Fill Out a Valid California Death of a Joint Tenant Affidavit Template

The California Death of a Joint Tenant Affidavit form serves as a crucial legal document for individuals navigating the complexities of property ownership after the passing of a joint tenant. This form is particularly important in situations where two or more individuals hold title to a property together, and one of them has died. By completing this affidavit, the surviving joint tenant can effectively establish their sole ownership of the property, thereby simplifying the transfer process and avoiding potential disputes. The form typically requires essential information, such as the names of the deceased and surviving joint tenants, details about the property in question, and a declaration confirming the death. Additionally, it may necessitate the inclusion of supporting documents, such as a death certificate, to validate the claim. Understanding the nuances of this form is vital for ensuring a smooth transition of property rights, allowing the surviving tenant to maintain their investment without unnecessary legal hurdles.

Dos and Don'ts

When filling out the California Death of a Joint Tenant Affidavit form, it is essential to approach the task with care and attention to detail. Here are six important dos and don’ts to consider:

- Do ensure that all information is accurate and complete before submission.

- Do provide a certified copy of the death certificate as required.

- Do sign the affidavit in the presence of a notary public to validate the document.

- Do check for any specific local requirements that may apply to your situation.

- Don’t leave any sections blank; fill in all necessary fields.

- Don’t forget to keep a copy of the completed affidavit for your records.

How to Use California Death of a Joint Tenant Affidavit

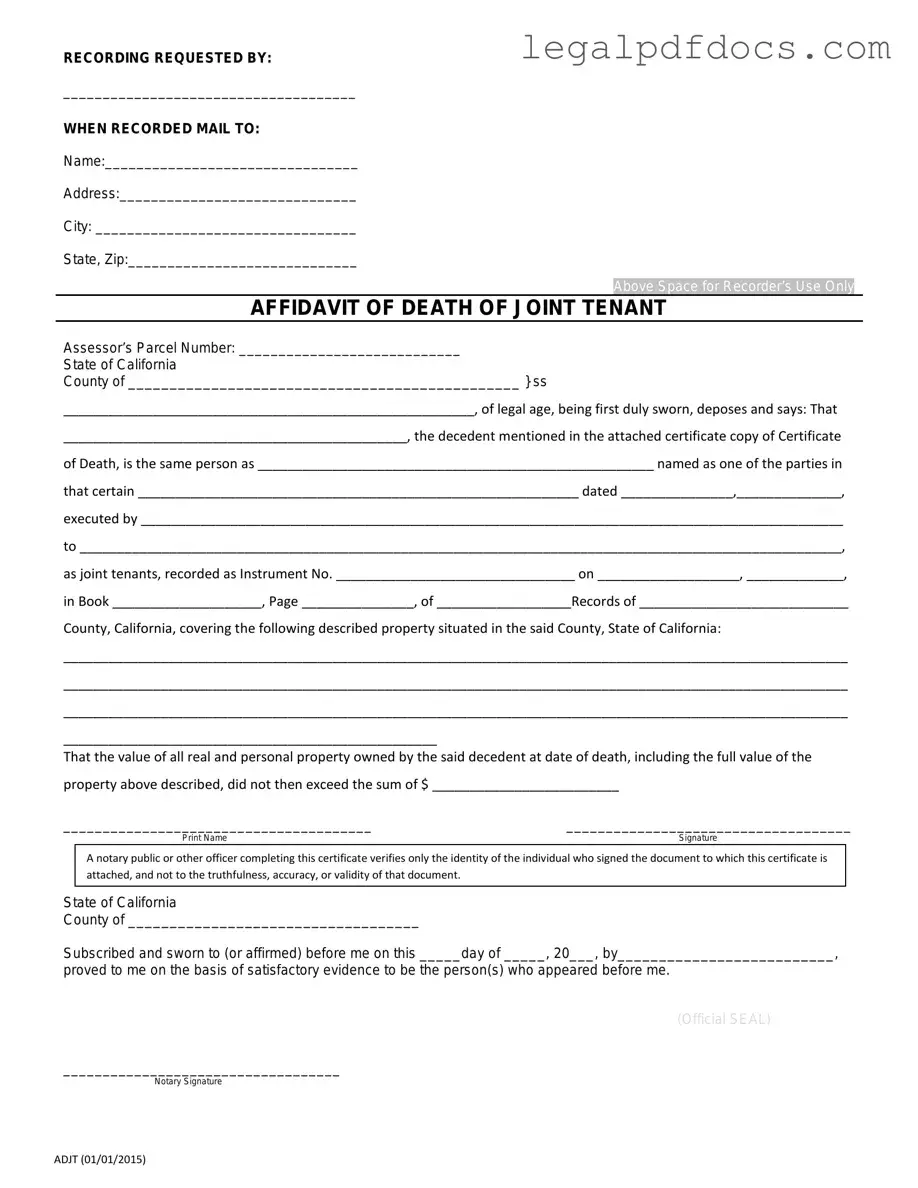

After gathering the necessary information, you will be ready to complete the California Death of a Joint Tenant Affidavit form. This form is essential for transferring property ownership when a joint tenant passes away. Follow these steps carefully to ensure accuracy.

- Begin by entering the name of the deceased joint tenant in the first section of the form.

- Provide the date of death. This information is crucial for the affidavit.

- Next, include the address of the property that is subject to the affidavit.

- List the names of all surviving joint tenants. Ensure that you include their full names as they appear on the property title.

- In the designated area, indicate your relationship to the deceased joint tenant. This helps establish your authority to complete the affidavit.

- Sign and date the affidavit at the bottom. Your signature confirms that the information provided is true and correct.

- Have the affidavit notarized. This step is necessary for the document to be legally binding.

Once the form is completed and notarized, it can be filed with the appropriate county recorder's office. This will officially update the property records to reflect the change in ownership.

More PDF Templates

Car Repair Estimate Template - Understand expected repair costs with a detailed estimate.

Miscarriage Discharge Papers - It reinforces the importance of following state-specific regulations related to fetal loss.

Odometer Disclosure Statement Texas - Failure to complete this form correctly can result in legal penalties.

Documents used along the form

When a joint tenant passes away in California, several forms and documents may be required to manage the transfer of property. These documents help clarify ownership and ensure that the remaining joint tenant can assert their rights. Below is a list of common forms used alongside the California Death of a Joint Tenant Affidavit.

- Grant Deed: This document transfers property ownership from one party to another. It is often used to formally record the change in ownership after the death of a joint tenant.

- Death Certificate: A certified copy of the deceased joint tenant's death certificate is typically required to validate the claim and support the affidavit.

- Title Report: This report provides information about the property’s title, including any liens or encumbrances, which may affect the transfer process.

- Property Tax Bill: A recent property tax bill may be necessary to confirm the ownership and ensure that taxes are current before transferring the property.

- Living Trust Documents: If the deceased had a living trust, these documents may need to be reviewed to determine how the property is to be handled after death.

- Will: The deceased’s will may provide additional instructions regarding the property and could influence the transfer process.

- Notice of Death: This document may be filed to officially notify relevant parties, including creditors, of the joint tenant's passing.

- Affidavit of Identity: This affidavit may be required to confirm the identity of the surviving joint tenant, especially if there are discrepancies in records.

- Change of Ownership Statement: This form is often required by local tax authorities to update the ownership records following a transfer.

- Transfer on Death Deed (TODD): If applicable, this document allows property to transfer directly to a beneficiary upon the owner's death, bypassing probate.

Understanding these documents can simplify the process of transferring property after the death of a joint tenant. Each form plays a crucial role in ensuring a smooth transition and protecting the rights of the surviving owner.

Misconceptions

The California Death of a Joint Tenant Affidavit form is a crucial document in the process of transferring property ownership after the death of a joint tenant. However, several misconceptions surround this form. Here are five common misunderstandings:

- 1. The affidavit is only needed for real estate. Many believe this form is exclusively for real estate transactions. In reality, it can also apply to other types of property held in joint tenancy, such as bank accounts or vehicles.

- 2. Only the surviving joint tenant can file the affidavit. Some think that only the surviving joint tenant has the authority to file this form. However, an authorized representative or executor can also submit the affidavit on behalf of the surviving tenant.

- 3. The affidavit eliminates the need for a will. A common misconception is that filing this affidavit negates the need for a will. While it facilitates the transfer of joint tenancy property, a will is still important for addressing other assets and ensuring the deceased's wishes are honored.

- 4. The affidavit can be filed anytime after death. People often assume there is no time limit for filing the affidavit. In California, it is advisable to file the affidavit promptly after the joint tenant's death to avoid complications in the transfer process.

- 5. The affidavit guarantees a smooth transfer of property. While the affidavit is a significant step, it does not guarantee a hassle-free transfer. Potential disputes among heirs or issues with the property title can still arise, necessitating further legal action.

Understanding these misconceptions can help individuals navigate the process more effectively and ensure a smoother transition of property ownership.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit is used to transfer property ownership when one joint tenant passes away. |

| Governing Law | This form is governed by California Probate Code Section 5600 et seq., which outlines the rights of joint tenants and the transfer of property upon death. |

| Eligibility | Only the surviving joint tenant(s) can file this affidavit to claim full ownership of the property after the death of a co-tenant. |

| Filing Requirements | The affidavit must be filed with the county recorder's office where the property is located to update the title records. |

| Supporting Documents | A certified copy of the deceased joint tenant's death certificate is typically required to accompany the affidavit. |

Key takeaways

When dealing with the California Death of a Joint Tenant Affidavit form, it’s important to understand a few key points to ensure the process goes smoothly. Here are some essential takeaways:

- The affidavit is used to establish the death of a joint tenant and to transfer their share of the property to the surviving joint tenant.

- Filling out the form accurately is crucial. Double-check all names, dates, and property details to avoid delays.

- A certified copy of the deceased joint tenant’s death certificate must be attached to the affidavit.

- Both the surviving joint tenant and the notary public must sign the affidavit. This helps verify its authenticity.

- Once completed, the affidavit should be filed with the county recorder’s office where the property is located.

- Using the affidavit can simplify the transfer process, avoiding lengthy probate proceedings.

- Consulting with a legal professional may be beneficial, especially if there are complications or disputes regarding the property.