Official Deed Form for California

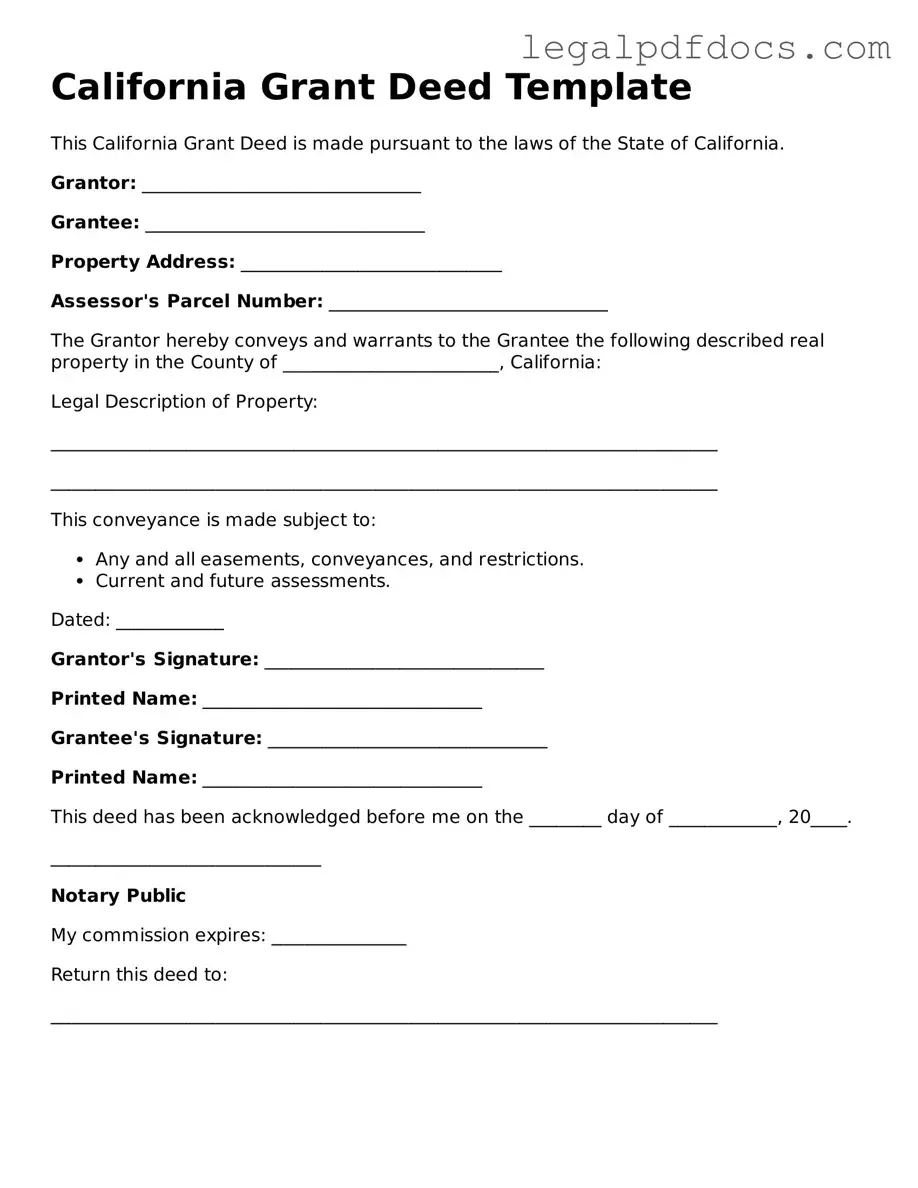

The California Deed form plays a crucial role in real estate transactions, serving as a legal document that facilitates the transfer of property ownership. This form is essential for ensuring that the transfer is executed properly and is recognized by the state. Within the deed, key elements such as the names of the grantor and grantee, a detailed description of the property, and the type of deed being utilized—whether it be a grant deed, quitclaim deed, or another variant—are clearly outlined. Additionally, the form requires the inclusion of signatures and may necessitate notarization to validate the transfer. Understanding the nuances of the California Deed form is vital for both buyers and sellers, as it not only protects their interests but also ensures compliance with state laws. By grasping the major aspects of this document, individuals can navigate the complexities of property transactions with greater confidence and clarity.

Dos and Don'ts

When filling out the California Deed form, consider the following guidelines:

- Do ensure that all names are spelled correctly. Accurate spelling is crucial for legal documents.

- Do provide a complete and accurate description of the property. This includes the address and any legal descriptions necessary.

- Don't leave any required fields blank. Incomplete forms may lead to delays or rejections.

- Don't forget to have the form notarized. A notarized signature is often required for the deed to be valid.

How to Use California Deed

After you have gathered the necessary information, you are ready to fill out the California Deed form. This process involves providing accurate details to ensure the transfer of property is legally recognized. Follow these steps carefully to complete the form correctly.

- Begin by entering the current date at the top of the form.

- Fill in the name of the grantor (the person transferring the property). Include their full legal name.

- Provide the address of the grantor, ensuring it is complete with city, state, and ZIP code.

- Next, enter the name of the grantee (the person receiving the property). Use their full legal name as well.

- Include the address of the grantee, again making sure it is complete with city, state, and ZIP code.

- Describe the property being transferred. Include the legal description as required, such as lot number, block number, or any other identifying information.

- Indicate the type of deed being used, such as a grant deed or quitclaim deed.

- Sign the form where indicated. The grantor must sign to validate the deed.

- Have the signature notarized. A notary public will need to witness the signing and provide their seal.

- Finally, submit the completed form to the appropriate county recorder's office for filing.

Find Popular Deed Forms for US States

Contract for Deed Texas Template - Several types of deeds exist to accommodate different transaction scenarios.

How to Transfer a Deed in Kansas - A warranty deed guarantees that the seller has clear title to the property being sold.

Deed for Property - Recording a deed with the local government office helps establish public record of the ownership transfer.

Quit Claim Deed Georgia - This form may include warranties or guarantees.

Documents used along the form

When handling property transactions in California, several forms and documents may accompany the California Deed form. Each of these documents serves a specific purpose and helps ensure that the transfer of property is completed smoothly and legally. Below is a list of common documents often used in conjunction with a deed.

- Grant Deed: This document transfers ownership of real property and provides certain guarantees to the buyer about the title.

- Quitclaim Deed: This form allows a person to transfer their interest in a property to another without making any guarantees about the title.

- Title Report: A report that outlines the legal status of the property, including any liens, easements, or other claims against it.

- Preliminary Change of Ownership Report: This form must be filed with the county assessor's office when property changes hands, helping to update tax records.

- Property Tax Bill: This document provides information about the current property taxes owed and ensures that the new owner is aware of their tax obligations.

- Affidavit of Death: Used when transferring property after the death of the owner, this document confirms the owner's passing and the rightful heirs.

- Trustee's Deed: This deed is used when property is transferred by a trustee, often in accordance with a trust agreement.

- Bill of Sale: While not always necessary for real estate, this document can be used to transfer personal property associated with the real estate transaction.

Understanding these documents can help facilitate a smoother property transaction process. Each form plays a crucial role in ensuring that ownership is properly transferred and that all legal requirements are met.

Misconceptions

Understanding the California Deed form can be challenging. Here are eight common misconceptions about it:

- All deeds are the same. Different types of deeds serve different purposes. For instance, a grant deed conveys property ownership, while a quitclaim deed transfers any interest the grantor may have without guaranteeing it.

- A deed must be notarized to be valid. While notarization is recommended, not all deeds require it to be legally binding. However, having a notary can help avoid disputes later on.

- Deeds do not need to be recorded. Recording a deed is crucial. It provides public notice of ownership and protects against claims from third parties.

- Only attorneys can prepare a deed. While it’s wise to consult a lawyer, individuals can prepare their own deeds as long as they follow the legal requirements.

- Once a deed is signed, it cannot be changed. Deeds can be amended or revoked, but the process must be done according to state laws and usually requires a new deed.

- All property transfers require a deed. Some transfers, such as those between spouses or through inheritance, may not require a deed, depending on the circumstances.

- Deeds are only for real estate. While commonly associated with real estate, deeds can also apply to other types of property, such as vehicles.

- Once a deed is recorded, it cannot be contested. Even recorded deeds can be challenged in court under certain conditions, such as fraud or lack of capacity.

By understanding these misconceptions, individuals can navigate property transactions more effectively and protect their interests.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Deed form is a legal document used to transfer ownership of real property in California. |

| Types of Deeds | Common types include Grant Deeds, Quitclaim Deeds, and Warranty Deeds, each serving different purposes in property transfer. |

| Governing Law | The California Civil Code governs the use and requirements of deed forms in the state. |

| Signature Requirements | The deed must be signed by the grantor, and notarization is typically required to ensure validity. |

| Recording | To provide public notice of the transfer, the deed should be recorded with the county recorder's office where the property is located. |

Key takeaways

Filling out and using the California Deed form is an essential process for transferring property ownership. Here are some key takeaways to consider:

- Accurate Information is Crucial: Ensure that all details, such as names, addresses, and property descriptions, are correct. Errors can lead to legal complications.

- Signature Requirements: The deed must be signed by the grantor (the person transferring the property). In some cases, notarization is also required to validate the document.

- Recording the Deed: After completing the form, it must be filed with the county recorder’s office. This step is vital to make the transfer official and protect the new owner’s rights.

- Understanding Different Types of Deeds: Familiarize yourself with various deed types, such as grant deeds and quitclaim deeds, as each serves different purposes and offers varying levels of protection.