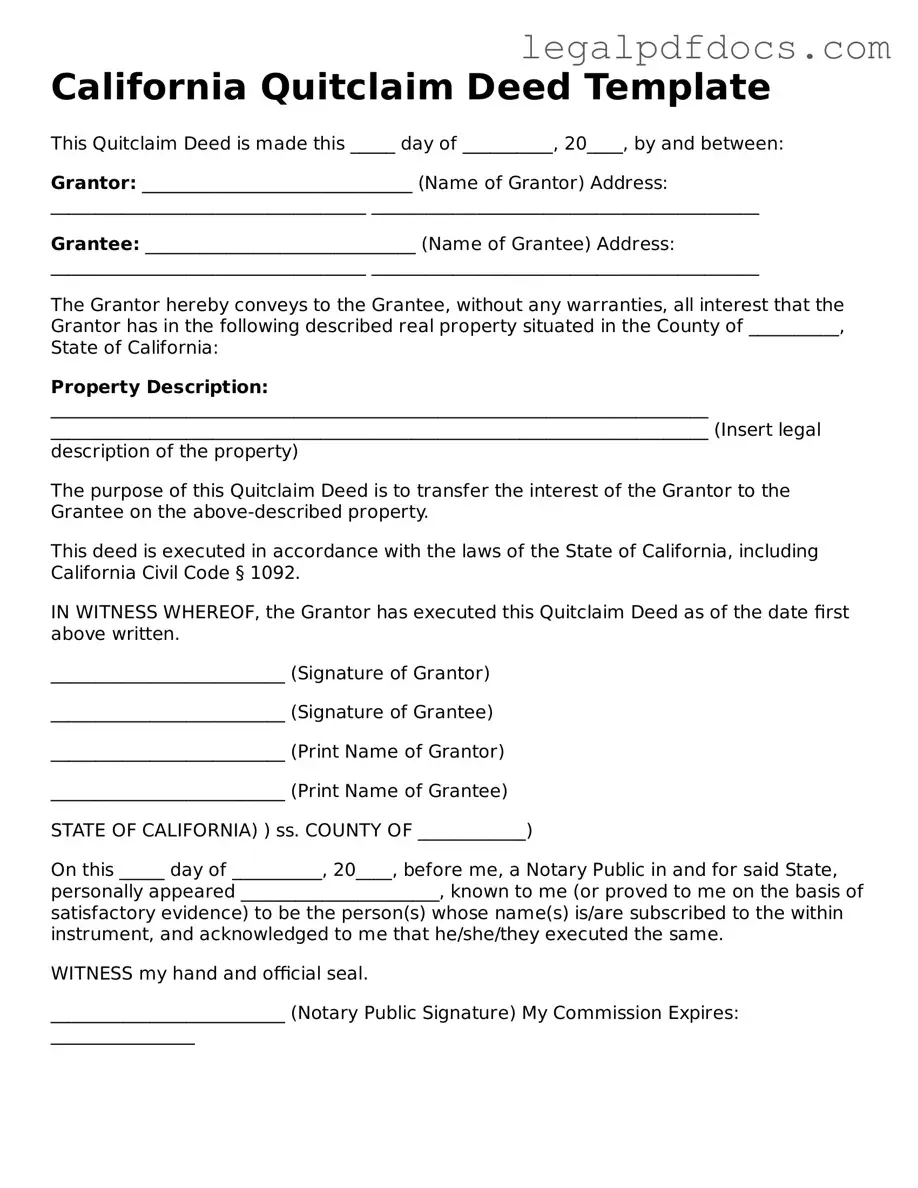

Official Quitclaim Deed Form for California

The California Quitclaim Deed form serves as a crucial legal instrument for property owners looking to transfer their interest in real estate without making any guarantees about the title. This form is particularly valuable in situations where the granter wishes to relinquish their rights to a property, often among family members or in divorce settlements, where the transfer may occur without monetary exchange. Unlike other types of deeds, a quitclaim deed does not provide the grantee with any assurances regarding the validity of the title, which means that the recipient assumes the risk associated with any potential claims against the property. This lack of warranty can make the quitclaim deed a straightforward yet risky choice for both parties involved. The form must be properly filled out, signed, and notarized to be legally effective, and it is typically recorded with the county recorder’s office to ensure public notice of the transfer. Understanding the nuances of this deed is essential for anyone considering property transfer in California, as it can significantly impact ownership rights and future property transactions.

Dos and Don'ts

When filling out the California Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some do's and don'ts to keep in mind:

- Do provide the full legal names of all parties involved in the transaction.

- Do include the correct property description, including the address and any relevant parcel numbers.

- Do sign the form in front of a notary public to ensure its validity.

- Do check for any local requirements that may need to be fulfilled before submitting the deed.

- Don't leave any fields blank; ensure all required information is filled out completely.

- Don't forget to file the completed deed with the county recorder's office to make it official.

By following these simple guidelines, you can help ensure that the Quitclaim Deed process goes smoothly and that your interests are protected.

How to Use California Quitclaim Deed

After completing the California Quitclaim Deed form, it is essential to ensure that the document is properly executed and recorded. This step is crucial to legally transfer property rights. The following steps will guide you through filling out the form accurately.

- Obtain the Form: Download the California Quitclaim Deed form from a reliable source or visit your local county recorder’s office to get a physical copy.

- Enter the Grantor's Information: In the designated area, write the name of the person or entity transferring the property. Include the address of the grantor as well.

- Enter the Grantee's Information: Next, fill in the name of the person or entity receiving the property. Make sure to include their address as well.

- Describe the Property: Provide a detailed description of the property being transferred. This may include the address, parcel number, and any other identifying information.

- Indicate Consideration: State the amount of money or other consideration being exchanged for the property. If the transfer is a gift, you may note that as well.

- Sign the Document: The grantor must sign the Quitclaim Deed in the presence of a notary public. Ensure that the signature matches the name listed on the form.

- Notarization: After signing, the notary will complete their section, verifying the identity of the grantor and witnessing the signature.

- Record the Deed: Take the completed and notarized Quitclaim Deed to the county recorder's office where the property is located. Pay any required recording fees.

Find Popular Quitclaim Deed Forms for US States

Who Can Prepare a Quit Claim Deed in Florida - It is often used in divorce settlements to transfer property rights.

Quitclaim Deed Form Texas - Those entering into a Quitclaim Deed should consider any possible future disputes or claims.

Quitclaim Deed Form Kansas - A quitclaim deed does not require the granter to have owned the property previously.

Documents used along the form

A California Quitclaim Deed is a vital document used to transfer property ownership. However, several other forms and documents are often necessary to accompany it. Below is a list of related documents that may be relevant in the property transfer process.

- Grant Deed: This document is used to transfer property while providing certain guarantees about the title. It assures the buyer that the seller holds clear title to the property and has the right to sell it.

- Property Transfer Tax Declaration: This form is required by many counties in California. It provides information about the property transfer and may be used to calculate any applicable transfer taxes.

- Title Report: A title report outlines the current ownership and any liens or encumbrances on the property. It is essential for verifying the property's status before a transfer occurs.

- Affidavit of Death: If the property is being transferred due to the death of the owner, this document serves as proof of death and may help facilitate the transfer without going through probate.

- Trustee’s Deed: This document is used when property is transferred from a trust. It outlines the authority of the trustee to convey the property on behalf of the trust beneficiaries.

- Homestead Declaration: This form can protect a portion of a homeowner's equity from creditors. It may be relevant when transferring property to ensure continued protection.

Understanding these documents can help ensure a smooth property transfer process. Each form plays a distinct role in protecting the interests of all parties involved in the transaction.

Misconceptions

Understanding the California Quitclaim Deed form is essential for anyone involved in property transfers. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

A Quitclaim Deed Transfers Ownership Completely.

While a quitclaim deed does transfer whatever interest the grantor has in the property, it does not guarantee that the grantor holds clear title. If there are existing liens or claims against the property, those do not disappear with the quitclaim deed.

-

Quitclaim Deeds Are Only for Family Transfers.

Although often used among family members, quitclaim deeds can be utilized in various transactions, including sales between unrelated parties or to clear up title issues.

-

Quitclaim Deeds Are Only Valid in California.

Quitclaim deeds are recognized in many states across the U.S. While the specifics may vary, the general concept remains the same. It is important to understand the local laws governing property transfers.

-

A Quitclaim Deed Eliminates All Liability.

Using a quitclaim deed does not absolve the grantor of any liabilities associated with the property. If the property has debts or legal issues, the grantor may still be held responsible.

-

All Parties Must Be Present to Sign the Quitclaim Deed.

While it is ideal for all parties to be present during the signing, it is not a strict requirement. The deed can be signed by one party and then delivered to the other party later, provided it is done according to legal standards.

-

A Quitclaim Deed Does Not Require Notarization.

In California, a quitclaim deed must be notarized to be legally valid. This step is crucial for ensuring the deed is recognized by the county recorder's office.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties. |

| Governing Law | The California Quitclaim Deed is governed by California Civil Code Section 1092. |

| Purpose | This form is often used to transfer property between family members or to clear up title issues. |

| Parties Involved | The document involves a grantor (the person transferring the property) and a grantee (the person receiving the property). |

| Consideration | Consideration is not required for a quitclaim deed, but it may be included for clarity. |

| Recording | To ensure the transfer is public, the deed must be recorded with the county recorder's office. |

| Tax Implications | Transfers via quitclaim deeds may trigger property tax reassessment under California law. |

| Signature Requirements | The grantor must sign the deed, and the signature may need to be notarized for recording. |

| Limitations | A quitclaim deed does not guarantee that the grantor has clear title to the property. |

Key takeaways

Filling out and using a California Quitclaim Deed form can seem daunting, but it doesn't have to be. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Quitclaim Deed transfers ownership interest in a property from one person to another without guaranteeing that the title is clear.

- Identify the Parties: Clearly list the names of both the grantor (the person giving up their interest) and the grantee (the person receiving the interest).

- Provide Accurate Property Description: Include a detailed description of the property being transferred. This typically includes the address and legal description.

- Signatures Matter: Both the grantor and any required witnesses must sign the deed for it to be valid.

- Notarization Required: A Quitclaim Deed must be notarized to be legally binding in California.

- Record the Deed: After signing and notarizing, the deed should be filed with the county recorder's office to make the transfer public.

- Check for Existing Liens: Since a Quitclaim Deed does not guarantee a clear title, it’s wise to check for any liens or claims against the property.

- Understand Tax Implications: Transferring property may have tax consequences, so consult a tax professional if needed.

- Use Correct Form: Ensure you are using the most current version of the California Quitclaim Deed form to avoid any issues.

- Seek Legal Advice if Unsure: If you have any doubts or questions, consider consulting with a legal professional to ensure everything is handled correctly.

By keeping these points in mind, you can navigate the process of using a Quitclaim Deed with confidence.