Official Promissory Note Form for California

The California Promissory Note form is a crucial document in the realm of personal and business finance. It serves as a written promise from one party to pay a specific sum of money to another party at a designated time, often accompanied by interest. This form outlines essential details, including the loan amount, interest rate, repayment schedule, and any collateral involved. It can be tailored for various situations, whether for personal loans between friends or more formal agreements between businesses. Understanding the key components of this document can help both lenders and borrowers navigate their financial obligations with clarity and confidence. By establishing clear terms, the California Promissory Note aims to protect the interests of both parties, ensuring that all expectations are set and met. Whether you’re borrowing or lending, knowing how to properly use this form is vital for a smooth transaction.

Dos and Don'ts

When filling out the California Promissory Note form, it’s important to follow certain guidelines. Here are five things you should and shouldn’t do:

- Do: Read the entire form carefully before starting. Understanding each section will help you fill it out correctly.

- Do: Use clear and legible handwriting or type the information. This ensures that all parties can read the details without confusion.

- Do: Include all required information, such as the names of the borrower and lender, loan amount, and repayment terms.

- Do: Sign and date the document in the appropriate places. Your signature is necessary for the agreement to be valid.

- Do: Keep a copy of the completed form for your records. This will be useful in case of any disputes later on.

- Don't: Leave any blank spaces. If a section does not apply, write “N/A” to avoid confusion.

- Don't: Use vague language. Be specific about the terms of the loan to prevent misunderstandings.

- Don't: Forget to review the form before submitting it. Double-checking can catch mistakes that may have been overlooked.

- Don't: Sign the document without understanding the terms. Make sure you are comfortable with the agreement before you commit.

- Don't: Ignore state laws regarding promissory notes. Familiarize yourself with any legal requirements specific to California.

How to Use California Promissory Note

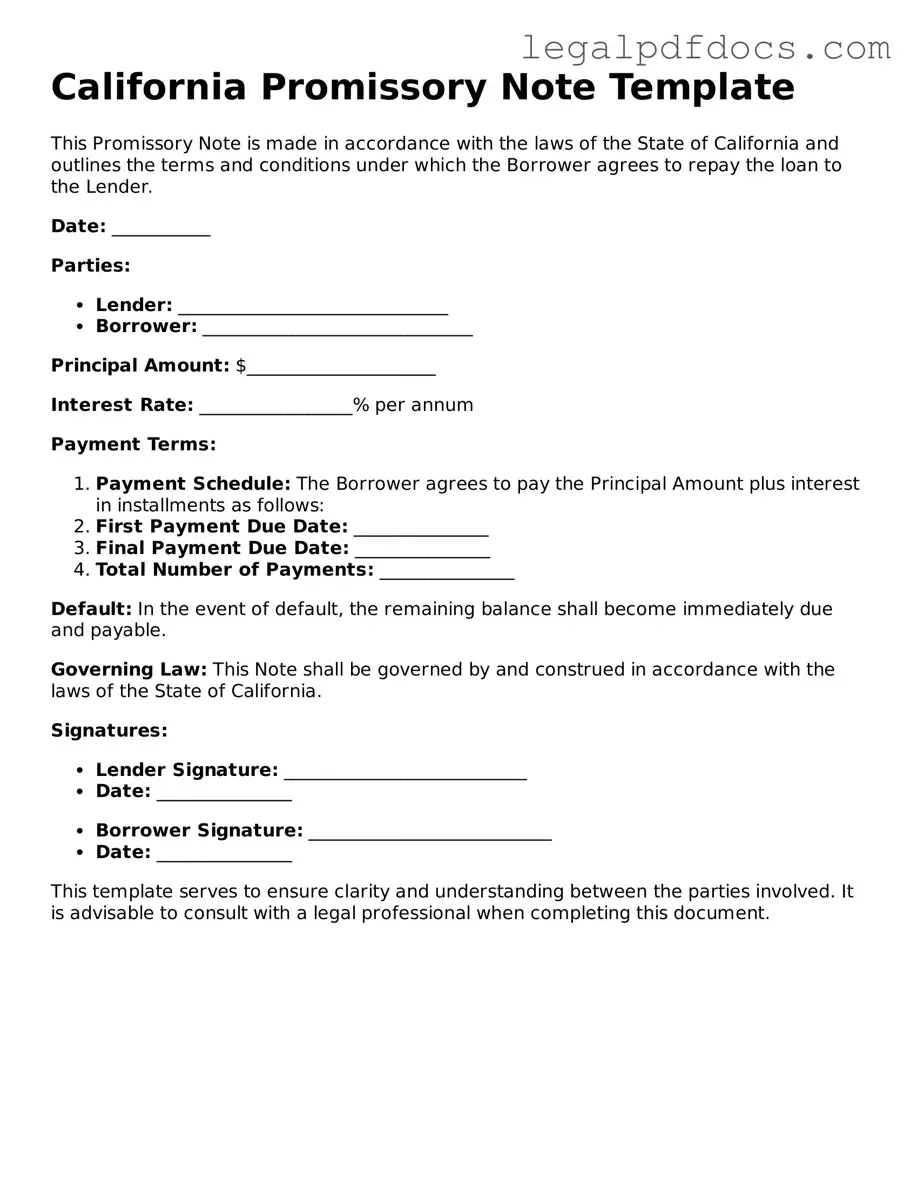

After gathering the necessary information, you’re ready to fill out the California Promissory Note form. Completing this form accurately is essential for establishing the terms of your loan agreement. Follow these steps to ensure everything is filled out correctly.

- Title the Document: At the top of the form, write "Promissory Note" to clearly indicate the purpose of the document.

- Enter the Date: Write the date when the note is being executed.

- Identify the Borrower: Fill in the full name and address of the person or entity borrowing the money.

- Identify the Lender: Provide the full name and address of the person or entity lending the money.

- State the Loan Amount: Clearly write the amount of money being borrowed in both numerical and written form.

- Specify the Interest Rate: Include the annual interest rate applicable to the loan, if any.

- Define the Payment Terms: Outline the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the due date of the first payment.

- Include Late Fees: If applicable, state any late fees that will be charged if payments are not made on time.

- Signatures: Both the borrower and lender must sign and date the document at the bottom to make it legally binding.

Once the form is completed, keep copies for your records. It’s advisable to have the document notarized for additional legal protection. This ensures that all parties are clear on the terms and conditions of the loan.

Find Popular Promissory Note Forms for US States

Texas Promissory Note Template - Witnessing or notarizing a Promissory Note can add an extra layer of validity to the agreement.

Promissory Note Template Illinois - The repayment schedule can be flexible, based on mutual agreement.

Documents used along the form

In California, a promissory note is a crucial document used in lending agreements. It outlines the borrower's promise to repay a loan under specific terms. Alongside the promissory note, several other forms and documents are often utilized to provide clarity and legal protection for both parties involved in the transaction. Below is a list of these commonly associated documents.

- Loan Agreement: This document details the terms of the loan, including the amount, interest rate, repayment schedule, and any conditions that must be met by either party.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the collateral and the rights of the lender in case of default.

- Disclosure Statement: This form provides the borrower with important information about the loan, including fees, interest rates, and potential penalties for late payments.

- Deed of Trust: Used in real estate transactions, this document secures the loan with the property itself, allowing the lender to take possession if the borrower defaults.

- Guaranty Agreement: A third party may sign this document to guarantee the borrower's repayment, adding an additional layer of security for the lender.

- Payment Schedule: This document outlines the specific dates and amounts due for each payment, helping borrowers manage their repayment plan.

- Amendment Agreement: If any terms of the original promissory note need to be changed, this document formally amends the existing agreement.

- Default Notice: In the event of missed payments, this notice is sent to inform the borrower of their default status and the potential consequences.

- Release of Liability: Once the loan is fully repaid, this document confirms that the borrower is no longer liable for the debt, releasing them from any further obligations.

These documents collectively serve to establish clear expectations and protect the interests of both lenders and borrowers. Properly utilizing these forms can help mitigate risks and ensure a smoother lending process.

Misconceptions

Understanding the California Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- A Promissory Note Must Be Notarized: Some assume that notarization is a requirement for a promissory note to be valid. While notarization can add a layer of authenticity, it is not legally required in California.

- Only Written Promissory Notes are Valid: There is a belief that only written notes are enforceable. However, verbal agreements can also be valid, though they are harder to prove in court.

- Promissory Notes are Only for Large Loans: Many think that these notes are only necessary for significant loans. In fact, they can be used for any amount, big or small, to document a debt.

- Interest Rates Must Be Included: Some people think that a promissory note must include an interest rate. While it's common to include one, it is not a requirement, and a note can be interest-free.

- Once Signed, a Promissory Note Cannot Be Changed: There is a misconception that a signed promissory note is set in stone. In reality, the parties can agree to modify the terms at any time, as long as both consent to the changes.

- Promissory Notes are Only for Personal Loans: Many believe these notes are only relevant for personal loans. However, they are also used in business transactions, real estate, and other financial dealings.

- Defaulting on a Promissory Note is a Criminal Offense: Some think that failing to repay a promissory note is a crime. In truth, it is typically a civil matter, leading to financial penalties rather than criminal charges.

By understanding these misconceptions, individuals can navigate the complexities of promissory notes more effectively, ensuring they protect their interests in financial agreements.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. |

| Governing Law | The California Promissory Note is governed by the California Civil Code, specifically sections related to contracts and obligations. |

| Interest Rates | The note can specify an interest rate, which must comply with California usury laws to avoid excessive rates. |

| Enforceability | As long as the note is clear and meets all legal requirements, it is enforceable in a court of law. |

Key takeaways

Understanding the purpose of a promissory note is crucial. This document serves as a written promise to pay a specific amount of money to a lender.

Make sure to include all essential details. The note should clearly state the amount borrowed, interest rate, repayment schedule, and maturity date.

Identifying the parties involved is important. Clearly list the borrower and lender’s names and addresses to avoid any confusion.

Consider specifying the method of payment. Indicate whether payments will be made electronically, by check, or through another method.

Include any late fees or penalties. If payments are missed, outline the consequences to protect the lender’s interests.

Be aware of state laws. California has specific regulations regarding interest rates and lending practices that must be followed.

Sign and date the document. Both parties should sign the promissory note to make it legally binding.

Keep a copy for your records. Both the borrower and lender should retain a signed copy for future reference.