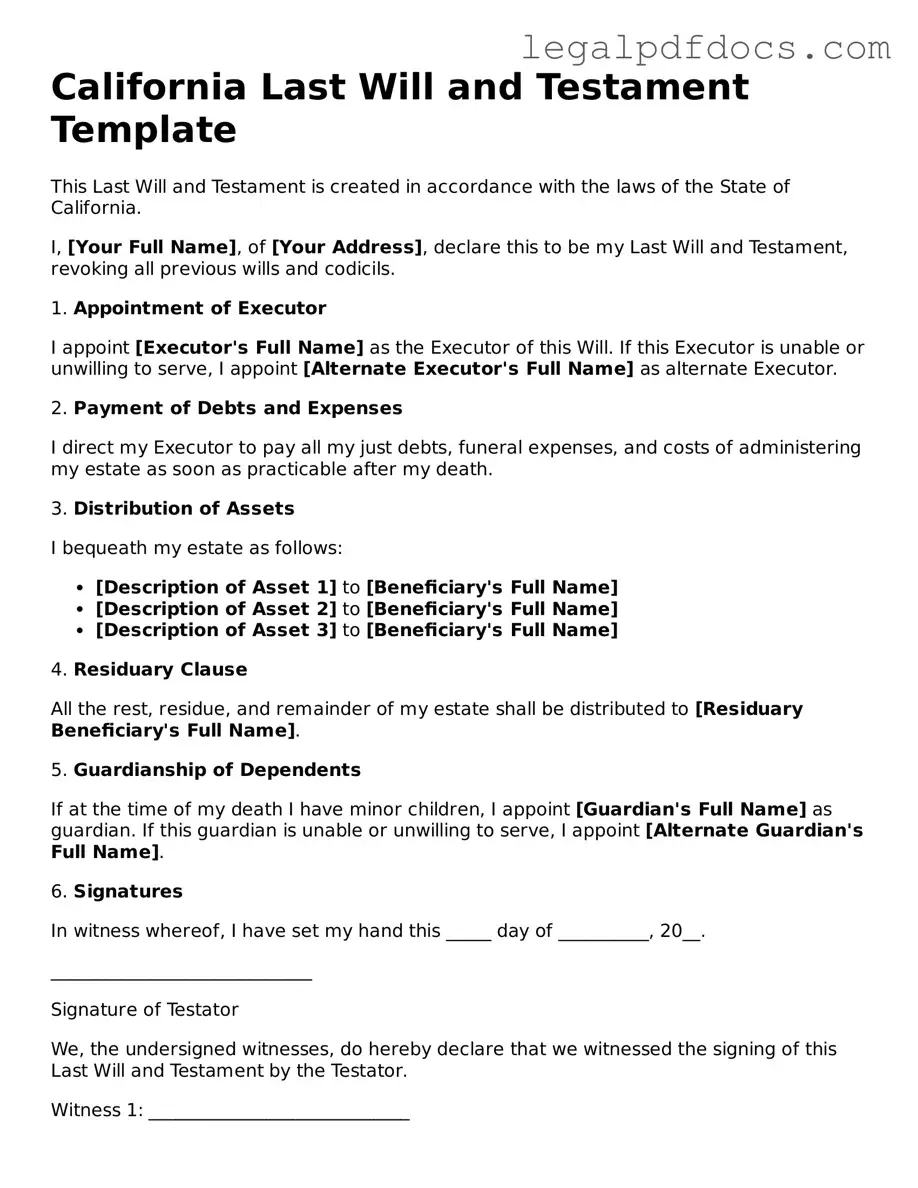

Official Last Will and Testament Form for California

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In California, this legal document outlines how your assets will be distributed, who will care for your minor children, and even appoints an executor to manage your estate. The California Last Will and Testament form is designed to be straightforward, allowing individuals to specify their desires clearly. It includes sections for naming beneficiaries, detailing specific bequests, and establishing guardianship for dependents. Moreover, the form emphasizes the importance of signatures and witnesses, which are crucial for validating the document. Understanding this form is vital for anyone looking to secure their legacy and provide peace of mind for their loved ones. By taking the time to complete this form, individuals can avoid potential disputes and ensure their wishes are respected, making it a fundamental aspect of personal estate planning.

Dos and Don'ts

When filling out the California Last Will and Testament form, it’s important to follow certain guidelines to ensure your wishes are clearly stated and legally valid. Here are five things you should and shouldn't do:

- Do: Clearly state your full name and address at the beginning of the will.

- Do: Specify how you want your assets distributed among your beneficiaries.

- Do: Sign the document in the presence of at least two witnesses.

- Do: Include a statement revoking any previous wills or codicils.

- Do: Keep your will in a safe place and inform your executor where it is located.

- Don't: Use ambiguous language that could lead to confusion about your intentions.

- Don't: Forget to date the will; this helps establish its validity.

- Don't: Leave out important details about your beneficiaries, such as their full names.

- Don't: Attempt to write the will without consulting a legal professional if you have complex assets.

- Don't: Ignore state laws regarding the signing and witnessing of the will.

How to Use California Last Will and Testament

Completing a California Last Will and Testament form is an important step in ensuring that your wishes regarding your estate are clearly outlined. Once you have filled out the form, you will need to sign it in the presence of witnesses to make it legally binding.

- Begin by obtaining the California Last Will and Testament form. You can find it online or through legal resources.

- At the top of the form, fill in your full name and address. This identifies you as the testator.

- Designate an executor by providing their name and contact information. This person will be responsible for carrying out your wishes.

- List the beneficiaries by including their names and relationships to you. Be specific about what each person will receive.

- Include any specific bequests. This could be personal items, property, or financial assets you want to leave to certain individuals.

- Address the distribution of the remainder of your estate. Specify how any remaining assets should be divided among the beneficiaries.

- Indicate any guardianship arrangements if you have minor children. Provide the names of the individuals you wish to appoint as guardians.

- Review the form thoroughly to ensure all information is accurate and complete.

- Sign the form in front of at least two witnesses. They must also sign the document to validate it.

- Store the completed will in a safe place, and inform your executor and family members of its location.

Find Popular Last Will and Testament Forms for US States

Template for a Will - Ensures that personal belongings are given to those who appreciate them most.

Georgia Last Will and Testament - Your wishes may differ for various properties and assets.

Template for a Will - Can outline methods for resolving disputes regarding estate matters.

Documents used along the form

When preparing a California Last Will and Testament, it’s essential to consider additional documents that can help ensure your wishes are fully realized and legally binding. These forms can facilitate the management of your estate, address healthcare decisions, and provide clarity to your beneficiaries. Below is a list of commonly used documents that complement a Last Will and Testament.

- Durable Power of Attorney: This document allows you to designate someone to manage your financial affairs if you become incapacitated. It ensures your bills are paid and your assets are managed without court intervention.

- Advance Healthcare Directive: Also known as a living will, this document outlines your healthcare preferences in case you cannot communicate your wishes. It can include instructions about life support and other critical medical decisions.

- Revocable Living Trust: A trust allows you to place your assets in a legal entity that you control during your lifetime. Upon your death, the assets can be distributed to your beneficiaries without going through probate, saving time and money.

- Beneficiary Designations: For certain assets, like life insurance policies and retirement accounts, you can specify beneficiaries directly. This can help ensure these assets pass directly to your chosen individuals, bypassing the will process.

- Codicil: This is an amendment to your existing will. If you need to make minor changes or updates, a codicil allows you to do so without creating an entirely new will.

- Estate Inventory: This document lists all of your assets and liabilities. It can be helpful for your executor to understand the scope of your estate and facilitate the distribution process.

- Funeral Instructions: While not legally binding, providing clear instructions regarding your funeral preferences can ease the burden on your loved ones during a difficult time and ensure your wishes are honored.

Incorporating these documents into your estate planning can provide peace of mind and clarity for both you and your loved ones. Taking the time to prepare these forms ensures that your wishes are respected and that your estate is handled according to your preferences.

Misconceptions

- Misconception 1: A handwritten will is not valid in California.

- Misconception 2: A will must be notarized to be valid.

- Misconception 3: Once a will is created, it cannot be changed.

- Misconception 4: A will automatically go into effect upon the testator's death.

This is incorrect. California recognizes handwritten wills, also known as holographic wills, as valid if they are signed by the testator and the material provisions are in their handwriting. However, it is advisable to follow standard formats to avoid disputes.

In California, notarization is not a requirement for a will to be valid. A will can be validly executed with the signatures of two witnesses. Notarization can add an extra layer of authenticity but is not mandatory.

This is false. A will can be amended or revoked at any time before the testator's death. This can be done through a codicil, which is an amendment, or by creating an entirely new will that explicitly revokes the previous one.

While a will does take effect after death, it must first go through the probate process. This legal procedure validates the will and ensures that the deceased's assets are distributed according to their wishes.

PDF Specifications

| Fact Name | Description |

|---|---|

| Legal Requirement | In California, a Last Will and Testament must be in writing to be valid. |

| Witnesses | The will must be signed by at least two witnesses who are present at the same time. |

| Age Requirement | To create a valid will in California, you must be at least 18 years old. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the old one. |

| Governing Law | The California Probate Code governs the creation and execution of wills in the state. |

Key takeaways

Creating a Last Will and Testament in California is an important step in planning for the future. Here are key takeaways to consider when filling out and using the California Last Will and Testament form:

- Understand the Purpose: A will outlines how your assets will be distributed after your death and can designate guardians for minor children.

- Eligibility Requirements: You must be at least 18 years old and of sound mind to create a valid will in California.

- Clear Identification: Clearly identify yourself and your beneficiaries. Include full names and relationships to avoid confusion.

- Executor Appointment: Choose a trustworthy executor who will be responsible for carrying out your wishes as stated in the will.

- Witness Requirements: California requires at least two witnesses to sign your will. They should not be beneficiaries to ensure the will's validity.

- Revocation of Previous Wills: If you create a new will, it automatically revokes any prior wills. Ensure that your intentions are clear.

- Storage and Accessibility: Store your will in a safe place, and inform your executor and loved ones about its location. This ensures it can be easily accessed when needed.

Taking the time to understand these key points can help ensure that your wishes are honored and that the process goes smoothly for your loved ones.