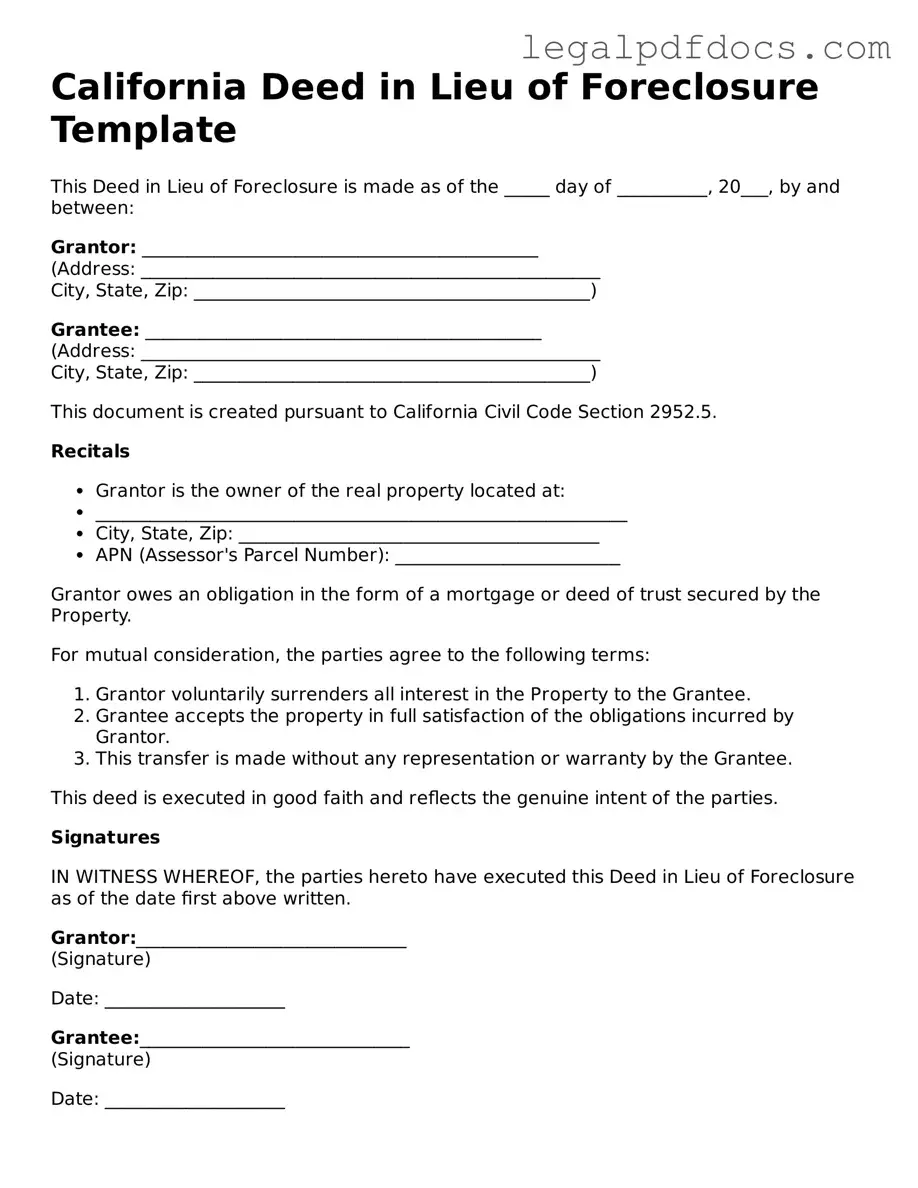

Official Deed in Lieu of Foreclosure Form for California

The California Deed in Lieu of Foreclosure form serves as a vital tool for homeowners facing financial difficulties. It provides a way for them to transfer ownership of their property back to the lender, thereby avoiding the lengthy and often stressful foreclosure process. This voluntary agreement benefits both parties: homeowners can relieve themselves of the burden of an unaffordable mortgage, while lenders can recover their investment more efficiently. The form outlines essential details, including the property description, the parties involved, and any outstanding obligations. Additionally, it addresses the homeowner's rights and responsibilities throughout the process. By signing this document, homeowners can take a proactive step toward regaining control of their financial situation, while lenders can streamline their asset recovery efforts. Understanding the nuances of this form is crucial for anyone considering this option in California.

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do ensure that all parties involved in the transaction are correctly identified.

- Do provide accurate property details, including the legal description.

- Do include the date of the transaction clearly.

- Do sign the document in the presence of a notary public.

- Do keep copies of the completed form for your records.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't use outdated forms; always use the latest version.

- Don't forget to review the document for errors before submission.

- Don't submit the form without ensuring all signatures are obtained.

How to Use California Deed in Lieu of Foreclosure

After completing the California Deed in Lieu of Foreclosure form, it is important to ensure that all parties involved understand their rights and responsibilities. Once the form is filled out and signed, it will need to be recorded with the county recorder's office. This step is crucial for making the deed official and for protecting the interests of both the borrower and the lender.

- Obtain the California Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the name of the borrower(s) in the designated section at the top of the form.

- Provide the address of the property being conveyed.

- Include the legal description of the property. This can typically be found on the property deed or tax documents.

- Indicate the name of the lender or the institution receiving the property.

- Sign the form in the presence of a notary public. Ensure all borrower signatures are present.

- Have the notary public complete their section, confirming the identities of the signers.

- Make copies of the completed form for your records.

- Submit the original deed to the county recorder's office for recording.

- Confirm that the deed has been recorded and obtain a copy for your records.

Find Popular Deed in Lieu of Foreclosure Forms for US States

Foreclosure in Georgia - A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure.

Deed in Lieu Vs Foreclosure - This approach often requires less paperwork compared to traditional foreclosures.

Will I Owe Money After a Deed in Lieu of Foreclosure - Executing this deed should be accompanied by thorough documentation of the homeowner’s financial challenges.

Documents used along the form

A Deed in Lieu of Foreclosure is a useful tool for homeowners facing financial difficulties. It allows them to transfer ownership of their property to the lender to avoid the lengthy and often stressful foreclosure process. Along with this form, several other documents may be needed to ensure a smooth transaction. Below is a list of related documents that are commonly used in conjunction with the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes to the original loan terms. It may include adjustments to the interest rate or payment schedule, helping homeowners manage their financial obligations more effectively.

- Notice of Default: This is a formal notification sent to the borrower indicating that they have defaulted on their mortgage payments. It serves as a warning and typically precedes foreclosure proceedings.

- Property Inspection Report: A report that assesses the condition of the property. Lenders often require this to understand any repairs or issues that may affect the property's value.

- Title Search Report: This document reveals the legal ownership of the property and any liens or encumbrances. It ensures that the lender is aware of any claims against the property before accepting the deed.

- Release of Liability: This agreement frees the homeowner from further obligations related to the mortgage once the deed is transferred. It protects them from future claims by the lender.

- Settlement Statement: A detailed account of all financial transactions involved in the deed transfer. It includes costs, fees, and any payments made by the borrower or lender.

- Affidavit of Title: A sworn statement by the homeowner confirming their ownership of the property and disclosing any claims or issues that may affect the title.

- Transfer Tax Declaration: This document may be required by the county to report the transfer of property ownership. It helps ensure that any applicable taxes are paid during the transaction.

Understanding these documents can simplify the process of a Deed in Lieu of Foreclosure. Each plays a vital role in protecting both the homeowner and the lender, ensuring that the transfer of property ownership is clear and legally binding.

Misconceptions

When it comes to the California Deed in Lieu of Foreclosure, there are several common misconceptions that can lead to confusion. Understanding these misconceptions can help homeowners make informed decisions during difficult financial times.

- It eliminates all debt associated with the mortgage. While a deed in lieu can relieve you of the property and mortgage, it does not automatically erase all debts. You may still be responsible for any remaining balances or other obligations.

- It is a quick and easy process. Although a deed in lieu can be faster than a foreclosure, it still requires a thorough review by the lender. The process can take time and may involve various steps before completion.

- Homeowners can just hand over the keys. Simply returning the keys to the lender does not suffice. A formal deed in lieu agreement must be signed to transfer ownership legally.

- It will not affect your credit score. A deed in lieu will impact your credit score, though typically less severely than a foreclosure. However, it is still considered a negative mark.

- All lenders accept deeds in lieu. Not every lender offers this option. Some may prefer to proceed with foreclosure, so it’s essential to check with your lender first.

- It is the same as a short sale. A deed in lieu and a short sale are different. A short sale involves selling the property for less than the mortgage balance, while a deed in lieu transfers the property back to the lender without a sale.

- It absolves you of all future liability. Depending on the terms of the agreement, you might still face tax implications or other liabilities after the deed in lieu is executed.

- It can be done without legal advice. While it’s possible to navigate the process without legal counsel, having an attorney can help ensure that your rights are protected and that you understand all implications.

- It is only for homeowners in extreme financial distress. While often used in dire situations, a deed in lieu can also be a strategic choice for homeowners looking to avoid the lengthy foreclosure process.

- Once agreed, the lender cannot change their mind. Even after a deed in lieu is agreed upon, the lender may still have conditions or requirements that need to be met before finalizing the agreement.

By clarifying these misconceptions, homeowners can better navigate the complexities surrounding a deed in lieu of foreclosure and make choices that align with their financial goals.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by California Civil Code Sections 1475-1480. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify for this option. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and its negative impact on credit scores. |

| Process | Borrowers must submit a request to the lender, who will review their financial situation before accepting the deed. |

| Documentation | Borrowers typically need to provide financial statements, hardship letters, and other relevant documents to the lender. |

| Deficiency Judgments | In California, lenders may not pursue deficiency judgments against borrowers who complete a deed in lieu of foreclosure. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences related to forgiven debt. |

| Impact on Credit | A deed in lieu of foreclosure will still impact a borrower’s credit score, but generally less severely than a foreclosure. |

| Alternatives | Other options include loan modifications, short sales, or bankruptcy, which may be more suitable depending on individual circumstances. |

Key takeaways

When dealing with the California Deed in Lieu of Foreclosure form, it is essential to understand several key points to ensure a smooth process. Here are some important takeaways:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure. This can help mitigate the impact on the homeowner's credit score.

- Eligibility Requirements: Not all homeowners qualify for this option. Lenders typically require that the property is not encumbered by other liens and that the homeowner is facing financial hardship.

- Negotiating Terms: Before filling out the form, homeowners should negotiate with their lender. This may include discussing potential forgiveness of remaining debt or any moving assistance that could be offered.

- Complete the Form Accurately: It’s crucial to fill out the Deed in Lieu of Foreclosure form correctly. Any inaccuracies can lead to delays or rejection of the request.

- Consulting Professionals: Seeking advice from a real estate attorney or a housing counselor can provide valuable insights and help navigate the process effectively.

- Implications for Future Housing: Homeowners should be aware that a Deed in Lieu of Foreclosure may still affect future housing opportunities, including rental agreements and mortgage applications.

By keeping these points in mind, homeowners can better prepare for the process and make informed decisions regarding their property and financial future.