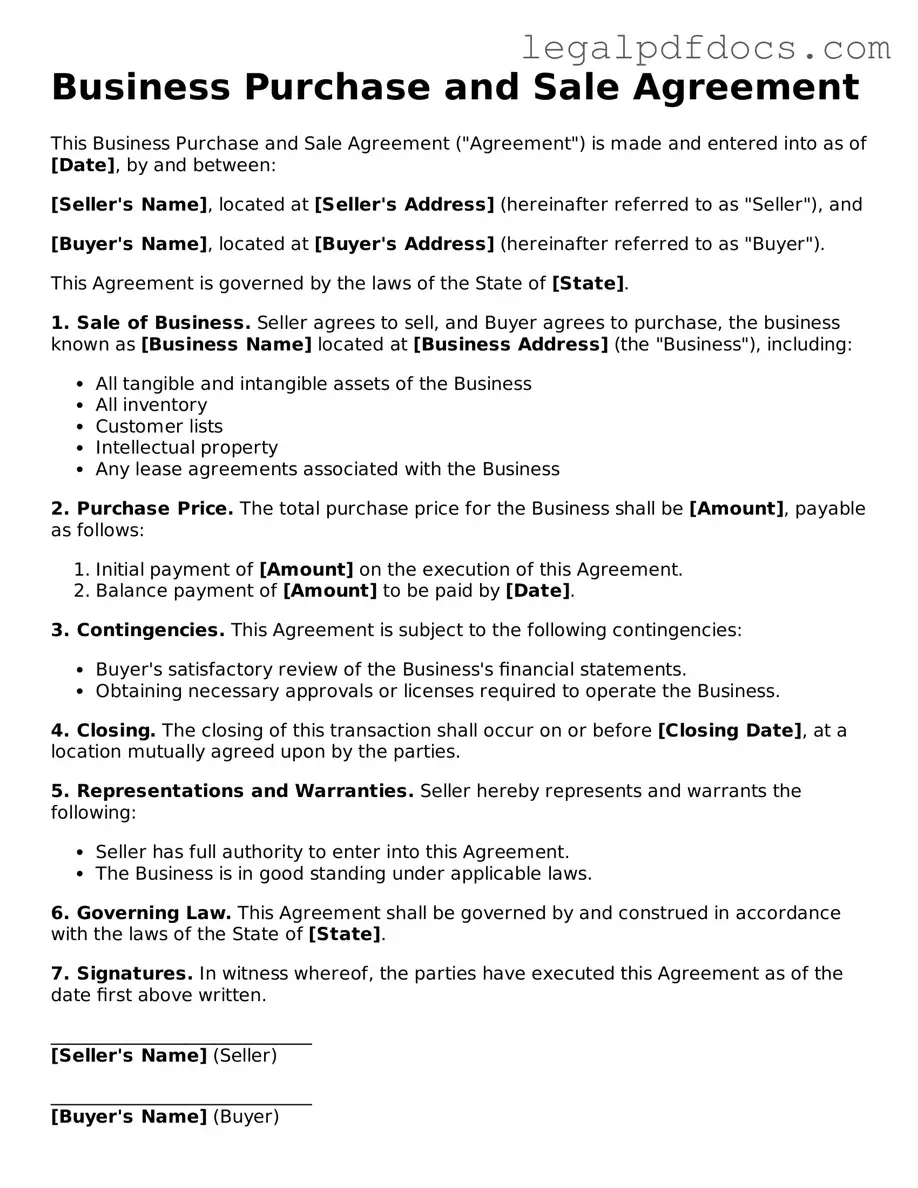

Business Purchase and Sale Agreement Template

The Business Purchase and Sale Agreement is a crucial document in the world of commerce, serving as the foundation for transactions involving the transfer of business ownership. This agreement outlines the terms and conditions under which a business is sold, providing clarity and protection for both the buyer and the seller. Key components typically include the purchase price, payment terms, and details about the assets being transferred, such as inventory, equipment, and intellectual property. Additionally, the agreement often addresses liabilities, warranties, and representations made by the seller, ensuring that the buyer is fully informed of what they are acquiring. Closing conditions and timelines are also integral, as they establish the framework for completing the sale. By carefully detailing these aspects, the Business Purchase and Sale Agreement helps to mitigate risks and prevent disputes, making it an essential tool for anyone involved in buying or selling a business.

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, attention to detail is crucial. Here are four important dos and don'ts to consider:

- Do read the entire form carefully before beginning to fill it out.

- Don't leave any sections blank; provide information for all required fields.

- Do consult with a legal professional if you have questions about specific terms.

- Don't rush through the process; take your time to ensure accuracy.

How to Use Business Purchase and Sale Agreement

Completing the Business Purchase and Sale Agreement form is a crucial step in formalizing the transaction between the buyer and seller. This document outlines the terms of the sale and ensures that both parties are clear about their obligations and expectations. Follow these steps carefully to fill out the form accurately.

- Begin by entering the date at the top of the form. This establishes when the agreement is being made.

- Fill in the names and addresses of both the buyer and the seller. Ensure that the information is complete and accurate.

- Provide a detailed description of the business being sold. Include its name, location, and any relevant identifying information.

- Specify the purchase price. Clearly state the total amount agreed upon for the sale of the business.

- Outline the terms of payment. Indicate whether the payment will be made in full at closing or if there will be installments.

- Detail any contingencies that must be met before the sale can be finalized. This could include financing approvals or inspections.

- Include any representations and warranties made by the seller regarding the business. This may cover the condition of assets, liabilities, and legal compliance.

- State the closing date. This is the date when the transaction will officially take place.

- Sign and date the agreement at the bottom. Both parties should do this to indicate their acceptance of the terms.

- Make copies of the completed form for both the buyer and seller to retain for their records.

More Forms:

Indiana Llc Forms - Consolidates business decisions into a single, formalized document.

Simple Shared Well Agreement Form - This agreement will remain in effect until terminated by all parties.

Documents used along the form

When engaging in a business transaction, particularly the purchase and sale of a business, several important documents accompany the Business Purchase and Sale Agreement. Each of these documents serves a unique purpose, ensuring that the interests of both the buyer and the seller are protected. Below is a list of key forms and documents often used in conjunction with the Business Purchase and Sale Agreement.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller. It typically details the basic terms of the sale and serves as a starting point for negotiations.

- Due Diligence Checklist: A comprehensive list that guides the buyer in assessing the business's financial, legal, and operational aspects. It helps identify any potential issues before finalizing the sale.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document protects sensitive information shared during the negotiation process, ensuring that proprietary details remain confidential.

- Bill of Sale: A legal document that formally transfers ownership of the business from the seller to the buyer. It includes details about the assets being sold and confirms that the transaction has taken place.

- Asset Purchase Agreement: If the buyer is acquiring specific assets rather than the entire business, this document outlines which assets are included in the sale and any liabilities the buyer will assume.

- Employment Agreements: If the sale involves retaining key employees, these agreements outline the terms of their continued employment, including salary, benefits, and responsibilities.

- Closing Statement: This document summarizes the final terms of the transaction, including the purchase price, adjustments, and any fees. It is presented at the closing of the sale to ensure transparency and agreement on financial details.

Understanding these documents is crucial for anyone involved in the purchase or sale of a business. Each plays a vital role in facilitating a smooth transaction and protecting the interests of all parties involved.

Misconceptions

Understanding the Business Purchase and Sale Agreement (BPSA) is essential for anyone involved in buying or selling a business. However, several misconceptions can cloud judgment and lead to misunderstandings. Below is a list of ten common misconceptions about the BPSA, along with clarifications to help demystify this important document.

- It is a simple document that requires no legal expertise. Many believe that a BPSA is straightforward and can be filled out without professional help. In reality, the nuances of business transactions often necessitate legal guidance to protect all parties involved.

- All BPSAs are the same. Each BPSA is unique, tailored to the specific transaction at hand. Factors like the type of business, the terms of sale, and the parties involved can significantly alter the content and structure of the agreement.

- Once signed, the agreement cannot be changed. While a BPSA is a binding document, it can be amended if both parties agree to the changes. Flexibility exists, but it requires mutual consent and proper documentation.

- Only the buyer needs to review the agreement. This misconception overlooks the importance of the seller's perspective. Both parties should thoroughly review the BPSA to ensure their interests are adequately represented and protected.

- It only covers the sale price. The BPSA encompasses much more than just the price. It includes terms related to payment methods, contingencies, representations, warranties, and even post-sale obligations.

- A verbal agreement is enough. Relying on verbal agreements can lead to misunderstandings and disputes. A written BPSA provides clarity and serves as a legal record of the terms agreed upon.

- It is only relevant during the closing process. The BPSA plays a critical role throughout the entire transaction process, from negotiation to closing and even post-sale obligations. Its significance extends beyond just the signing date.

- It protects only the buyer. This misconception neglects the fact that a well-drafted BPSA protects the interests of both the buyer and the seller. It ensures that both parties are held accountable to the terms agreed upon.

- You can use a generic template for any business sale. While templates can be helpful, they often lack the specificity needed for individual transactions. Customization is key to addressing the unique aspects of each sale.

- Once the deal is done, the BPSA is no longer important. The BPSA remains relevant even after the transaction is complete. It serves as a reference point for any future disputes or questions that may arise regarding the terms of the sale.

By understanding these misconceptions, individuals can approach the Business Purchase and Sale Agreement with greater clarity and confidence. Engaging with legal professionals during this process can further enhance understanding and ensure a smoother transaction.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold. |

| Parties Involved | The agreement typically involves a seller (the current business owner) and a buyer (the prospective new owner). |

| Governing Law | The agreement is governed by the laws of the state where the business is located. For example, in California, it follows California business law. |

| Purchase Price | The document specifies the total purchase price and may include details on payment methods and schedules. |

| Assets Included | It outlines which assets are included in the sale, such as inventory, equipment, and intellectual property. |

| Liabilities | The agreement may address any liabilities that the buyer will assume or that will remain with the seller after the sale. |

| Due Diligence | Buyers often conduct due diligence to verify the information provided by the seller before finalizing the agreement. |

| Closing Date | The agreement specifies a closing date, which is when the transaction is officially completed. |

| Contingencies | It may include contingencies that must be met for the sale to proceed, such as financing or regulatory approvals. |

Key takeaways

When filling out and using the Business Purchase and Sale Agreement form, keep these key takeaways in mind:

- Understand the purpose of the agreement. This document outlines the terms of the sale, ensuring both parties are on the same page.

- Clearly define the business being sold. Include details such as the business name, location, and any relevant assets.

- Specify the purchase price and payment terms. Be explicit about how and when payments will be made.

- Outline any contingencies that must be met for the sale to proceed. This could include financing or regulatory approvals.

- Include provisions for representations and warranties. Both parties should affirm the accuracy of the information provided.

- Detail the closing process. Specify when and where the transaction will be finalized and what documents will be exchanged.

- Consider including post-closing obligations. This might involve the seller assisting with the transition or training the buyer.

- Review the agreement carefully. Ensure that all terms are clear and that both parties fully understand their rights and responsibilities.

Taking these points into account can help facilitate a smoother transaction and protect both parties involved.