Official Gift Deed Form for California

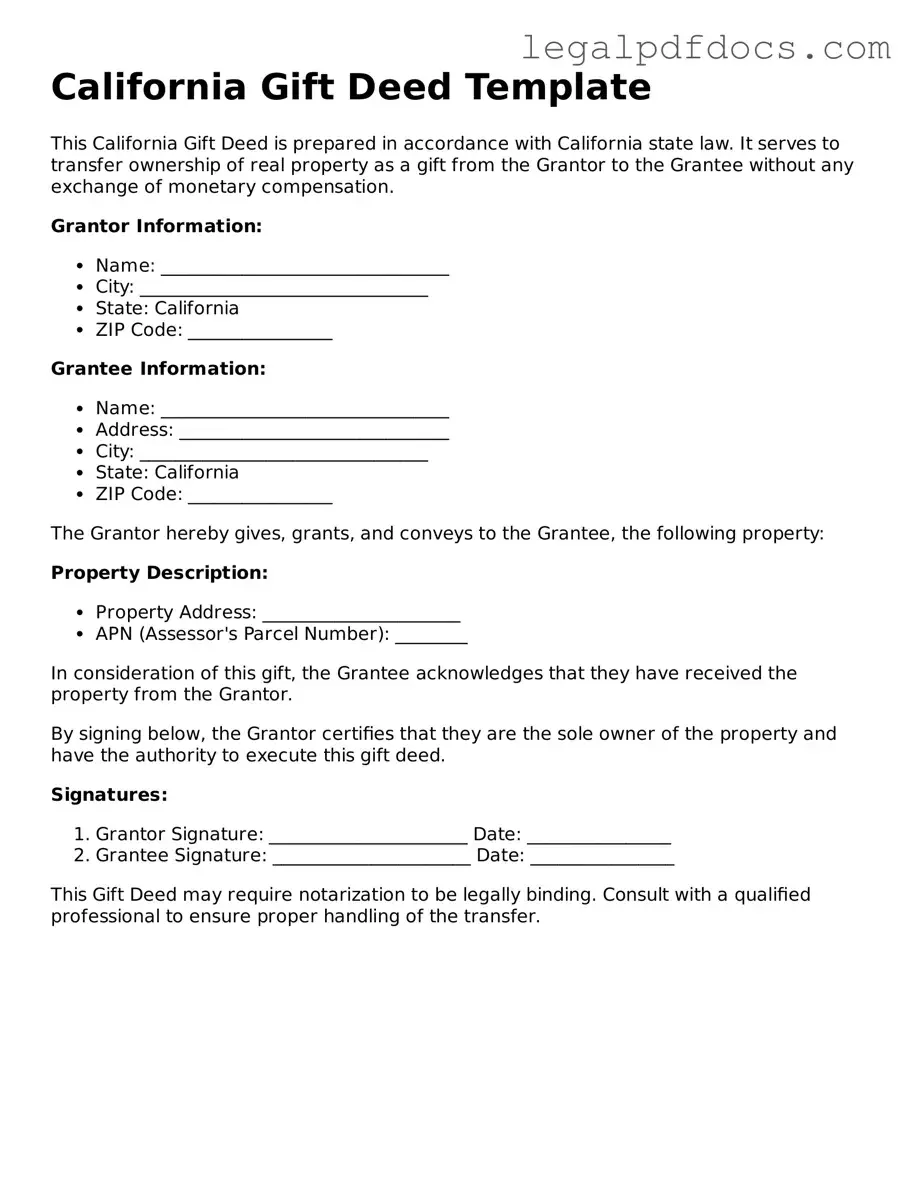

The California Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without the exchange of monetary compensation. This document allows the donor to convey ownership of real estate to a recipient, commonly referred to as the donee, while ensuring that the transfer is recorded and recognized under California law. A properly executed Gift Deed must include essential details such as the names of both parties, a clear description of the property, and the signature of the donor. Additionally, the form may require notarization to validate the transaction. Importantly, the Gift Deed can have significant tax implications, as it may affect both the donor's and donee's tax liabilities. Understanding these aspects is vital for anyone considering a property transfer in California, as the implications extend beyond the mere act of giving. Furthermore, the form serves to protect the interests of both parties by providing clear evidence of the intent to gift, thereby reducing the potential for future disputes over ownership.

Dos and Don'ts

When filling out the California Gift Deed form, attention to detail is crucial. Here are five important dos and don'ts to keep in mind:

- Do ensure that all names are spelled correctly. Mistakes can lead to complications in the future.

- Do provide a clear description of the property being gifted. This helps avoid any ambiguity.

- Do sign the form in front of a notary public. This step is essential for the validity of the deed.

- Don't leave any sections blank. Incomplete forms may be rejected or cause delays.

- Don't forget to check local regulations. Some counties may have additional requirements.

How to Use California Gift Deed

After gathering the necessary information and documents, you are ready to fill out the California Gift Deed form. Ensure all details are accurate to avoid any delays in processing. Follow these steps carefully to complete the form.

- Obtain the California Gift Deed form from a reliable source or download it from the official state website.

- Begin with the title section. Clearly write “Gift Deed” at the top of the form.

- Fill in the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift). Include their addresses.

- Describe the property being transferred. Include the address, parcel number, and any relevant legal descriptions.

- State the consideration, which is typically “for love and affection” in a gift deed.

- Sign the form in front of a notary public. Both the grantor and the grantee should sign the document.

- Ensure that the notary public completes their section by providing their signature and seal.

- Make copies of the completed and notarized form for your records.

- File the original Gift Deed with the county recorder’s office in the county where the property is located.

Find Popular Gift Deed Forms for US States

Texas Gift Deed Form - For real property gifts, a Gift Deed must comply with state property transfer laws.

Documents used along the form

When transferring property as a gift in California, the Gift Deed form is often accompanied by several other documents. These documents help ensure that the transfer is legally valid and properly recorded. Below is a list of commonly used forms and documents that may accompany a Gift Deed.

- Grant Deed: This document serves as evidence of the transfer of property from one party to another. It includes a guarantee from the grantor that they hold clear title to the property and have the right to transfer it.

- Quitclaim Deed: Unlike a Grant Deed, a Quitclaim Deed transfers whatever interest the grantor has in the property without any warranties. It is often used between family members or in situations where the parties know each other well.

- Property Tax Exemption Form: In California, certain property transfers may qualify for tax exemptions. This form is submitted to the local tax assessor to ensure that the property is not reassessed for tax purposes after the transfer.

- Preliminary Change of Ownership Report: This form is required by the county assessor to document changes in property ownership. It provides important information about the property and the parties involved in the transfer.

- Affidavit of Identity: This affidavit can help clarify the identities of the parties involved in the transaction. It is especially useful when there are common names or potential confusion about ownership.

- Notice of Transfer: This document notifies relevant parties, such as lenders or homeowners associations, about the change in ownership. It can help prevent misunderstandings regarding property rights and responsibilities.

- Title Insurance Policy: While not always required, obtaining title insurance protects the new owner against any claims or issues that may arise related to the title of the property after the transfer.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit set by the IRS, the donor may need to file this form to report the gift for tax purposes.

- Living Trust Document: If the property is being transferred into a living trust, this document outlines the terms of the trust and how the property will be managed during the grantor's lifetime and after their death.

Each of these documents plays a significant role in the process of transferring property as a gift. Ensuring that all necessary paperwork is completed accurately can help prevent legal complications in the future. Understanding these forms can empower individuals to navigate the gift transfer process with confidence.

Misconceptions

Understanding the California Gift Deed form can be challenging due to several misconceptions. Here are eight common misunderstandings:

- All gifts of property require a Gift Deed. Many people believe that any transfer of property as a gift necessitates a Gift Deed. However, small gifts or personal property transfers may not require this formal documentation.

- A Gift Deed can be revoked at any time. Some individuals think that once a Gift Deed is signed, it can easily be undone. In reality, revoking a Gift Deed often requires legal action and can be complicated.

- The donor must be present during the signing. There is a misconception that the donor must physically be present when the recipient signs the Gift Deed. In fact, the donor can sign the deed in advance, as long as it is properly notarized.

- A Gift Deed is the same as a Quitclaim Deed. Many assume that a Gift Deed and a Quitclaim Deed serve the same purpose. While both transfer property, a Gift Deed specifically indicates that the transfer is a gift without any exchange of money.

- Gift Deeds are only for family members. Some people think that Gift Deeds can only be used to transfer property between family members. However, friends or even charitable organizations can also be recipients of a Gift Deed.

- There are no tax implications for using a Gift Deed. It is a common belief that transferring property through a Gift Deed is tax-free. In reality, the IRS has gift tax regulations that may apply, depending on the value of the property.

- Gift Deeds can be used for any type of property. Some individuals believe that Gift Deeds can be used for all types of property. However, certain types of property, like real estate encumbered by a mortgage, may have restrictions.

- Once a Gift Deed is filed, the recipient has full control immediately. Many think that filing a Gift Deed gives the recipient immediate control over the property. While the deed transfers ownership, the recipient may still need to address any existing liens or encumbrances.

Clarifying these misconceptions can help individuals navigate the process of transferring property in California more effectively.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Gift Deed form is used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | This form is governed by California Civil Code Section 11911, which outlines the requirements for gift deeds in the state. |

| Requirements | To be valid, the gift deed must be signed by the donor and notarized, ensuring that the transfer is legally recognized. |

| Tax Implications | Gifts of property may have tax implications, including potential gift tax responsibilities for the donor, depending on the value of the property. |

Key takeaways

When filling out and using the California Gift Deed form, it's important to keep several key points in mind. Here are five essential takeaways:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. It’s a legal way to give property as a gift.

- Complete Information: Ensure that all required fields are filled out accurately. This includes the names of the giver and receiver, property description, and the date of the gift.

- Signatures Matter: Both the giver and the receiver must sign the deed. Notarization is also required to validate the document.

- Record the Deed: After completing the Gift Deed, file it with the county recorder’s office. This step is crucial to make the transfer official and public.

- Tax Implications: Be aware that gifting property may have tax consequences. Consult with a tax professional to understand any potential liabilities.