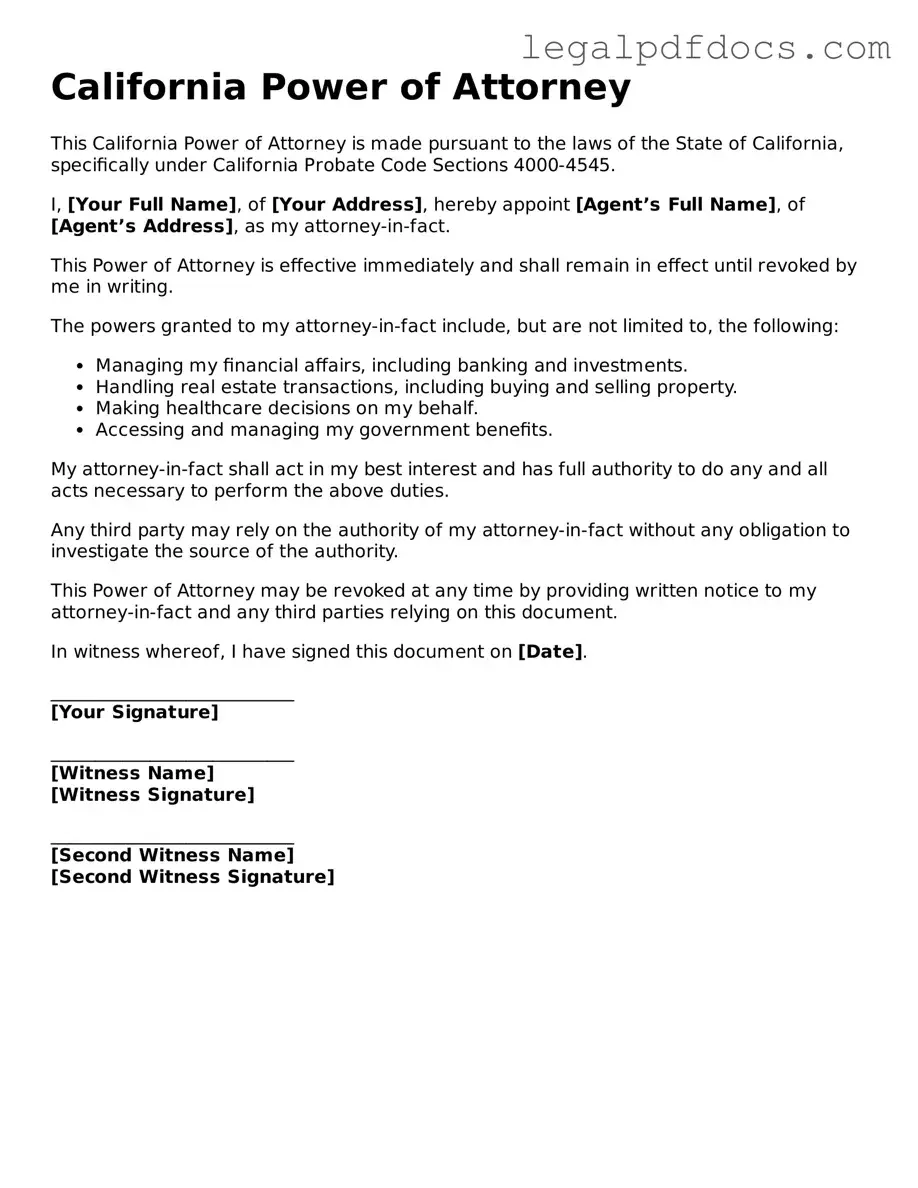

Official Power of Attorney Form for California

The California Power of Attorney form serves as a crucial legal document that empowers individuals to designate another person to make decisions on their behalf, particularly in financial and healthcare matters. This form is essential for anyone looking to ensure their preferences are honored when they can no longer communicate their wishes due to illness or incapacity. It allows the appointed agent, often referred to as the attorney-in-fact, to manage a range of responsibilities, from handling bank transactions to making medical decisions. Importantly, the form can be tailored to grant broad or limited powers, depending on the granter’s needs. Additionally, California law requires specific formalities for the execution of this document, including the need for the principal’s signature and, in some cases, the presence of a notary public or witnesses. Understanding the nuances of this form is vital for anyone seeking to navigate the complexities of personal decision-making in times of need.

Dos and Don'ts

When filling out the California Power of Attorney form, it is essential to approach the task with care and attention to detail. Here are seven important things to keep in mind:

- Do read the entire form carefully before starting. Understanding the document will help ensure accuracy.

- Don't rush through the process. Take your time to complete each section thoughtfully.

- Do clearly identify the person you are appointing as your agent. Make sure their name and contact information are correct.

- Don't leave any sections blank unless instructed. Incomplete forms may lead to complications later.

- Do sign and date the form in the appropriate places. Your signature is essential for the document to be valid.

- Don't forget to have the document notarized if required. Notarization adds an extra layer of authenticity.

- Do keep a copy of the completed form for your records. Having a copy can be helpful in the future.

By following these guidelines, you can help ensure that your Power of Attorney form is filled out correctly and serves its intended purpose.

How to Use California Power of Attorney

Filling out the California Power of Attorney form is a straightforward process that requires careful attention to detail. Once completed, the form must be signed and notarized before it can be used. Here’s how to fill out the form step-by-step.

- Obtain the Form: Download the California Power of Attorney form from a reliable source or visit a local legal office to obtain a physical copy.

- Read the Instructions: Familiarize yourself with the instructions provided with the form to ensure you understand the requirements.

- Identify the Principal: Fill in your full name and address in the designated section as the principal, the person granting the authority.

- Designate the Agent: Enter the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Specify Powers: Clearly outline the specific powers you wish to grant your agent. This can include financial decisions, medical choices, or other legal matters.

- Set a Duration: Indicate whether the Power of Attorney is durable (effective even if you become incapacitated) or if it has a specific expiration date.

- Sign the Form: Sign and date the form in the presence of a notary public to validate it. Ensure all signatures are complete.

- Distribute Copies: Provide copies of the signed form to your agent, any relevant institutions, and keep one for your records.

Find Popular Power of Attorney Forms for US States

Do You Need a Lawyer for Power of Attorney - Often created with the assistance of legal professionals for clarity.

Poa Financial Form - A healthcare Power of Attorney specifically addresses medical decisions.

Documents used along the form

When creating a Power of Attorney in California, several other forms and documents may be beneficial to ensure comprehensive legal coverage. These documents can help clarify intentions and provide additional authority or guidance for the appointed agent.

- Advance Healthcare Directive: This document allows individuals to specify their healthcare preferences and appoint someone to make medical decisions on their behalf if they become unable to do so.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if the principal becomes incapacitated, ensuring that the agent can act on their behalf at all times.

- Living Will: A Living Will outlines an individual’s wishes regarding medical treatment in situations where they cannot communicate their preferences, particularly at the end of life.

- Trust Agreement: This document establishes a trust, allowing a trustee to manage assets on behalf of beneficiaries. It can work alongside a Power of Attorney for financial management.

- Financial Power of Attorney: This specialized form grants an agent authority specifically over financial matters, such as managing bank accounts, paying bills, and handling investments.

- Will: A Will outlines how an individual's assets should be distributed after their death. It can complement a Power of Attorney by addressing matters not covered while the individual is alive.

These documents can enhance the effectiveness of a Power of Attorney by addressing various aspects of personal and financial management. It is advisable to consider each document's purpose and how they interact with one another to ensure comprehensive planning.

Misconceptions

Here are 10 common misconceptions about the California Power of Attorney form:

-

Misconception 1: A Power of Attorney is only for financial matters.

A Power of Attorney can cover various areas, including healthcare decisions and property management, not just financial issues.

-

Misconception 2: The agent must be a lawyer.

Anyone over the age of 18 can be appointed as an agent, as long as they are trustworthy and capable.

-

Misconception 3: A Power of Attorney is permanent and cannot be revoked.

You can revoke a Power of Attorney at any time, as long as you are mentally competent to do so.

-

Misconception 4: A Power of Attorney takes away all control from the principal.

The principal retains control and can specify the extent of the agent's authority in the document.

-

Misconception 5: The Power of Attorney is effective immediately upon signing.

It can be set to take effect immediately, or it can be made effective only upon the principal's incapacity.

-

Misconception 6: A Power of Attorney is the same as a living will.

A living will addresses end-of-life decisions, while a Power of Attorney allows someone to make decisions on your behalf.

-

Misconception 7: All Power of Attorney forms are the same.

Power of Attorney forms can vary by state and purpose, so it is important to use the correct form for California.

-

Misconception 8: Once signed, the agent can do anything they want.

The agent must act in the best interest of the principal and within the authority granted in the document.

-

Misconception 9: You need a witness to sign a Power of Attorney.

While witnesses are not always required, notarization is typically recommended to validate the document.

-

Misconception 10: A Power of Attorney is not necessary if you are married.

Even if you are married, a Power of Attorney is beneficial for making decisions when one spouse is unable to do so.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Power of Attorney (POA) allows an individual to appoint someone else to manage their financial or medical decisions. |

| Governing Law | The California Power of Attorney is governed by the California Probate Code, specifically Sections 4000-4545. |

| Types of POA | There are two main types: Durable Power of Attorney for financial matters and Advance Health Care Directive for medical decisions. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. |

| Witness Requirements | The form must be signed by the principal and either witnessed by two individuals or notarized. |

Key takeaways

When filling out and using the California Power of Attorney form, there are several important points to keep in mind. Here are key takeaways to ensure you understand the process:

- Understand the Purpose: A Power of Attorney allows you to appoint someone to make decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select a trustworthy individual as your agent. This person will have significant control over your affairs.

- Specify Powers Clearly: Clearly outline the powers you are granting to your agent. Be specific about financial, medical, or legal decisions.

- Consider a Durable Power of Attorney: A durable Power of Attorney remains effective even if you become incapacitated. This is crucial for long-term planning.

- Sign in Front of Witnesses: California law requires that you sign the document in front of at least one witness or a notary public.

- Review and Update Regularly: Life circumstances change. Regularly review your Power of Attorney to ensure it still reflects your wishes.

- Notify Your Agent: After completing the form, inform your agent about their responsibilities and your expectations.

- Keep Copies Safe: Store the signed document in a secure location and provide copies to your agent and relevant institutions.

Following these guidelines will help ensure that your Power of Attorney is effective and aligns with your intentions.