for various contingencies, such as financing, inspections, and appraisal conditions. |

| Disclosure Requirements | California law mandates that sellers disclose known defects and other material facts about the property. |

| Closing Date | The agreement specifies a closing date, which is the date when the property title is transferred to the buyer. |

| Property Description | A detailed description of the property being sold is included to avoid ambiguity. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties to be enforceable. |

Key takeaways

When filling out and using the California Real Estate Purchase Agreement form, it is essential to understand the key components and requirements. Here are ten important takeaways to consider:

- Understand the Parties Involved: Clearly identify the buyer and seller in the agreement. This includes their legal names and contact information.

- Property Description: Provide a detailed description of the property being sold. This includes the address, parcel number, and any relevant legal descriptions.

- Purchase Price: Specify the total purchase price for the property. This should be clearly stated to avoid any confusion.

- Deposit Amount: Indicate the amount of the initial deposit. This is typically a percentage of the purchase price and demonstrates the buyer's commitment.

- Financing Contingencies: If the purchase depends on financing, include specific contingencies that outline the buyer's ability to secure a loan.

- Closing Date: Set a timeline for the closing date. This is when the transaction is finalized, and ownership is transferred.

- Disclosures: Familiarize yourself with required disclosures. Sellers must provide information about the property's condition and any known issues.

- Contingencies: Include any additional contingencies that may apply, such as inspections or appraisal requirements, to protect the buyer's interests.

- Signatures: Ensure that all parties sign the agreement. This makes it legally binding and confirms that both buyer and seller agree to the terms.

- Consult a Professional: It is advisable to seek legal or real estate professional guidance when completing the form to ensure compliance with California laws.

By keeping these key points in mind, individuals can navigate the Real Estate Purchase Agreement process more effectively, ensuring a smoother transaction.