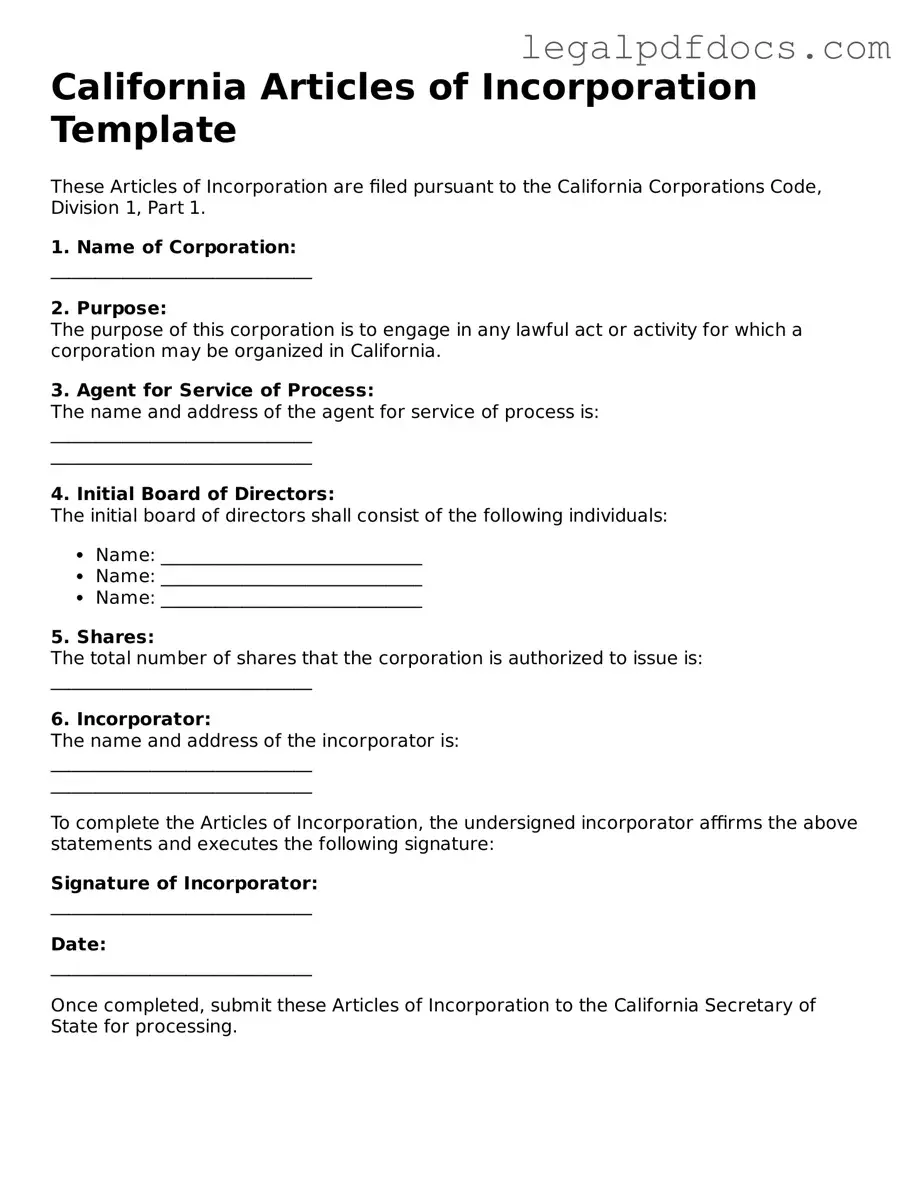

Official Articles of Incorporation Form for California

The California Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form serves as the foundation for creating a legal entity, outlining essential information about the corporation, such as its name, purpose, and the address of its initial registered office. It also includes details about the corporation's stock structure, specifying the number of shares the corporation is authorized to issue and the classes of stock, if applicable. Additionally, the form requires the names and addresses of the initial directors, who will oversee the corporation's operations during its early stages. By completing and filing this form with the California Secretary of State, individuals can initiate the incorporation process, paving the way for limited liability protection and the ability to conduct business as a formal entity. Understanding the components of this form is essential for ensuring compliance with state regulations and setting a solid foundation for future growth.

Dos and Don'ts

When filling out the California Articles of Incorporation form, there are several important guidelines to follow. Adhering to these can help ensure that your application is processed smoothly.

- Do provide accurate information about your corporation's name, ensuring it is unique and complies with state regulations.

- Do include the purpose of your corporation clearly, as this helps define your business activities.

- Do list the names and addresses of the initial directors accurately, as this information is crucial for the formation of your board.

- Do ensure that the registered agent's information is correct, as this person will receive legal documents on behalf of the corporation.

- Don't leave any sections of the form blank; incomplete forms may lead to delays or rejection.

- Don't use abbreviations or informal language in your descriptions; clarity and professionalism are essential.

- Don't forget to sign and date the form; an unsigned document will not be accepted.

By following these guidelines, individuals can navigate the process of filing the Articles of Incorporation more effectively.

How to Use California Articles of Incorporation

After completing the California Articles of Incorporation form, you will need to submit it to the California Secretary of State along with the appropriate filing fee. This process officially establishes your corporation in California.

- Obtain the Articles of Incorporation form from the California Secretary of State’s website or your local office.

- Fill in the name of your corporation. Ensure it complies with California naming requirements.

- Provide the purpose of your corporation. A brief description of your business activities will suffice.

- List the name and address of your corporation's initial agent for service of process. This person will receive legal documents on behalf of the corporation.

- Specify the number of shares your corporation is authorized to issue. If applicable, indicate the par value of those shares.

- Include the names and addresses of the initial directors of the corporation.

- Sign and date the form. This signature must be from an individual authorized to sign on behalf of the corporation.

- Review the completed form for accuracy and completeness.

- Prepare the filing fee, which can vary based on your corporation type and the services you choose.

- Submit the form and payment to the California Secretary of State, either by mail or in person.

Find Popular Articles of Incorporation Forms for US States

Illinois Articles of Incorporation - It may include the rights and preferences for different classes of stock.

How Much Does a Llc Cost in Texas - The form may require a description of the business activities of the corporation.

Documents used along the form

When forming a corporation in California, the Articles of Incorporation is a foundational document. However, several other forms and documents are often necessary to complete the incorporation process and ensure compliance with state regulations. Below is a list of essential documents that are typically used in conjunction with the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for the corporation's governance. It details the roles of directors and officers, how meetings are conducted, and other operational guidelines.

- Statement of Information: Required to be filed within 90 days of incorporation, this document provides the state with updated information about the corporation, including its address, management, and registered agent.

- Employer Identification Number (EIN): Issued by the IRS, an EIN is necessary for tax purposes and is often required to open a business bank account. It serves as the corporation's unique identifier for federal tax matters.

- Initial Board of Directors Meeting Minutes: Documenting the first meeting of the board, this record establishes key decisions made at the onset, such as the appointment of officers and the adoption of bylaws.

- Stock Certificates: If the corporation issues stock, these certificates serve as proof of ownership for shareholders. They include essential details like the number of shares and the name of the shareholder.

- Shareholder Agreement: This optional document outlines the rights and responsibilities of shareholders, including how shares can be transferred and what happens in the event of a shareholder's death or departure.

- Business Licenses and Permits: Depending on the nature of the business, various local, state, or federal licenses may be required to operate legally. These can include permits for zoning, health, and safety compliance.

- Resolutions: Written records of decisions made by the board or shareholders, resolutions document significant actions such as approving contracts, borrowing funds, or making major business decisions.

Understanding and preparing these documents is crucial for a successful incorporation process in California. Each plays a specific role in establishing the corporation's legal framework and ensuring compliance with applicable laws. Proper attention to these details can facilitate smooth operations and safeguard the interests of all parties involved.

Misconceptions

When it comes to the California Articles of Incorporation form, several misconceptions can lead to confusion. Here are five common myths and the facts that clarify them:

-

Misconception 1: Anyone can file Articles of Incorporation without restrictions.

In reality, only individuals or entities that meet specific criteria can file. Typically, at least one person must be designated as an incorporator, and the business must have a valid purpose under California law.

-

Misconception 2: The Articles of Incorporation are the only document needed to start a business.

This is not true. While the Articles of Incorporation are essential for forming a corporation, additional documents such as bylaws, initial reports, and permits may also be necessary depending on the business type and location.

-

Misconception 3: Filing Articles of Incorporation guarantees protection from personal liability.

While incorporating can provide a layer of protection, it does not eliminate personal liability in all situations. Personal guarantees, fraud, or failure to follow corporate formalities can still expose individuals to liability.

-

Misconception 4: The process of filing Articles of Incorporation is quick and easy.

The process can be straightforward, but it requires careful attention to detail. Mistakes in the form can lead to delays or rejection, so it’s important to ensure all information is accurate and complete.

-

Misconception 5: Once filed, Articles of Incorporation cannot be changed.

This is incorrect. Amendments can be made to the Articles of Incorporation if necessary. However, the process for making changes involves additional filings and may require approval from the board of directors or shareholders.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California Corporations Code governs the Articles of Incorporation. |

| Purpose | The form is used to officially create a corporation in California. |

| Filing Requirement | Filing the Articles of Incorporation with the California Secretary of State is mandatory. |

| Information Needed | Essential details include the corporation's name, address, and agent for service of process. |

| Entity Type | The form can be used for both profit and non-profit corporations. |

| Duration | Corporations can be formed with a perpetual duration unless stated otherwise. |

| Filing Fee | A fee is required upon submission, which varies based on the type of corporation. |

| Amendments | Changes to the Articles of Incorporation can be made through a formal amendment process. |

| Public Record | Once filed, the Articles of Incorporation become a public document accessible by anyone. |

Key takeaways

When considering the California Articles of Incorporation, it’s essential to understand the key aspects that can significantly influence your business formation process. Here are six important takeaways:

- Purpose of Incorporation: The Articles of Incorporation serve as the foundational document for your corporation. They outline the basic structure and purpose of your business.

- Information Required: You will need to provide specific details such as the corporation’s name, address, and the names of the initial directors. Ensure all information is accurate to avoid delays.

- Filing Fees: There is a fee associated with filing the Articles of Incorporation. Be prepared to pay this fee when submitting your documents to the California Secretary of State.

- Registered Agent: Your corporation must designate a registered agent. This person or entity will be responsible for receiving legal documents on behalf of your corporation.

- Compliance with State Laws: It’s crucial to comply with California state laws regarding corporate formation. This includes adhering to any specific requirements laid out by the Secretary of State.

- Post-Filing Responsibilities: After filing, there are ongoing responsibilities, such as holding annual meetings and maintaining corporate records. Stay organized to ensure compliance.