Official Operating Agreement Form for California

The California Operating Agreement form serves as a foundational document for Limited Liability Companies (LLCs) operating within the state. This form outlines the internal governance structure and operational guidelines for the company, ensuring that all members understand their roles and responsibilities. Key aspects of the agreement include the distribution of profits and losses, management structure, and procedures for adding or removing members. Additionally, the document addresses decision-making processes, voting rights, and dispute resolution methods, which are crucial for maintaining harmony among members. By clearly defining these elements, the Operating Agreement helps prevent misunderstandings and conflicts, fostering a more efficient and effective business environment. It is essential for LLCs to have a well-drafted Operating Agreement to comply with California state laws and to protect the interests of all parties involved.

Dos and Don'ts

When filling out the California Operating Agreement form, it's important to keep a few things in mind. Here’s a simple list of what to do and what to avoid:

- Do: Read the instructions carefully before starting.

- Do: Provide accurate information about your business and members.

- Do: Keep a copy of the completed form for your records.

- Do: Make sure all members sign the agreement where required.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any sections blank unless instructed.

- Don't: Use legal jargon or complicated language.

- Don't: Forget to update the agreement if there are changes in membership.

How to Use California Operating Agreement

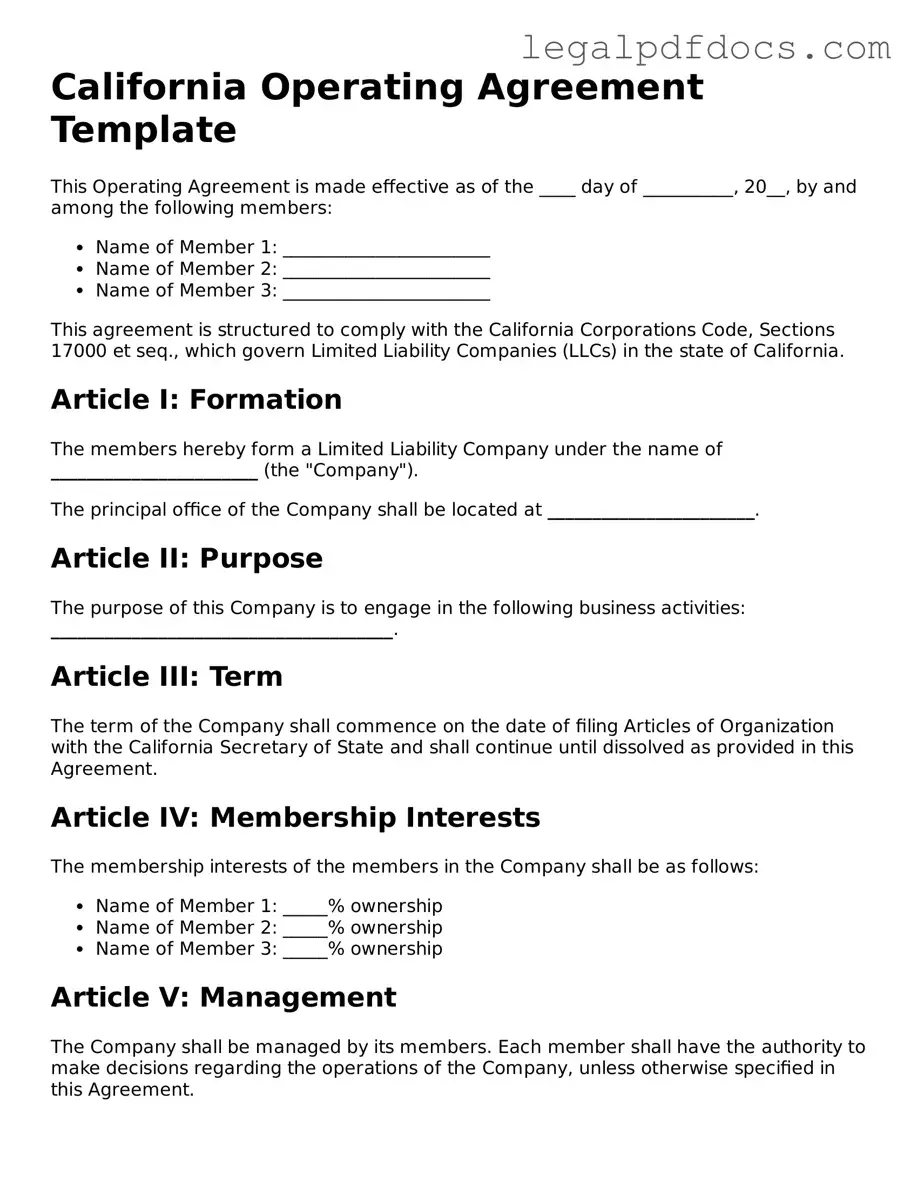

Once you have the California Operating Agreement form ready, you will need to fill it out with the necessary information. This document outlines the management structure and operating procedures for your business. Follow these steps to complete the form accurately.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal office address for the LLC.

- List the names and addresses of all members involved in the LLC.

- Specify the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Detail each member's ownership percentage and any capital contributions they are making.

- Outline the voting rights of each member, including how decisions will be made.

- Include provisions for adding new members or transferring ownership interests.

- State the duration of the LLC, whether it is perpetual or has a specific end date.

- Sign and date the document. Ensure all members also sign where required.

After completing the form, review it for accuracy. It may be beneficial to keep a copy for your records. You can then proceed to file the agreement as required by state law.

Find Popular Operating Agreement Forms for US States

How to Create an Operating Agreement - Can define how and when distributions to members will occur.

Idaho Llc Operating Agreement - An Operating Agreement can enhance strategic planning for your business.

Documents used along the form

When establishing a limited liability company (LLC) in California, the Operating Agreement is a crucial document that outlines the management structure and operational guidelines of the business. However, several other forms and documents often accompany it to ensure compliance with state laws and to protect the interests of all members involved. Below is a list of these important documents.

- Articles of Organization: This is the foundational document required to officially form an LLC in California. It includes essential information such as the LLC's name, address, and the name of the registered agent.

- Statement of Information: This document must be filed within 90 days of forming the LLC. It provides updated information about the LLC, including the names and addresses of its members and managers.

- Operating Agreement: While this document is already mentioned, it is worth noting that it details the management structure, ownership percentages, and operational procedures of the LLC. It serves as an internal document, guiding how the business will be run.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes and is required if the LLC has more than one member or plans to hire employees. It functions like a Social Security number for the business.

- Bylaws: Although not mandatory for an LLC, bylaws can outline the rules for the internal management of the company. They can cover topics such as meetings, voting rights, and the roles of members.

- Membership Certificates: These certificates can be issued to members to signify ownership interest in the LLC. While not legally required, they can serve as a formal acknowledgment of a member's stake in the company.

- Tax Forms: Depending on the nature of the LLC's business and its tax classification, various tax forms may be required at both the state and federal levels. This could include forms for income tax, sales tax, or employment tax.

In summary, while the California Operating Agreement is a vital document for any LLC, it is essential to consider these additional forms and documents. Each plays a unique role in ensuring that the business operates smoothly and remains compliant with state regulations. Understanding these documents can help business owners navigate the complexities of forming and managing their LLCs effectively.

Misconceptions

When it comes to the California Operating Agreement form, several misconceptions can lead to confusion. Understanding the truth behind these myths is essential for anyone involved in a limited liability company (LLC) in California.

- Misconception 1: An Operating Agreement is not necessary for an LLC.

- Misconception 2: The Operating Agreement must be filed with the state.

- Misconception 3: All Operating Agreements must be the same.

- Misconception 4: Once created, the Operating Agreement cannot be changed.

Many people believe that an Operating Agreement is optional. While California law does not require LLCs to have one, having this document is crucial. It outlines the management structure and operational procedures, helping to prevent disputes among members.

Some assume that the Operating Agreement needs to be submitted to the California Secretary of State. In reality, this document is kept internally. It should be accessible to all members but does not require state filing.

There is a belief that a one-size-fits-all Operating Agreement exists. However, each LLC is unique, and the Operating Agreement should reflect the specific needs and agreements of its members. Customization is key.

Some think that an Operating Agreement is set in stone. In fact, it can be amended as needed, provided that all members agree to the changes. Flexibility allows the agreement to evolve with the company.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | The California Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in California. |

| Governing Law | This agreement is governed by the California Corporations Code, specifically Sections 17300 to 17360. |

| Purpose | The primary purpose of the Operating Agreement is to define the rights and responsibilities of the members and managers of the LLC. |

| Flexibility | California law allows LLCs significant flexibility in structuring their Operating Agreements, enabling customization to fit specific business needs. |

| Not Mandatory | While it is highly recommended to have an Operating Agreement, California law does not require LLCs to file this document with the state. |

Key takeaways

Understand the purpose of the California Operating Agreement. This document outlines the management structure and operational procedures of a limited liability company (LLC).

Identify all members of the LLC. Each member's rights, responsibilities, and contributions should be clearly stated in the agreement.

Detail the management structure. Decide whether the LLC will be member-managed or manager-managed and specify the roles accordingly.

Include provisions for profit and loss distribution. Clearly outline how profits and losses will be shared among members.

Address the process for adding or removing members. Establish clear guidelines to avoid disputes in the future.

Consider dispute resolution methods. Including procedures for resolving conflicts can save time and money down the line.

Review and update the agreement regularly. Changes in membership or business operations may necessitate revisions to the document.