Official Durable Power of Attorney Form for California

The California Durable Power of Attorney form serves as a critical legal instrument that empowers individuals to designate another person to manage their financial and legal affairs in the event they become incapacitated. This form is particularly significant because it remains effective even if the principal, the individual granting the authority, loses the ability to make decisions due to illness or injury. By executing this document, individuals can ensure that their chosen agent can handle a variety of tasks, including managing bank accounts, paying bills, and making investment decisions, thereby providing peace of mind during uncertain times. The form also allows for the specification of the scope of authority granted to the agent, which can be broad or limited based on the principal's preferences. Furthermore, it is essential for the principal to choose a trustworthy and competent agent, as this person will have significant control over the principal's financial well-being. Understanding the nuances of the Durable Power of Attorney form, including its requirements and implications, is vital for anyone considering this important legal tool in California.

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it’s important to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do read the instructions carefully before starting. Understanding the requirements can save you time and prevent mistakes.

- Do choose a trustworthy agent. This person will have significant authority over your financial and legal matters.

- Do ensure the form is signed in front of a notary public. This adds an extra layer of validity to your document.

- Do keep a copy of the completed form in a safe place. You may need to refer to it in the future.

- Do review and update the form as needed. Life changes, and your power of attorney should reflect that.

- Don't rush through the form. Taking your time can help you avoid errors that could lead to complications later.

- Don't appoint someone who may have conflicts of interest. Your agent should act in your best interest without personal gain.

- Don't leave any sections blank. Incomplete forms can be challenged or deemed invalid.

- Don't forget to discuss your decisions with your agent. Clear communication can prevent misunderstandings down the line.

- Don't assume that a previous power of attorney remains valid. Always check if updates are necessary.

How to Use California Durable Power of Attorney

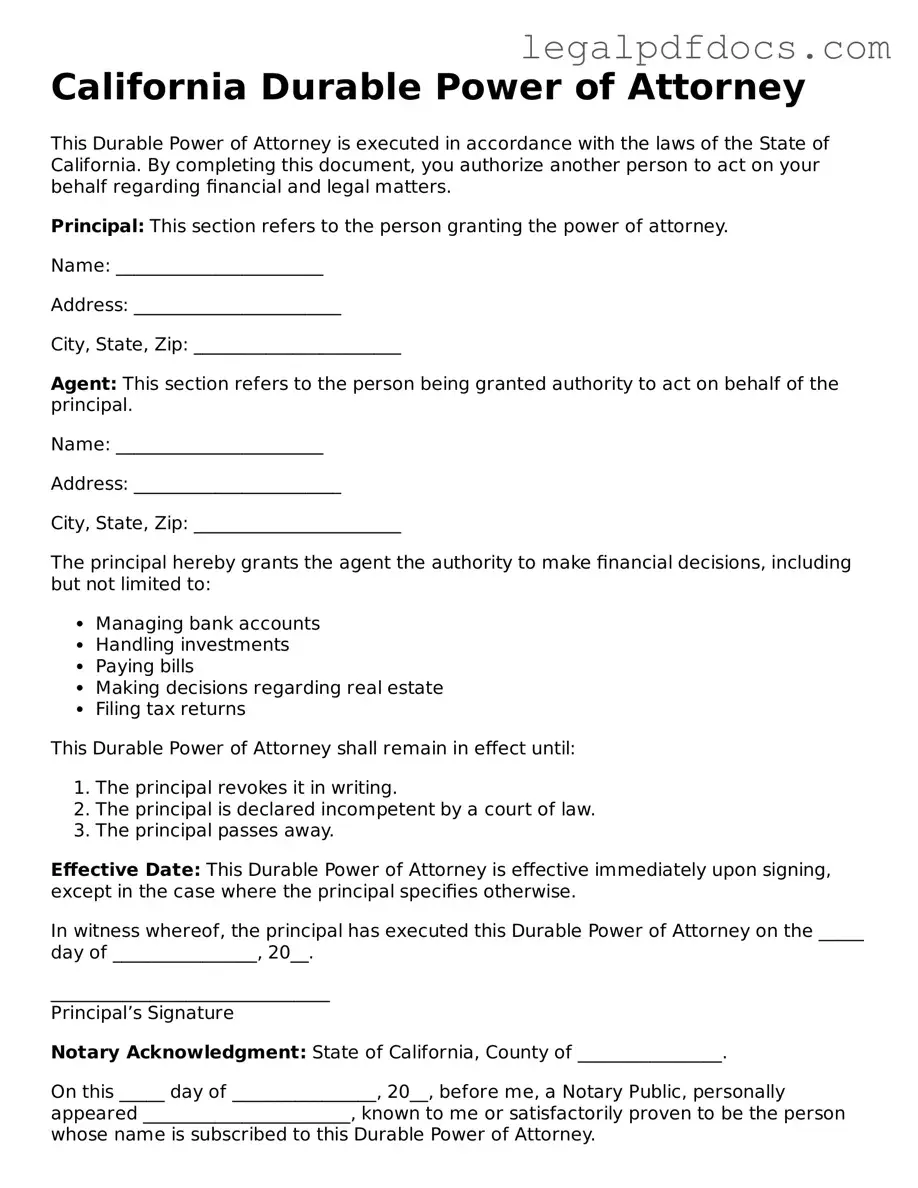

Completing the California Durable Power of Attorney form is a straightforward process that allows you to designate someone to manage your financial affairs if you become unable to do so. Follow the steps below to ensure you fill out the form correctly.

- Obtain the California Durable Power of Attorney form. You can find it online or at legal stationery stores.

- Fill in your name and address at the top of the form. This identifies you as the principal.

- Designate your agent by writing their name and address in the specified section. This person will act on your behalf.

- Specify the powers you are granting to your agent. You can choose general powers or limit them to specific tasks.

- Include any additional instructions or limitations if necessary. Be clear to avoid confusion later.

- Sign and date the form in the presence of a notary public. This step is crucial for the document's validity.

- Provide copies of the signed form to your agent and any relevant institutions, such as banks or healthcare providers.

Once you have completed the form, it is important to keep it in a safe place and inform your agent where to find it. This ensures that your wishes are honored when the time comes.

Find Popular Durable Power of Attorney Forms for US States

How to Get Power of Attorney in Florida - It serves as a safeguard against potential disputes among family members during critical times.

What Does a Durable Power of Attorney Allow You to Do - A trusted agent can prevent fraud or misuse of your finances while you’re incapacitated.

Illinois Power of Attorney for Property 2023 - This document can enhance your peace of mind concerning future uncertainties.

Michigan Durable Power of Attorney Form - The process of establishing this document is relatively straightforward, making it accessible to many.

Documents used along the form

When creating a California Durable Power of Attorney (DPOA), several other forms and documents may be beneficial to ensure comprehensive legal planning. Each of these documents serves a unique purpose and can complement the DPOA in managing your affairs effectively.

- Advance Healthcare Directive: This document allows individuals to specify their healthcare preferences in case they become unable to communicate their wishes. It combines both a living will and a power of attorney for healthcare decisions.

- Financial Power of Attorney: Similar to the DPOA, this document specifically grants someone the authority to manage financial matters. It can be tailored for specific transactions or be broad in scope.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. This document can help avoid probate and ensures that assets are managed according to the individual’s wishes after death.

- Will: A will outlines how a person’s assets should be distributed after their death. It can also designate guardians for minor children and is essential for ensuring that personal wishes are honored.

- HIPAA Release Form: This form allows individuals to authorize specific people to access their medical records. It is crucial for ensuring that those designated can make informed healthcare decisions.

- Beneficiary Designations: Many financial accounts and insurance policies allow individuals to name beneficiaries. Ensuring these designations are up-to-date can help streamline the transfer of assets upon death.

- Property Deeds: If real estate is involved, updating property deeds to reflect ownership or to place property into a trust can be essential for estate planning.

- Guardianship Designation: For individuals with minor children, this document allows parents to designate guardians in case of their untimely passing, ensuring that children are cared for by trusted individuals.

Each of these documents plays a vital role in comprehensive estate planning. By considering and utilizing them alongside the California Durable Power of Attorney, individuals can better prepare for the future and ensure that their wishes are respected in various situations.

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) form can be challenging, and misconceptions often lead to confusion. Here are ten common misunderstandings about this important legal document:

- It only applies to financial decisions. Many people think a DPOA is limited to financial matters. In reality, it can also cover health care decisions, depending on how it is drafted.

- It becomes effective only when the principal is incapacitated. A DPOA can be set up to take effect immediately or only upon the principal's incapacitation. The choice is up to the individual creating the document.

- Once signed, it cannot be changed or revoked. This is not true. A principal can revoke or amend their DPOA at any time as long as they are mentally competent.

- All DPOAs are the same. There are different types of DPOAs, and they can vary significantly based on the specific powers granted and the needs of the principal.

- Only lawyers can create a DPOA. While it is advisable to consult with a legal professional, individuals can create a DPOA on their own using templates or forms available online.

- A DPOA automatically includes the power to make medical decisions. A DPOA for finances does not include medical decision-making authority unless explicitly stated in the document.

- It expires after a certain period. A DPOA remains valid until the principal revokes it, the principal passes away, or a court invalidates it.

- All agents are required to act in the best interest of the principal. While agents have a fiduciary duty to act in good faith, not all agents are held to the same standards unless specified in the DPOA.

- Family members automatically have authority to act on behalf of the principal. Without a DPOA in place, family members do not have legal authority to make decisions for someone who is incapacitated.

- A DPOA is only necessary for the elderly. Anyone, regardless of age, can benefit from having a DPOA in place, especially if they have specific wishes regarding their health care or finances.

Understanding these misconceptions can help individuals make informed decisions about their legal planning and ensure their wishes are respected.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual to appoint someone else to manage their financial and legal affairs if they become incapacitated. |

| Governing Law | The California Durable Power of Attorney is governed by the California Probate Code, specifically sections 4000 to 4545. |

| Durability | This type of power of attorney remains effective even if the person who created it becomes mentally incapacitated. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

Key takeaways

When considering a California Durable Power of Attorney (DPOA), it's important to understand its purpose and how to effectively complete and use the form. Here are some key takeaways:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select a trusted individual as your agent. This person will have significant authority, so ensure they are responsible and reliable.

- Be Specific: Clearly outline the powers you are granting. You can specify general powers or limit them to particular areas, such as real estate or banking.

- Sign and Date: To make the DPOA valid, you must sign and date the document in the presence of a notary public or two witnesses, depending on your preferences.

- Keep Copies Accessible: Once completed, keep the original document in a safe place and provide copies to your agent, family members, and financial institutions as needed.

Filling out and using a Durable Power of Attorney in California can provide peace of mind. It ensures that your financial and legal matters are handled according to your wishes, even if you are unable to manage them yourself.